Form 8938 Filing Requirement

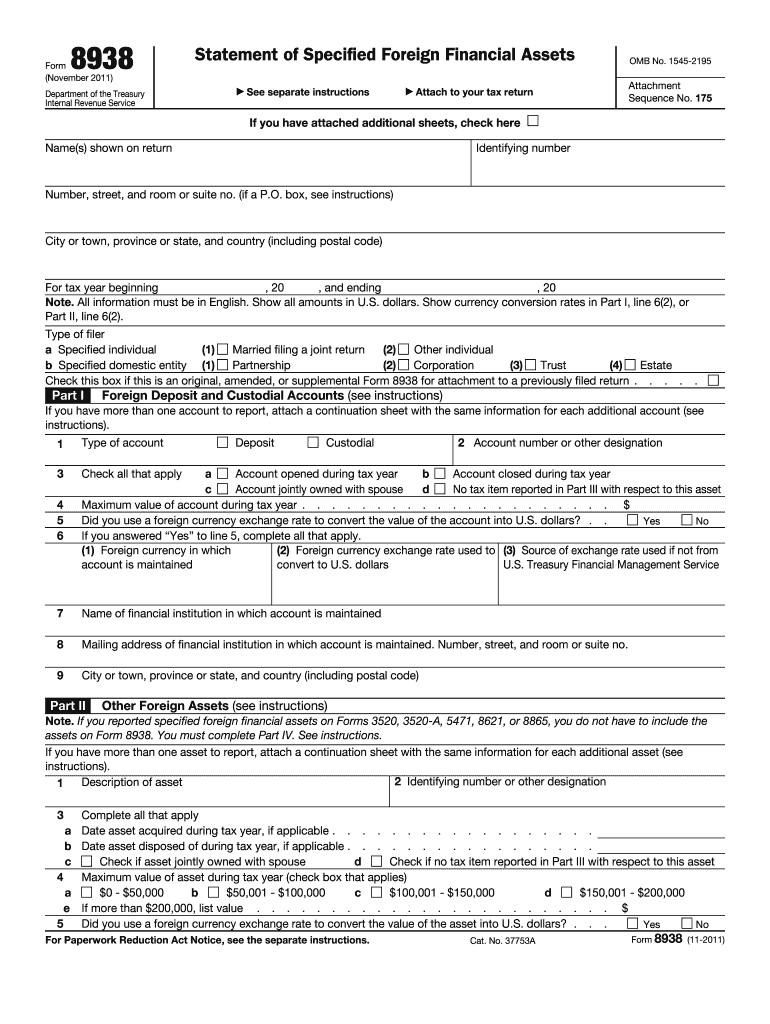

Form 8938 Filing Requirement - Edit, sign and save irs 8938 instructions form. Threshold for unmarried us resident. Get ready for tax season deadlines by completing any required tax forms today. Web form 8938 3 filing requirements. Web form 8938 filing requirements. Web form 8938 is required if you meet specific criteria associated with any foreign assets in your name. Here are the different threshold filing requirements for form 8938: Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Web different form 8938 threshold filing requirements. Whether you’ll need to file form 8938 depends on all three factors listed below:

Who has to file form 8938? Web you must file a form 8938 if you must file an income tax return and: Web form 8938 is used by certain u.s. Whether you’ll need to file form 8938 depends on all three factors listed below: “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign. You are not required to report specified foreign financial assets on. Here are the different threshold filing requirements for form 8938: Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test — or otherwise. Your us citizenship and immigration status;. Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form.

Web if you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax. Web the form 8938 is required to be filed at the same time that a tax return is filed. You are not required to report specified foreign financial assets on. Who has to file form 8938? Web file form 8938 as follows. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax. Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Get ready for tax season deadlines by completing any required tax forms today. Web this article will focus on the requirements for us person individuals who have certain specified foreign financial assets and are required to file us tax returns. Your us citizenship and immigration status;.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

If a person requires more. Form 8938 threshold & requirements. Web form 8938 is used by certain u.s. Edit, sign and save irs 8938 instructions form. You are married filing a joint income tax return and the total value of your specified foreign financial assets is.

Form 8938 Blank Sample to Fill out Online in PDF

Specified individual filing as a nonresident alien at the end of his or her tax year. Your us citizenship and immigration status;. Form 8938 threshold & requirements. “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign. Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign.

Form 8938 Filing Requirement Tax Strategies Motley Fool Community

Web if you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax. If a person requires more. Form 8938 threshold & requirements. Web us persons, including us citizens, legal permanent residents, and foreign nationals who meet th e substantial presence.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Edit, sign and save irs 8938 instructions form. Threshold for unmarried us resident. Your us citizenship and immigration status;. Here are the different threshold filing requirements for form 8938: Web this article will focus on the requirements for us person individuals who have certain specified foreign financial assets and are required to file us tax returns.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax. “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign. Web form 8938 filing requirements. Specified individual filing as a nonresident alien at the end of his.

Form 8938 Edit, Fill, Sign Online Handypdf

Web form 8938 is required if you meet specific criteria associated with any foreign assets in your name. You are not required to report specified foreign financial assets on. Form 8938 threshold & requirements. If a person requires more. Here are the different threshold filing requirements for form 8938:

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web this article will focus on the requirements for us person individuals who have certain specified foreign financial assets and are required to file us tax returns. You are not required to report specified foreign financial assets on. Specified individual filing as a nonresident alien at the end of his or her tax year. Your us citizenship and immigration status;..

Is Form 8938 Reporting Required for Foreign Pension Plans?

You are not required to report specified foreign financial assets on. In some cases, you may only need to file a fbar and in other cases, you. This is logical, since the form 8938 is a component of the tax return. Web if you are required to file form 8938, you must report the specified foreign financial assets in which.

The FORM 8938 Here is what you need to know if you are filing it

Specified individual filing as a nonresident alien at the end of his or her tax year. Form 8938 threshold & requirements. The form 8938 filing requirement. Web the form 8938 is required to be filed at the same time that a tax return is filed. Web form 8938 is used by certain u.s.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8938 threshold & requirements. Web form 8938 3 filing requirements. Get ready for tax season deadlines by completing any required tax forms today. Whether you’ll need to file form 8938 depends on all three factors listed below: Web form 8938 is required if you meet specific criteria associated with any foreign assets in your name.

Taxpayers Who Meet The Form 8938.

Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form. Web form 8938 3 filing requirements. Form 8938 threshold & requirements. Web form 8938 is required if you meet specific criteria associated with any foreign assets in your name.

Web Form 8938 Filing Requirements.

Threshold for unmarried us resident. Whether you’ll need to file form 8938 depends on all three factors listed below: Edit, sign and save irs 8938 instructions form. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test — or otherwise.

This Is Logical, Since The Form 8938 Is A Component Of The Tax Return.

You are not required to report specified foreign financial assets on. Web you must file a form 8938 if you must file an income tax return and: Web different form 8938 threshold filing requirements. Web file form 8938 as follows.

You Are Married Filing A Joint Income Tax Return And The Total Value Of Your Specified Foreign Financial Assets Is.

The form 8938 filing requirement. If a person requires more. Specified individual filing as a nonresident alien at the end of his or her tax year. Web form 8938 is used by certain u.s.