Form 8880 Turbotax

Form 8880 Turbotax - Depending on your adjusted gross income. I believe i am entitled to claim a savings credit on form 8880. Solved•by intuit•8•updated july 13, 2022. Check box 12, code d , which displays amounts you. Generating qualified retirement savings contributions for form 8880. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Because of this i don't know how to even proceed. Web 8880 you cannot take this credit if either of the following applies. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Easily sort by irs forms to find the product that best fits your tax.

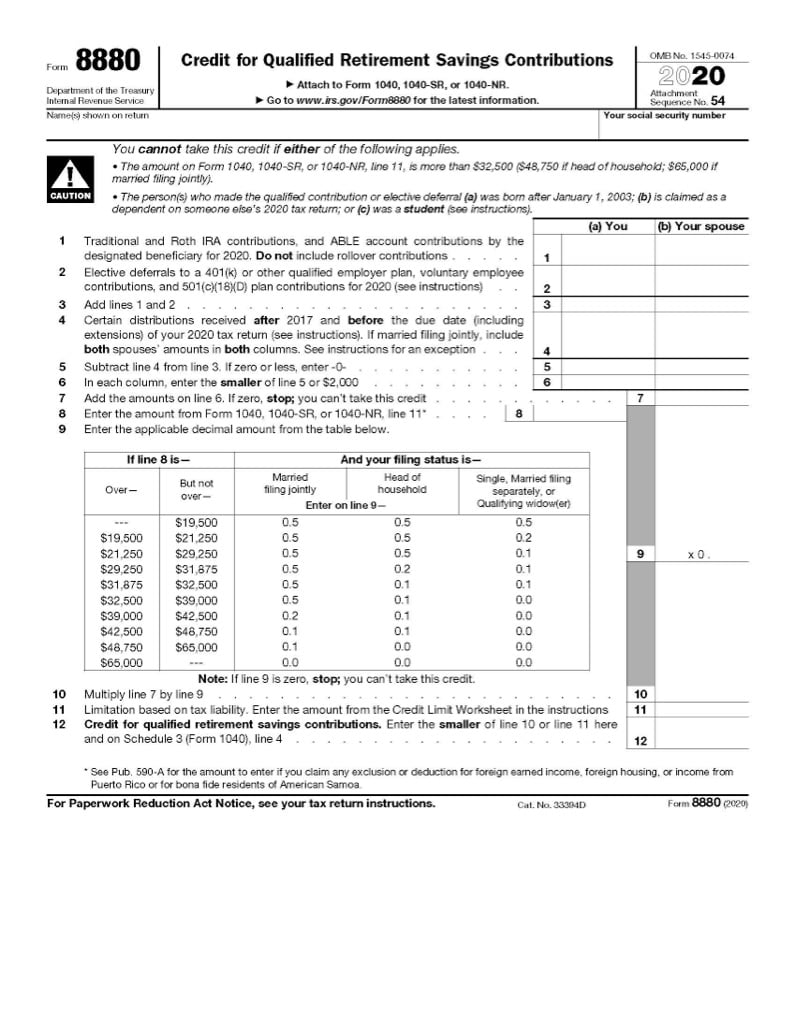

Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. • the person(s) who made the. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. In proconnect tax, when you. Web irs form 8880 is used specifically for the retirement saver’s credit. Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of contributions. The irs tax form needed to file for the saver's credit is form 8880. The form is straightforward and will walk you through the steps needed (and. Web how do i fill out a form 8880? I believe i am entitled to claim a savings credit on form 8880.

There is no worksheet to review or analyze. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. To claim the credit, you must complete irs form 8880 and include it with your tax return. Depending on your adjusted gross income. Web form 8880 i'm stumped. The form is straightforward and will walk you through the steps needed (and. Web what are the retirement savings contributions credit (form 8880) requirements? The irs tax form needed to file for the saver's credit is form 8880. For tax years prior to 2018, you can only claim the savers. Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. To claim the credit, you must complete irs form 8880 and include it with your tax return. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Solved•by intuit•8•updated july 13, 2022..

Form 8880 Claiming the Saver’s Credit Jackson Hewitt

For tax years prior to 2018, you can only claim the savers. • the person(s) who made the. Web what are the retirement savings contributions credit (form 8880) requirements? Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of.

What Is the IRS Form 8880? TurboTax Tax Tips & Videos

For tax years prior to 2018, you can only claim the savers. Easily sort by irs forms to find the product that best fits your tax. $65,000 if married filing jointly). Generating qualified retirement savings contributions for form 8880. Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to.

SimpleTax Form 8880 YouTube

Web 8880 you cannot take this credit if either of the following applies. The form is straightforward and will walk you through the steps needed (and. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. You may be eligible to claim the retirement savings contributions credit, also.

turbotax报税 form 2441 line 2c 税务 美卡论坛

Web 8880 you cannot take this credit if either of the following applies. Web form 8880 i'm stumped. Web 8880 you cannot take this credit if either of the following applies. Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. There is no.

Form 8880 Tax Incentives For Retirement Account —

To claim the credit, you must complete irs form 8880 and include it with your tax return. There is no worksheet to review or analyze. This is where you’ll report your income to determine eligibility and all of the contributions you. Turbotax says i do not qualify. Web irs form 8880 is used specifically for the retirement saver’s credit.

Solved Form 8880 Line 4 Certain distributions Is TurboTax Doing It

Web what are the retirement savings contributions credit (form 8880) requirements? Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. The irs tax form needed to file for the saver's credit is form 8880. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. For.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Web irs form 8880 is used specifically for the retirement saver’s credit. Web how do i fill out a form 8880? $65,000 if married filing jointly). Web 8880 you cannot take this credit if either of the following applies. Solved•by intuit•8•updated july 13, 2022.

Tax Center Forms, FAQ and TurboTax Discounts USAA

I believe i am entitled to claim a savings credit on form 8880. Web beginning in 2018, as part of a provision contained in the tax cuts and jobs act of 2017, a retirement savings contribution credit may be claimed for the amount of contributions. $65,000 if married filing jointly). Web see what tax forms are included in turbotax basic,.

TurboTax 2022 Form 1040 Credits for Retirement Savings Contributions

This is where you’ll report your income to determine eligibility and all of the contributions you. I'm not even sure if i qualify for it yet my turbo tax says i do. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. • the person(s) who made the. Web form 8880 i'm stumped.

Web How Do I Fill Out A Form 8880?

To claim the credit, you must complete irs form 8880 and include it with your tax return. Easily sort by irs forms to find the product that best fits your tax. Solved•by intuit•8•updated july 13, 2022. Web use form 8880.

Web Beginning In 2018, As Part Of A Provision Contained In The Tax Cuts And Jobs Act Of 2017, A Retirement Savings Contribution Credit May Be Claimed For The Amount Of Contributions.

Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. This is where you’ll report your income to determine eligibility and all of the contributions you. Web 8880 you cannot take this credit if either of the following applies.

Web See What Tax Forms Are Included In Turbotax Basic, Deluxe, Premier And Home & Business Tax Software.

Because of this i don't know how to even proceed. The irs tax form needed to file for the saver's credit is form 8880. Web what are the retirement savings contributions credit (form 8880) requirements? I'm not even sure if i qualify for it yet my turbo tax says i do.

Web Irs Form 8880 Is Used Specifically For The Retirement Saver’s Credit.

Web key takeaways irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. In proconnect tax, when you. I believe i am entitled to claim a savings credit on form 8880. Web 8880 you cannot take this credit if either of the following applies.