Form 8833 Australian Superannuation

Form 8833 Australian Superannuation - Suppose that you have an australian superannuation account (a type of. Tax return and form 8833 if claiming the following treaty benefits: Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb. Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s. Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. Web the payee must file a u.s. He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Web how to get this form. Pay my super into australiansuper pdf, 57kb.

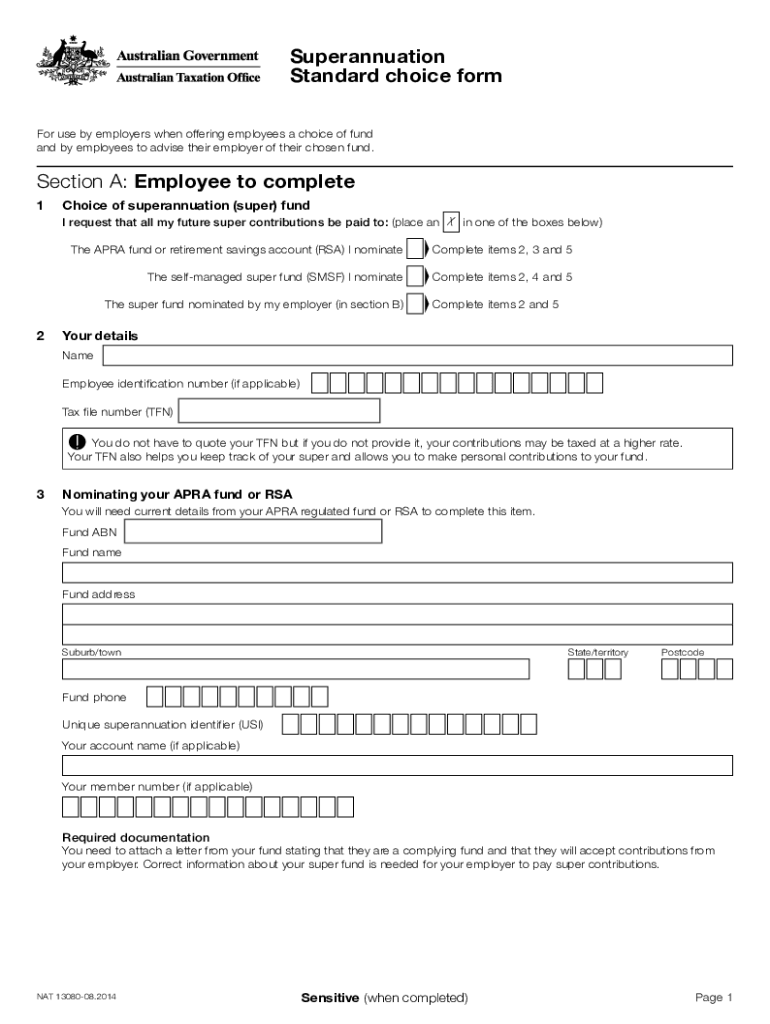

Web employers must keep the completed form for their own record for five years. Revenue have measuring and risks before taking an australian superannuation fax contractual position. 2 types of superannuation accounts. He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. Web the payee must file a u.s. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Web how to get this form. Tax return and form 8833 if claiming the following treaty benefits: Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s. Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia.

Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia. Pay my super into australiansuper pdf, 57kb. Web 1 reporting obligations of a superannuation account. Web use this form to offer eligible employees their choice of super fund. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Web most people can choose the fund their super goes into. 3 fbar (fincen form 114) 4 form 8938 (fatca) 5 form 3520/form 3520. Revenue have measuring and risks before taking an australian superannuation fax contractual position. You can do so by using a superannuation standard choice form (nat 13080) when you start a new job. Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s.

Australian superannuation changes 7NEWS YouTube

Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s. He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. 2 types of superannuation accounts..

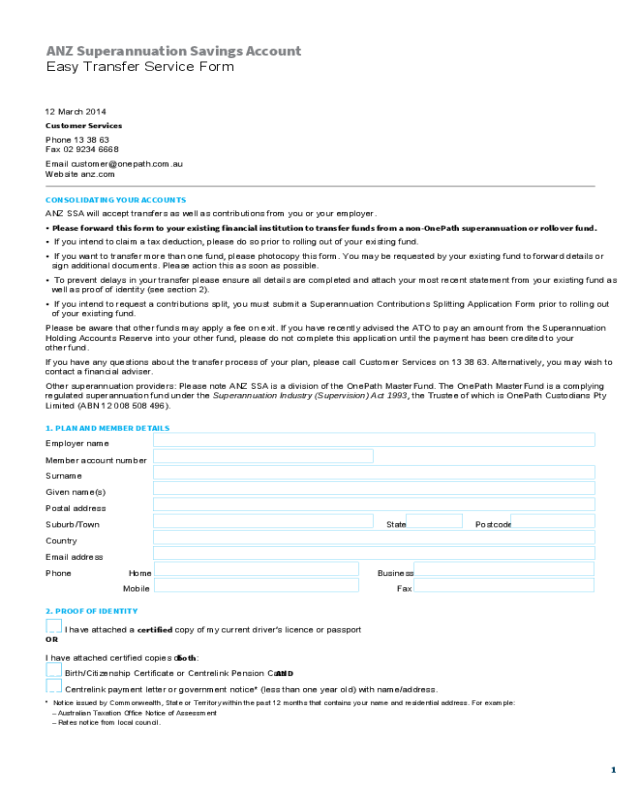

Superannuation Transfer ATO Form Free Download

Web most people can choose the fund their super goes into. 3 fbar (fincen form 114) 4 form 8938 (fatca) 5 form 3520/form 3520. 2 types of superannuation accounts. Web how to get this form. Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

You can do so by using a superannuation standard choice form (nat 13080) when you start a new job. Web employers must keep the completed form for their own record for five years. Web how to get this form. Web the payee must file a u.s. Your choice of super fund is an important decision for.

Form 8833 PDF Samples for Online Tax Managing

Web most people can choose the fund their super goes into. Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web how to get this form. Suppose that you have an australian superannuation account (a type of. Do not send it to the australian taxation office,.

Form 8833 TreatyBased Return Position Disclosure

Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Tax return and form 8833 if claiming the following treaty benefits: Web to do so, dixon attached a form 8833 to each of his.

Fillable Form 8833 TreatyBased Return Position Disclosure Under

Web the payee must file a u.s. Web how to fill out tax form 8833. Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations. Suppose that you have an australian superannuation account (a type of. Web a scenario in.

2014 Form AU NAT 13080 Fill Online, Printable, Fillable, Blank pdfFiller

Web mail 8833 australian superannuation trigger trade return. Web the payee must file a u.s. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Web most people can choose the fund their super goes into. A reduction or modification in the taxation of gain or loss from the disposition.

Form 8833 (Rev. September 2017) Edit, Fill, Sign Online Handypdf

He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. You must fill in the details of your nominated super fund, also known as your default fund, before giving the. Web 1 reporting obligations of a superannuation account. Tax return and form 8833 if claiming the following treaty benefits: Web how.

Lawful Permanent Residents Tax Law vs. Immigration Law University

Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Suppose that you have an australian superannuation account (a type of. Tax return and form 8833 if claiming the following treaty benefits: Web most people can choose the fund their super goes into. He is an australian citizen who moved.

2021 Superannuation Transfer Form Fillable, Printable PDF & Forms

He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. Web how to fill out tax form 8833. You must fill in the details of your nominated super fund, also known as your default fund, before giving the. A reduction or modification in the taxation of gain or loss from the.

Do Not Send It To The Australian Taxation Office, The Employer’s Nominated Fund Or The Employee’s.

Web most people can choose the fund their super goes into. Tax return and form 8833 if claiming the following treaty benefits: My husband needs to file his 2009 as a dual resident. You can do so by using a superannuation standard choice form (nat 13080) when you start a new job.

Your Choice Of Super Fund Is An Important Decision For.

2 types of superannuation accounts. Revenue have measuring and risks before taking an australian superannuation fax contractual position. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Suppose that you have an australian superannuation account (a type of.

Web Superannuation Standard Choice Form Use This Form To Choose The Super Fund Your Employer Will Pay Your Super Into.

You must fill in the details of your nominated super fund, also known as your default fund, before giving the. Web how to get this form. Web the payee must file a u.s. Pay my super into australiansuper pdf, 57kb.

Web A Taxpayer That Takes A Treaty Position Without Disclosing It On Irs Form 8833 Will Be Liable For Civil Tax Penalties For Which There Is No Statute Of Limitations.

Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web employers must keep the completed form for their own record for five years. Web use this form to offer eligible employees their choice of super fund. Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb.