Form 8615 Instructions 2022

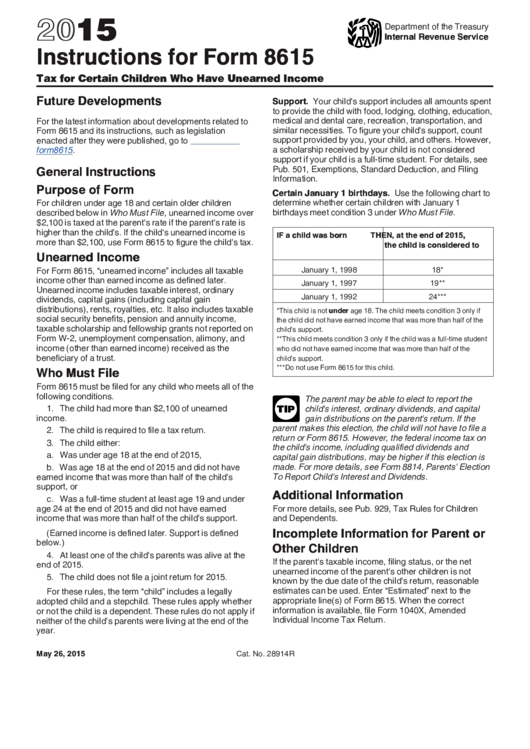

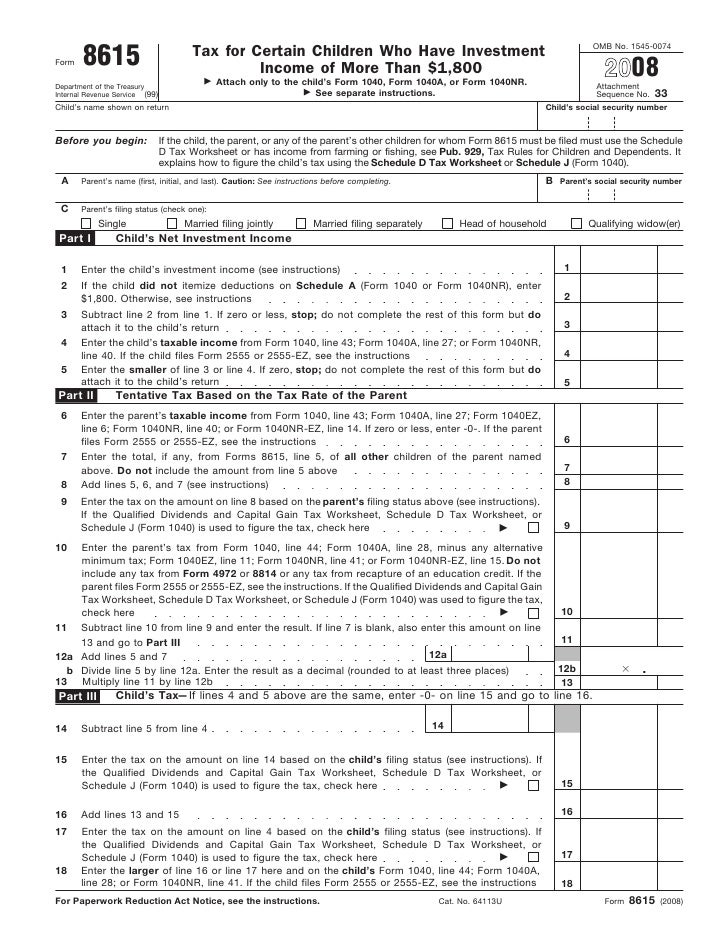

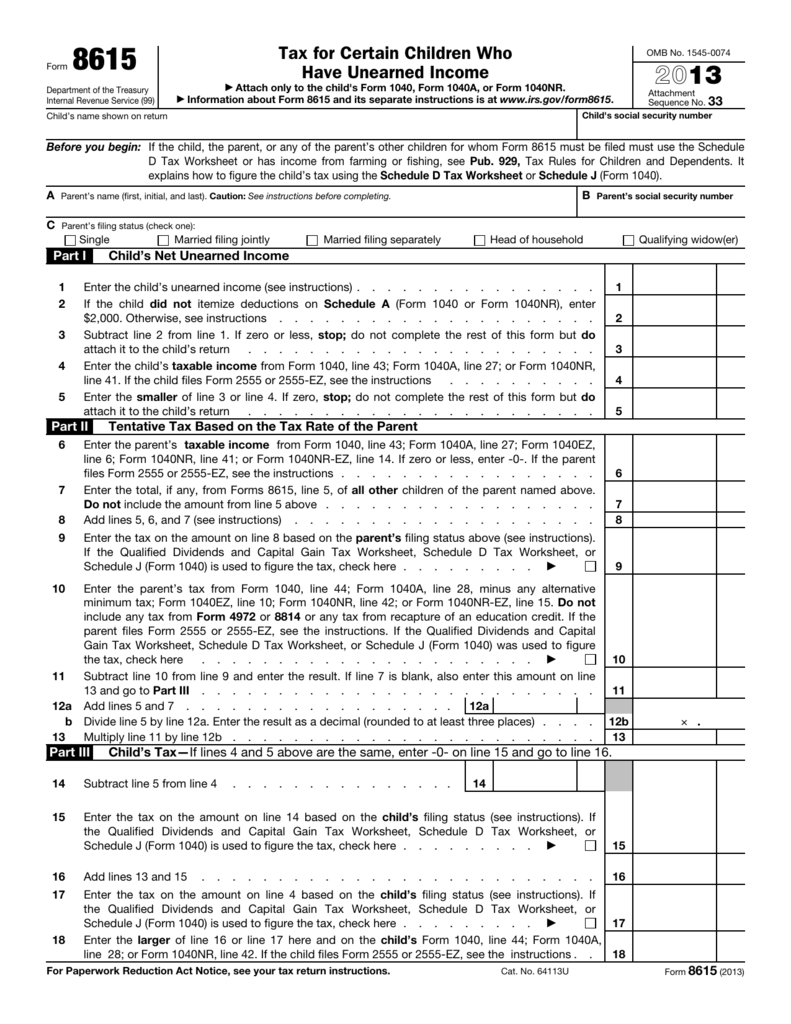

Form 8615 Instructions 2022 - You are required to file a tax return. Here what's considered earned income? Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: The child is required to file a tax return. Purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,300 is. Web form 8615 must be filed with the child’s tax return if all of the following apply: Find the document template you need from our collection of legal form samples. Web form 8615 must be filed for any child who meets all of the following conditions. Web enter the parent's name and social security number (ssn), as outlined in the form 8615 instructions. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income.

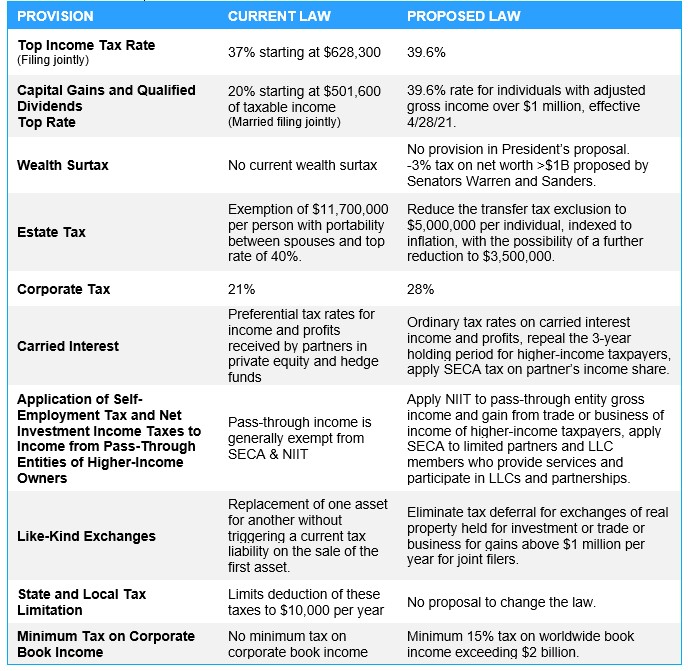

Web enter the parent's name and social security number (ssn), as outlined in the form 8615 instructions. Tax for certain children who have unearned income. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). Department of the treasury internal revenue service. Web per irs instructions for form 8615: Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Here what's considered earned income? Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Instructions for form 8615 form. Web complete irs 8615 in just a couple of clicks following the guidelines below:

Tax for certain children who have unearned income. Web solved•by intuit•15•updated july 12, 2022. Ad upload, modify or create forms. Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web qualified dividends on form 8615, line 5. Find the document template you need from our collection of legal form samples. Try it for free now! You had more than $2,300 of unearned income. The child had more than $2,300 of unearned income. Web enter the parent's name and social security number (ssn), as outlined in the form 8615 instructions.

Solved Form 8615 election for children to be taxed at par... Intuit

For example, if the child's parents were married to each other and filed a. Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 15307: Register and subscribe now to work on your irs form 8615 & more fillable forms. Web form 8615 must be filed with the child’s tax return if all of the.

Form 8615 Tax for Certain Children Who Have Unearned (2015

Try it for free now! Here what's considered earned income? Web form 8615 must be filed for any child who meets all of the following conditions: Do not file draft forms. Web qualified dividends on form 8615, line 5.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Web enter the parent's name and social security number (ssn), as outlined in the form 8615 instructions. Web solved•by intuit•15•updated july 12, 2022. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web this.

net investment tax 2021 form Do Good Podcast Fonction

Web form 8615 must be filed for any child who meets all of the following conditions. Web solved•by intuit•15•updated july 12, 2022. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Register and subscribe now to work on your.

Form 8615 Instructions (2015) printable pdf download

Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 15307: For example, if the child's parents were married to each other and filed a. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's..

Form 8615Tax for Children Under Age 14 With Investment of Mor…

The child is required to file a tax return. For example, if the child's parents were married to each other and filed a. Under age 18, age 18 and did not have earned income that. Web solved•by intuit•15•updated july 12, 2022. You had more than $2,300 of unearned income.

Form 8615 Office Depot

Under age 18, age 18 and did not have earned income that. For example, if the child's parents were married to each other and filed a. Here what's considered earned income? Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. You are required to file a.

Form 568 instructions 2012

Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web form 8615 must be filed for any child who meets all of the following conditions: Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Try it.

Solved Form 8615 election for children to be taxed at par... Intuit

Under age 18, age 18 and did not have earned income that. Web 11/29/2022 inst 8615: Find the document template you need from our collection of legal form samples. Web form 8615 must be filed for any child who meets all of the following conditions. Tax for certain children who have unearned income.

Instructions for IRS Form 8615 Tax For Certain Children Who Have

Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Under age 18, age 18 and did not have earned income that. Web form 8615 must be filed for any child who meets all of the following conditions: The child had more than $2,300 of unearned income. Tax for certain children.

Instructions For Form 8615 Form.

Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Web per irs instructions for form 8615: Tax for certain children who have unearned income.

Web Solved•By Intuit•15•Updated July 12, 2022.

Do not file draft forms. Purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,300 is. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web enter the parent's name and social security number (ssn), as outlined in the form 8615 instructions.

You Are Required To File A Tax Return.

The child is required to file a tax return. Attach only to the child’s form 1040 or. You had more than $2,300 of unearned income. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5).

Register And Subscribe Now To Work On Your Irs Form 8615 & More Fillable Forms.

For example, if the child's parents were married to each other and filed a. Below are answers to frequently asked questions about using form 8615 and 8814 in proseries basic and proseries. Under age 18, age 18 and did not have earned income that. Web qualified dividends on form 8615, line 5.