Form 8606 Instruction

Form 8606 Instruction - Web for the four situations listed at the top of this article, you can trigger form 8606 with these instructions: Web irs form 8606 is a tax form for documenting nondeductible contributions and any associated distributions from an ira, including traditional, sep, and simple. Or form 1040nr, lines 16a and 16b. 5/2015 purpose this form is used by community living assistance and support services (class) and community first choice (cfc) to: Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. Form 1040a, lines 11a and 11b; Web form 8606 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8606. Web federal form 8606 instructions future developments for the latest information about developments related to form 8606 and its instructions, such as legislation enacted. Sign in to your turbotax account open your return if it. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified.

5/2015 purpose this form is used by community living assistance and support services (class) and community first choice (cfc) to: Web form 8606, nondeductible iras, is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an ira. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Form 1040a, lines 11a and 11b; Instead, see the instructions for form 1040, lines 15a and 15b; Web irs form 8606 is a tax form for documenting nondeductible contributions and any associated distributions from an ira, including traditional, sep, and simple. Also, to find out if any of your. Web form 8606 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8606. Or form 1040nr, lines 16a and 16b. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified.

Web general instructions future developments for the latest information about developments related to 2020 form 8606 and its instructions, such as legislation enacted after they. Web for the four situations listed at the top of this article, you can trigger form 8606 with these instructions: Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Or form 1040nr, lines 16a and 16b. Form 1040a, lines 11a and 11b; Web general instructions future developments for the latest information about developments related to 2019 form 8606 and its instructions, such as legislation enacted after they. Sign in to your turbotax account open your return if it. 5/2015 purpose this form is used by community living assistance and support services (class) and community first choice (cfc) to: Also, to find out if any of your. Web general instructions future developments for the latest information about developments related to 2022 form 8606 and its instructions, such as legislation enacted after they.

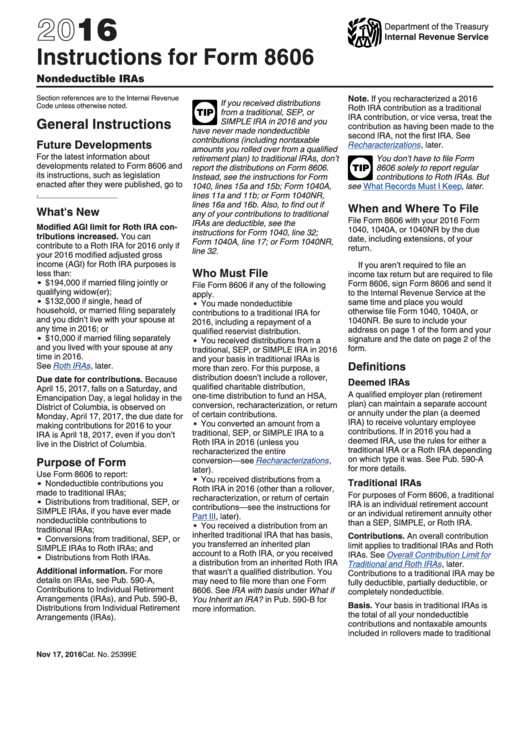

Instructions For Form 8606 2016 printable pdf download

Also, to find out if any of your. Web irs form 8606 is a tax form for documenting nondeductible contributions and any associated distributions from an ira, including traditional, sep, and simple. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified. Web.

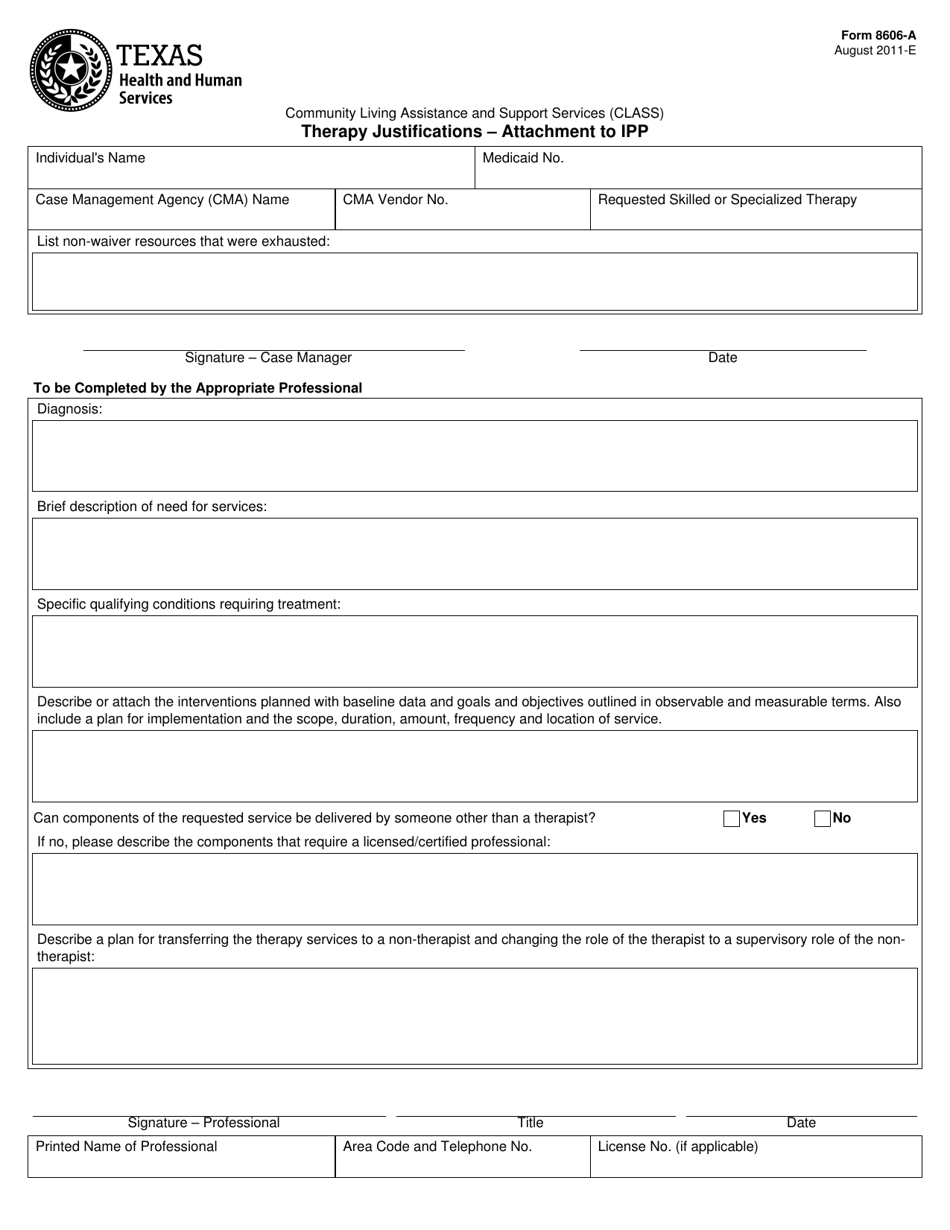

Form 8606A Download Fillable PDF or Fill Online Therapy Justifications

Or form 1040nr, lines 16a and 16b. Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Form 1040a, lines 11a.

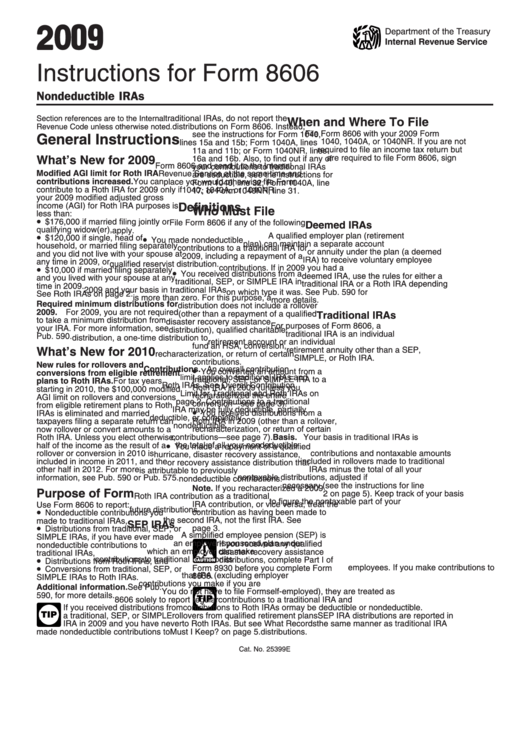

Instructions For Form 8606 Nondeductible Iras 2009 printable pdf

Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified. Instead, see the instructions for form 1040, lines 15a and 15b; Web general instructions future developments for the latest information about developments related to 2019 form 8606 and its instructions, such as legislation.

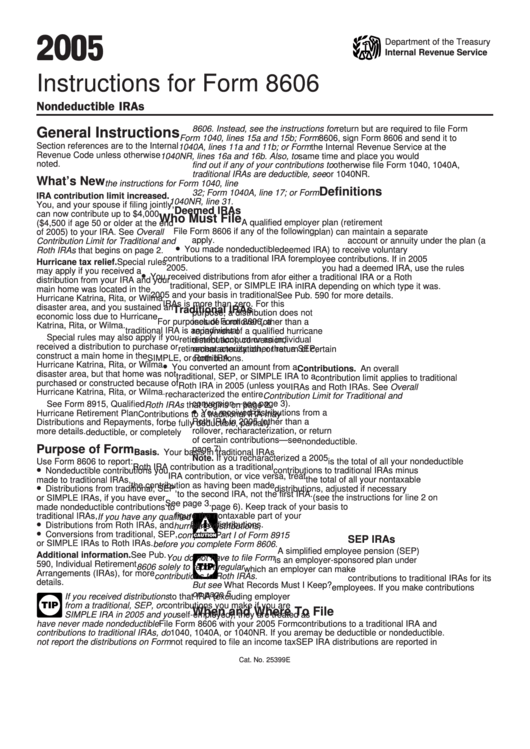

Instructions For Form 8606 Nondeductible Iras 2005 printable pdf

Web federal form 8606 instructions future developments for the latest information about developments related to form 8606 and its instructions, such as legislation enacted. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Or form 1040nr, lines 16a and 16b. Web general instructions future developments for.

Instructions For Form 8606 Nondeductible Iras 2003 printable pdf

Web federal form 8606 instructions future developments for the latest information about developments related to form 8606 and its instructions, such as legislation enacted. Web general instructions future developments for the latest information about developments related to 2019 form 8606 and its instructions, such as legislation enacted after they. 5/2015 purpose this form is used by community living assistance and.

Form 8606 Nondeductible IRAs (2014) Free Download

Web for the four situations listed at the top of this article, you can trigger form 8606 with these instructions: Web form 8606 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8606. Or form 1040nr, lines 16a and 16b. Instead, see the instructions for form 1040, lines 15a and 15b; Web form 8606 is used.

Fill Free fillable F8606 2018 Form 8606 PDF form

Sign in to your turbotax account open your return if it. 5/2015 purpose this form is used by community living assistance and support services (class) and community first choice (cfc) to: Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information. Form 1040a, lines 11a and 11b;.

Instructions For Form 8606 Nondeductible Iras 2007 printable pdf

Instead, see the instructions for form 1040, lines 15a and 15b; Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified. Also, to find out if any of your. Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a.

irs form 8606 instructions 2018 Fill Online, Printable, Fillable

Sign in to your turbotax account open your return if it. Or form 1040nr, lines 16a and 16b. Web general instructions future developments for the latest information about developments related to 2022 form 8606 and its instructions, such as legislation enacted after they. Web federal form 8606 instructions future developments for the latest information about developments related to form 8606.

Instructions For Form 8606 Nondeductible Iras 2008 printable pdf

Web general instructions future developments for the latest information about developments related to 2020 form 8606 and its instructions, such as legislation enacted after they. Web for the four situations listed at the top of this article, you can trigger form 8606 with these instructions: Web irs form 8606 is a tax form for documenting nondeductible contributions and any associated.

Web Irs Form 8606 Is A Tax Form For Documenting Nondeductible Contributions And Any Associated Distributions From An Ira, Including Traditional, Sep, And Simple.

Web form 8606, nondeductible iras, is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an ira. Form 1040a, lines 11a and 11b; Web federal form 8606 instructions future developments for the latest information about developments related to form 8606 and its instructions, such as legislation enacted. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified.

Web Form 8606 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form8606.

Web for the four situations listed at the top of this article, you can trigger form 8606 with these instructions: Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. 5/2015 purpose this form is used by community living assistance and support services (class) and community first choice (cfc) to: Sign in to your turbotax account open your return if it.

Web General Instructions Future Developments For The Latest Information About Developments Related To 2020 Form 8606 And Its Instructions, Such As Legislation Enacted After They.

Web general instructions future developments for the latest information about developments related to 2019 form 8606 and its instructions, such as legislation enacted after they. Also, to find out if any of your. Instead, see the instructions for form 1040, lines 15a and 15b; Web form 8606 department of the treasury internal revenue service (99) nondeductible iras a go to www.irs.gov/form8606 for instructions and the latest information.

Web General Instructions Future Developments For The Latest Information About Developments Related To 2022 Form 8606 And Its Instructions, Such As Legislation Enacted After They.

Or form 1040nr, lines 16a and 16b.