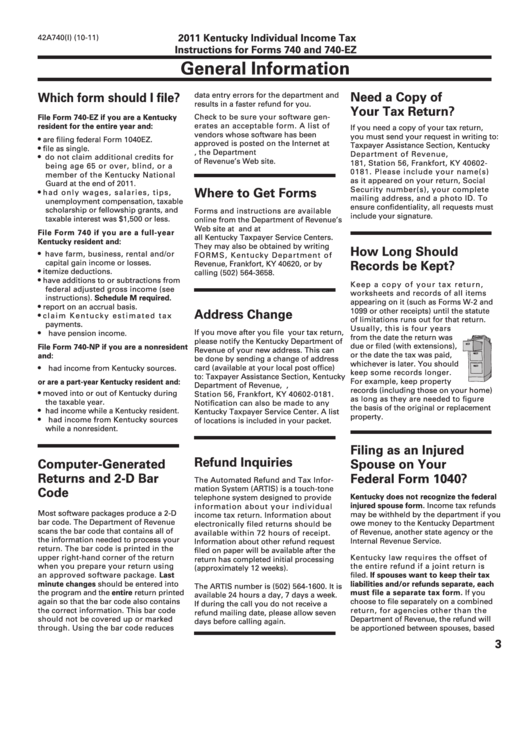

Form 740 Instructions

Form 740 Instructions - • have additions to or. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000. Web tax year 2020 form 1040 instructions. The rules for importation are contained in code of federal regulations title 47. Web which form should i file? Form 740 is the kentucky income tax return for use by all taxpayers. What are the conditions for importing radio frequency devices in the united states? Changes to the earned income credit (eic). The enhancements for taxpayers without a qualifying child. Web for more information, see the instructions for schedule 8812 (form 1040).

Web popular forms & instructions; Individual tax return form 1040 instructions; Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000. • have farm, business, rental and/or capital gain income or losses. • have additions to or. Web which form should i file? The enhancements for taxpayers without a qualifying child. Web 740 dividing deductions between spouses use this schedule if married filing separately on a combined return. Changes to the earned income credit (eic). What are the conditions for importing radio frequency devices in the united states?

Changes to the earned income credit (eic). Form 740 is the kentucky income tax return for use by all taxpayers. Web for more information, see the instructions for schedule 8812 (form 1040). Web 740 dividing deductions between spouses use this schedule if married filing separately on a combined return. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000. • have additions to or. Individual tax return form 1040 instructions; Web download or print the 2022 kentucky (form 740 individual full year resident income tax instructions packet) (2022) and other income tax forms from the kentucky. The maximum amount of credit for each small enter lle income as shown business for each year shall not. Web popular forms & instructions;

740V Electronic Filing Payment Voucher Form 42A740S23

Web which form should i file? What are the conditions for importing radio frequency devices in the united states? Form 740 is the kentucky income tax return for use by all taxpayers. • have farm, business, rental and/or capital gain income or losses. Web this form may be used by both individuals and corporations requesting an income tax refund.

740 Form Fill Out and Sign Printable PDF Template signNow

Web for more information, see the instructions for schedule 8812 (form 1040). The rules for importation are contained in code of federal regulations title 47. Web this form may be used by both individuals and corporations requesting an income tax refund. • have farm, business, rental and/or capital gain income or losses. The enhancements for taxpayers without a qualifying child.

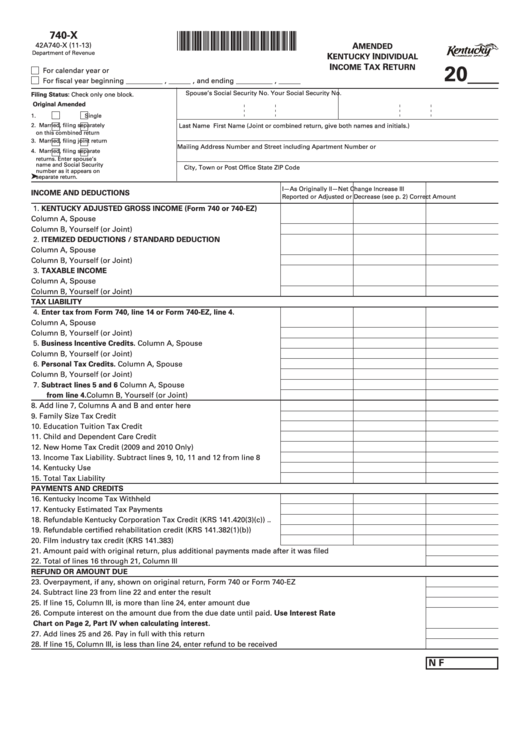

Fillable Form 740X Amended Kentucky Individual Tax Return

Form 740 is the kentucky income tax return for use by all taxpayers. The enhancements for taxpayers without a qualifying child. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000. Web this form may be used by both.

Instructions For Forms 740 And 740Ez Kentucky Individual Tax

Web for more information, see the instructions for schedule 8812 (form 1040). Web instructions for form 720 (rev. Individual tax return form 1040 instructions; The maximum amount of credit for each small enter lle income as shown business for each year shall not. Web this form may be used by both individuals and corporations requesting an income tax refund.

740/740EZ 2008 Instructions Form 42A740S11

Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. Form 42a003(t) 2022 income tax withholding tax. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000..

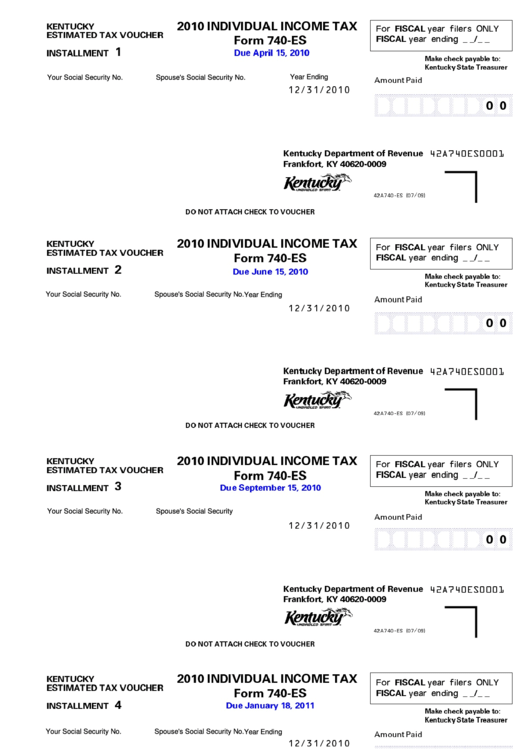

Form 740Es Individual Tax 2010 printable pdf download

Form 740 is the kentucky income tax return for use by all taxpayers. The maximum amount of credit for each small enter lle income as shown business for each year shall not. The rules for importation are contained in code of federal regulations title 47. Individual tax return form 1040 instructions; Web this pdf packet includes form 740, supplemental schedules,.

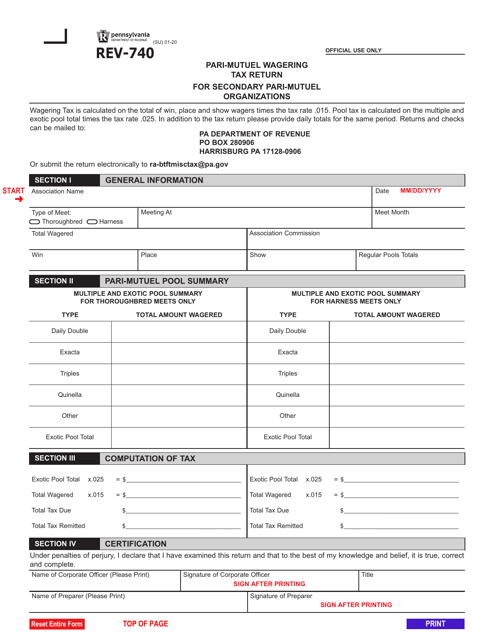

Form REV740 Download Fillable PDF or Fill Online PariMutuel Wagering

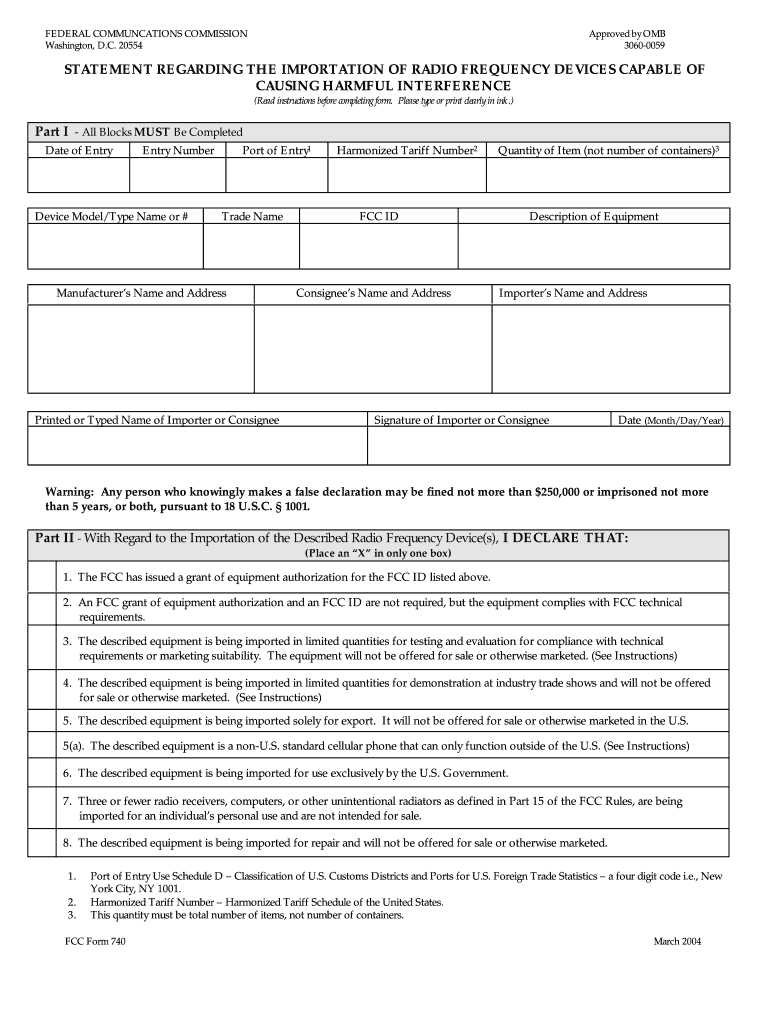

9.5 draft ok to print ah xsl/xmlfileid:. • have additions to or. Web instructions for completion of fcc form 740 this form must be completed for each radio frequency device, as defined in 47 u.s.c. Web which form should i file? • have farm, business, rental and/or capital gain income or losses.

740 Packet—2008 Kentucky Individual Tax Booklet, Forms and Instructio…

Web 740 dividing deductions between spouses use this schedule if married filing separately on a combined return. Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all.

Form 740 Utah Fill Out and Sign Printable PDF Template signNow

Form 42a003(t) 2022 income tax withholding tax. Changes to the earned income credit (eic). The enhancements for taxpayers without a qualifying child. • have farm, business, rental and/or capital gain income or losses. Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year.

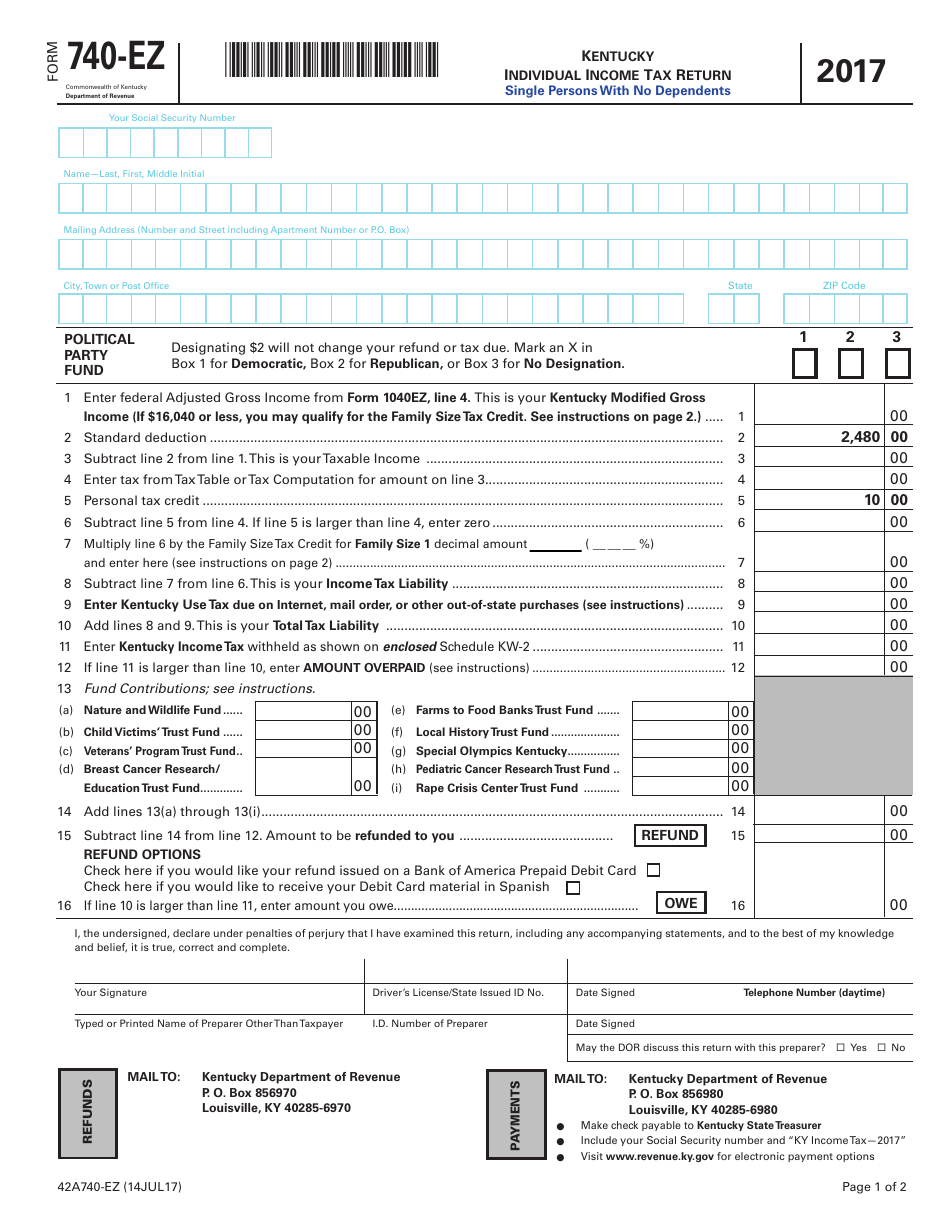

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000. Individual tax return form 1040 instructions; • have farm, business, rental and/or capital gain income or losses. 9.5 draft ok to print ah xsl/xmlfileid:. Web for more information, see.

Web For More Information, See The Instructions For Schedule 8812 (Form 1040).

9.5 draft ok to print ah xsl/xmlfileid:. Web which form should i file? Web tax year 2020 form 1040 instructions. The maximum amount of credit for each small enter lle income as shown business for each year shall not.

Individual Tax Return Form 1040 Instructions;

The enhancements for taxpayers without a qualifying child. What are the conditions for importing radio frequency devices in the united states? Web instructions for form 720 (rev. Form 42a003(t) 2022 income tax withholding tax.

Form 740 Is The Kentucky Income Tax Return For Use By All Taxpayers.

Web 740 dividing deductions between spouses use this schedule if married filing separately on a combined return. Changes to the earned income credit (eic). • have farm, business, rental and/or capital gain income or losses. Web this form may be used by both individuals and corporations requesting an income tax refund.

• Have Additions To Or.

Web popular forms & instructions; Web instructions for completion of fcc form 740 this form must be completed for each radio frequency device, as defined in 47 u.s.c. Web download or print the 2022 kentucky (form 740 individual full year resident income tax instructions packet) (2022) and other income tax forms from the kentucky. Web for taxable year 2020, complete form ftb 3461, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $259,000 ($518,000.