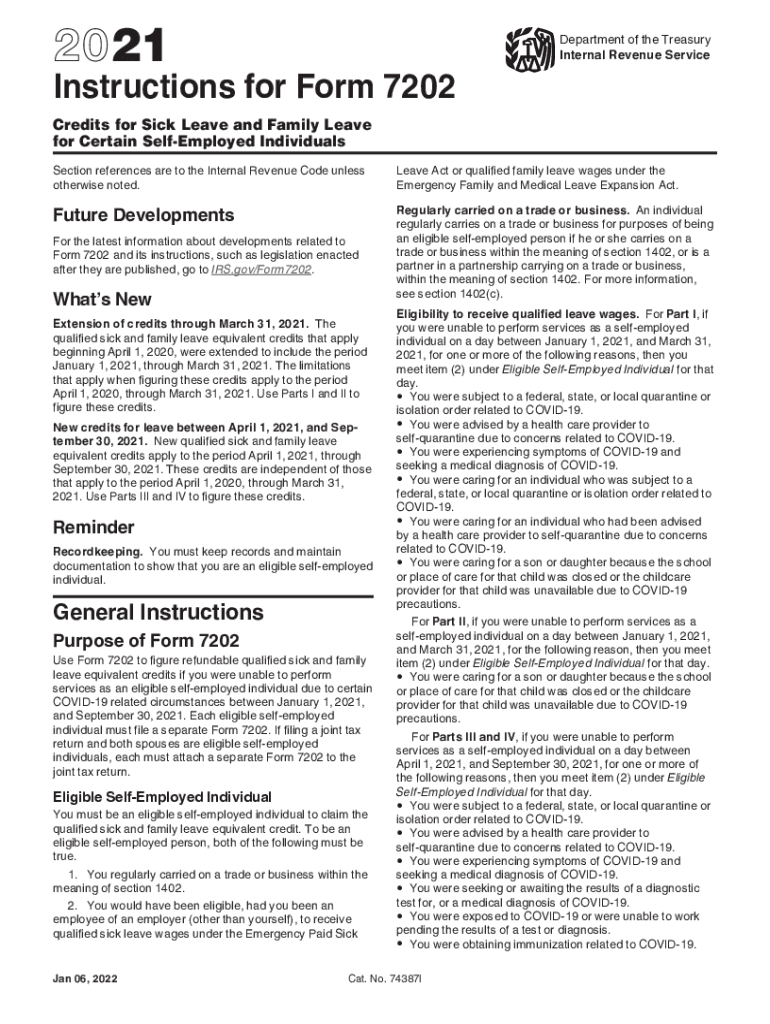

Form 7202 Instructions 2021

Form 7202 Instructions 2021 - Web how to generate form 7202 in lacerte. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Save or instantly send your ready documents. Click here for forms' availability: Irs instructions can be found. The credits for sick leave and family leave for certain self. 7202 another option you have is to file without the. Easily fill out pdf blank, edit, and sign them. These amounts are then entered on the taxpayer’s form 1040. Solved • by intuit • 170 • updated december 21, 2022.

Follow the simple instructions below: Web get your online template and fill it in using progressive features. 7202 another option you have is to file without the. Department of the treasury internal revenue service. Web how to generate form 7202 in lacerte. Web this form should be available tomorrow 2/11/2021 unless irs changes it again. Solved • by intuit • 170 • updated december 21, 2022. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

The credits for sick leave and family leave for certain self. Save or instantly send your ready documents. 7202 another option you have is to file without the. Enjoy smart fillable fields and interactivity. Solved • by intuit • 170 • updated december 21, 2022. Click here for forms' availability: Follow the simple instructions below: To learn more, see instructions for form 7202. Web get your online template and fill it in using progressive features. These amounts are then entered on the taxpayer’s form 1040.

Form 7202 Instructions Fill Online, Printable, Fillable, Blank

Web this form should be available tomorrow 2/11/2021 unless irs changes it again. Enjoy smart fillable fields and interactivity. Experience all the advantages of. 7202 another option you have is to file without the. Click here for forms' availability:

Irs Instructions 7202 Fill Out and Sign Printable PDF Template signNow

The credits for sick leave and family leave for certain self. Solved • by intuit • 170 • updated december 21, 2022. These amounts are then entered on the taxpayer’s form 1040. Experience all the advantages of. Enjoy smart fillable fields and interactivity.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Web how to generate form 7202 in lacerte. The credits for sick leave and family leave for certain self. Follow the simple instructions below: Irs instructions can be found. These amounts are then entered on the taxpayer’s form 1040.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web get your online template and fill it in using progressive features. To learn more, see instructions for form 7202. Easily fill out pdf blank, edit, and sign them. The credits for sick leave and family leave for certain self. These amounts are then entered on the taxpayer’s form 1040.

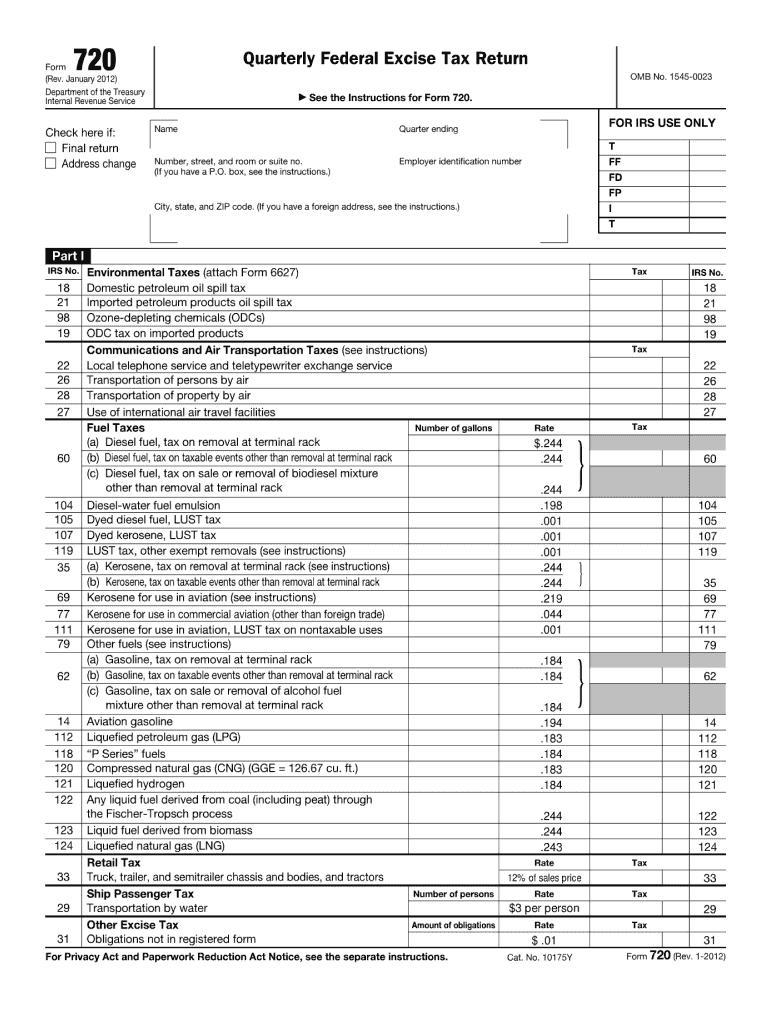

Form 720 Fill Out and Sign Printable PDF Template signNow

Solved • by intuit • 170 • updated december 21, 2022. Follow the simple instructions below: Enjoy smart fillable fields and interactivity. Experience all the advantages of. Easily fill out pdf blank, edit, and sign them.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. 7202 another option you have is to file without the. Web this form should be available tomorrow 2/11/2021 unless irs changes it again. To learn more, see instructions for.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

7202 another option you have is to file without the. Click here for forms' availability: Irs instructions can be found. The credits for sick leave and family leave for certain self. Follow the simple instructions below:

How to Complete Form 720 Quarterly Federal Excise Tax Return

Experience all the advantages of. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Click here for forms' availability: Department of the treasury internal revenue service. Web how to generate form 7202 in lacerte.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. The credits for sick leave and family leave for certain self. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken..

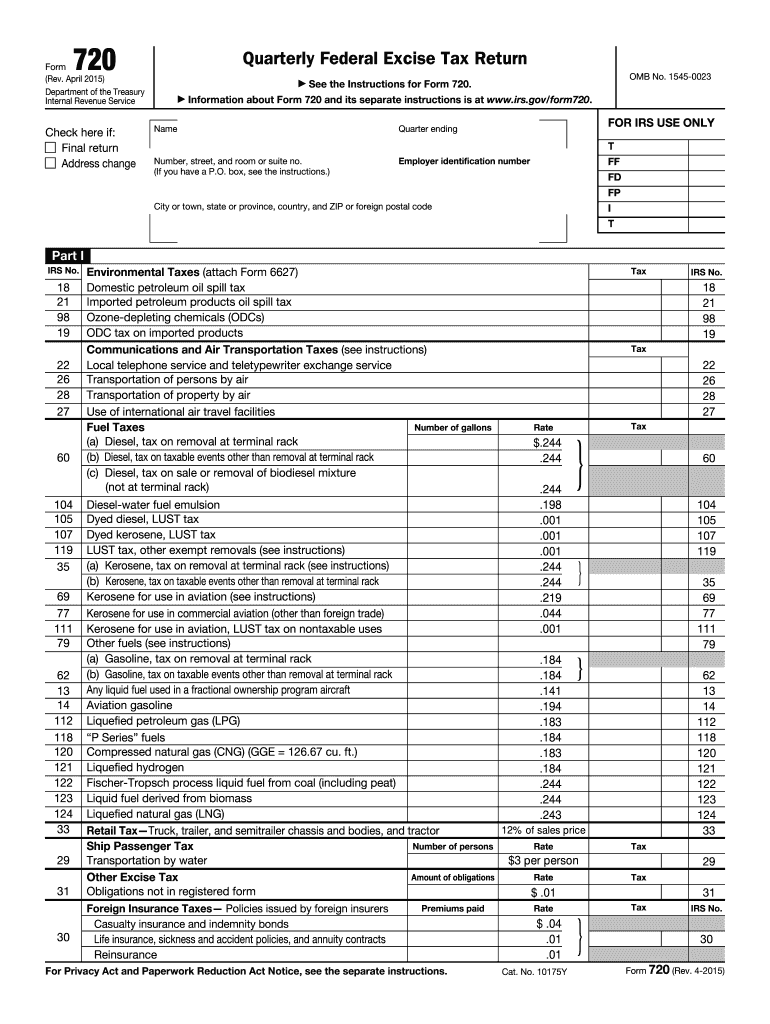

720 2015 form Fill out & sign online DocHub

Enjoy smart fillable fields and interactivity. Web this form should be available tomorrow 2/11/2021 unless irs changes it again. Follow the simple instructions below: Easily fill out pdf blank, edit, and sign them. Department of the treasury internal revenue service.

Web This Form Should Be Available Tomorrow 2/11/2021 Unless Irs Changes It Again.

To learn more, see instructions for form 7202. Save or instantly send your ready documents. Web how to generate form 7202 in lacerte. Solved • by intuit • 170 • updated december 21, 2022.

Experience All The Advantages Of.

Department of the treasury internal revenue service. The credits for sick leave and family leave for certain self. Web the tax credits will be claimed on 2020 form 1040 for leave taken between april 1, 2020, and december 31, 2020, and on their 2021 form 1040 for leave taken. Irs instructions can be found.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Click here for forms' availability: 7202 another option you have is to file without the. Follow the simple instructions below: Enjoy smart fillable fields and interactivity.

These Amounts Are Then Entered On The Taxpayer’s Form 1040.

Web get your online template and fill it in using progressive features.