Form 720 V

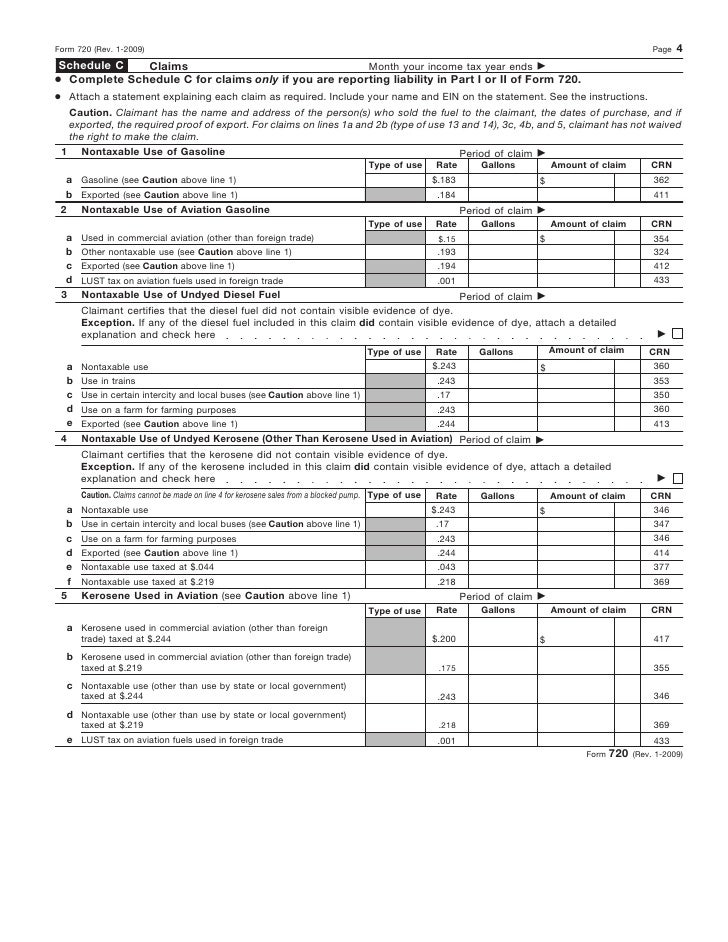

Form 720 V - To complete this section, the employer will. Web may 12, 2020. Web form 720 is to be filed one month after the end of each calendar quarter, except for certain kinds of excise taxes that are not for the payment of premiums to foreign insurance. Web you must file form 720 if: • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. I., without reduction of any. Quarterly federal excise tax return. The virgin islands imposes a gross receipts tax on total receipts from the conduct of business within the v. Form 730 tax on wagering:. See the instructions for form 720.

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Web purpose of form use form 720 and attachments to report your liability by irs no. Web may 12, 2020. I., without reduction of any. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web how to complete form 720. Form 730 tax on wagering:. April 2015) department of the treasury internal revenue service. Irs form 720 you can also view the 2023 fee notice from the irs here. Do not send a copy of the electronically filed return with the payment of tax.

Web form 720 is to be filed one month after the end of each calendar quarter, except for certain kinds of excise taxes that are not for the payment of premiums to foreign insurance. Irs form 720 you can also view the 2023 fee notice from the irs here. Do not send a copy of the electronically filed return with the payment of tax. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Quarterly federal excise tax return. If this is an employer’s last. Web how to complete form 720. And pay the excise taxes listed on the form. Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. I., without reduction of any.

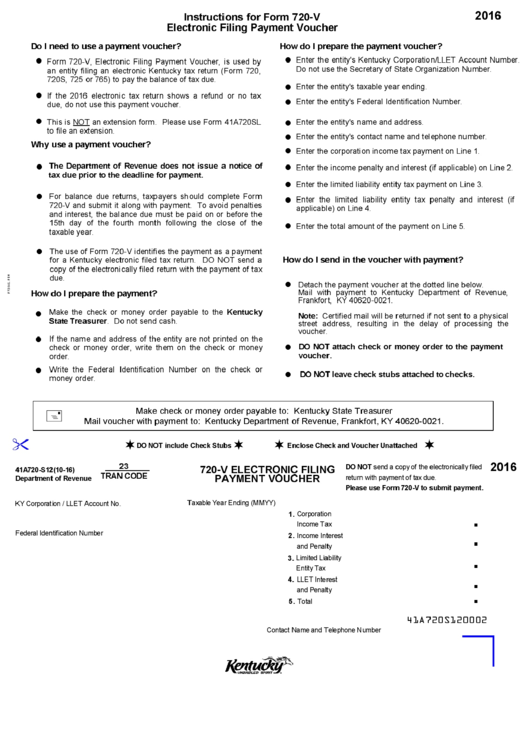

Form 720V Electronic Filing Payment Voucher 2016 printable pdf

I., without reduction of any. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. You can download or print. Web purpose of form use form 720 and attachments to report your liability by irs no. Web form 720 is to be filed.

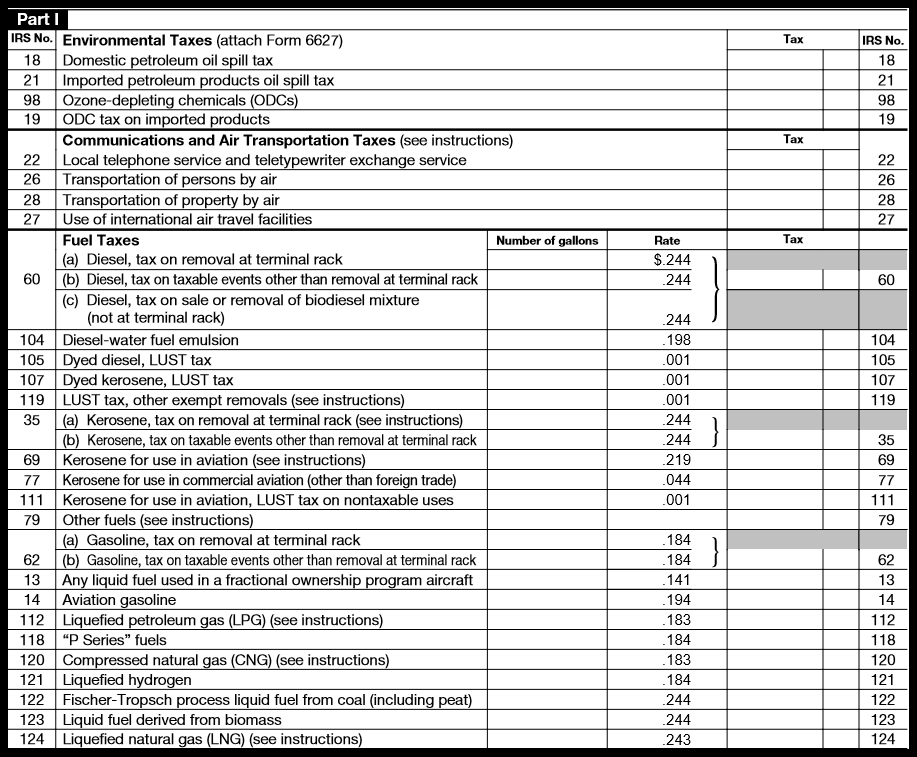

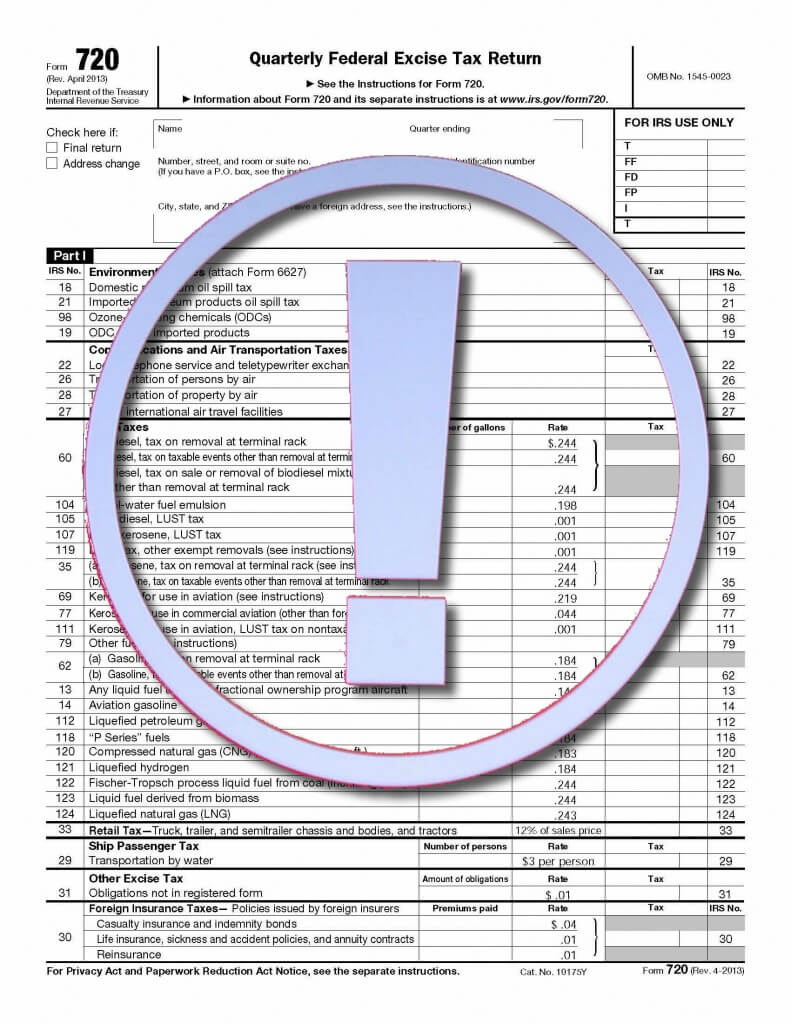

How to Complete Form 720 Quarterly Federal Excise Tax Return

Web may 12, 2020. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web how to complete form 720. If you report a liability on part i or. The virgin islands imposes a gross receipts tax on total receipts from the conduct.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

Web may 12, 2020. See the instructions for form 720. April 2018) department of the treasury internal revenue service. Web form 720 is to be filed one month after the end of each calendar quarter, except for certain kinds of excise taxes that are not for the payment of premiums to foreign insurance. If this is an employer’s last.

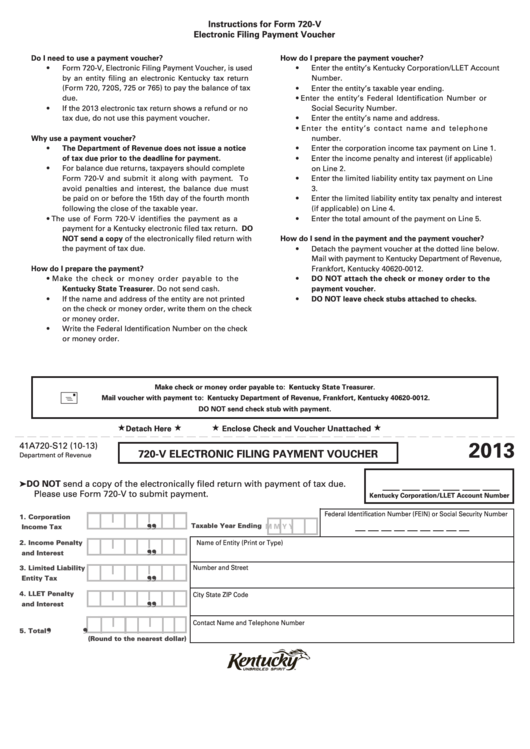

Form 720V Electronic Filing Payment Voucher 2013 printable pdf

I., without reduction of any. If this is an employer’s last. To complete this section, the employer will. And pay the excise taxes listed on the form. April 2015) department of the treasury internal revenue service.

Where To File Virgin Islands Return Form 720 B Fill Online, Printable

Tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of. Web purpose of form use form 720 and attachments to report your liability by irs no. See the instructions for form 720. Web retail tax—truck, trailer, and semitrailer chassis and bodies, and tractor form. April 2018) department of the.

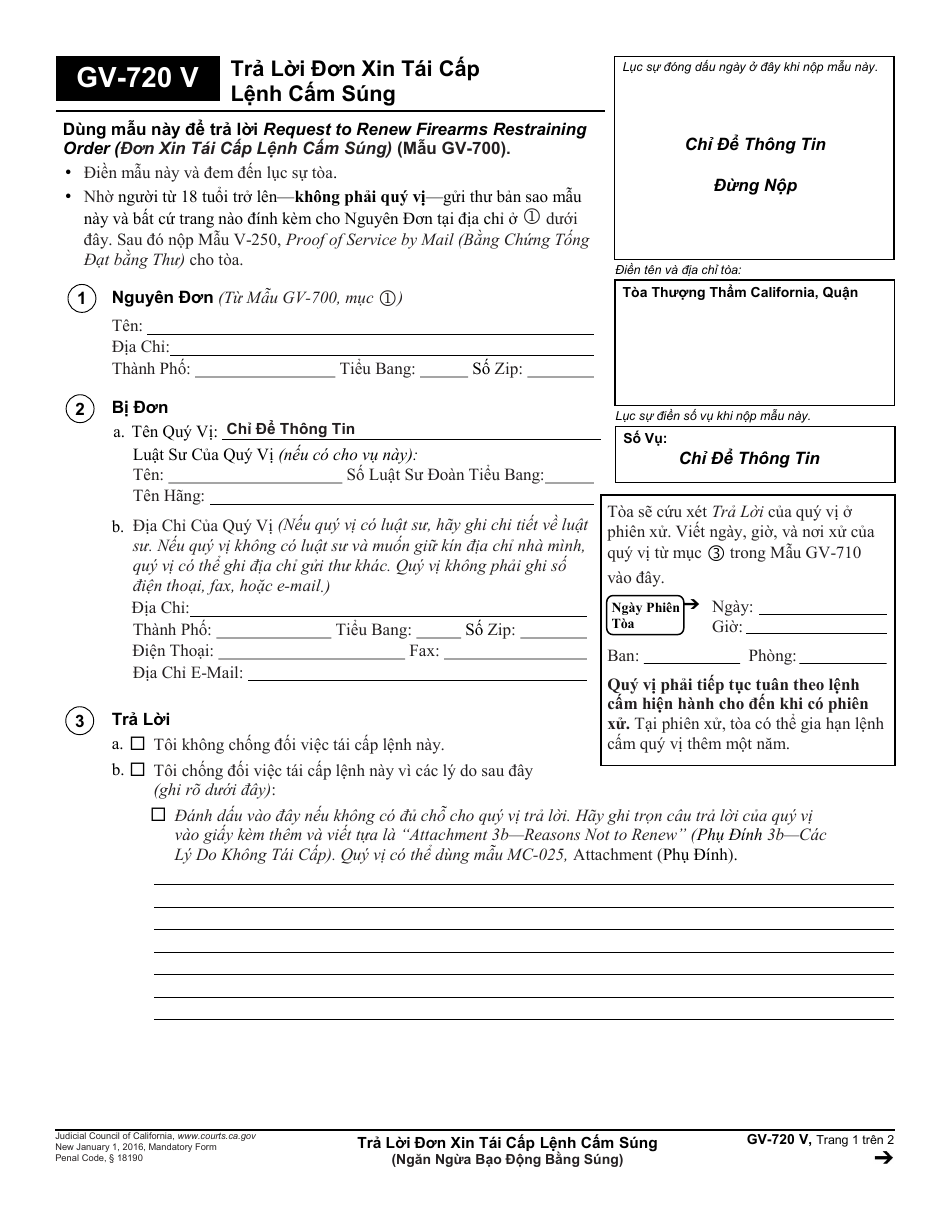

Form GV720 V Download Printable PDF or Fill Online Response to Request

Web purpose of form use form 720 and attachments to report your liability by irs no. Web retail tax—truck, trailer, and semitrailer chassis and bodies, and tractor form. Tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of. You can download or print. • you were liable for, or.

Modelo 720 720 Tax Form Marbella Solicitors Group

Form 730 tax on wagering:. Web how to complete form 720. Web we last updated the quarterly federal excise tax return in december 2022, so this is the latest version of form 720, fully updated for tax year 2022. And pay the excise taxes listed on the form. • you were liable for, or responsible for collecting, any of the.

Form 720 Efile Quarterly Federal Excise Tax Returns

Quarterly federal excise tax return. You can download or print. Web how to complete form 720. Web purpose of form use form 720 and attachments to report your liability by irs no. April 2018) department of the treasury internal revenue service.

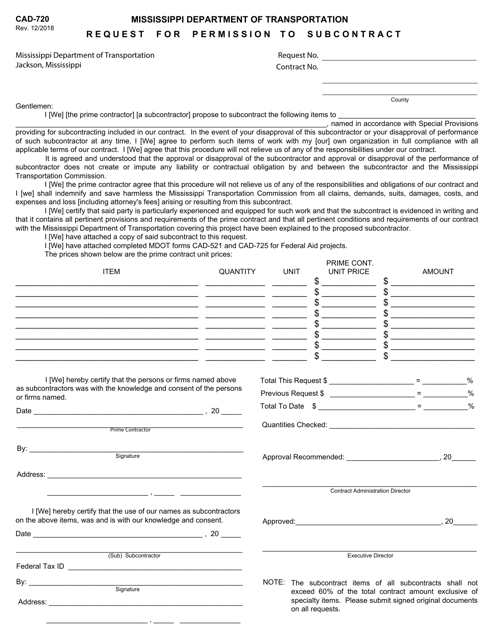

Form CAD720 Download Fillable PDF or Fill Online Request for

April 2018) department of the treasury internal revenue service. Do not send a copy of the electronically filed return with the payment of tax. Irs form 720 you can also view the 2023 fee notice from the irs here. Web may 12, 2020. You can download or print.

Form 720 Quarterly Federal Excise Tax Return

Irs form 720 you can also view the 2023 fee notice from the irs here. And pay the excise taxes listed on the form. Web how to complete form 720. Tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of. Web may 12, 2020.

Web May 12, 2020.

Irs form 720 you can also view the 2023 fee notice from the irs here. In the examples below, the company plan covered an. If you report a liability on part i or. Web form 720 is to be filed one month after the end of each calendar quarter, except for certain kinds of excise taxes that are not for the payment of premiums to foreign insurance.

Web In 2023, The Irs Will Issue An Updated Form 720 For The Second Quarter With The Pcori Fees Adjusted For The Upcoming July 31 Payment Date.

April 2018) department of the treasury internal revenue service. Web you must file form 720 if: I., without reduction of any. If this is an employer’s last.

April 2015) Department Of The Treasury Internal Revenue Service.

See the instructions for form 720. Quarterly federal excise tax return. Web how to complete form 720. Tax form 720, quarterly federal excise tax return, is used to calculate and make excise tax payments on certain categories of.

To Complete This Section, The Employer Will.

Web purpose of form use form 720 and attachments to report your liability by irs no. Form 730 tax on wagering:. You can download or print. The virgin islands imposes a gross receipts tax on total receipts from the conduct of business within the v.