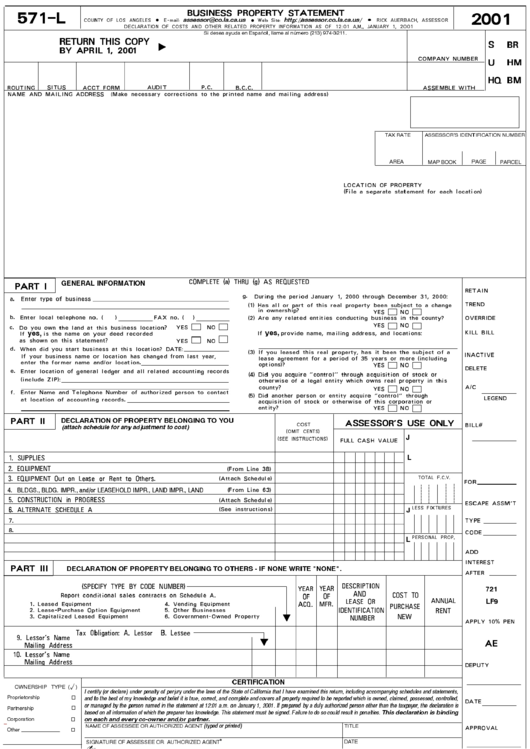

Form 571 L Instructions

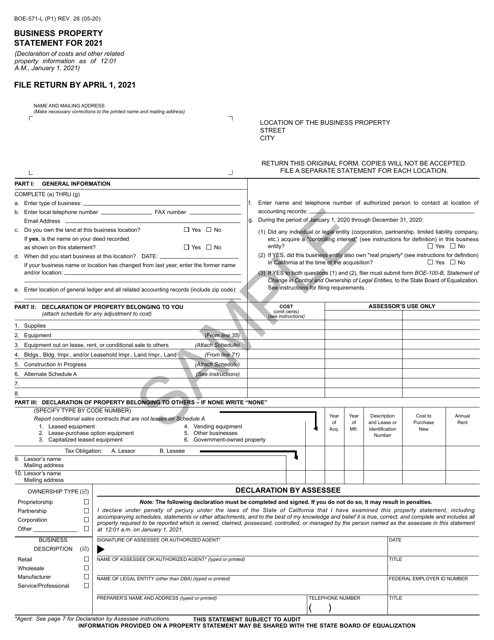

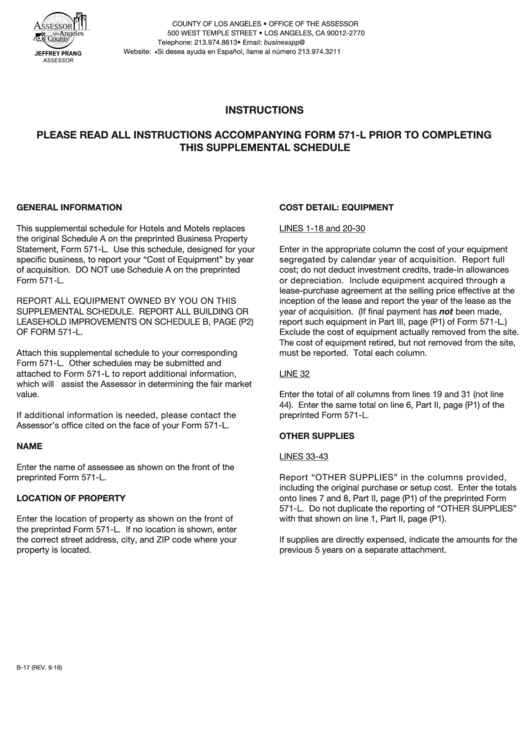

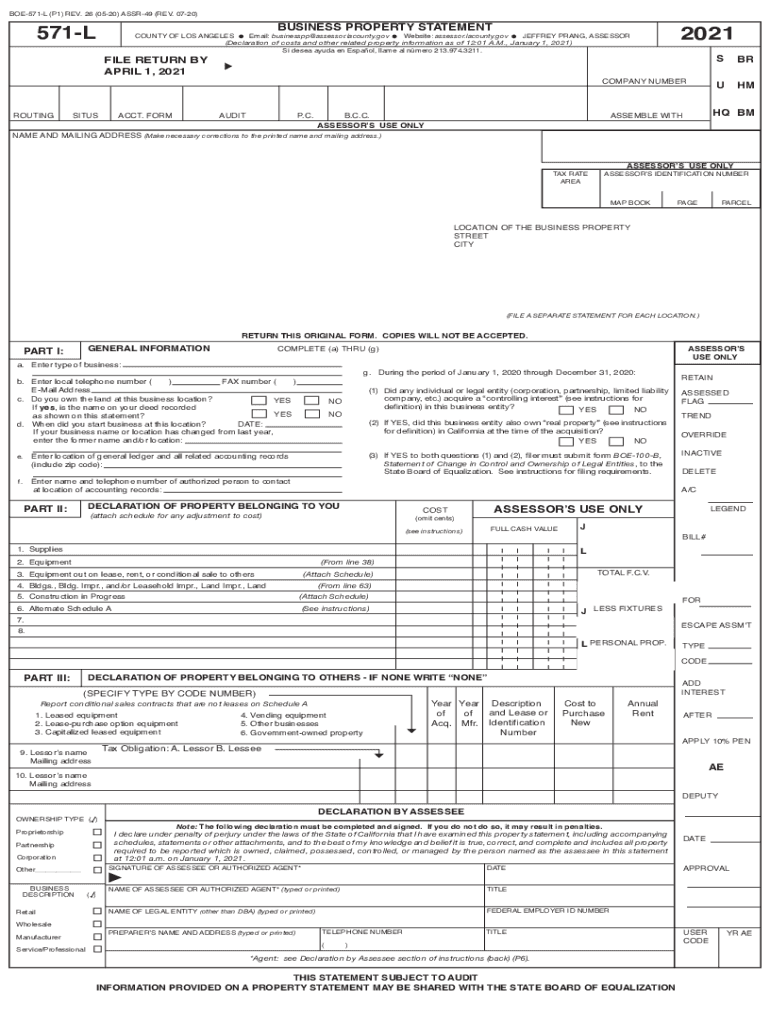

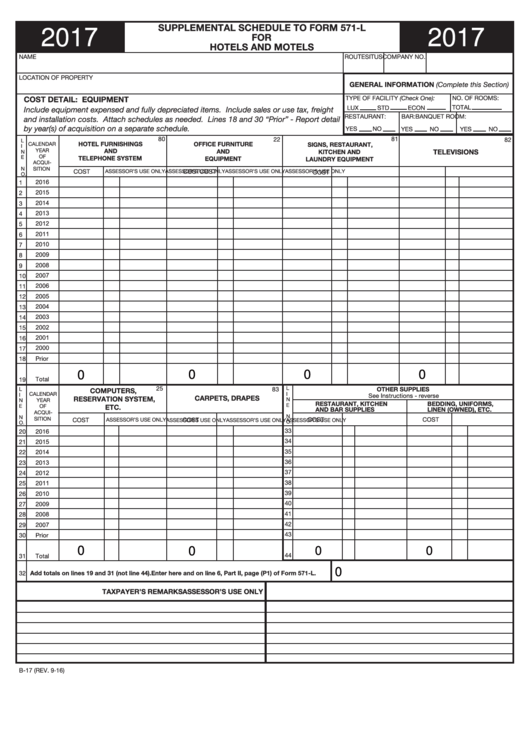

Form 571 L Instructions - For more information , read the assessor's business personal property information page. Basically, it is a tax on a. Web state board of equalization. Required or needed forms (files): Web the 571l (bps) form is used to declare cost information regarding supplies business equipment and leasehold improvements for each business location. Equipment report all those business assets used in your business as of january. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. See instructions for filing requirements. Equipment report all those business assets used in your business as of january 1. Web select the business personal property form you need from the following list.

Required or needed forms (files): Web state board of equalization. Equipment report all those business assets used in your business as of january 1. Equipment report all those business assets used in your business as of january. See instructions for filing requirements. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Web the process to file electronically is secure and fast. It’s a property tax form that business owners (like startups) need to file every year that reports business property. For more information , read the assessor's business personal property information page. Web the 571l (bps) form is used to declare cost information regarding supplies business equipment and leasehold improvements for each business location.

Web the 571l (bps) form is used to declare cost information regarding supplies business equipment and leasehold improvements for each business location. Equipment report all those business assets used in your business as of january. Web select the business personal property form you need from the following list. See instructions for filing requirements. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Equipment report all those business assets used in your business as of january 1. Basically, it is a tax on a. Web the process to file electronically is secure and fast. Web state board of equalization. Required or needed forms (files):

Form 571 L Alameda County Aulaiestpdm Blog

Required or needed forms (files): Web the process to file electronically is secure and fast. Equipment report all those business assets used in your business as of january 1. Web state board of equalization. For more information , read the assessor's business personal property information page.

2011 Form CA BOE571L Fill Online, Printable, Fillable, Blank pdfFiller

Required or needed forms (files): Web select the business personal property form you need from the following list. Web the process to file electronically is secure and fast. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Basically, it is a tax.

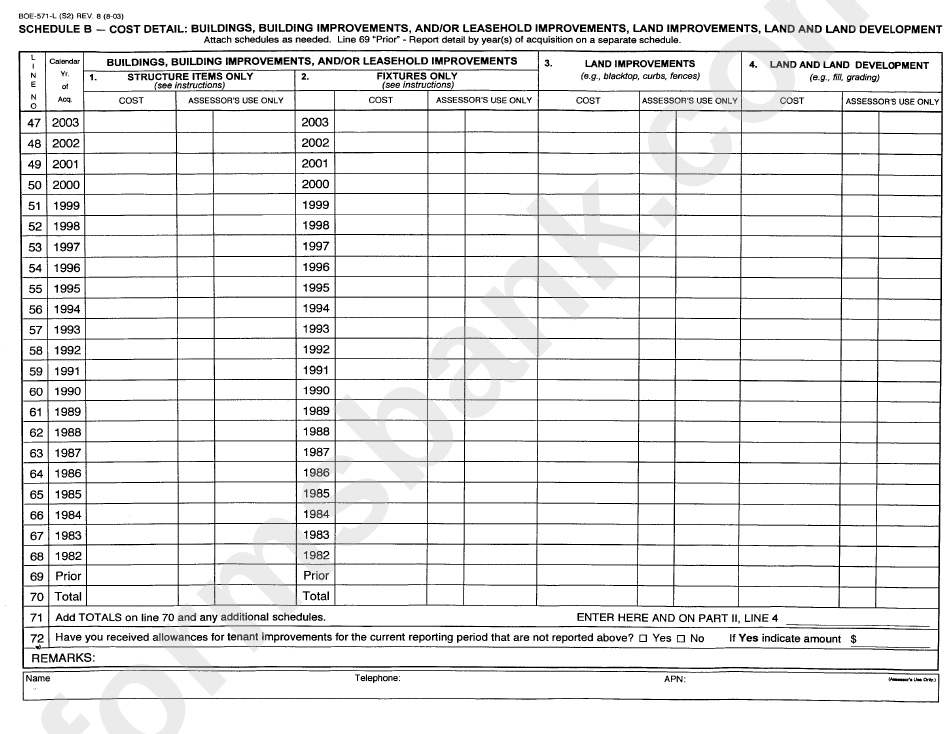

Form Boe571L Schedule B Cost Detail Buildings, Building

Equipment report all those business assets used in your business as of january 1. For more information , read the assessor's business personal property information page. Web state board of equalization. Web select the business personal property form you need from the following list. See instructions for filing requirements.

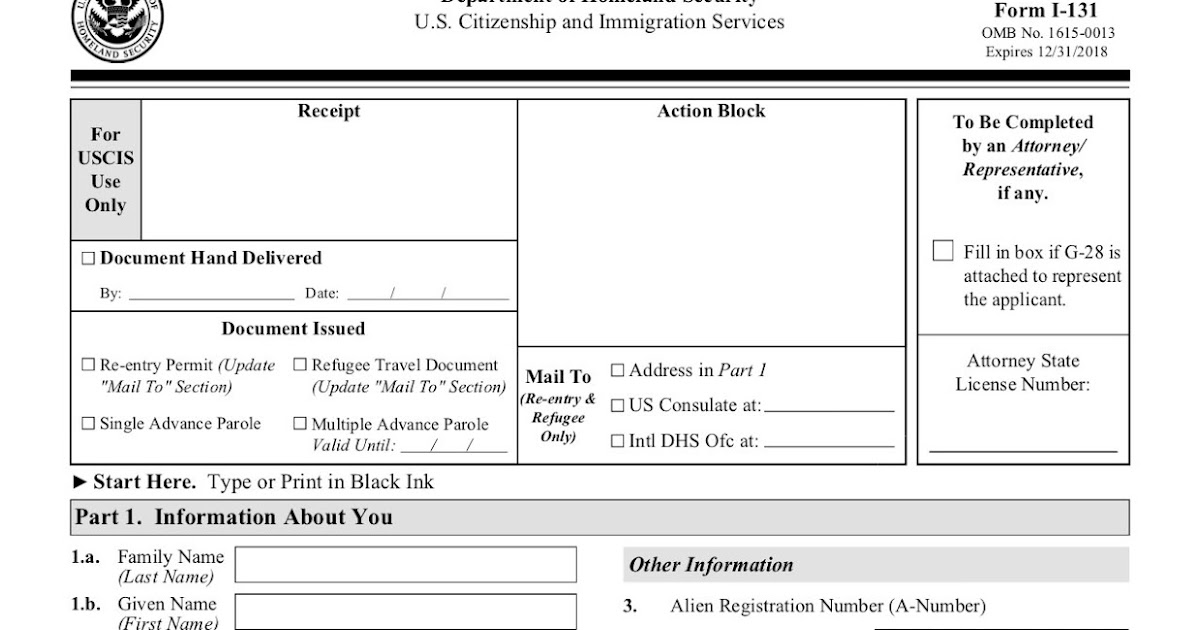

HOW TO APPLY FOR A U.S. REFUGEE TRAVEL DOCUMENT (FORM I571)? (UNITED

For more information , read the assessor's business personal property information page. It’s a property tax form that business owners (like startups) need to file every year that reports business property. Web select the business personal property form you need from the following list. See instructions for filing requirements. Required or needed forms (files):

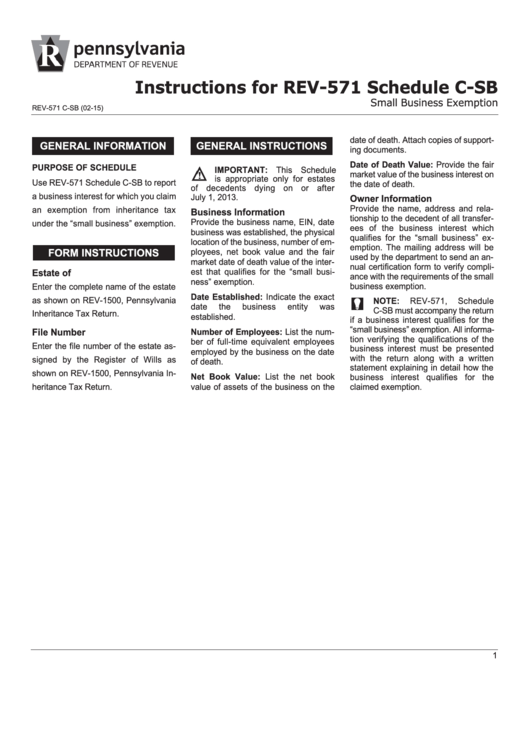

Instructions For Rev571 Schedule CSb printable pdf download

Required or needed forms (files): Equipment report all those business assets used in your business as of january 1. Web the 571l (bps) form is used to declare cost information regarding supplies business equipment and leasehold improvements for each business location. Web state board of equalization. Equipment report all those business assets used in your business as of january.

Form BOE571L Download Printable PDF or Fill Online Business Property

Web state board of equalization. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Equipment report all those business assets used in your business as of january. Web the 571l (bps) form is used to declare cost information regarding supplies business equipment.

Form B17 Instructions Supplemental Schedule To Form 571L For Hotels

It’s a property tax form that business owners (like startups) need to file every year that reports business property. Required or needed forms (files): For more information , read the assessor's business personal property information page. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled,.

CA BOE571L (P1) 20212022 Fill and Sign Printable Template Online

Web select the business personal property form you need from the following list. See instructions for filing requirements. Web the process to file electronically is secure and fast. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Equipment report all those business.

Fillable Supplemental Schedule To Form 571L For Hotels And Motels

It’s a property tax form that business owners (like startups) need to file every year that reports business property. Web select the business personal property form you need from the following list. For more information , read the assessor's business personal property information page. Web the process to file electronically is secure and fast. Required or needed forms (files):

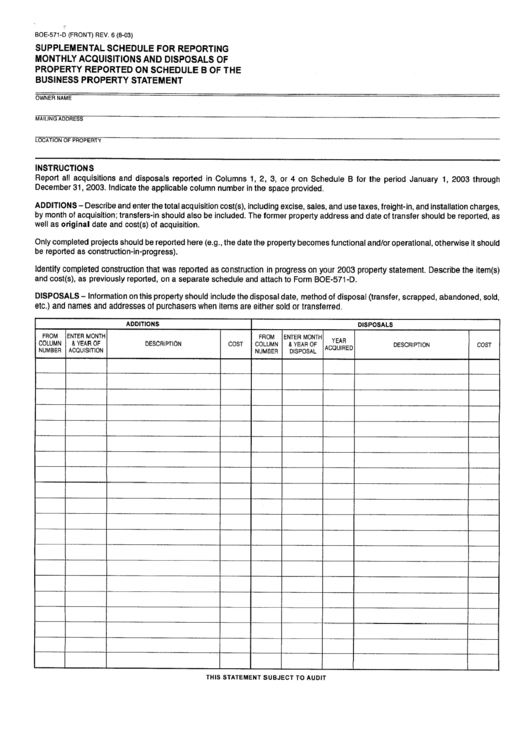

Form Boe571D Supplemental Shedule For Reporting Monthly

Web select the business personal property form you need from the following list. Equipment report all those business assets used in your business as of january. Basically, it is a tax on a. It’s a property tax form that business owners (like startups) need to file every year that reports business property. Web this form constitutes an official request that.

Web The 571L (Bps) Form Is Used To Declare Cost Information Regarding Supplies Business Equipment And Leasehold Improvements For Each Business Location.

Required or needed forms (files): For more information , read the assessor's business personal property information page. Basically, it is a tax on a. Web the process to file electronically is secure and fast.

It’s A Property Tax Form That Business Owners (Like Startups) Need To File Every Year That Reports Business Property.

Web select the business personal property form you need from the following list. Web this form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on. Equipment report all those business assets used in your business as of january 1. Web state board of equalization.

See Instructions For Filing Requirements.

Equipment report all those business assets used in your business as of january.