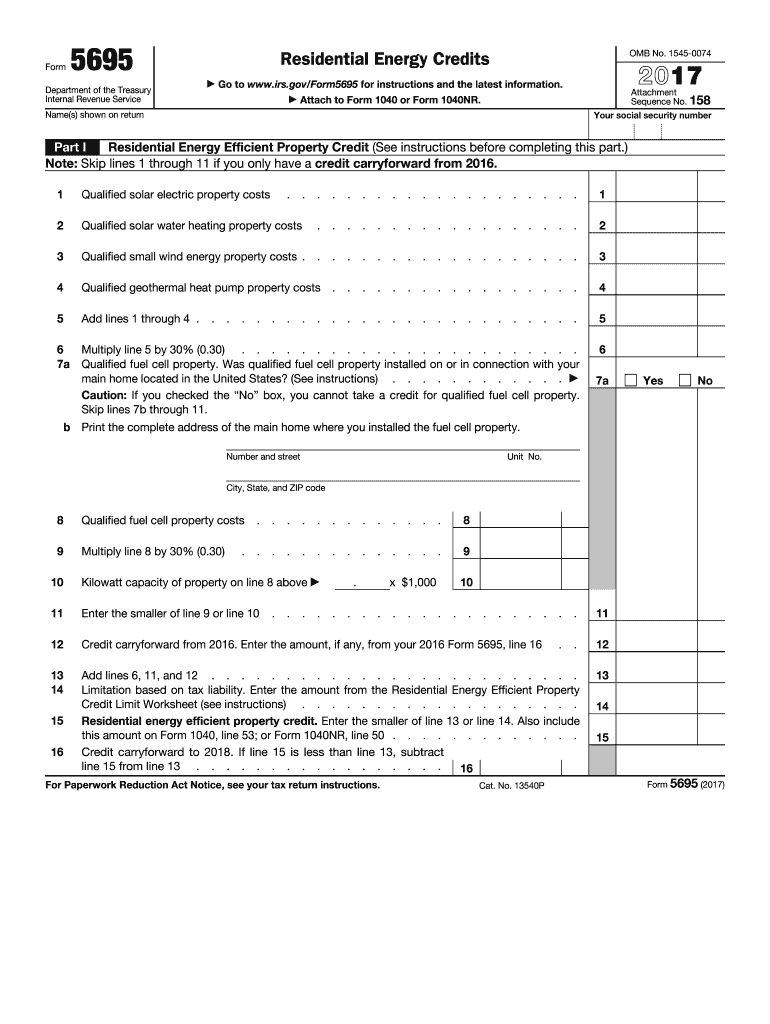

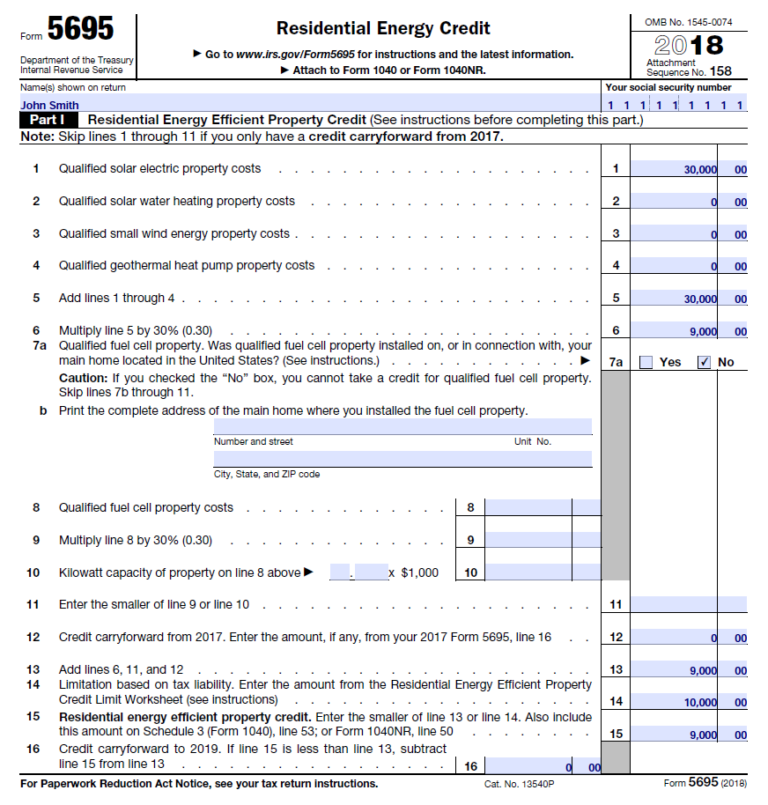

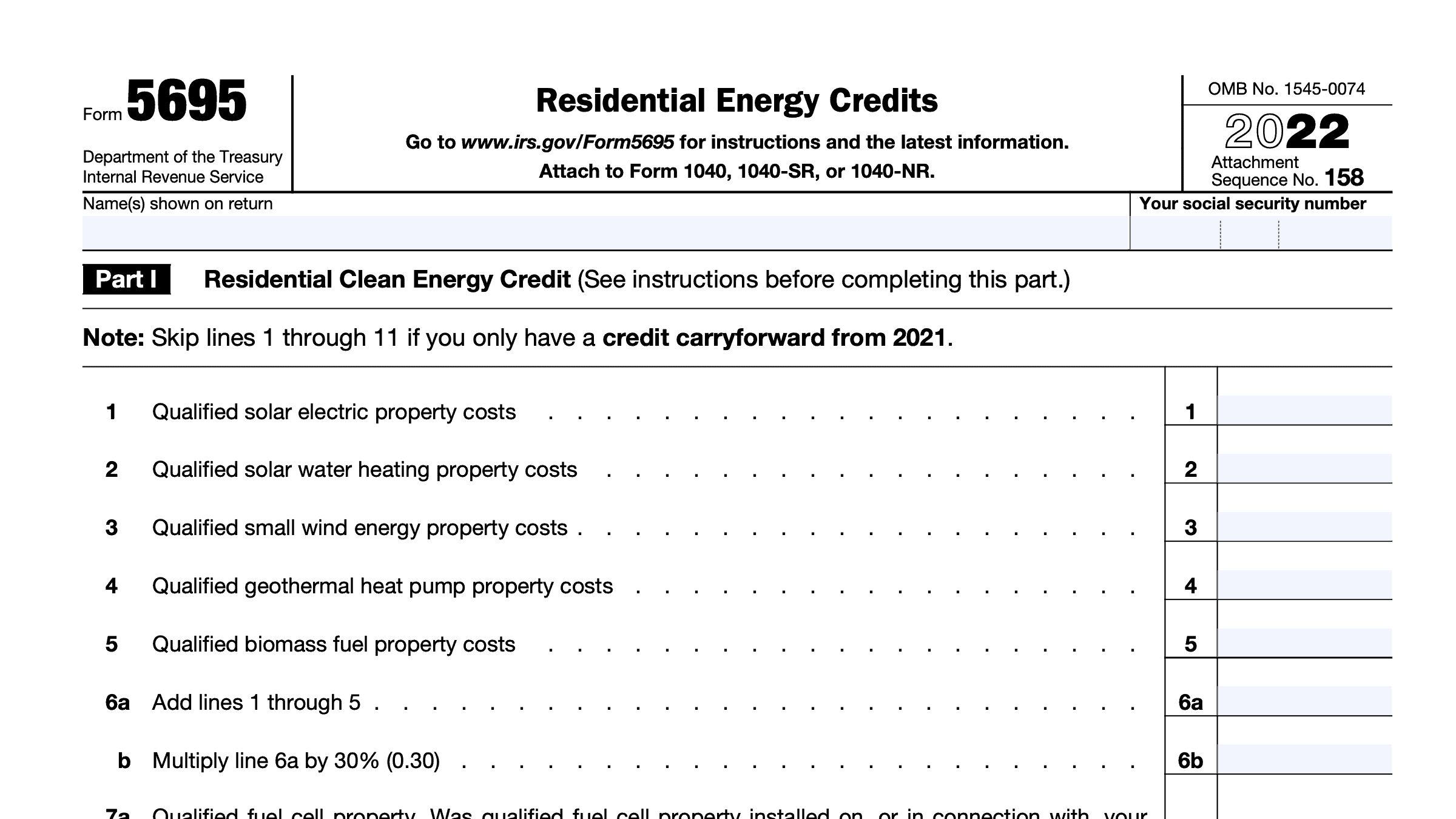

Form 5695 Instructions 2022

Form 5695 Instructions 2022 - The current version of the credit has been extended through the end of 2022 while the newly enhanced version is in effect for tax years 2023 through 2032. Web form 5695 instructions. Review the eligibility requirements for the residential energy efficient property credit. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion (s) are relevant to your home improvement project. Web residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web the residential energy credits are: The residential energy credits are the residential clean energy credit, and the energy efficient home improvement credit. 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.) note: Enter your energy efficiency property costs.

Web how to claim the solar tax credit (itc): Purpose of form use form 5695 to figure and take your residential energy credits. Enter your energy efficiency property costs. The residential energy credits are the residential clean energy credit, and the energy efficient home improvement credit. Web residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. The credit is based on the amount of energy saved by the improvements you make to your home. Web purpose of form use form 5695 to figure and take your residential energy credits. Review the eligibility requirements for the residential energy efficient property credit. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including. 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.) note:

The residential energy credits are: The residential energy credits are the residential clean energy credit, and the energy efficient home improvement credit. The credit is based on the amount of energy saved by the improvements you make to your home. Web how to complete irsform 5695 in 2022: 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.) note: Web in 2022 the nonbusiness energy property credit was enhanced and renamed the energy efficient home improvement credit. Enter your energy efficiency property costs. Review the eligibility requirements for the residential energy efficient property credit. Web how to claim the solar tax credit (itc): Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return.

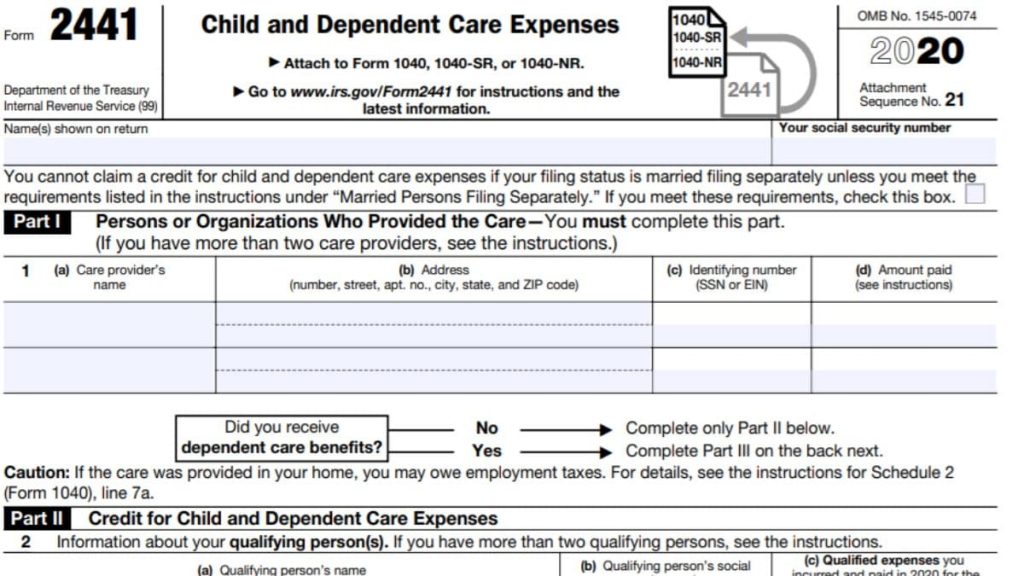

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Web form 5695 instructions. Web how to complete irsform 5695 in 2022: Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. The residential energy credits are the residential clean energy credit, and the energy efficient home improvement credit. Web the residential energy credits are:

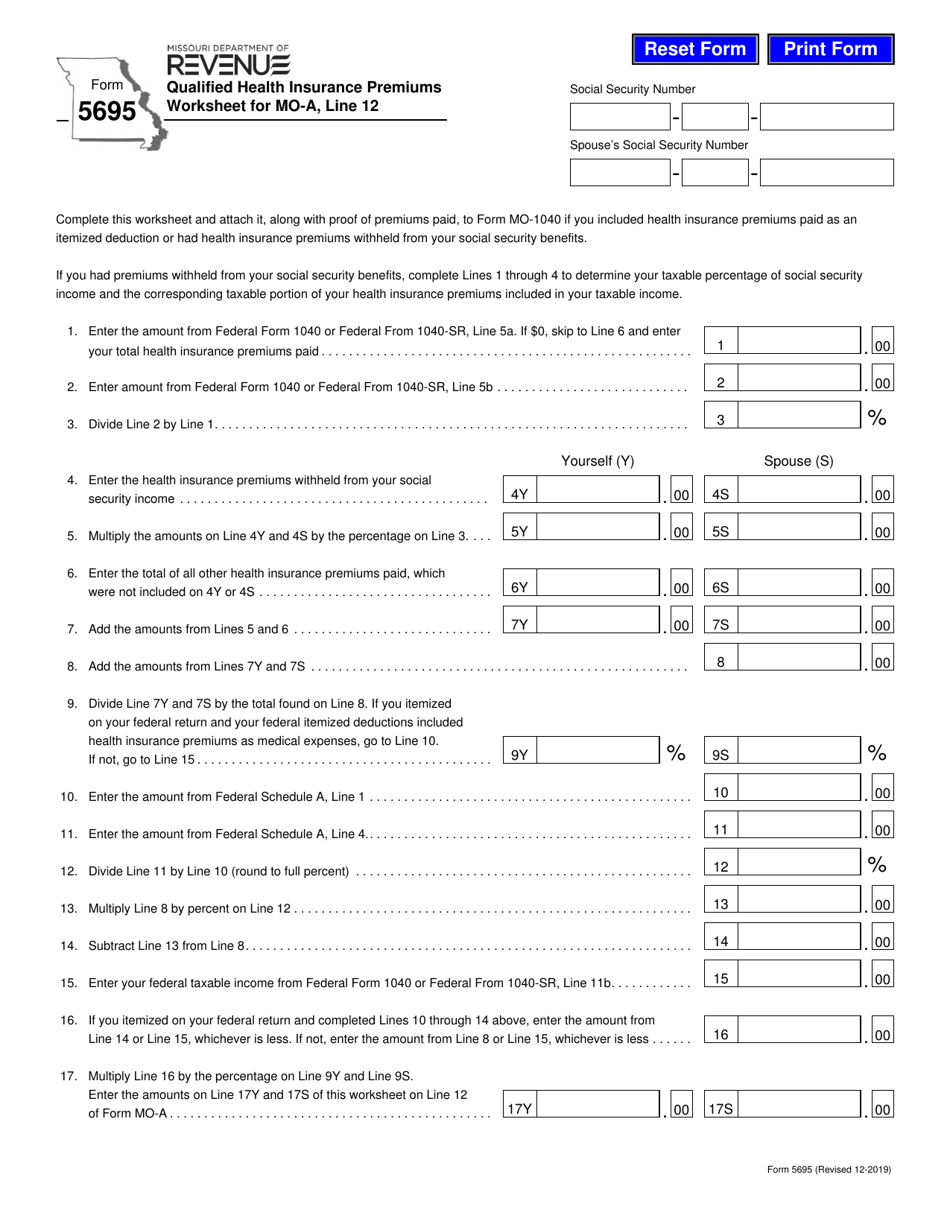

5695 form Fill out & sign online DocHub

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including. The residential clean energy credit, and. The current version of the credit has been extended through the end of 2022 while the newly enhanced version is in effect for tax years 2023 through 2032. Web information about form 5695, residential energy credits, including recent updates, related.

Completed Form 5695 Residential Energy Credit Capital City Solar

Web in 2022 the nonbusiness energy property credit was enhanced and renamed the energy efficient home improvement credit. Enter your energy efficiency property costs. The residential clean energy credit, and. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Web federal tax form 5695 is used to calculate your residential energy.

IRS Form 5695 Instructions Residential Energy Credits

Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Review the eligibility requirements for the residential energy efficient property credit. Web in 2022 the nonbusiness.

Form 5695 2021 2022 IRS Forms TaxUni

Web how to complete irsform 5695 in 2022: Web form 5695 instructions. Review the eligibility requirements for the residential energy efficient property credit. Enter your energy efficiency property costs. Web how to claim the solar tax credit (itc):

Form 5695 YouTube

Purpose of form use form 5695 to figure and take your residential energy credits. The residential clean energy credit, and. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. The residential clean energy credit, and the energy efficient home improvement credit. Web how to.

Business Line Of Credit Stated 2022 Cuanmologi

Web how to complete irsform 5695 in 2022: Web the residential energy credits are: Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.).

Form 5695 Download Fillable PDF or Fill Online Qualified Health

Web residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.) note: Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including. The residential clean energy credit, and the energy efficient home improvement.

How to Complete IRSForm 5695 in 2022 Instructions, Tip...

The residential clean energy credit, and. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including. Purpose of form use form 5695 to figure and take your residential energy credits. It’s divided into two parts based on the.

How To Save Money On Taxes By Filing IRS Form 5695

The residential energy credits are the residential clean energy credit, and the energy efficient home improvement credit. Web form 5695 instructions. Web purpose of form use form 5695 to figure and take your residential energy credits. Enter your energy efficiency property costs. Web per irs instructions for form 5695, page 1:

Form 5695 Calculates Tax Credits For A Variety Of Qualified Residential Energy Improvements, Including.

Enter your energy efficiency property costs. The residential energy credits are: Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web per irs instructions for form 5695, page 1:

Web In 2022 The Nonbusiness Energy Property Credit Was Enhanced And Renamed The Energy Efficient Home Improvement Credit.

The residential clean energy credit, and the energy efficient home improvement credit. Web the residential energy credits are: Purpose of form use form 5695 to figure and take your residential energy credits. Web how to claim the solar tax credit (itc):

Web How To Complete Irsform 5695 In 2022:

Web form 5695 instructions. Web federal tax form 5695 is used to calculate your residential energy credit, and must be submitted alongside form 1040 with your income tax return. It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion (s) are relevant to your home improvement project. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The Current Version Of The Credit Has Been Extended Through The End Of 2022 While The Newly Enhanced Version Is In Effect For Tax Years 2023 Through 2032.

Web purpose of form use form 5695 to figure and take your residential energy credits. 158 name(s) shown on return your social security number part i residential clean energy credit (see instructions before completing this part.) note: The credit is based on the amount of energy saved by the improvements you make to your home. The residential clean energy credit, and.