Form 568 Llc

Form 568 Llc - If your llc has one owner, you’re a single member limited liability company (smllc). Web we last updated california form 568 in february 2023 from the california franchise tax board. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web an llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an estimated fee with form ftb 3536, by the original due date of the llc’s return. Ftb 3522, llc tax voucher. 3537 (llc), payment for automatic extension for llcs. We make it simple to register your new llc. Per the ca ftb limited liability company (llc) website: Ad access irs tax forms. Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 352 2 with the franchise tax board of california.

Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. If your llc has one owner, you’re a single member limited liability company (smllc). The llc doesn't have a california source of income; We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Form 568, limited liability company return of income ftb. Ftb 3832, limited liability company nonresident members’ consent. Web if your llc has one owner, you’re a single member limited liability company (smllc). If you are married, you and your spouse are considered one owner and can elect to be treated as an smllc.

Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use schedule r to apportion income between the two states. Filing requirements and related questions show all what form do i file for my limited liability company? We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. We make it simple to register your new llc. Web an llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an estimated fee with form ftb 3536, by the original due date of the llc’s return. File your llc paperwork in just 3 easy steps! If your llc has one owner, you’re a single member limited liability company (smllc). We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Complete, edit or print tax forms instantly. Ftb 3536 (llc), estimated fee for llcs.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Filing requirements and related questions show all what form do i file for my limited liability company? I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real.

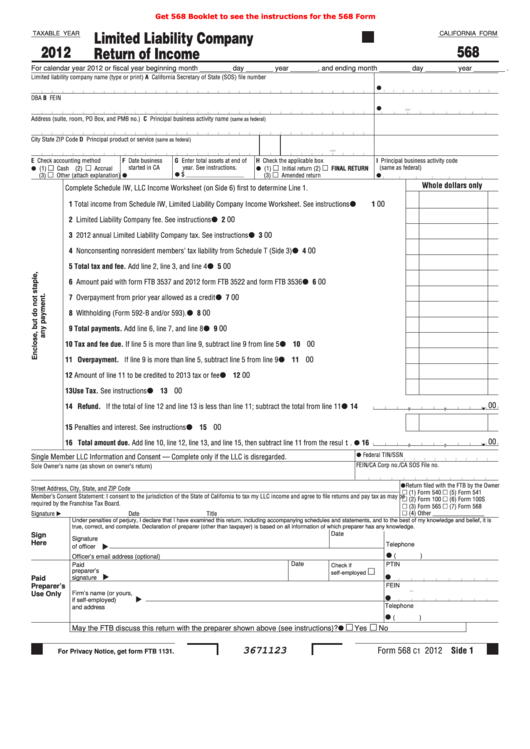

Fillable California Form 568 Limited Liability Company Return Of

Ftb 3536 (llc), estimated fee for llcs. Complete, edit or print tax forms instantly. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Web an llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was.

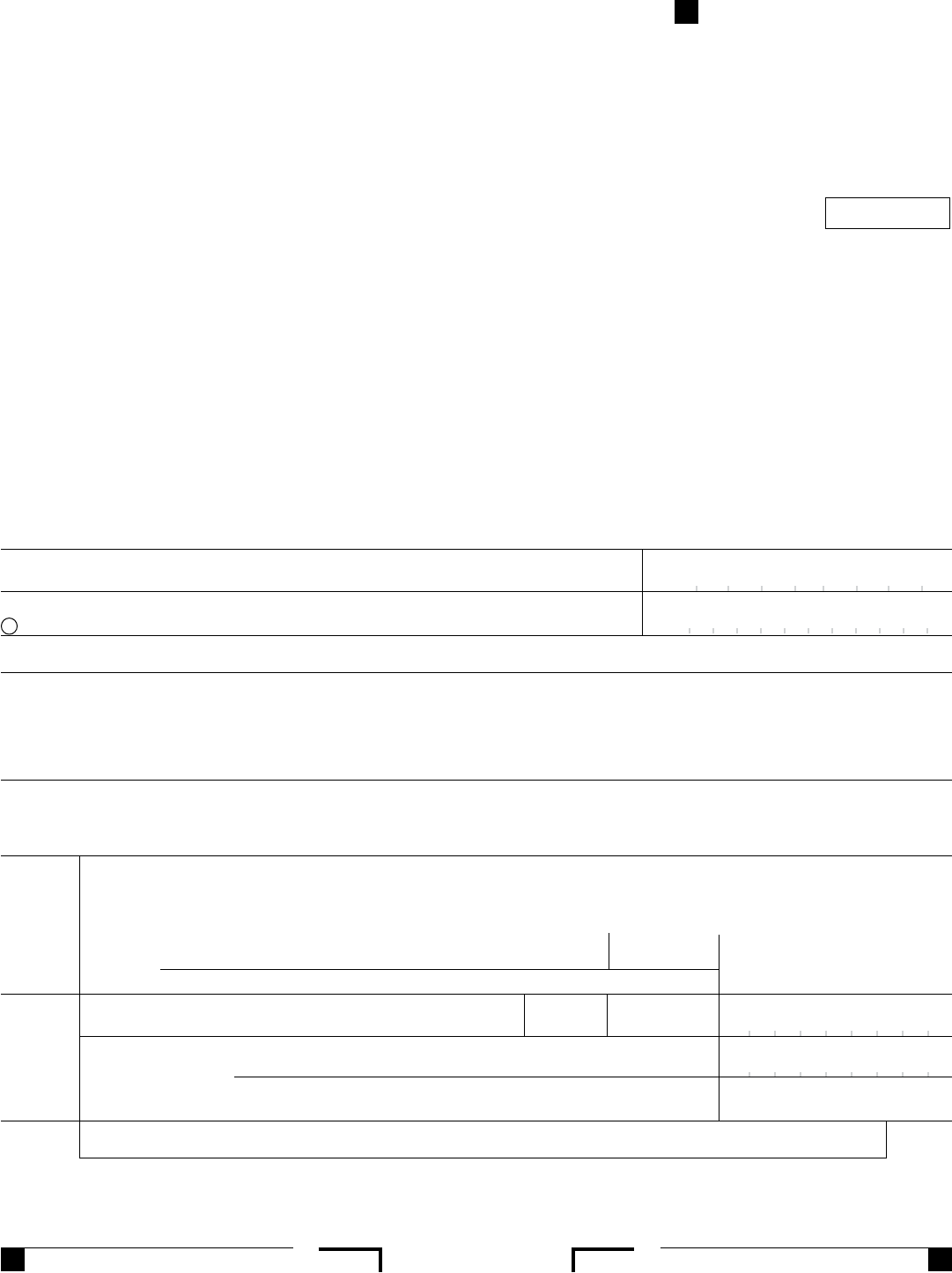

Contractor's Estimate Sheet Single

If your llc has one owner, you’re a single member limited liability company (smllc). We'll do the legwork so you can set aside more time & money for your business. Filing requirements and related questions show all what form do i file for my limited liability company? Ad protect your personal assets with a $0 llc—just pay state filing fees..

2016 Form 568 Limited Liability Company Return Of Edit, Fill

The llc doesn't have a california source of income; Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Per the ca ftb limited liability company (llc) website: 3537 (llc), payment for automatic extension for llcs. Edit, sign and save limited liability company tax form.

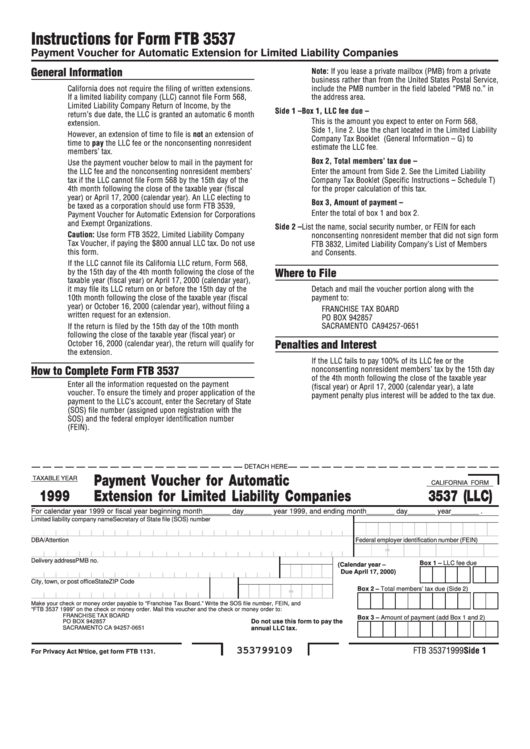

Form Ftb 3537 Payment Voucher For Automatic Extension For Limited

Edit, sign and save limited liability company tax form. Web if your llc has one owner, you’re a single member limited liability company (smllc). They are subject to the annual tax, llc fee. Pdffiller allows users to edit, sign, fill & share all type of documents online. We'll do the legwork so you can set aside more time & money.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Form 568, limited liability company return of income ftb. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for.

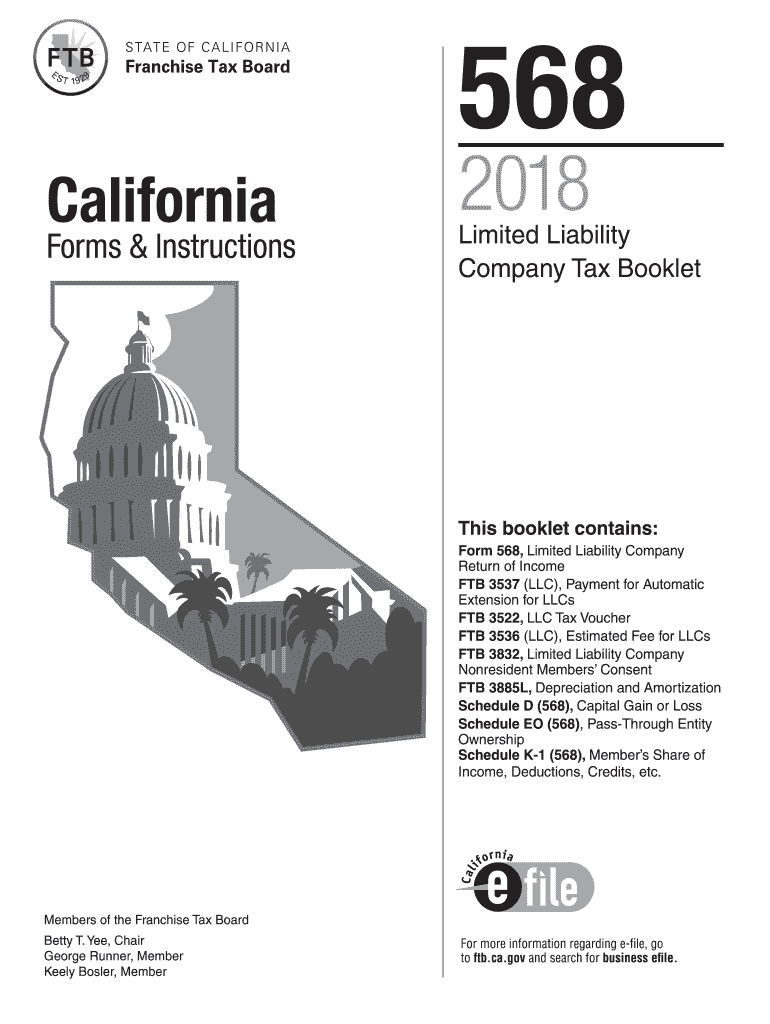

20182022 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. Form 568, limited liability company return of income ftb. Web use limited liability company tax voucher (ftb 3522) estimate and pay the llc fee by the 15th day of the 6th month after the beginning of the current tax year. We'll do the legwork so you can.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

If your llc has one owner, you’re a single member limited liability company (smllc). File your llc paperwork in just 3 easy steps! Web use limited liability company tax voucher (ftb 3522) estimate and pay the llc fee by the 15th day of the 6th month after the beginning of the current tax year. Web form 568 accounts for the.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 352 2 with the franchise tax board of california. Get ready for tax season deadlines by completing any required tax forms today. Web if your llc has one owner, you’re a single member limited liability company (smllc). They are subject to the annual.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

If you are married, you and your spouse are considered one owner and can elect to be treated as an smllc. Web if your llc has one owner, you’re a single member limited liability company (smllc). Web use limited liability company tax voucher (ftb 3522) estimate and pay the llc fee by the 15th day of the 6th month after.

Pdffiller Allows Users To Edit, Sign, Fill & Share All Type Of Documents Online.

Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. Per the ca ftb limited liability company (llc) website: File your llc paperwork in just 3 easy steps!

They Are Subject To The Annual Tax, Llc Fee.

We make it simple to register your new llc. Web an llc must file form 568, pay any nonconsenting nonresident members’ tax, and pay any amount of the llc fee owed that was not paid as an estimated fee with form ftb 3536, by the original due date of the llc’s return. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government.

If You Are Married, You And Your Spouse Are Considered One Owner And Can Elect To Be Treated As An Smllc.

3537 (llc), payment for automatic extension for llcs. Edit, sign and save limited liability company tax form. Ftb 3536 (llc), estimated fee for llcs. Ftb 3832, limited liability company nonresident members’ consent.

Web Use Limited Liability Company Tax Voucher (Ftb 3522) Estimate And Pay The Llc Fee By The 15Th Day Of The 6Th Month After The Beginning Of The Current Tax Year.

Web 568 2022 limited liability company tax booklet this booklet contains: The llc isn't actively doing business in california, or; Complete, edit or print tax forms instantly. If your llc has one owner, you’re a single member limited liability company (smllc).