Form 5500 Plan Characteristic Codes 2021

Form 5500 Plan Characteristic Codes 2021 - 1b benefits are primarily flat dollar (includes dollars per year of service). Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. There are three main categories of characteristic codes. These codes are only for defined benefit. Web the irs allows you to enter up to 10 codes on the form 5500. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: But more complex plan designs may have many codes. 10 or more employer plan under code. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.)

But more complex plan designs may have many codes. Web the irs allows you to enter up to 10 codes on the form 5500. There are three main categories of characteristic codes. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. 10 or more employer plan under code. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. These codes are only for defined benefit. 1b benefits are primarily flat dollar (includes dollars per year of service). Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is:

But more complex plan designs may have many codes. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web the irs allows you to enter up to 10 codes on the form 5500. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) These codes are only for defined benefit. There are three main categories of characteristic codes. 10 or more employer plan under code. 1b benefits are primarily flat dollar (includes dollars per year of service). Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively.

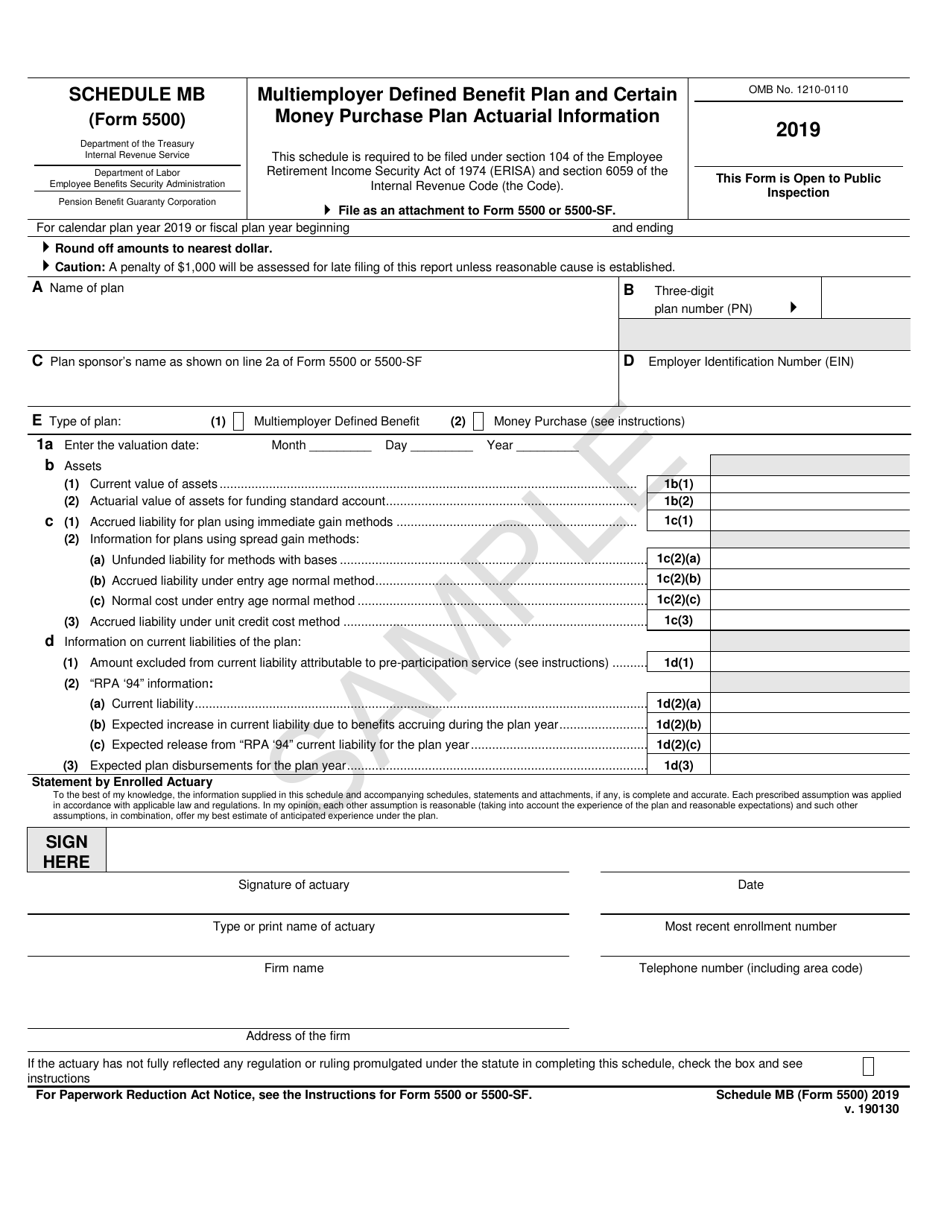

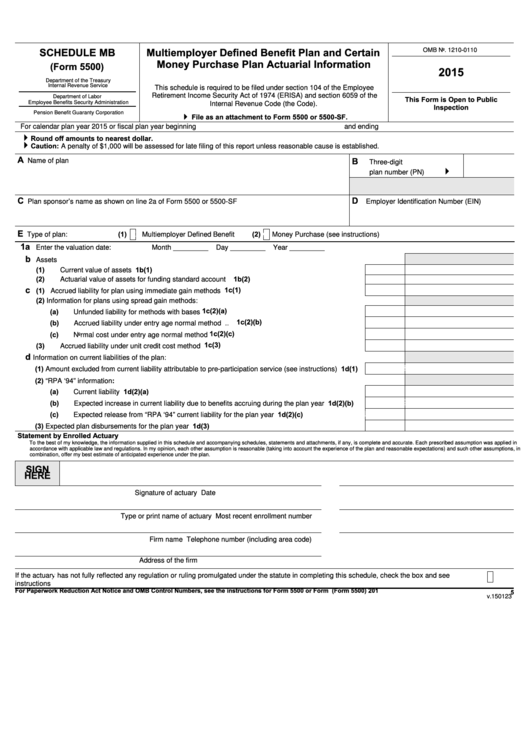

IRS Form 5500 Schedule MB Download Fillable PDF or Fill Online

10 or more employer plan under code. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. (failure to enter a valid receipt.

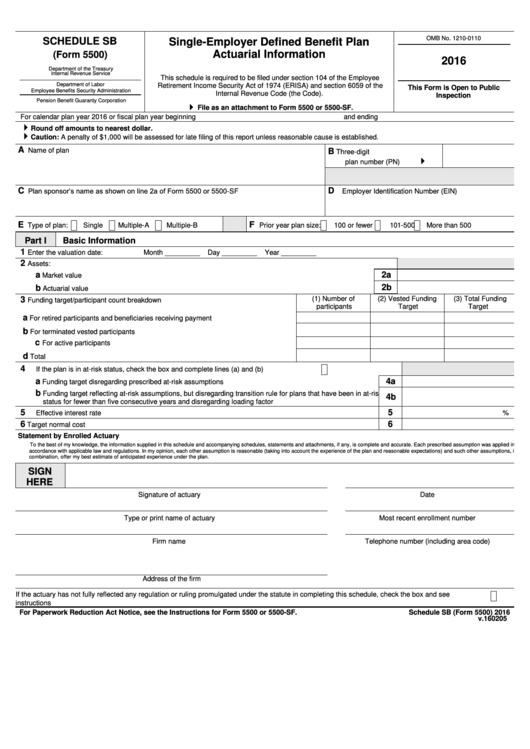

Fillable Schedule Sb (Form 5500) SingleEmployer Defined Benefit Plan

1b benefits are primarily flat dollar (includes dollars per year of service). Web the irs allows you to enter up to 10 codes on the form 5500. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. There are three main categories.

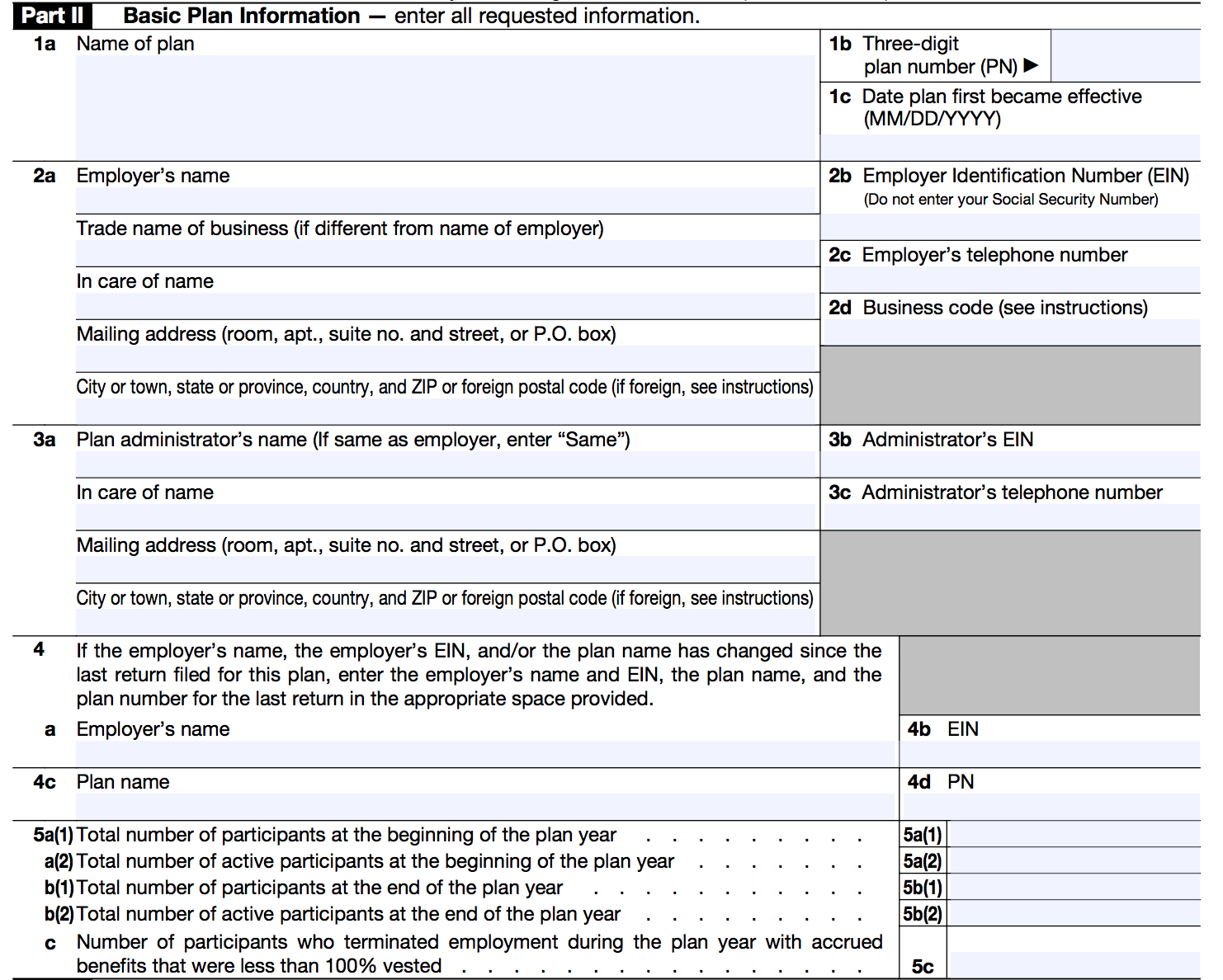

Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500

10 or more employer plan under code. Web the irs allows you to enter up to 10 codes on the form 5500. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the.

Form 5500 Sf Instructions 2018 slidesharetrick

These codes are only for defined benefit. Web the irs allows you to enter up to 10 codes on the form 5500. 1b benefits are primarily flat dollar (includes dollars per year of service). Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web for the calendar plan year 2021 or.

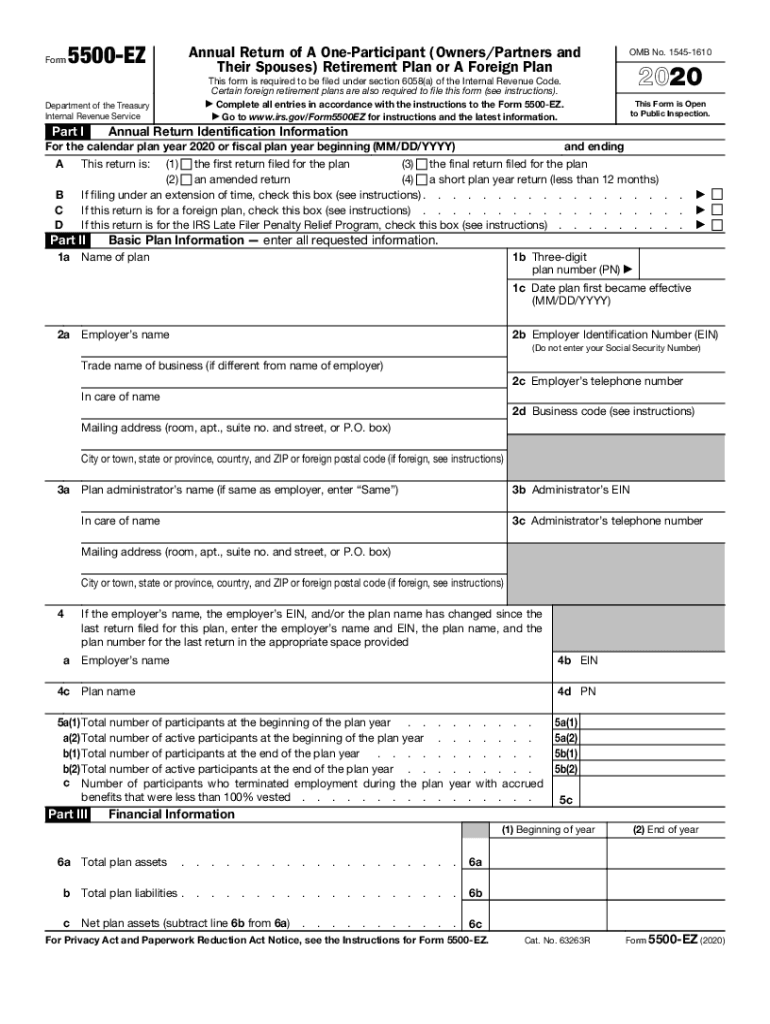

How to File Form 5500EZ Solo 401k

Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web the irs allows you to enter up to 10 codes on the form 5500. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. (failure to enter a valid receipt confirmation code.

Form 5500 Fill Out and Sign Printable PDF Template signNow

10 or more employer plan under code. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web the irs allows you to enter.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

But more complex plan designs may have many codes. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web the irs allows you to enter up to 10 codes on the form.

Form 5500 Schedule Mb Multiemployer Defined Benefit Plan And

These codes are only for defined benefit. Web the irs allows you to enter up to 10 codes on the form 5500. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web the instructions for the 2021 form 5500 will further.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

10 or more employer plan under code. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web the instructions for the 2021.

How to File Form 5500EZ Solo 401k

Web the irs allows you to enter up to 10 codes on the form 5500. There are three main categories of characteristic codes. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.).

(Failure To Enter A Valid Receipt Confirmation Code Will Subject The Form 5500 Filing To Rejection As Incomplete.)

10 or more employer plan under code. But more complex plan designs may have many codes. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web for the calendar plan year 2021 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is:

There Are Three Main Categories Of Characteristic Codes.

1b benefits are primarily flat dollar (includes dollars per year of service). These codes are only for defined benefit. Web the irs allows you to enter up to 10 codes on the form 5500. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-3.png)