Form 5500 Filing Deadline 2022

Form 5500 Filing Deadline 2022 - (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. 17 2022) by filing irs form 5558 by aug. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Web recent developments requesting a waiver of the electronic filing requirements: The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Deadlines and extensions applicable to the form 5500 series return. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is:

Deadlines and extensions applicable to the form 5500 series return. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). 17 2022) by filing irs form 5558 by aug. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Plan sponsors can request an. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

17 2022) by filing irs form 5558 by aug. Web recent developments requesting a waiver of the electronic filing requirements: Deadlines and extensions applicable to the form 5500 series return. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Plan sponsors can request an. Must file electronically through efast2. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

17 2022) by filing irs form 5558 by aug. Plan sponsors can request an. Must file electronically through efast2. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

10 Common Errors in Form 5500 Preparation Outsourcing Services

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web recent developments requesting a waiver of the electronic filing requirements: Must file electronically through.

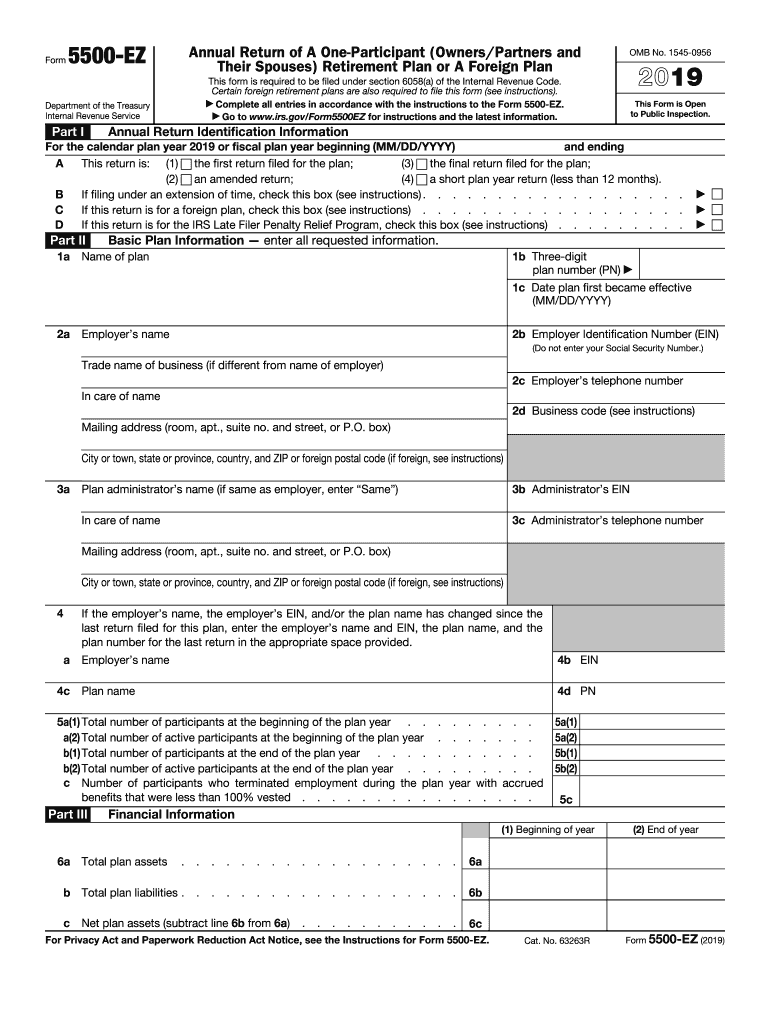

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may.

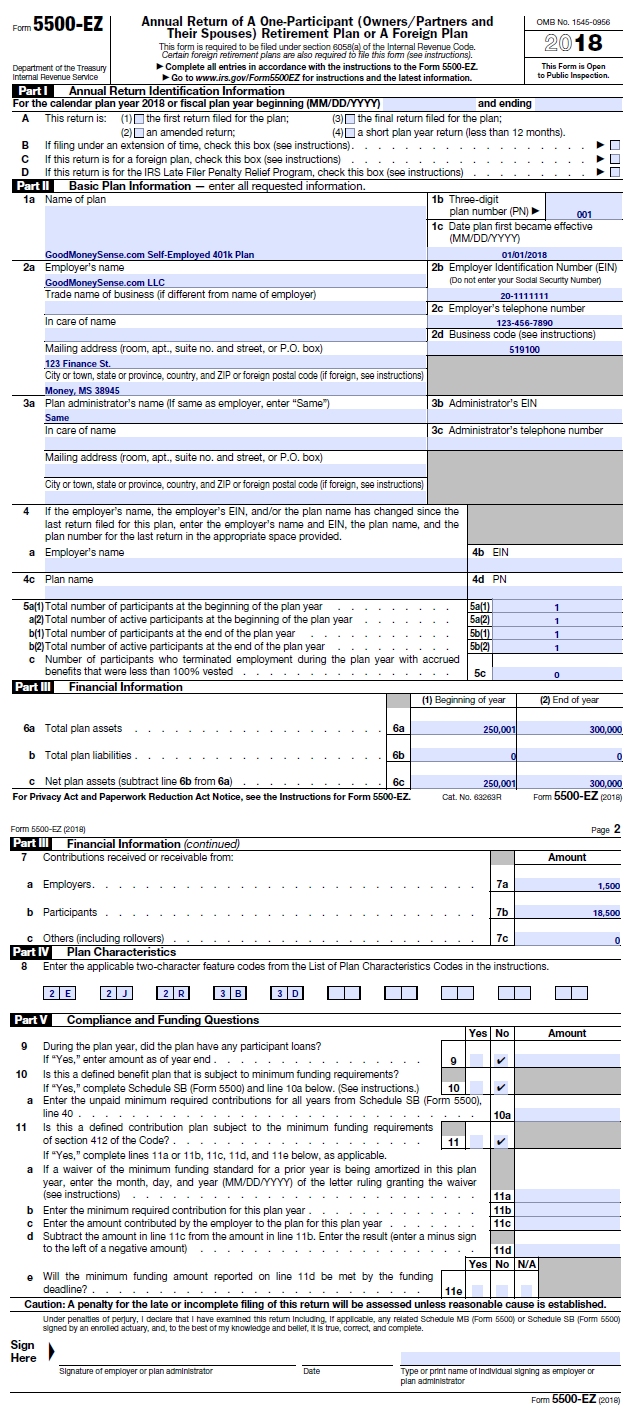

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a.

Form 5500 Filing A Dangerous Compliance Trap BASIC

17 2022) by filing irs form 5558 by aug. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Must file electronically through efast2. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. (due by the form.

Form 5500 Instructions 5 Steps to Filing Correctly

Plan sponsors can request an. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) 17 2022) by filing irs form 5558 by aug. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. In this primer article we highlight who must file, the.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

(due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Deadlines and extensions applicable to the form 5500 series return. Web typically, the form 5500 is due by july 31st for calendar year plans, with.

Form 5500 Deadline Is it Extended Due to COVID19? Mitchell Wiggins

Web recent developments requesting a waiver of the electronic filing requirements: The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Web typically, the form 5500 is due.

Form 5500 Sf Instructions 2018 slidesharetrick

Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Deadlines and extensions applicable to the form 5500 series return. Plan sponsors can request an. Web recent developments requesting a waiver of the electronic filing requirements: Web typically, the form 5500 is due by july 31st for calendar year plans, with.

How to File Form 5500EZ Solo 401k

Web recent developments requesting a waiver of the electronic filing requirements: Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Must file electronically through efast2. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. For information on filing a request.

15Th, But If The Filing Due Date Falls On A Saturday, Sunday Or Federal Holiday, It May Be Filed On The Next Business Day.

17 2022) by filing irs form 5558 by aug. In this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Must file electronically through efast2. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is:

Plan Sponsors Can Request An.

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Deadlines and extensions applicable to the form 5500 series return. For information on filing a request for a hardship waiver for 2022 or 2023 plan years, see rev. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

15Th, But If The Filing Due Date Falls On A Saturday, Sunday Or Federal Holiday, It May Be Filed On The Next.

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. (due by the form 5500 filing deadline—usually july 31, which falls on a weekend in 2022.) The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web recent developments requesting a waiver of the electronic filing requirements: