Form 5471 Sch E Instructions

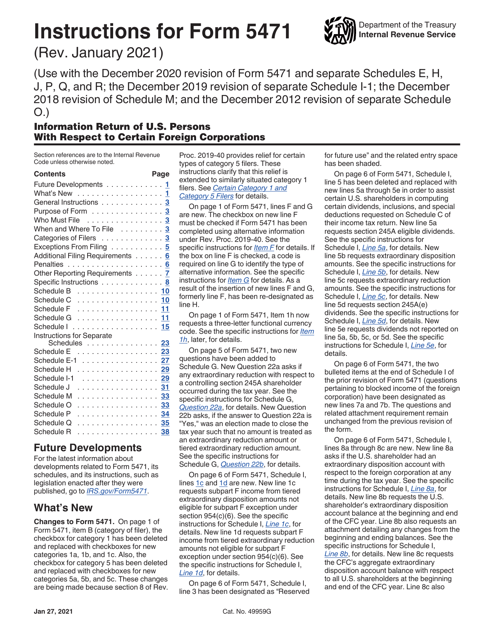

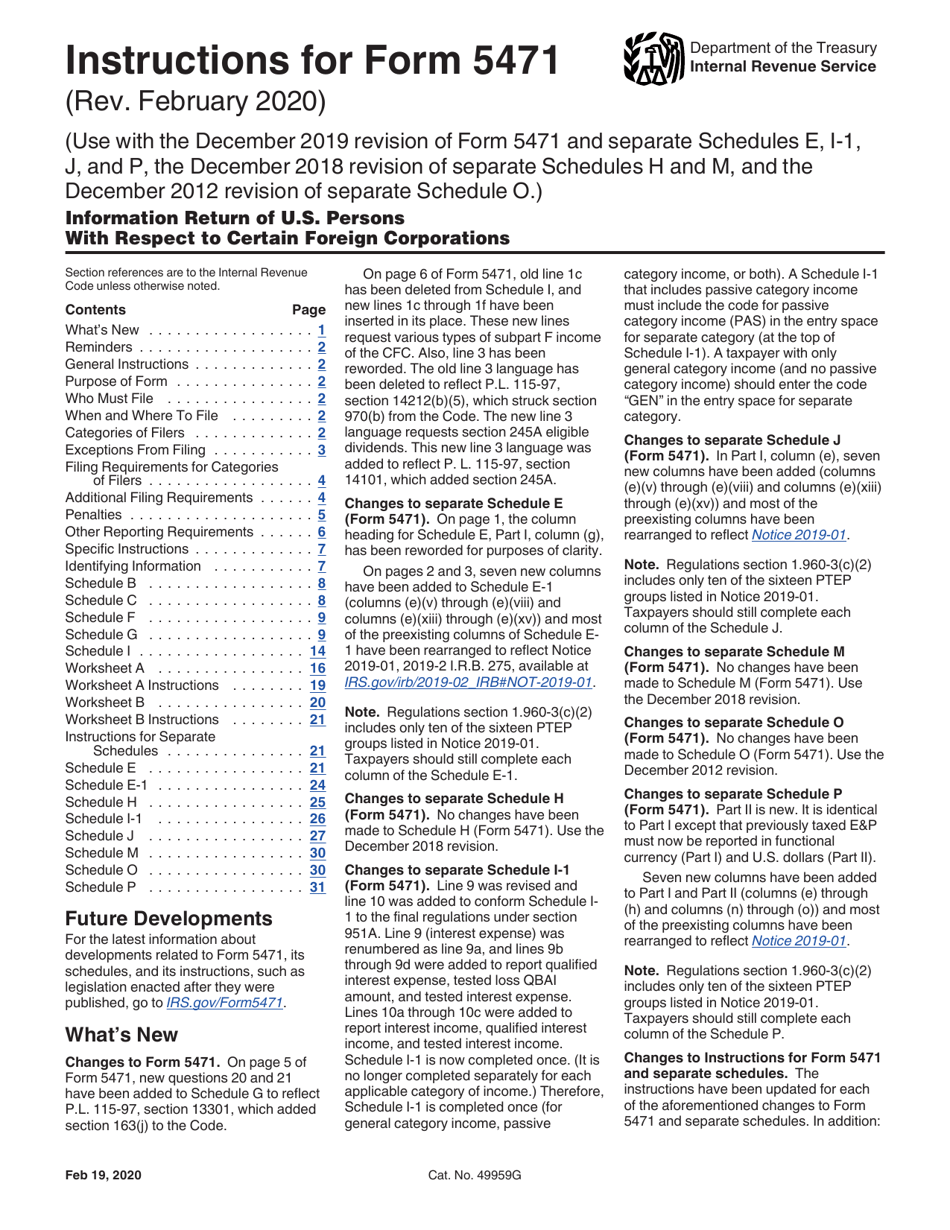

Form 5471 Sch E Instructions - Web the form 5471 schedules are: Persons with respect to certain foreign corporations Web changes to separate schedule e (form 5471). Exploring how to prepare schedule p form 5471 ptep: Web instructions for form 5471(rev. Web for paperwork reduction act notice, see instructions. Web schedule p draft as of (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s. Web how to prepare schedule p form 5471 ptep. Web instructions for form 5471(rev. On page 1, the column heading for schedule e, part i, column (g), has been reworded for purposes of clarity.

Form 5471 filers generally use the same category of filer codes used on form 1118. Web the form 5471 schedules are: On page 1, the column heading for schedule e, part i, column (g), has been reworded for purposes of clarity. In part i, section 1, list income, war profits, and excess profits taxes (income taxes) paid or accrued to each foreign country or u.s. Schedule e (form 5471) (rev. Web how to prepare schedule p form 5471 ptep. The december 2020 revision of separate schedules j, p, and r; Web instructions for form 5471(rev. December 2021) income, war profits, and excess profits taxes. The december 2018 revision of schedule m;

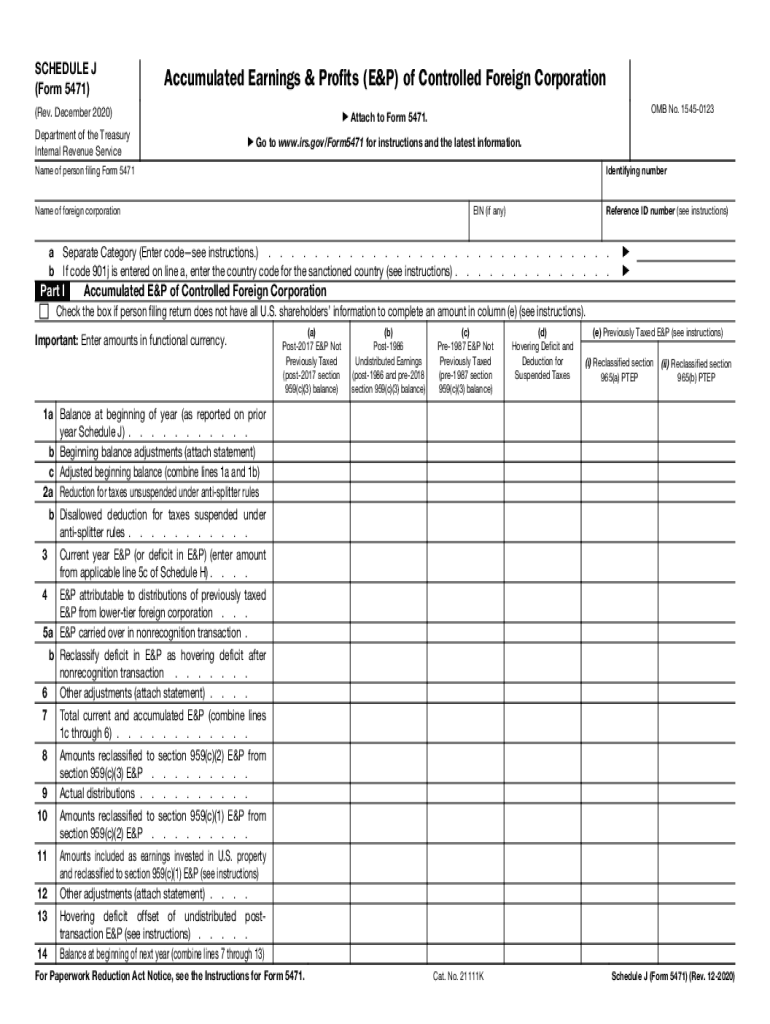

Web changes to separate schedule e (form 5471). Web (new) 2021 schedule j of form 5471. Web schedule o (form 5471) instructions schedule o. Web information about form 5471, information return of u.s. Web changes to separate schedule e (form 5471). Web persons with respect to certain foreign corporations; Web the form 5471 schedules are: Follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Person described in category 3 must complete part ii. The schedule j, the accumulated earnings and profits or e&p of a controlled foreign corporation.

IRS Issues Updated New Form 5471 What's New?

In part i, section 1, list income, war profits, and excess profits taxes (income taxes) paid or accrued to each foreign country or u.s. The category of filer checkboxes control which schedules on. Web schedule e (form 5471) (rev. Web persons with respect to certain foreign corporations; And the december 2012 revision of separate schedule o.)

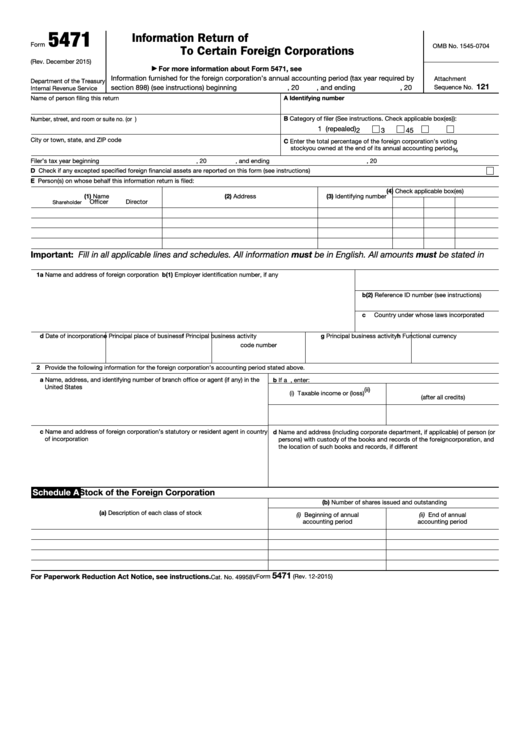

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

This schedule is different from many of the form 5471 schedules that are required for the different categories of filers or taxpayers. The purpose of the form 5471 schedule m is to report transactions between the cfc and its shareholders or related parties. And the december 2012 revision of separate schedule o.) Follow the instructions below for an individual (1040).

IRS Form 5471 Carries Heavy Penalties and Consequences

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web how to prepare schedule p form 5471 ptep. This article is designed to supplement the irs instructions to the form 5471. Person described in category 3 must complete part ii. This is especially true for a cfc (controlled foreign corporation).

Download Instructions for IRS Form 5471 Information Return of U.S

Web this article will help you generate form 5471 and any required schedules. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. This schedule is not an income tax return to report foreign tax, but rather an information return of u.s. The december 2020 revision of separate schedules j, p, and.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

On page 1, the column heading for schedule e, part i, column (g), has been reworded for purposes of clarity. December 2021) income, war profits, and excess profits taxes. Web instructions for form 5471(rev. In part i, section 1, list income, war profits, and excess profits taxes (income taxes) paid or accrued to each foreign country or u.s. Persons with.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Schedule e (form 5471) (rev. Form 5471 filers generally use the same category of filer codes used on form 1118. The category of filer checkboxes control which schedules on. Web instructions for form 5471(rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

The december 2018 revision of schedule m; Web persons with respect to certain foreign corporations; The category of filer checkboxes control which schedules on. Who must complete schedule h. E organization or reorganization of foreign corporation.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web this article will help you generate form 5471 and any required schedules. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). In part i, section 1, list income, war profits, and excess profits taxes (income taxes) paid or accrued to each foreign country.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Persons with respect to certain foreign corporations File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. On page 1, the column heading for schedule e, part i, column (g), has been reworded for.

Download Instructions for IRS Form 5471 Information Return of U.S

The schedule j, the accumulated earnings and profits or e&p of a controlled foreign corporation. Web this article will help you generate form 5471 and any required schedules. Schedule e (form 5471) (rev. E organization or reorganization of foreign corporation. Web (new) 2021 schedule j of form 5471.

Persons With Respect To Certain Foreign Corporations

Web (new) 2021 schedule j of form 5471. Anyone preparing a form 5471 knows that the. Web how to prepare schedule p form 5471 ptep. Who must complete schedule h.

The December 2020 Revision Of Separate Schedules J, P, And R;

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; This article is designed to supplement the irs instructions to the form 5471. On page 1, the column heading for schedule e, part i, column (g), has been reworded for purposes of clarity. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

E Organization Or Reorganization Of Foreign Corporation.

Web schedule o (form 5471) instructions schedule o. Exploring the (new) 2021 schedule j of form 5471: January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web changes to separate schedule e (form 5471).

Web Instructions For Form 5471(Rev.

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. This is especially true for a cfc (controlled foreign corporation). 71397a schedule e (form 5471) (rev. Web for paperwork reduction act notice, see instructions.