Form 5471 2022

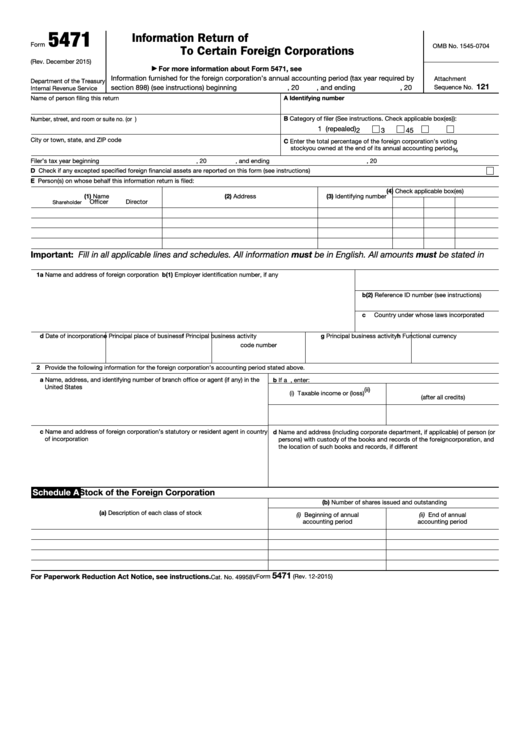

Form 5471 2022 - This information return is an important tax compliance tool and must be completed in full and on time in order to avoid penalties and interest. For instructions and the latest information. Complete, edit or print tax forms instantly. Citizens, residents, and businesses who are owners, directors, or officers of a foreign corporation. Ad get ready for tax season deadlines by completing any required tax forms today. On the last day of the tax year. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Section 2 — taxes deemed paid by foreign corporation for paperwork reduction act notice, see instructions.cat. 71397aschedule e (form 5471) (rev. 2 purpose of form 5471.

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. For example, when translating amounts to be reported on schedule e, you must generally use the average exchange rate as defined in section 986(a). Contents [ hide] 1 form 5471 & instructions. When and where to file. 2 purpose of form 5471. Web form 5471 is an information return that must be filed with the irs for certain u.s. Web you must file form 1040, u.s. Web information about form 5471, information return of u.s. Ad get ready for tax season deadlines by completing any required tax forms today. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

For example, when translating amounts to be reported on schedule e, you must generally use the average exchange rate as defined in section 986(a). This information return is an important tax compliance tool and must be completed in full and on time in order to avoid penalties and interest. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. For instructions and the latest information. On the last day of the tax year. What is it, how to file it, & when do you have to report foreign corporations to the irs. Resident during the year and who is a resident of the u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Complete irs tax forms online or print government tax documents. Ad access irs tax forms.

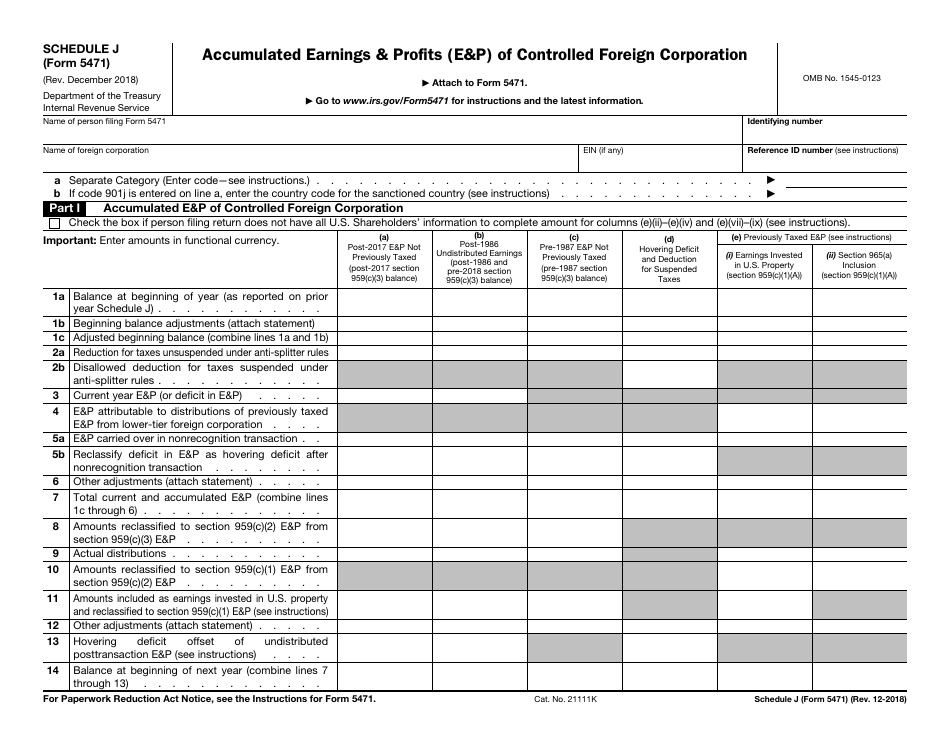

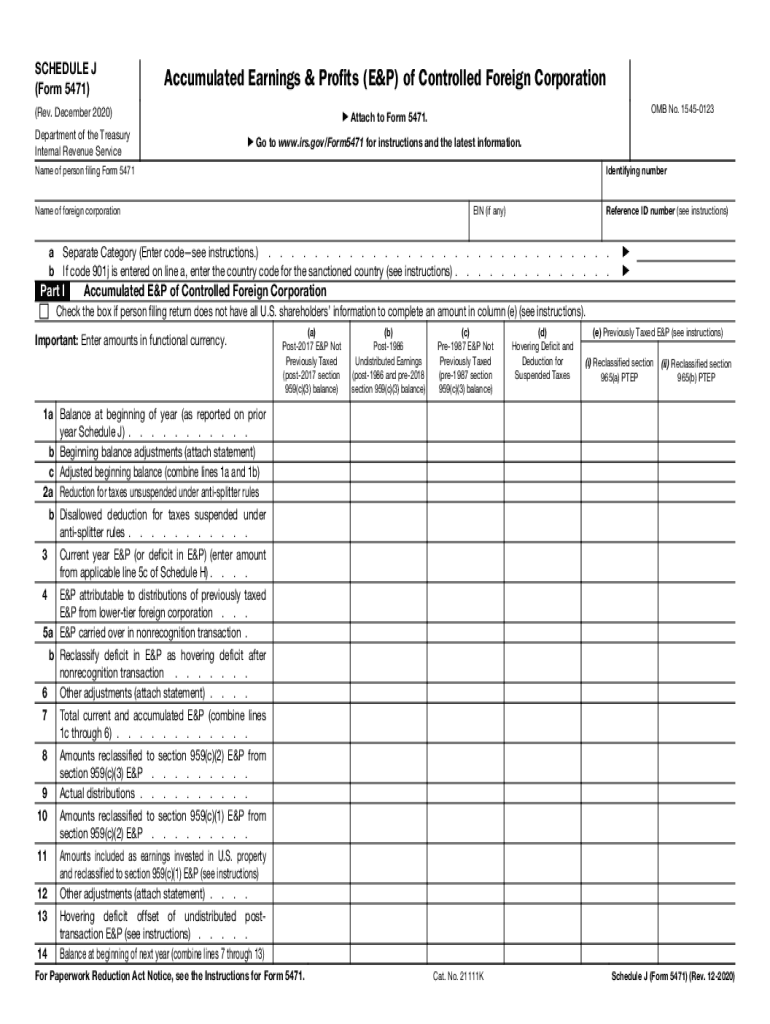

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Ad access irs tax forms. Web changes to form 5471. Citizens, residents, and businesses who are owners, directors, or officers of a foreign corporation. The form requires that you supply the irs with the corporation’s income statement, balance sheet, earnings and profits balances, and data on. When translating amounts from functional currency to u.s.

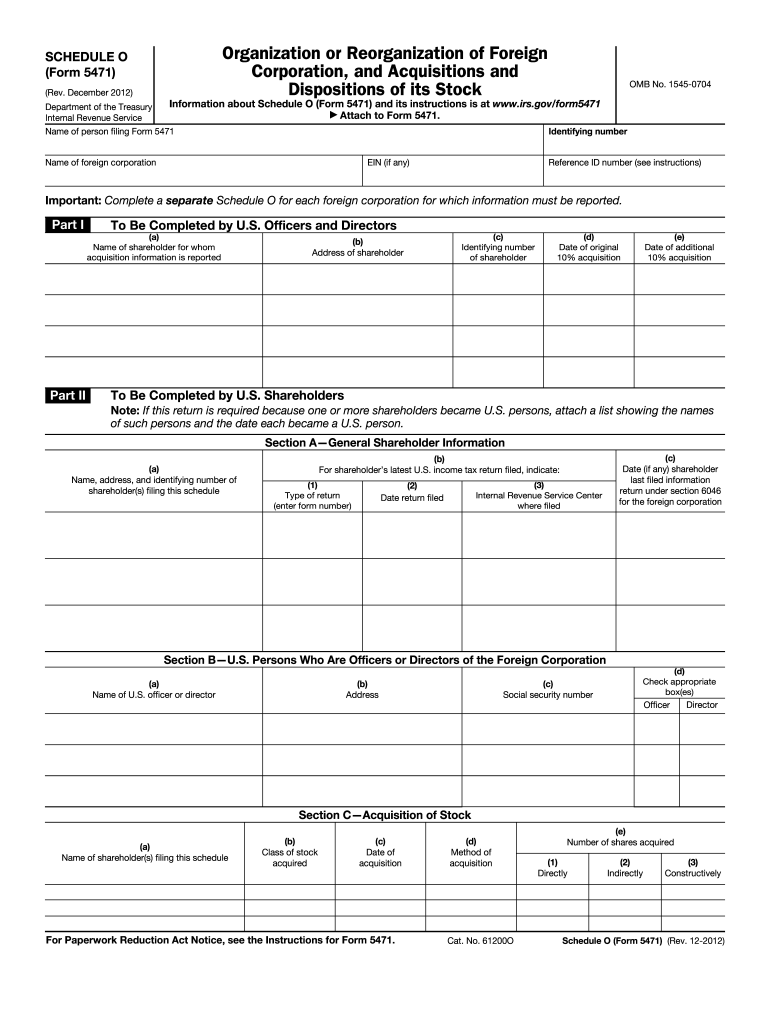

2012 form 5471 instructions Fill out & sign online DocHub

Web form 5471 is an information return that must be filed with the irs for certain u.s. Web reporting exchange rates on form 5471. For example, when translating amounts to be reported on schedule e, you must generally use the average exchange rate as defined in section 986(a). Citizens, residents, and businesses who are owners, directors, or officers of a.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web changes to form 5471. Resident during the year and who is a resident of the u.s. Web you must file form 1040, u.s. Complete irs tax forms online or print government tax documents. Persons with respect to certain foreign corporations.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

The form requires that you supply the irs with the corporation’s income statement, balance sheet, earnings and profits balances, and data on. What is it, how to file it, & when do you have to report foreign corporations to the irs. Complete, edit or print tax forms instantly. Ad access irs tax forms. On page 1 of form 5471, item.

20202022 Form IRS 5471 Schedule J Fill Online, Printable, Fillable

Section 2 — taxes deemed paid by foreign corporation for paperwork reduction act notice, see instructions.cat. Web the 2022 form 5471 instructions state that it could take over 32 hours to complete this form. Information furnished for the foreign corporation’s annual accounting period (tax year required by Web form 5471 is an information return that must be filed with the.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web reporting exchange rates on form 5471. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Contents [ hide] 1 form 5471 & instructions. Information return for foreign corporation 2023. For example, when translating amounts to be reported on schedule e, you must generally use the average exchange rate as defined.

IRS Issues Updated New Form 5471 What's New?

Section 2 — taxes deemed paid by foreign corporation for paperwork reduction act notice, see instructions.cat. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Web changes to form 5471. What is it, how to file it, & when.

International Tax Forms When to File a Form 5471/5472, Penalties for

Web reporting exchange rates on form 5471. Section 2 — taxes deemed paid by foreign corporation for paperwork reduction act notice, see instructions.cat. Attach a statement to your return to show the income for the part of the year you. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Information furnished for.

Everything You Need to Know About Form 5471

Web you must file form 1040, u.s. Web reporting exchange rates on form 5471. Web feb 10, 2022 cat. Web form 5471 is an information return that must be filed with the irs for certain u.s. The form requires that you supply the irs with the corporation’s income statement, balance sheet, earnings and profits balances, and data on.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Section 2 — taxes deemed paid by foreign corporation for paperwork reduction act notice, see instructions.cat. When and where to file. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Information furnished.

71397Aschedule E (Form 5471) (Rev.

Attach a statement to your return to show the income for the part of the year you. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. 2 purpose of form 5471. Resident during the year and who is a resident of the u.s.

Web Form 5471 Is An Information Return That Must Be Filed With The Irs For Certain U.s.

Web reporting exchange rates on form 5471. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. The form requires that you supply the irs with the corporation’s income statement, balance sheet, earnings and profits balances, and data on.

Complete Irs Tax Forms Online Or Print Government Tax Documents.

Web the 2022 form 5471 instructions state that it could take over 32 hours to complete this form. Dollars, you must use the method specified in these instructions. Ad get ready for tax season deadlines by completing any required tax forms today. Contents [ hide] 1 form 5471 & instructions.

Citizens, Residents, And Businesses Who Are Owners, Directors, Or Officers Of A Foreign Corporation.

When and where to file. Information furnished for the foreign corporation’s annual accounting period (tax year required by What is it, how to file it, & when do you have to report foreign corporations to the irs. On the last day of the tax year.