Form 5403 Delaware

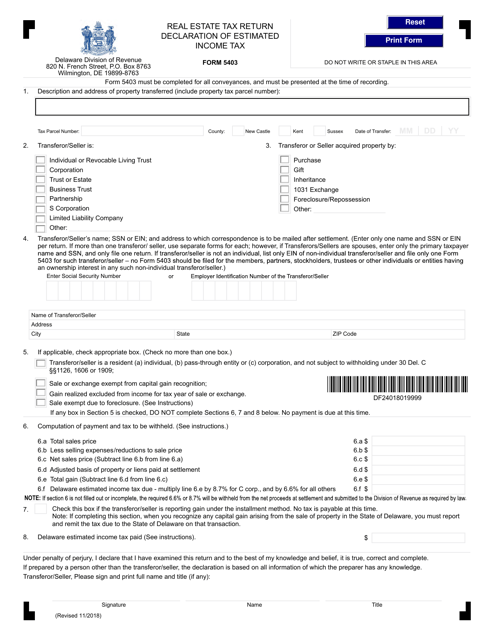

Form 5403 Delaware - Web delaware department of insurance. This is the amount payable to the delaware division of revenue. Web the delaware division of revenue oct. Web follow the simple instructions below: Web if your 2020 delawareagi exceeded$150,000, or if you are filing status 3 and your 2020 delaware agi exceeded $75,000, line 2 must be at least 110% of your 2020 tax liability. Ad register and subscribe now to work on your de form 5403 & more fillable forms. This form and the estimated income tax, if any, reported due and payable on this form must be. Web the transferor/seller must sign form 5403, print their full name and title, if any. This form must be filled out by the seller and submitted with the deed of sale whenever real estate is conveyed from one. Web this is the transferor’s/seller’s gain for purposes of computing your estimated payment for delaware income tax purposes.

Web delaware real estate declaration of estimated income tax. Web if your 2020 delawareagi exceeded$150,000, or if you are filing status 3 and your 2020 delaware agi exceeded $75,000, line 2 must be at least 110% of your 2020 tax liability. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. This form and the estimated income tax, if any, reported due and payable on this form must be. It also allows for exemption if the gain is excluded from income. On line 6.f enter the delaware estimated income tax. Edit, sign and print tax forms on any device with uslegalforms. Web the transferor/seller must sign form 5403, print their full name and title, if any. Web enter the amount of delaware tax due from line 6(h), unless you completed section 7. Electronic filing is fast, convenient, accurate and.

Web the delaware division of revenue oct. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Web if your 2020 delawareagi exceeded$150,000, or if you are filing status 3 and your 2020 delaware agi exceeded $75,000, line 2 must be at least 110% of your 2020 tax liability. Web the transferor/seller must sign form 5403, print their full name and title, if any. Of captive and financial insurance products 503 carr road, suite. Web form 5403 is provided by the delaware division of revenue. Web enter the amount of delaware tax due from line 6(h), unless you completed section 7. Web this is the transferor’s/seller’s gain for purposes of computing your estimated payment for delaware income tax purposes. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. On line 6.f enter the delaware estimated income tax.

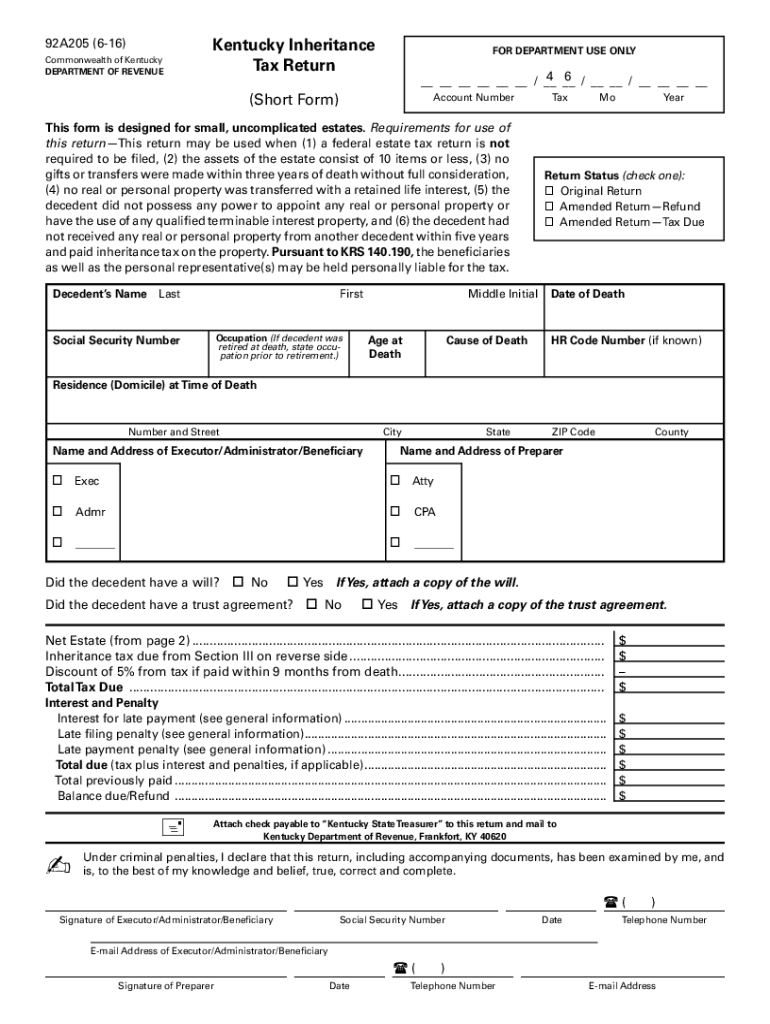

Kentucky inheritance tax return Fill out & sign online DocHub

Web delaware department of insurance. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Web enter the amount of delaware tax due from line 6(h), unless you completed section 7. This is the amount payable to the delaware division of revenue. Ad register and subscribe now to work on your.

Delaware Form 5403 effective 1/1/2019 Required for All Transfers of

Web form 5403 is provided by the delaware division of revenue. Ad register and subscribe now to work on your de form 5403 & more fillable forms. Of captive and financial insurance products 503 carr road, suite. Web enter the amount of delaware tax due from line 6(h), unless you completed section 7. It also allows for exemption if the.

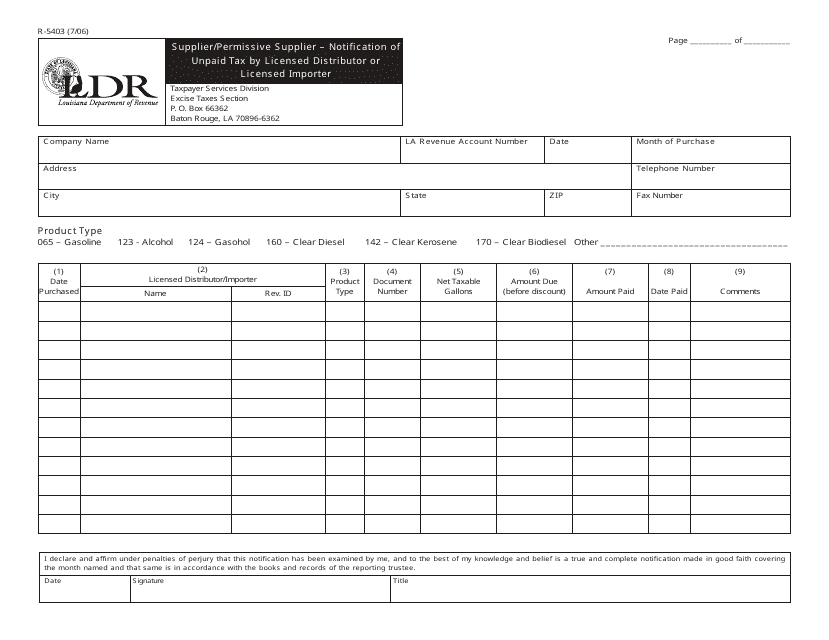

Form R5403 Download Fillable PDF or Fill Online Supplier/Permissive

Have you been searching for a quick and practical tool to fill out delaware form 5403 at a reasonable cost? It also allows for exemption if the gain is excluded from income. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Web form 5403 allows the seller to claim exemption.

Form 5403 Revisions YouTube

Web if your 2020 delawareagi exceeded$150,000, or if you are filing status 3 and your 2020 delaware agi exceeded $75,000, line 2 must be at least 110% of your 2020 tax liability. It also allows for exemption if the gain is excluded from income. This form and the estimated income tax, if any, reported due and payable on this form.

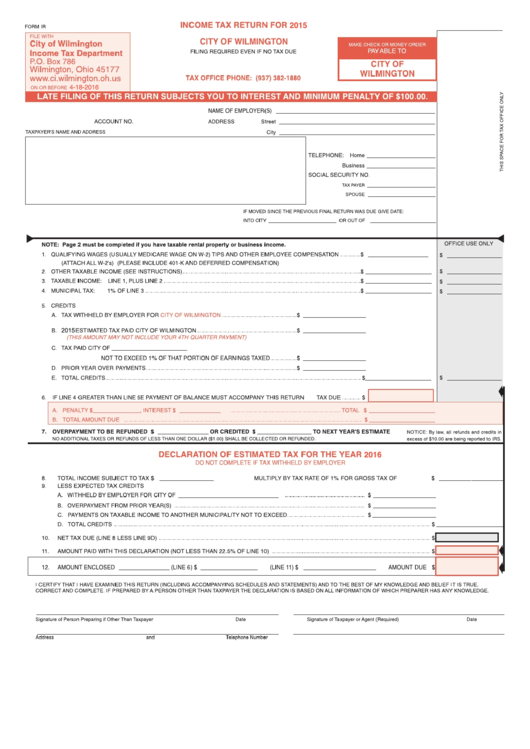

Formir Tax Return Cityofwilmington Tax Department

Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Electronic filing is fast, convenient, accurate and. Web enter the amount of delaware tax due from line 6(h), unless you completed section.

Form D Template Fill Out and Sign Printable PDF Template signNow

On line 6.f enter the delaware estimated income tax. Web follow the simple instructions below: It also allows for exemption if the gain is excluded from income. Have you been searching for a quick and practical tool to fill out delaware form 5403 at a reasonable cost? Web enter the amount of delaware tax due from line 6(h), unless you.

Form 5403 Download Fillable PDF or Fill Online Declaration of Estimated

Web delaware real estate declaration of estimated income tax. Have you been searching for a quick and practical tool to fill out delaware form 5403 at a reasonable cost? Web the transferor/seller must sign form 5403, print their full name and title, if any. This form must be filled out by the seller and submitted with the deed of sale.

PEBA Information Assets Ethics and Use Policy, Form 5403 2019

This form and the estimated income tax, if any, reported due and payable on this form must be. It also allows for exemption if the gain is excluded from income. Web the delaware division of revenue oct. Of captive and financial insurance products 503 carr road, suite. Web form 5403 allows the seller to claim exemption from tax because the.

2013 DE DoR Form 5403 Fill Online, Printable, Fillable, Blank pdfFiller

This form must be filled out by the seller and submitted with the deed of sale whenever real estate is conveyed from one. On line 6.f enter the delaware estimated income tax. Our service gives you an extensive. Have you been searching for a quick and practical tool to fill out delaware form 5403 at a reasonable cost? It also.

Delaware Form 5403 for Tax Withholding on the Sale of Real

Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware. Web if your 2020 delawareagi exceeded$150,000, or if you are filing status 3 and your 2020 delaware agi exceeded $75,000, line 2 must be at least 110% of your 2020 tax liability. This form and the estimated income tax, if any,.

Electronic Filing Is Fast, Convenient, Accurate And.

Edit, sign and print tax forms on any device with uslegalforms. Web enter the amount of delaware tax due from line 6(h), unless you completed section 7. Web the transferor/seller must sign form 5403, print their full name and title, if any. Web delaware real estate declaration of estimated income tax.

Web The Delaware Division Of Revenue Oct.

Web this is the transferor’s/seller’s gain for purposes of computing your estimated payment for delaware income tax purposes. Web follow the simple instructions below: This is the amount payable to the delaware division of revenue. Web delaware department of insurance.

Our Service Gives You An Extensive.

It also allows for exemption if the gain is excluded from income. It also allows for exemption if the gain is excluded from income. It also allows for exemption if the gain is excluded from income. On line 6.f enter the delaware estimated income tax.

Web Form 5403 Allows The Seller To Claim Exemption From Tax Because The Seller Is A Resident Of Delaware.

Web form 5403 is provided by the delaware division of revenue. This form and the estimated income tax, if any, reported due and payable on this form must be. Of captive and financial insurance products 503 carr road, suite. Web form 5403 allows the seller to claim exemption from tax because the seller is a resident of delaware.