Form 5329 For 2021

Form 5329 For 2021 - Complete, edit or print tax forms instantly. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Must be removed before printing. File form 5329 with your 2022 form 1040, 1040. Use form 5329 to report additional taxes on: Solved•by intuit17•updated december 21, 2022. Form 5329 applies to each individual that. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Ad get ready for tax season deadlines by completing any required tax forms today.

Use form 5329 to report additional taxes on: I have tt desktop edition and have successfully filled. Complete, edit or print tax forms instantly. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Ad get ready for tax season deadlines by completing any required tax forms today. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Solved•by intuit17•updated december 21, 2022. File form 5329 with your 2022 form 1040, 1040. Ad get ready for tax season deadlines by completing any required tax forms today.

Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Use form 5329 to report additional taxes on: Web per irs instructions for form 5329: File form 5329 with your 2022 form 1040, 1040. Solved•by intuit17•updated december 21, 2022. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Form 5329 applies to each individual that. 2020 instructions for form 5329.

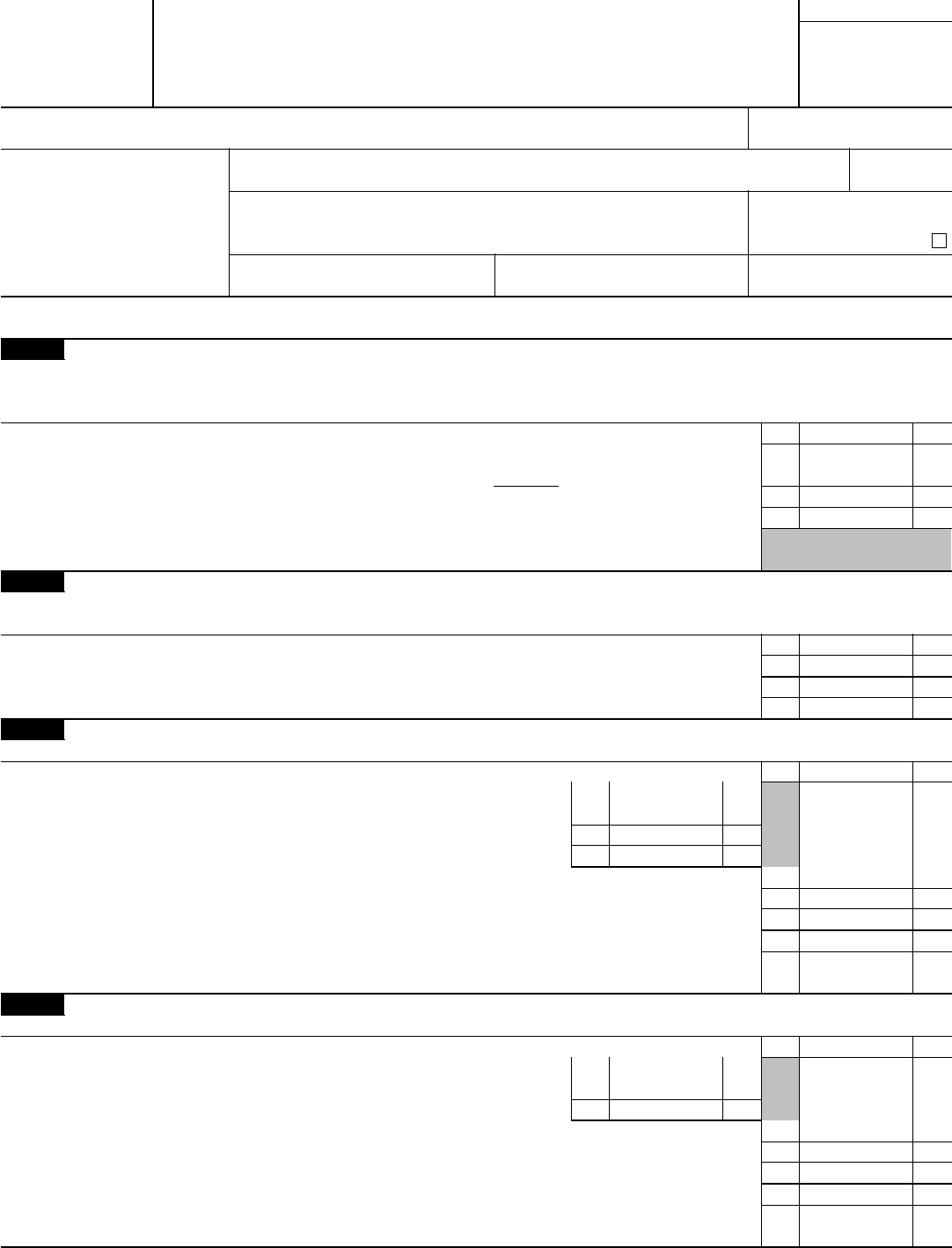

Form 5329 Edit, Fill, Sign Online Handypdf

File form 5329 with your 2022 form 1040, 1040. Web per irs instructions for form 5329: Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Ad get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by completing any required tax forms today.

Instructions for How to Fill in IRS Form 5329

Solved•by intuit17•updated december 21, 2022. Form 5329 applies to each individual that. 2020 instructions for form 5329. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Form 5329 Instructions & Exception Information for IRS Form 5329

Complete, edit or print tax forms instantly. Solved•by intuit17•updated december 21, 2022. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. I have tt desktop edition and have successfully filled. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329.

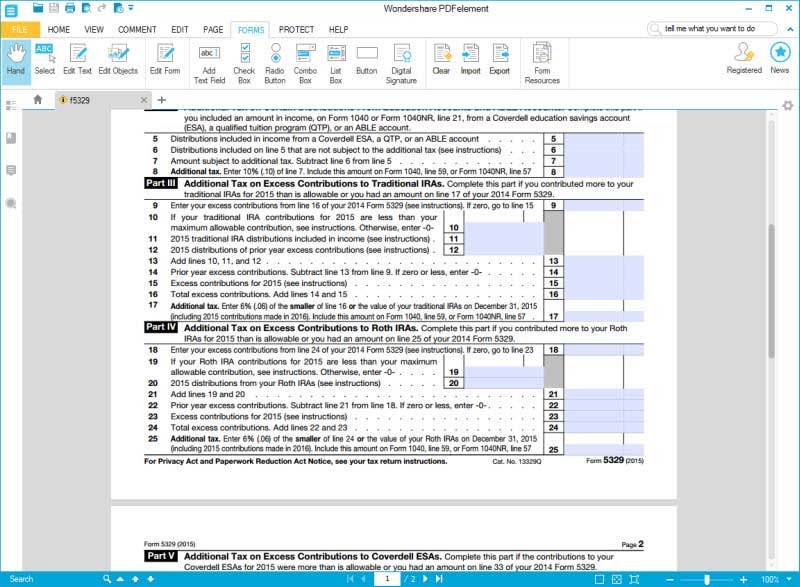

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Try it for free now! Web per irs instructions for form 5329: Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Ad get.

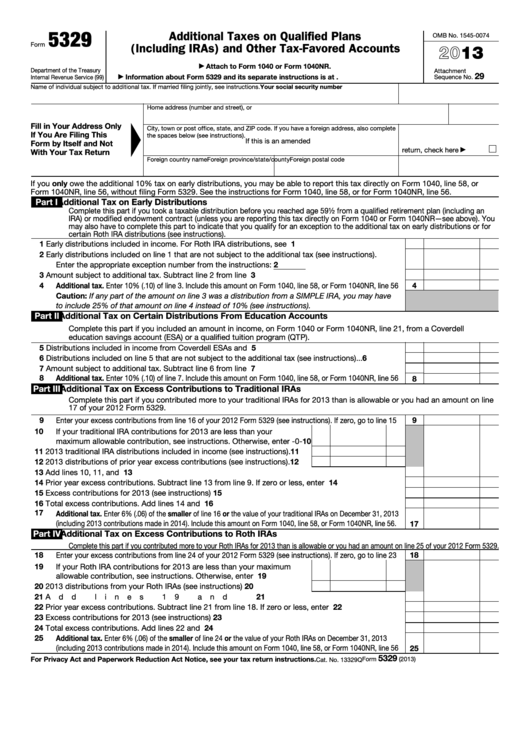

Form R5329 Gasoline Tax Refund Registration For Operators Of

Web understanding exceptions to form 5329, additional tax on early distributions. Solved•by intuit17•updated december 21, 2022. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas,.

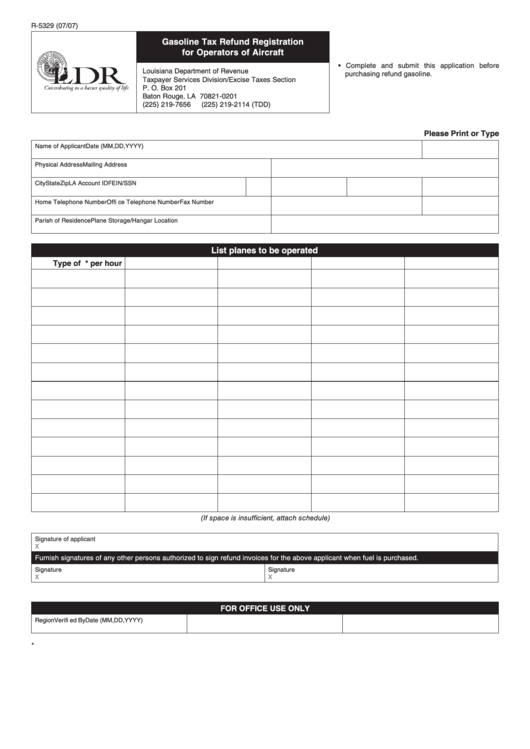

3.11.3 Individual Tax Returns Internal Revenue Service for Irs

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Must be removed before printing. I have tt desktop edition and have successfully filled. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

2012 form 5329 Fill out & sign online DocHub

Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed.

Roth Ira Form 5329 Universal Network

File form 5329 with your 2022 form 1040, 1040. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Complete, edit or print tax forms instantly. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Form 5329 applies.

Asking For Waiver Of Penalty / Request To Waive Penalty Sample Letter

Ad get ready for tax season deadlines by completing any required tax forms today. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Solved•by intuit17•updated december 21, 2022..

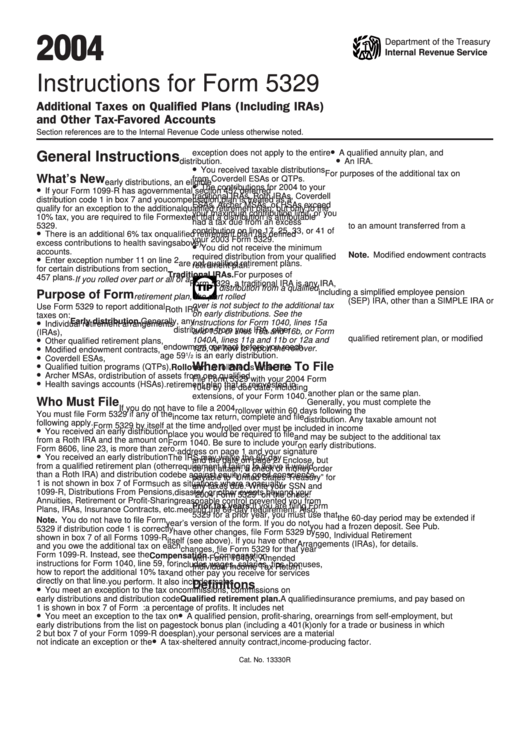

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Must be removed before printing. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Try it for free now! Web per irs instructions for form 5329: Ad get ready for tax season deadlines by completing any required tax forms today.

Upload, Modify Or Create Forms.

Complete, edit or print tax forms instantly. Form 5329 applies to each individual that. Web understanding exceptions to form 5329, additional tax on early distributions. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas.

When And Where To File.

I have tt desktop edition and have successfully filled. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. 2020 instructions for form 5329. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

Web On September 7, 2022, You Withdrew $800, The Entire Balance In The Roth Ira.

Solved•by intuit17•updated december 21, 2022. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Web per irs instructions for form 5329: Use form 5329 to report additional taxes on:

File Form 5329 With Your 2022 Form 1040, 1040.

Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today.