Form 5307 Instructions

Form 5307 Instructions - Fees for requests filed on form 5300 (application for determination for employee benefit plan) and form 5307. Basics for individuals and families, provides information about changes to withholding, standard and itemized deductions, moving. Web the irs has published a june 2023 draft of instructions for form 5307, application for determination for adopters of modified nonstandardized pre. Web page 1 of 6 of instructions for form 5307 6 the type and rule above prints on all proofs including departmental reproduction proofs. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan; Web about this form. Web information about form 5307, application for determination for adopters of master or prototype or volume submitter plans, including recent updates, related. Web the form and instructions have been updated to be completed on pay.gov as of july 1, 2023. For form 5310, submitted on or after august 1, 2021, form 5300 submitted. Web adopters of preapproved plans — whether standardized or nonstandardized — must use form 5307, application for determination for adopters of modified volume.

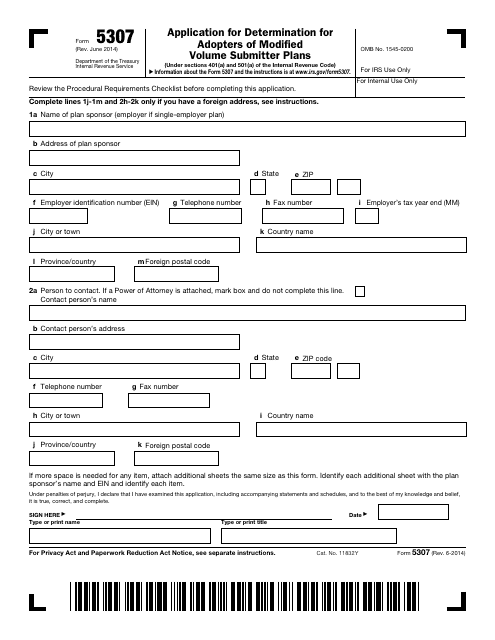

Form 5307, application for determination for. Web about this form. Review the procedural requirements checklist. Basics for individuals and families, provides information about changes to withholding, standard and itemized deductions, moving. Fees for requests filed on form 5300 (application for determination for employee benefit plan) and form 5307. Web determination letter requests for standardized plans that are not multiple employer plans should be submitted on form 5307 (application for determination for. Must be removed before printing. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan; June 2014) application for determination for adopters of modified volume submitter (vs) plans, an adopter of a volume submitter (vs). Web information about form 5307, application for determination for adopters of master or prototype or volume submitter plans, including recent updates, related.

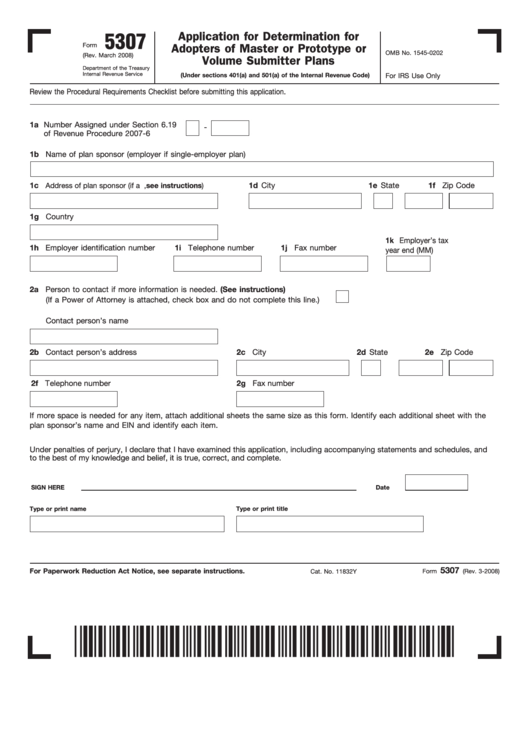

Form 5307, application for determination for. Web the form and instructions have been updated to be completed on pay.gov as of july 1, 2023. Web determination letter requests for standardized plans that are not multiple employer plans should be submitted on form 5307 (application for determination for. Web adopters of preapproved plans — whether standardized or nonstandardized — must use form 5307, application for determination for adopters of modified volume. Web information about the form 5307 and the instructions is at. The form and the instructions have undergone major. Form 5307, application for determination. Fees for requests filed on form 5300 (application for determination for employee benefit plan) and form 5307. Basics for individuals and families, provides information about changes to withholding, standard and itemized deductions, moving. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan;

Agrisure Grain Marketing Syngenta U.S.

Web publication 5307, tax reform: Form 5307, application for determination. Web the form and instructions have been updated to be completed on pay.gov as of july 1, 2023. Web page 1 of 6 of instructions for form 5307 6 the type and rule above prints on all proofs including departmental reproduction proofs. Basics for individuals and families, provides information about.

IRS Form 5307 Fill Out, Sign Online and Download Fillable PDF

Web page 1 of 6 of instructions for form 5307 6 the type and rule above prints on all proofs including departmental reproduction proofs. Form 5307, application for determination for. The addresses for employee plans submissions for determination letters, letter rulings, and ira opinion letters have changed. Fees for requests filed on form 5300 (application for determination for employee benefit.

표준 납품계약서(물품납품)(작성방법 포함) 부서별서식

Web information about form 5307, application for determination for adopters of master or prototype or volume submitter plans, including recent updates, related. Web we last updated the application for determination for adopters of modified volume submitter plans in february 2023, so this is the latest version of form 5307, fully. Must be removed before printing. Form 5307, application for determination.

Form 5307 Application for Determination for Adopters of Modified

Must be removed before printing. Web information about form 5307, application for determination for adopters of master or prototype or volume submitter plans, including recent updates, related. Web the announcement highlights four fee increases. Web we last updated the application for determination for adopters of modified volume submitter plans in february 2023, so this is the latest version of form.

Form 5307 Application for Determination for Adopters of Modified

Must be removed before printing. Web the irs has published a june 2023 draft of instructions for form 5307, application for determination for adopters of modified nonstandardized pre. Web determination letter requests for standardized plans that are not multiple employer plans should be submitted on form 5307 (application for determination for. Form 5307, application for determination for. This is a.

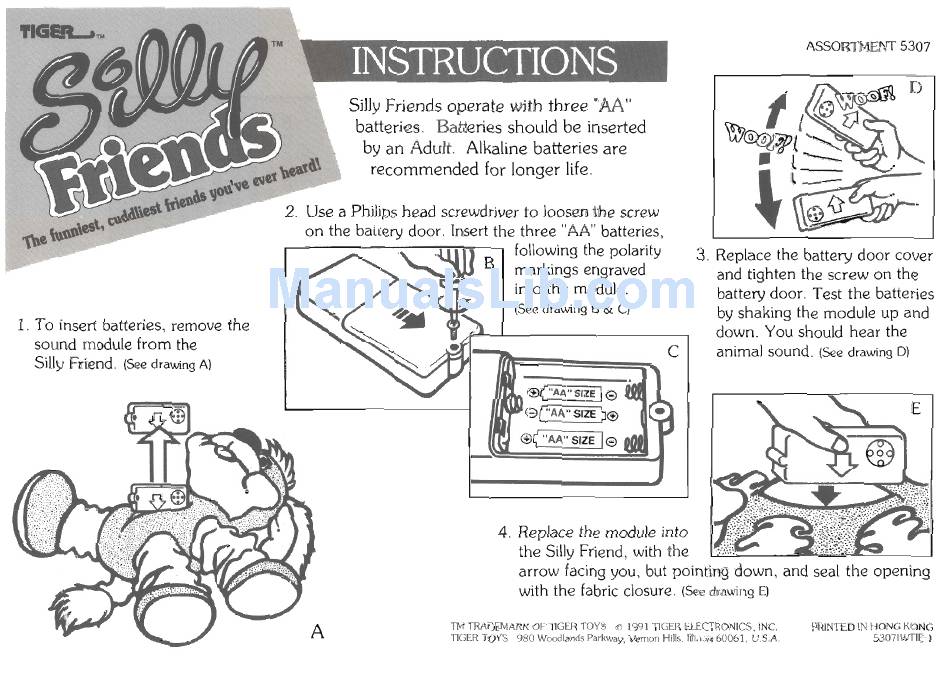

TIGER 5307 INSTRUCTIONS Pdf Download ManualsLib

Web publication 5307, tax reform: Form 5307, application for determination. Web information about form 5307, application for determination for adopters of master or prototype or volume submitter plans, including recent updates, related. Review the procedural requirements checklist. Web the form and instructions have been updated to be completed on pay.gov as of july 1, 2023.

Form 5307 Application for Determination for Adopters of Modified

Web adopters of preapproved plans — whether standardized or nonstandardized — must use form 5307, application for determination for adopters of modified volume. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan; Web the irs has published a june 2023 draft of instructions for form 5307, application for determination for adopters of.

Form 5307 Application for Determination for Adopters of Modified

This is a official federal forms form and can be. The addresses for employee plans submissions for determination letters, letter rulings, and ira opinion letters have changed. Review the procedural requirements checklist. June 2014) application for determination for adopters of modified volume submitter (vs) plans, an adopter of a volume submitter (vs). Web the irs recently released updated instructions for.

Fillable Form 5307 Application For Determination For Adopters Of

The form and the instructions have undergone major. For form 5310, submitted on or after august 1, 2021, form 5300 submitted. Form 5307, application for determination. Web we last updated the application for determination for adopters of modified volume submitter plans in february 2023, so this is the latest version of form 5307, fully. Please use this form to pay.

4326.4275_recto_PRIMARY_o6.jpg Gilcrease Museum

Web the irs has published a june 2023 draft of instructions for form 5307, application for determination for adopters of modified nonstandardized pre. Must be removed before printing. Web the announcement highlights four fee increases. Web about this form. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan;

Fees For Requests Filed On Form 5300 (Application For Determination For Employee Benefit Plan) And Form 5307.

Web we last updated the application for determination for adopters of modified volume submitter plans in february 2023, so this is the latest version of form 5307, fully. Web page 1 of 6 of instructions for form 5307 6 the type and rule above prints on all proofs including departmental reproduction proofs. Web publication 5307, tax reform: The addresses for employee plans submissions for determination letters, letter rulings, and ira opinion letters have changed.

This Is A Official Federal Forms Form And Can Be.

For form 5310, submitted on or after august 1, 2021, form 5300 submitted. Web about this form. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan; Must be removed before printing.

June 2014) Application For Determination For Adopters Of Modified Volume Submitter (Vs) Plans, An Adopter Of A Volume Submitter (Vs).

Web the irs has published a june 2023 draft of instructions for form 5307, application for determination for adopters of modified nonstandardized pre. Form 5307, application for determination. Web the announcement highlights four fee increases. Web the irs recently released updated instructions for form 5300, application for determination for employee benefit plan;

Web Information About Form 5307, Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans, Including Recent Updates, Related.

Web adopters of preapproved plans — whether standardized or nonstandardized — must use form 5307, application for determination for adopters of modified volume. Web instructions for form 5307, (rev. Basics for individuals and families, provides information about changes to withholding, standard and itemized deductions, moving. Form 5307, application for determination for.