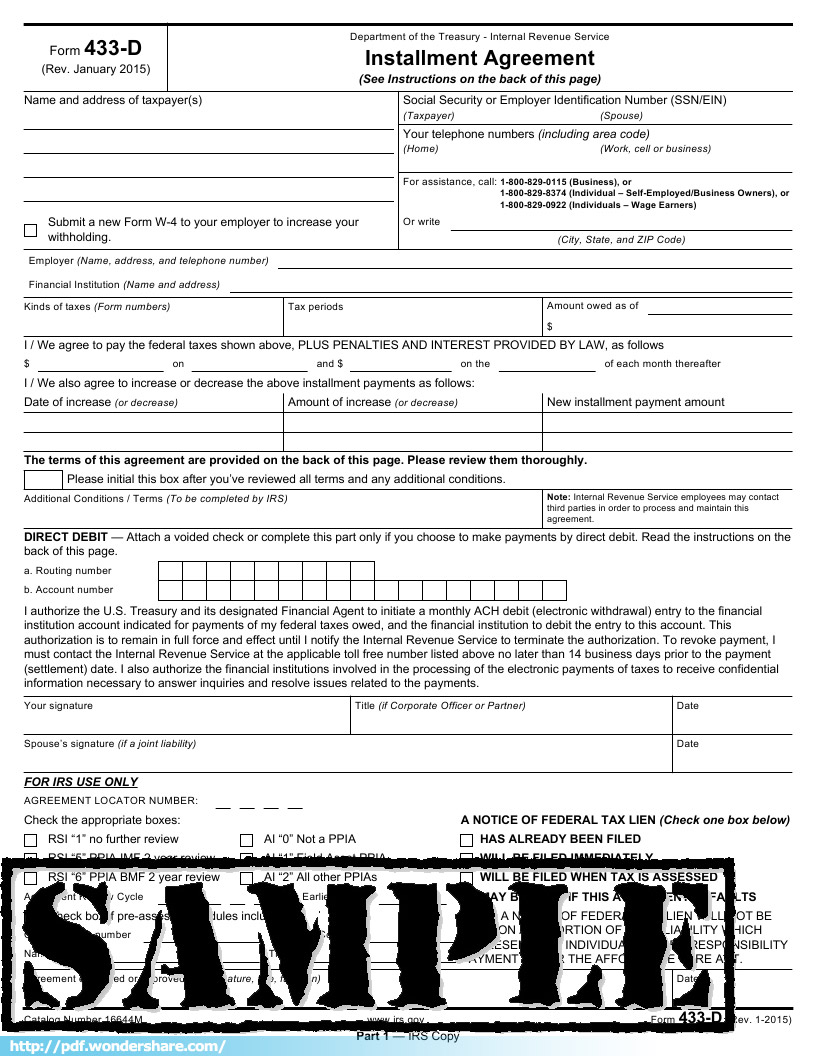

Form 433 D

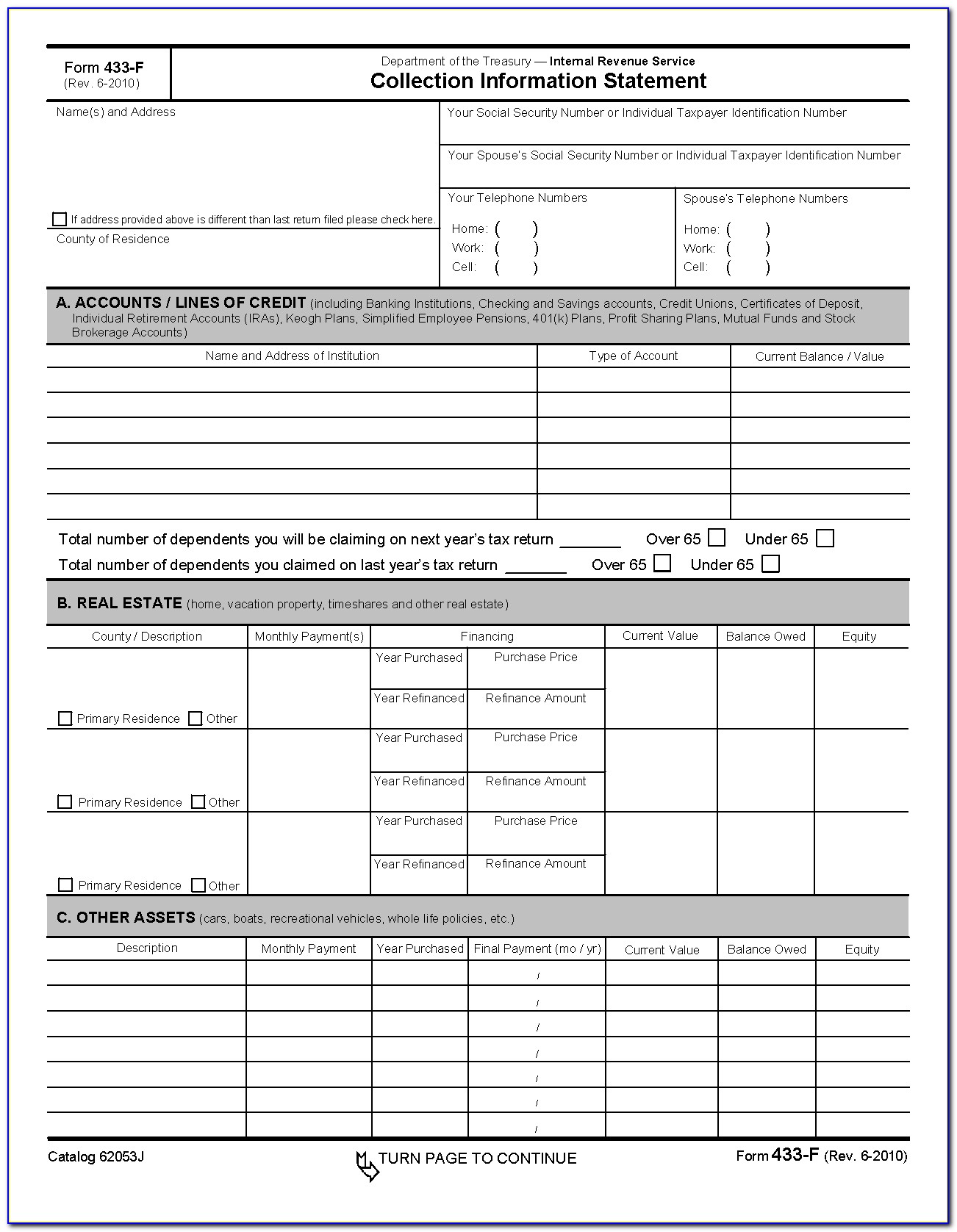

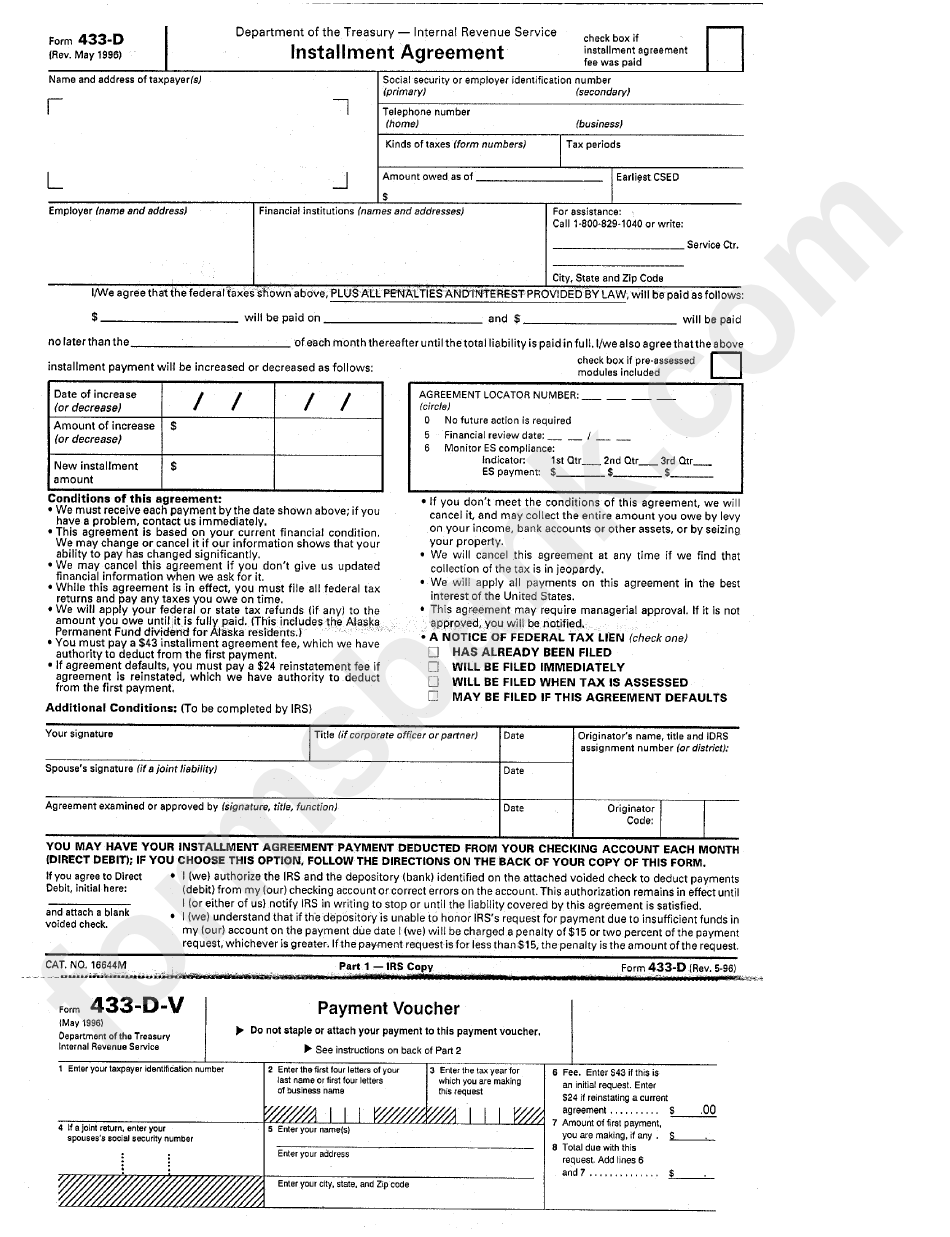

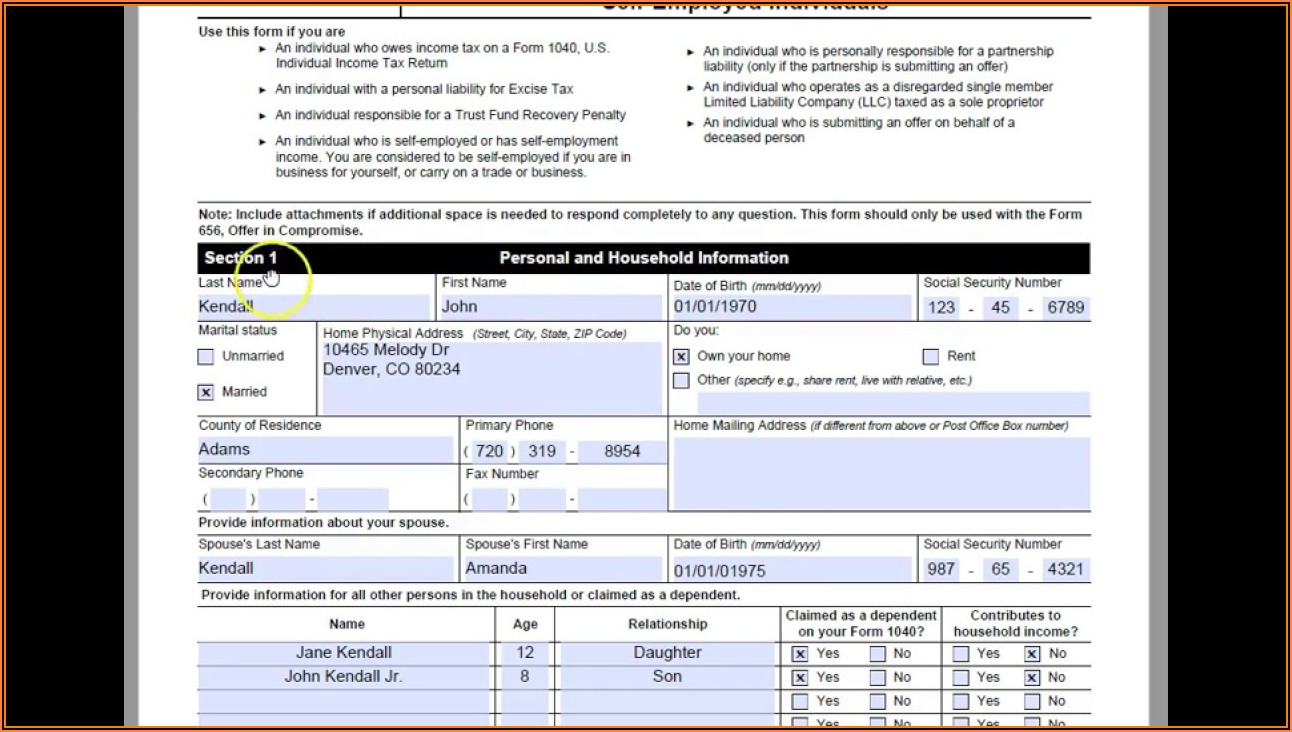

Form 433 D - This form is used by the united states internal revenue service. The form 9465 can be filed with a tax return. We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. The document finalizes the agreement between an individual or a business and the irs. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. Web what is an irs form 433d? Learn more about your taxes However, you need a form 9465 from the irs to initiate the tax resolution. It is a form taxpayers can submit to authorize a direct debit payment method. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes.

We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. The document finalizes the agreement between an individual or a business and the irs. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. However, you need a form 9465 from the irs to initiate the tax resolution. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. It is a form taxpayers can submit to authorize a direct debit payment method. This form is used by the united states internal revenue service. Learn more about your taxes This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web what is an irs form 433d?

The document finalizes the agreement between an individual or a business and the irs. It is a form taxpayers can submit to authorize a direct debit payment method. Web what is an irs form 433d? We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. However, you need a form 9465 from the irs to initiate the tax resolution. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. This form is used by the united states internal revenue service. Learn more about your taxes

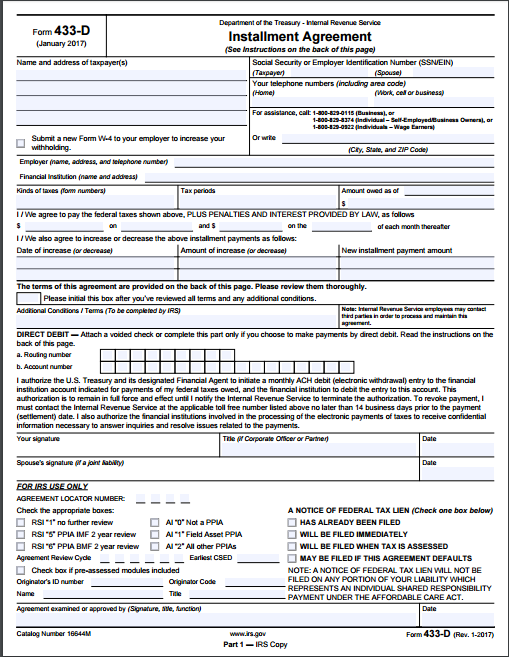

IRS Form 433D Free Download, Create, Edit, Fill and Print

The document finalizes the agreement between an individual or a business and the irs. However, you need a form 9465 from the irs to initiate the tax resolution. We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. This form is.

Aia G703 Form Instructions Form Resume Examples GEOGBBw5Vr

This form is used by the united states internal revenue service. Web what is an irs form 433d? We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. This particular form is used to apply for an installment agreement, which breaks.

Form 433D Installment Agreement Community Tax

It is a form taxpayers can submit to authorize a direct debit payment method. Learn more about your taxes This form is used by the united states internal revenue service. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. However, you need a form 9465 from the irs to initiate.

Form 433D Installment Agreement Internal Revenue Service printable

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. The document finalizes the agreement between an individual or a business and the irs. Web what is an irs form 433d? We’ll discuss your current financial situation and put a plan together to help you file the required.

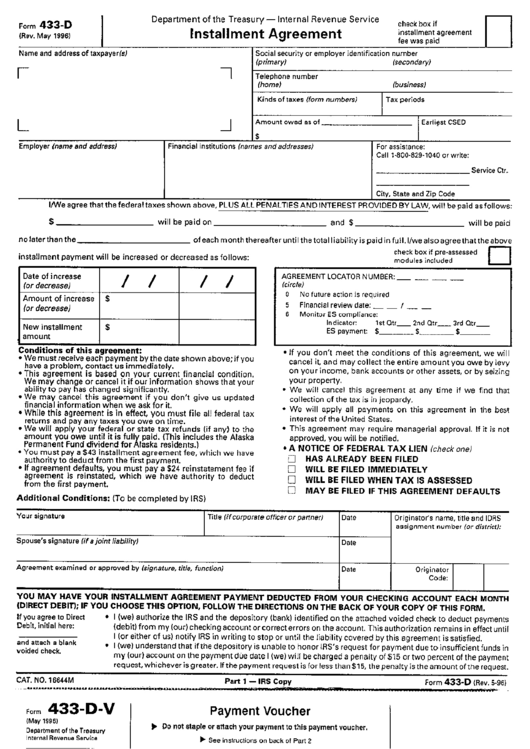

Fax Number For Irs Form 433 D Form Resume Examples MW9p3OO2AJ

Learn more about your taxes Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Web what is an irs form 433d? This form will be used to help formulate and.

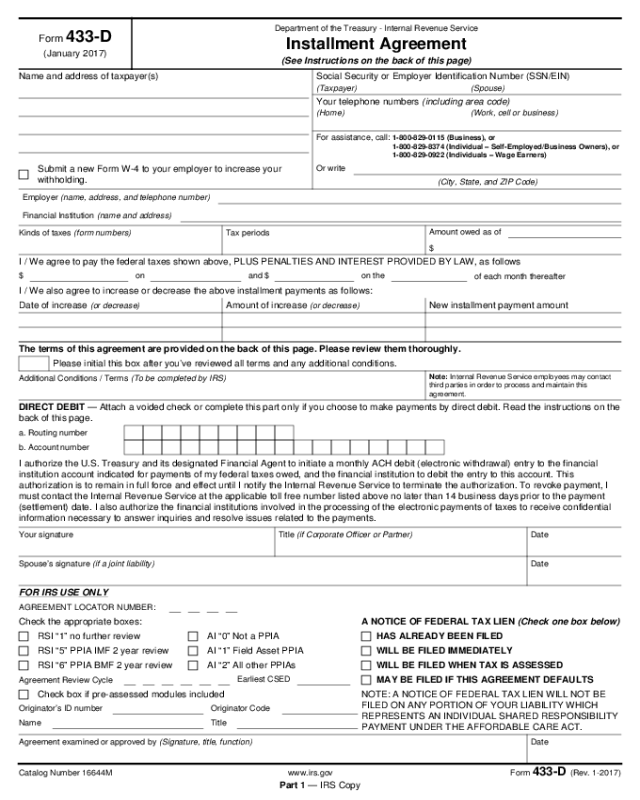

433D (2017) Edit Forms Online PDFFormPro

This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. This form is used by the united states internal revenue service. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. The document finalizes the agreement between an individual.

Irs Form 433 B Fillable Form Resume Examples a6YnPPx2Bg

This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. The document finalizes the agreement between an individual or a business and the irs. Web what is an irs form 433d? We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents.

Form 433d Edit, Fill, Sign Online Handypdf

This form is used by the united states internal revenue service. The document finalizes the agreement between an individual or a business and the irs. Learn more about your taxes This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. It is a form taxpayers can submit to authorize a direct.

Form 433D Installment Agreement printable pdf download

This form is used by the united states internal revenue service. It is a form taxpayers can submit to authorize a direct debit payment method. Learn more about your taxes This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. We’ll discuss your current financial situation and put.

Form 433 D Working out the Details of Your Payment Plan PDFfiller Blog

Learn more about your taxes We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. It is a form.

Web The Form 9465 Is Used Mainly By Taxpayers To Request And Authorize A Streamlined Installment Agreement.

This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. The form 9465 can be filed with a tax return. It is a form taxpayers can submit to authorize a direct debit payment method. This form is used by the united states internal revenue service.

However, You Need A Form 9465 From The Irs To Initiate The Tax Resolution.

Learn more about your taxes The document finalizes the agreement between an individual or a business and the irs. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. We’ll discuss your current financial situation and put a plan together to help you file the required forms and documents to get you in good standing with the irs.