Form 433 A Fillable

Form 433 A Fillable - Ad access irs tax forms. Try it for free now! Under 65 65 and over if you or your spouse are self. Upload, modify or create forms. Use fill to complete blank online. The irs uses this form to determine whether. Open it up using the online editor and start adjusting. Complete all blocks, except shaded areas. Engaged parties names, places of residence and numbers etc. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Complete all blocks, except shaded areas. Upload, modify or create forms. Complete, edit or print tax forms instantly. The information you’ll need to provide includes: Open it up using the online editor and start adjusting. Use fill to complete blank online. Complete, edit or print tax forms instantly. Your name, social security number,. Web enter the number of people in the household who can be claimed on this year’s tax return including you and your spouse. July 2022) state of maryland comptroller of maryland note:

Fill in the blank areas; The irs uses this form to determine whether. Complete, edit or print tax forms instantly. Try it for free now! Engaged parties names, places of residence and numbers etc. Write “n/a” (not applicable) in those blocks. Web part 1 — irs copy kinds of taxes (form numbers) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers (including area code). Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web this form is used for anyone who is dealing with a revenue officer or an appeals officer with the irs. More from h&r block if you.

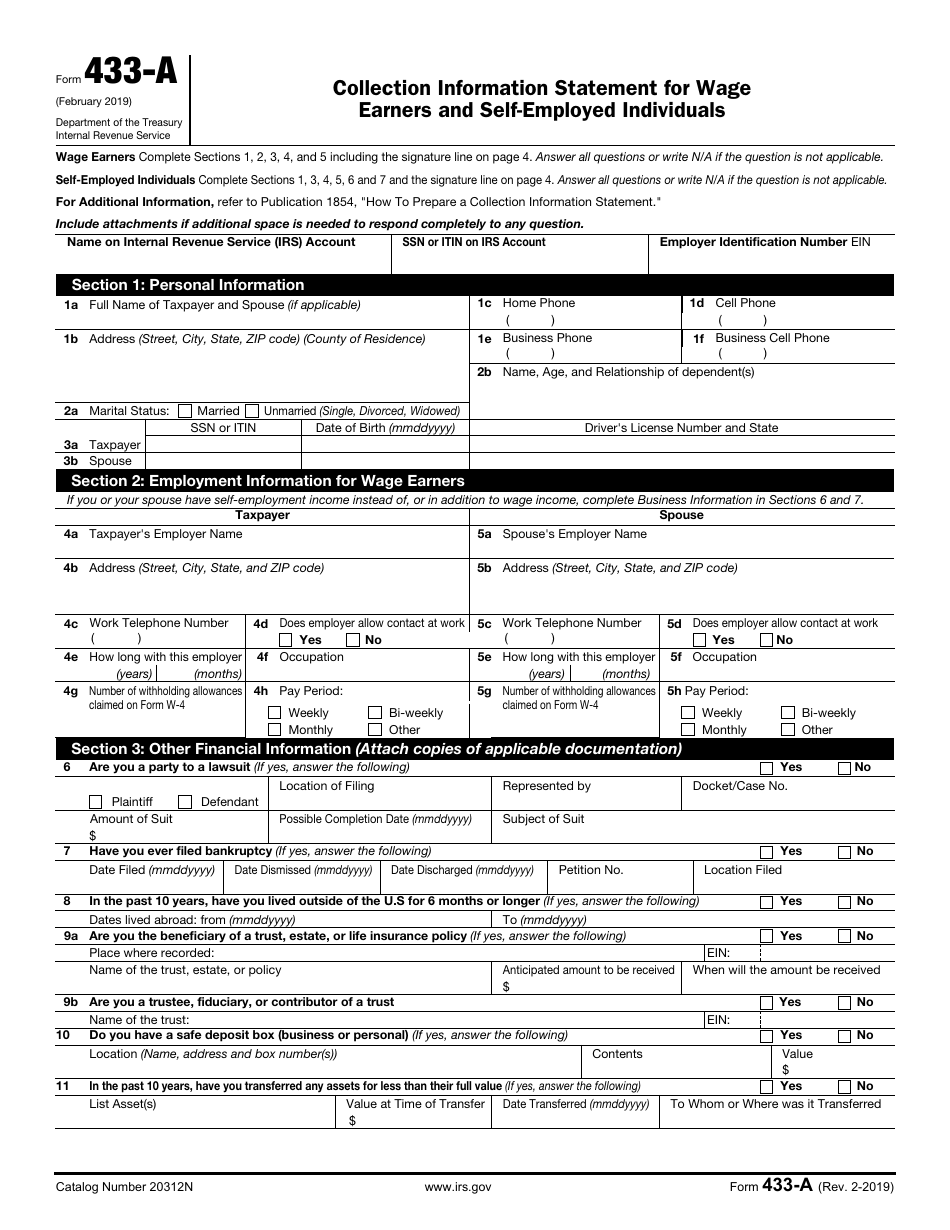

Fill Free fillable IRS Form 433A Collection Information Statement

Web this form is used for anyone who is dealing with a revenue officer or an appeals officer with the irs. This form is also about eight pages long. July 2022) state of maryland comptroller of maryland note: Your name, social security number,. Open it up using the online editor and start adjusting.

How to complete IRS form 433A OIC YouTube

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Write “n/a” (not applicable) in those blocks. The irs uses this form to determine whether. July 2022) state of maryland comptroller of maryland note: Complete all blocks, except shaded areas.

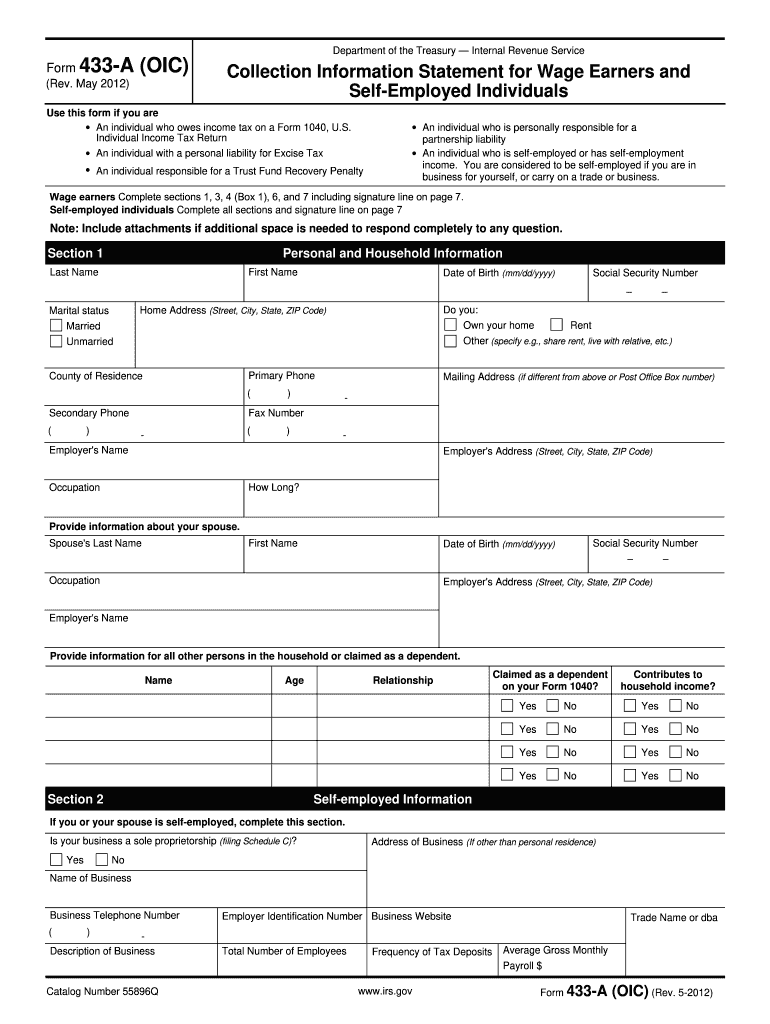

Form 433a Collection Information Statement For Wage Earners And Self 733

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web this form is used for anyone who is dealing with a revenue officer or an appeals officer with the irs. July 2022) state of maryland comptroller of maryland note: Your name, social security number,. Ad access irs tax forms.

Fill Free fillable IRS Form 433A Collection Information Statement

Write “n/a” (not applicable) in those blocks. This form is also about eight pages long. Complete, edit or print tax forms instantly. Complete all blocks, except shaded areas. The content offered on this page is for informational.

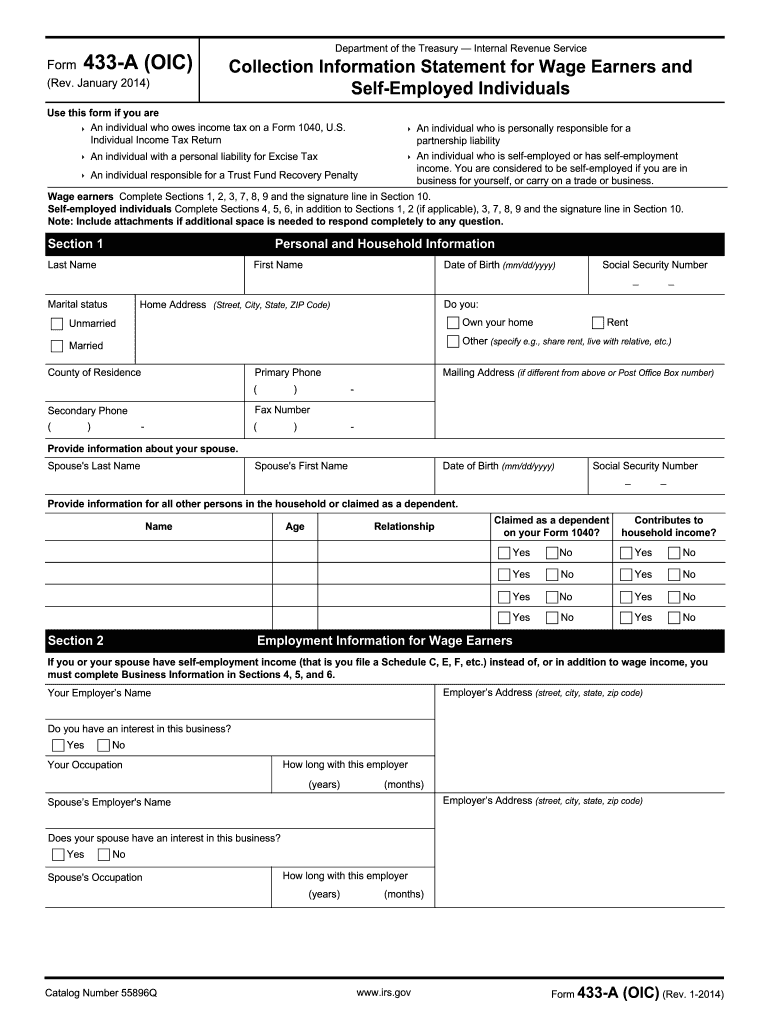

2014 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

July 2022) state of maryland comptroller of maryland note: The irs uses this form to determine whether. Complete, edit or print tax forms instantly. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Engaged parties names, places of residence and numbers etc.

W2 Form Fillable Form Resume Examples 6V3RPQW717

Under 65 65 and over if you or your spouse are self. Complete all blocks, except shaded areas. The irs uses this form to determine whether. Open it up using the online editor and start adjusting. Write “n/a” (not applicable) in those blocks.

Irs Form W 9 Fillable Form Resume Examples 1ZV8dl3V3X

Write “n/a” (not applicable) in those blocks. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. July 2022) state of maryland comptroller of maryland note: Upload, modify or create forms.

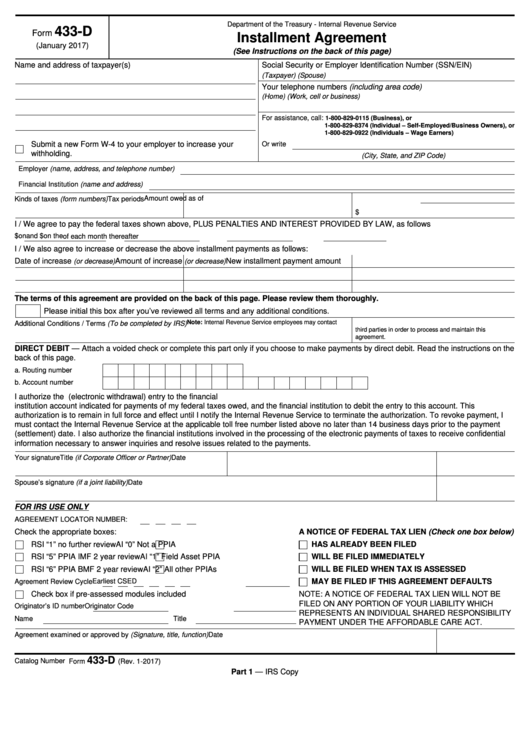

Fillable Form 433D Installment Agreement printable pdf download

This form provides the irs with a complete overview of. The content offered on this page is for informational. Web part 1 — irs copy kinds of taxes (form numbers) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers (including area code). Complete, edit or print tax forms instantly. Write “n/a” (not applicable) in those blocks.

433a Fillable Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Complete all blocks, except shaded areas. Engaged parties names, places of residence and numbers etc. Web part 1 — irs copy kinds of taxes (form numbers) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers (including area code). Uslegalforms allows users to edit, sign, fill & share all type of.

Quick Tips Filling Out IRS Form 433 Which Type Should You Use? YouTube

This form is also about eight pages long. The content offered on this page is for informational. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Write “N/A” (Not Applicable) In Those Blocks.

Open it up using the online editor and start adjusting. Your name, social security number,. Web this form is used for anyone who is dealing with a revenue officer or an appeals officer with the irs. Upload, modify or create forms.

Complete, Edit Or Print Tax Forms Instantly.

Try it for free now! Engaged parties names, places of residence and numbers etc. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

More From H&R Block If You.

Web part 1 — irs copy kinds of taxes (form numbers) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers (including area code). July 2022) state of maryland comptroller of maryland note: Fill in the blank areas; Use fill to complete blank online.

Under 65 65 And Over If You Or Your Spouse Are Self.

Ad access irs tax forms. Complete all blocks, except shaded areas. The information you’ll need to provide includes: The irs uses this form to determine whether.