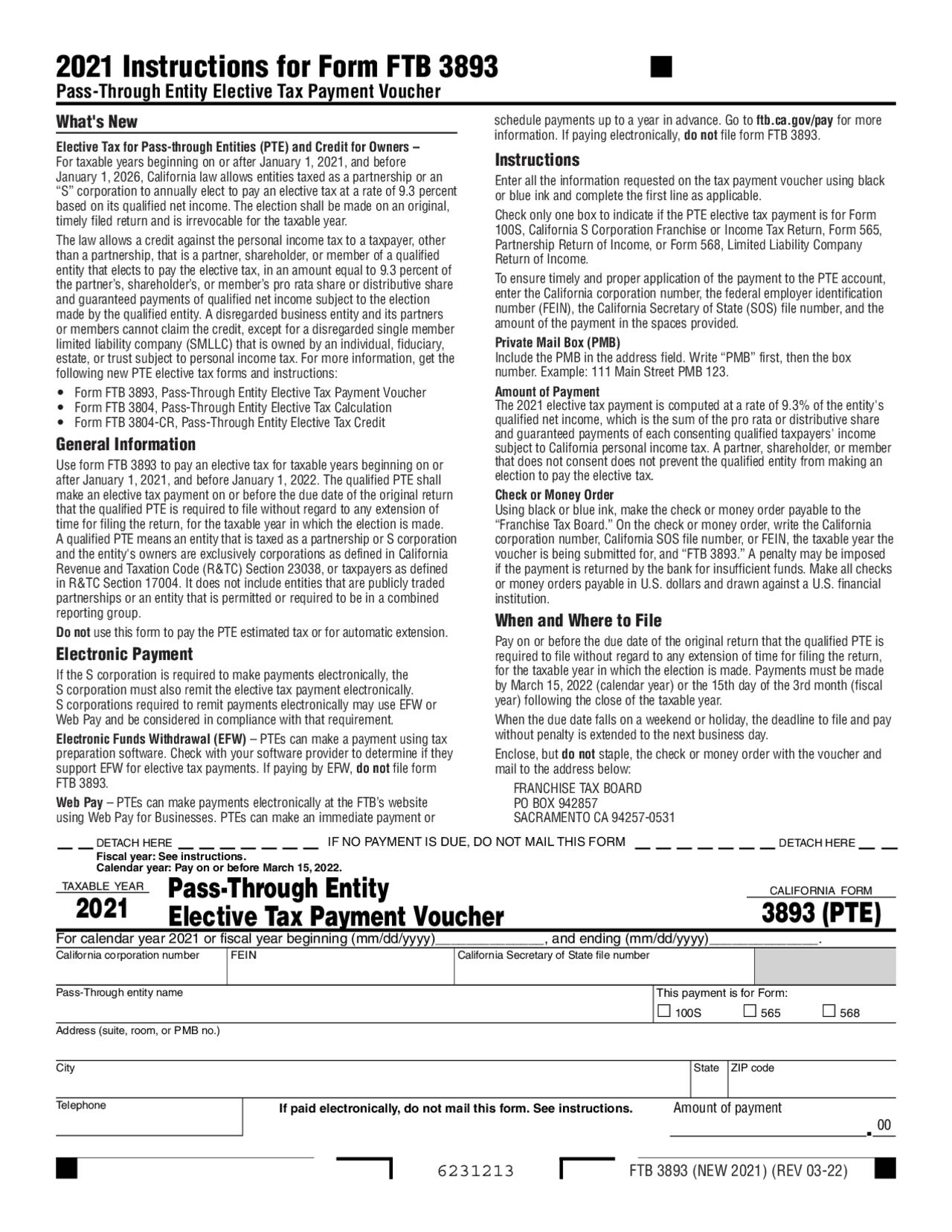

Form 3893 Instructions

Form 3893 Instructions - • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. We anticipate the revised form 3893 will be available march 7, 2022. For example, the form 1040 page is at. Web revised 2022, 2023 form 3893 instructions: This field is valid for form 1096 only and should be the tax year of the documents being. Instructions, page 1, column 2, when and where to file. Automatically include all shareholders go to california > other information worksheet. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your. For this discussion, ignore the. Partnerships and s corporations may.

Web revised 2022, 2023 form 3893 instructions: For example, the form 1040 page is at. Automatically include all shareholders go to california > other information worksheet. Exception for exempt organizations, federal,. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Web address as shown on form 943. Web 3893 filing instructions and transmittal letters are now prepared with release 2021.03031. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Only partner types individual, estate, trust, and grantor trust are. Web the instructions include:

For this discussion, ignore the. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. If an entity does not make that first. Only partner types individual, estate, trust, and grantor trust are. Instructions, page 1, column 2, when and where to file. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your. Web cch axcess™ tax and cch® prosystem fx® tax: Partnerships and s corporations may. Can i calculate late payment interest and penalties with. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan.

These instructions on how to open a book I found in an encyclopedia

Web tax forms and instructions: Automatically include all shareholders go to california > other information worksheet. Web instructions, and pubs is at irs.gov/forms. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web general information use form ftb 3893 to pay an elective tax.

California Form 3893 Passthrough Entity Tax Problems Windes

Web instructions, and pubs is at irs.gov/forms. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Only partner types individual, estate, trust, and grantor trust are..

Fill Free fillable USCIS PDF forms

For example, the form 1040 page is at. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Can i calculate late payment interest and penalties with. Web general information use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january.

3.12.37 IMF General Instructions Internal Revenue Service

Instructions, page 1, column 2, when and where to file. Web the instructions include: “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Automatically include all shareholders go to california > other information worksheet. Web tax forms and instructions:

2021 Instructions for Form 3893, PassThrough Entity Elective

Exception for exempt organizations, federal,. Almost every form and publication has a page on irs.gov with a friendly shortcut. Can i calculate late payment interest and penalties with. Web address as shown on form 943. Web instructions, and pubs is at irs.gov/forms.

Ata Chapters And Subchapters Pdf Merge lasopapromotions

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Only partner types individual, estate, trust, and grantor trust are. “ptes must make.

Gilbarco GBIR16 Card Reader Transmitter User Manual MDE 4635

Web revised 2022, 2023 form 3893 instructions: For this discussion, ignore the. Partnerships and s corporations may. Web instructions, and pubs is at irs.gov/forms. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan.

Certified Payroll Form Wh 347 Instructions Form Resume Examples

1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web instructions, and pubs is at irs.gov/forms. Web cch axcess™ tax and cch® prosystem fx® tax: Web general information use.

Virginia fprm pte Fill out & sign online DocHub

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web 3893 filing instructions and transmittal letters are now prepared with release 2021.03031. Exception for exempt organizations, federal,. This field is valid for form 1096 only and should be the tax year of the documents being. 1) ptes electing to pay.

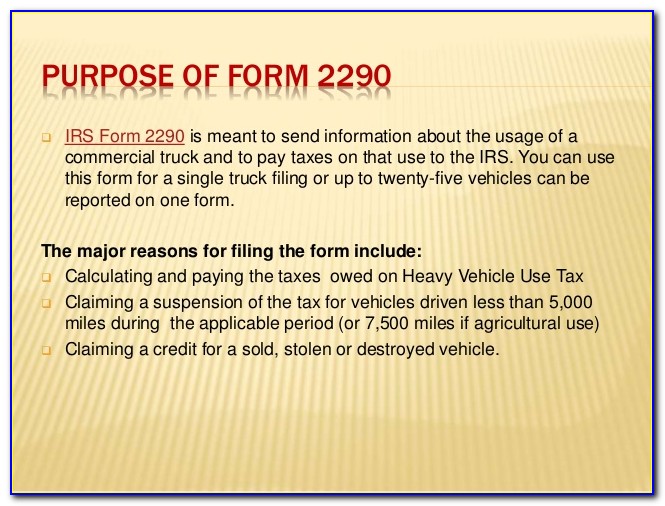

Form 2290 Irs Instructions Form Resume Examples aZDYGrXO79

Automatically include all shareholders go to california > other information worksheet. Exception for exempt organizations, federal,. Web cch axcess™ tax and cch® prosystem fx® tax: For example, the form 1040 page is at. This field is valid for form 1096 only and should be the tax year of the documents being.

Web Instructions, And Pubs Is At Irs.gov/Forms.

Web the instructions include: Web cch axcess™ tax and cch® prosystem fx® tax: Automatically include all shareholders go to california > other information worksheet. Web 3893 filing instructions and transmittal letters are now prepared with release 2021.03031.

Web Form 3893 Procedure Tax Software 2022 Prepare The 3804 Go To California > Passthrough Entity Tax Worksheet.

Web revised 2022, 2023 form 3893 instructions: For this discussion, ignore the. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. For example, the form 1040 page is at.

Web Address As Shown On Form 943.

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Only partner types individual, estate, trust, and grantor trust are. Partnerships and s corporations may. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your.

Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

Instructions, page 1, column 2, when and where to file. Web general information use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web address as shown on form 943. This field is valid for form 1096 only and should be the tax year of the documents being.