Form 3893 2022

Form 3893 2022 - Web revised 2022, 2023 form 3893 instructions: • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your. For example, the form 1040 page is at irs.gov/form1040; Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: What's new social security and medicare tax for 2022. For this discussion, ignore the effect of. Can i calculate late payment. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > ca29. Web almost every form and publication has a page on irs.gov with a friendly shortcut.

Web revised 2022, 2023 form 3893 instructions: For this discussion, ignore the effect of. Employer’s annual federal tax return for agricultural employees. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Department of the treasury internal revenue service. For example, the form 1040 page is at irs.gov/form1040; Please provide your email address and it will be emailed to you. We anticipate the revised form 3893 will be available march 7, 2022. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s.

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Instructions, page 1, column 2, when and where. Please provide your email address and it will be emailed to you. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web revised 2022, 2023 form 3893 instructions: Department of the treasury internal revenue service. This is only available by request. For this discussion, ignore the effect of. What's new social security and medicare tax for 2022.

什么事情让他们如此感动,难忘?北京市圣瑞物业服务有限公司

Web almost every form and publication has a page on irs.gov with a friendly shortcut. Can i calculate late payment. Instructions, page 1, column 2, when and where. Web forms 3893 2021 and 2022 automatically activate when form 3804 is present from methods 1 or 2 above. For example, the form 1040 page is at irs.gov/form1040;

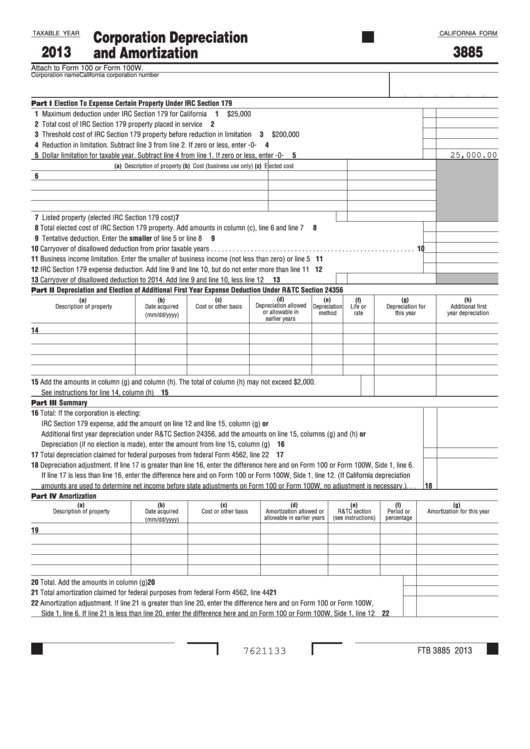

Fillable California Form 3885 Corporation Depreciation And

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet..

The Great Wave on form

Web form 3893 procedure tax software 2022 prepare the 3804 go to california > ca29. For this discussion, ignore the effect of. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web forms 3893 2021 and 2022 automatically activate when form 3804 is present from methods 1 or 2 above. Can.

Fill Free fillable USCIS PDF forms

This is only available by request. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Instructions, page 1, column 2, when and where. For this discussion, ignore the effect of. Please provide your email address and it will be emailed to you.

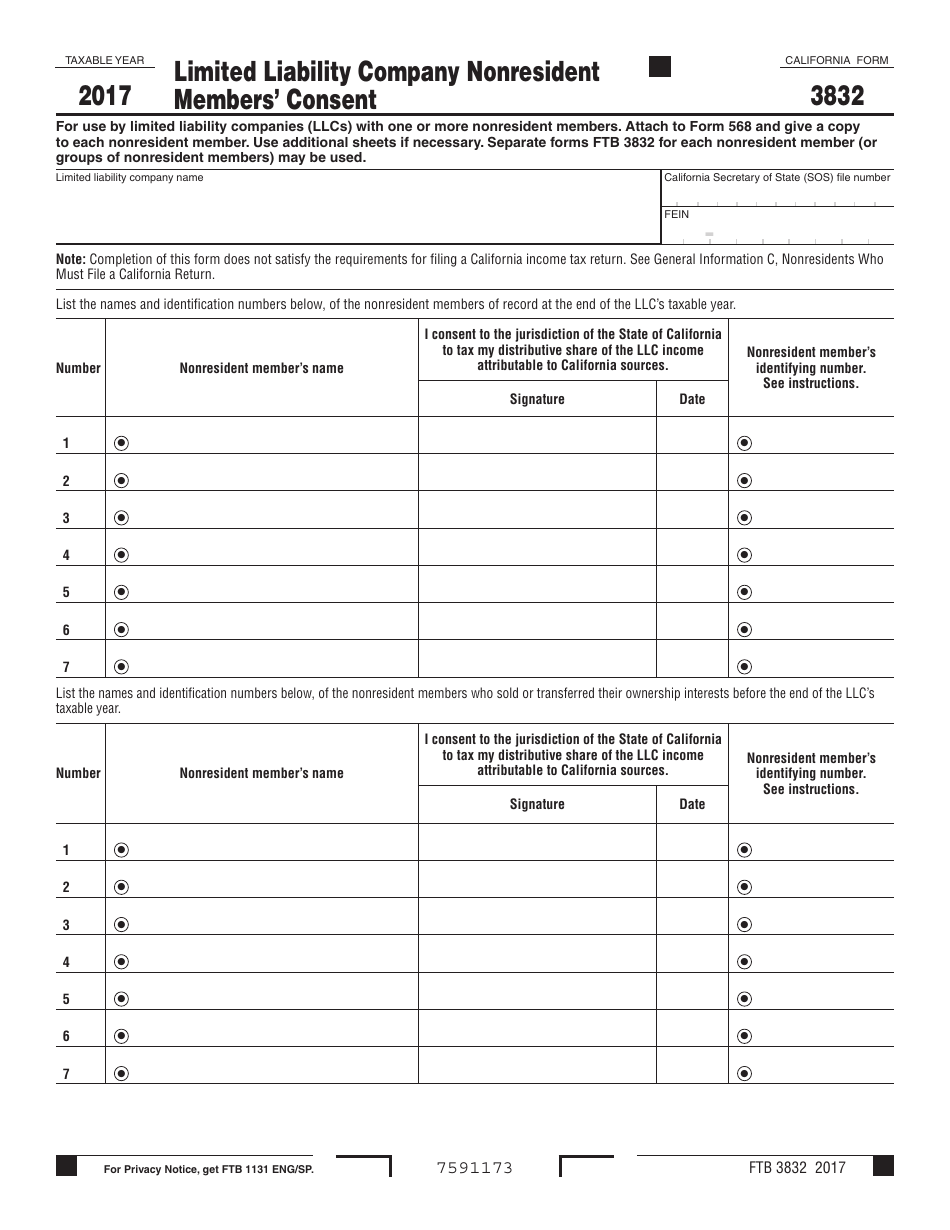

Form FTB3832 Download Printable PDF or Fill Online Limited Liability

The amount on ftb 3893 amount of payment carries to. We anticipate the revised form 3893 will be available march 7, 2022. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web forms 3893 2021 and 2022 automatically activate when form 3804 is present from methods 1 or 2 above. For example, the form.

ECOHSAT Admission Form 2021/2022 ND, HND, Diploma & Cert.

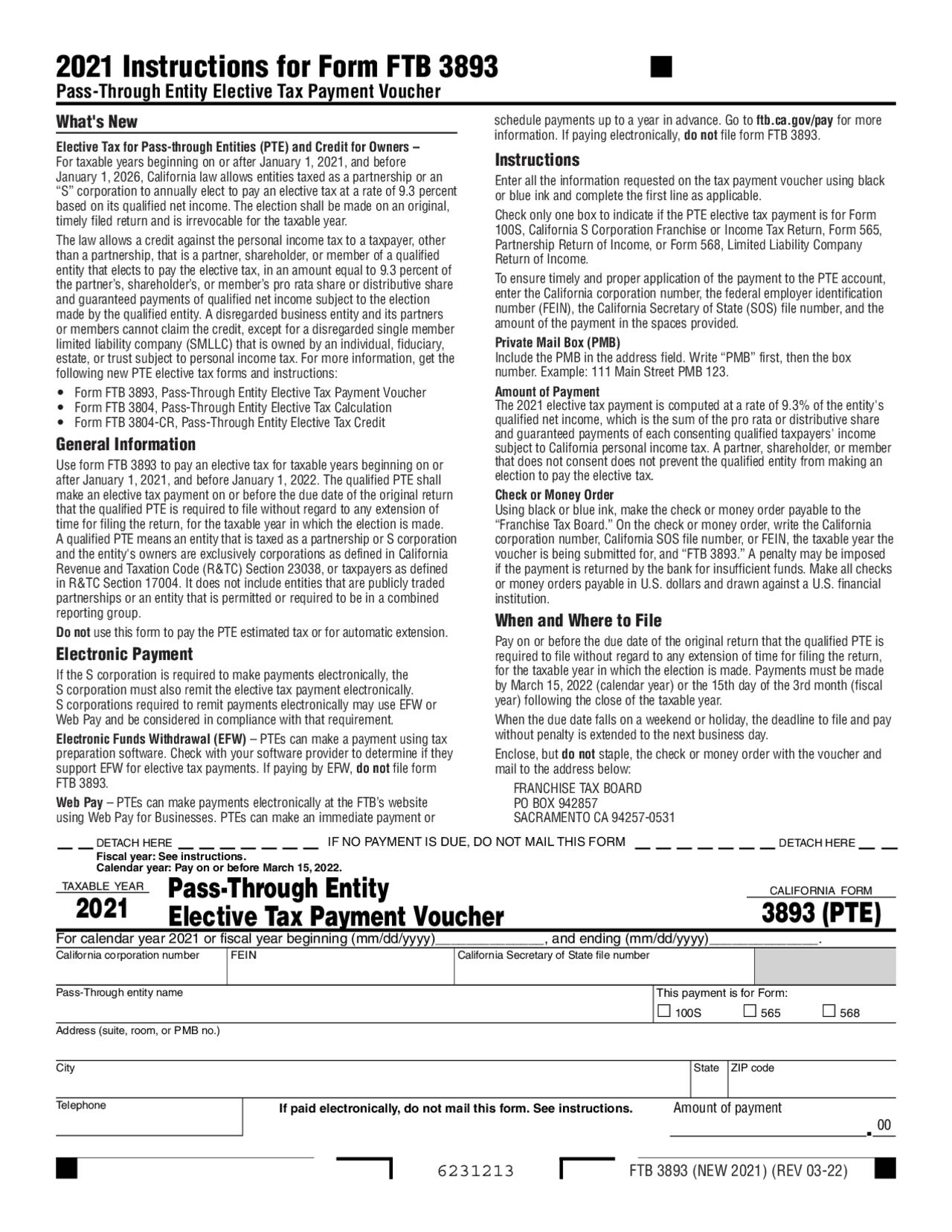

This is only available by request. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your. Web general information use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web 11/05/2022.

California Form 3893 Passthrough Entity Tax Problems Windes

Can i calculate late payment. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > ca29. Employer’s annual federal tax return for agricultural employees. “ptes must make all elective tax payments either by using the free web pay.

Virginia fprm pte Fill out & sign online DocHub

Web form 3893 procedure tax software 2022 prepare the 3804 go to california > ca29. We anticipate the revised form 3893 will be available march 7, 2022. Department of the treasury internal revenue service. For this discussion, ignore the effect of. For example, the form 1040 page is at irs.gov/form1040;

2021 Instructions for Form 3893, PassThrough Entity Elective

Web form 3893 procedure tax software 2022 prepare the 3804 go to california > ca29. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Employer’s annual federal tax return for agricultural employees. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

We anticipate the revised form 3893 will be available march 7, 2022. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Department of the treasury internal revenue service. Web.

Web Form 3893 Procedure Tax Software 2022 Prepare The 3804 Go To California > Ca29.

Web address as shown on form 943. We anticipate the revised form 3893 will be available march 7, 2022. For example, the form 1040 page is at irs.gov/form1040; Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view.

Web Form 3893 Procedure Tax Software 2022 Prepare The 3804 Go To California > Passthrough Entity Tax Worksheet.

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web revised 2022, 2023 form 3893 instructions: Web general information use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2017” on your.

This Is Only Available By Request.

The amount on ftb 3893 amount of payment carries to. Please provide your email address and it will be emailed to you. Can i calculate late payment. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943.

For This Discussion, Ignore The Effect Of.

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Employer’s annual federal tax return for agricultural employees. Instructions, page 1, column 2, when and where. Web almost every form and publication has a page on irs.gov with a friendly shortcut.