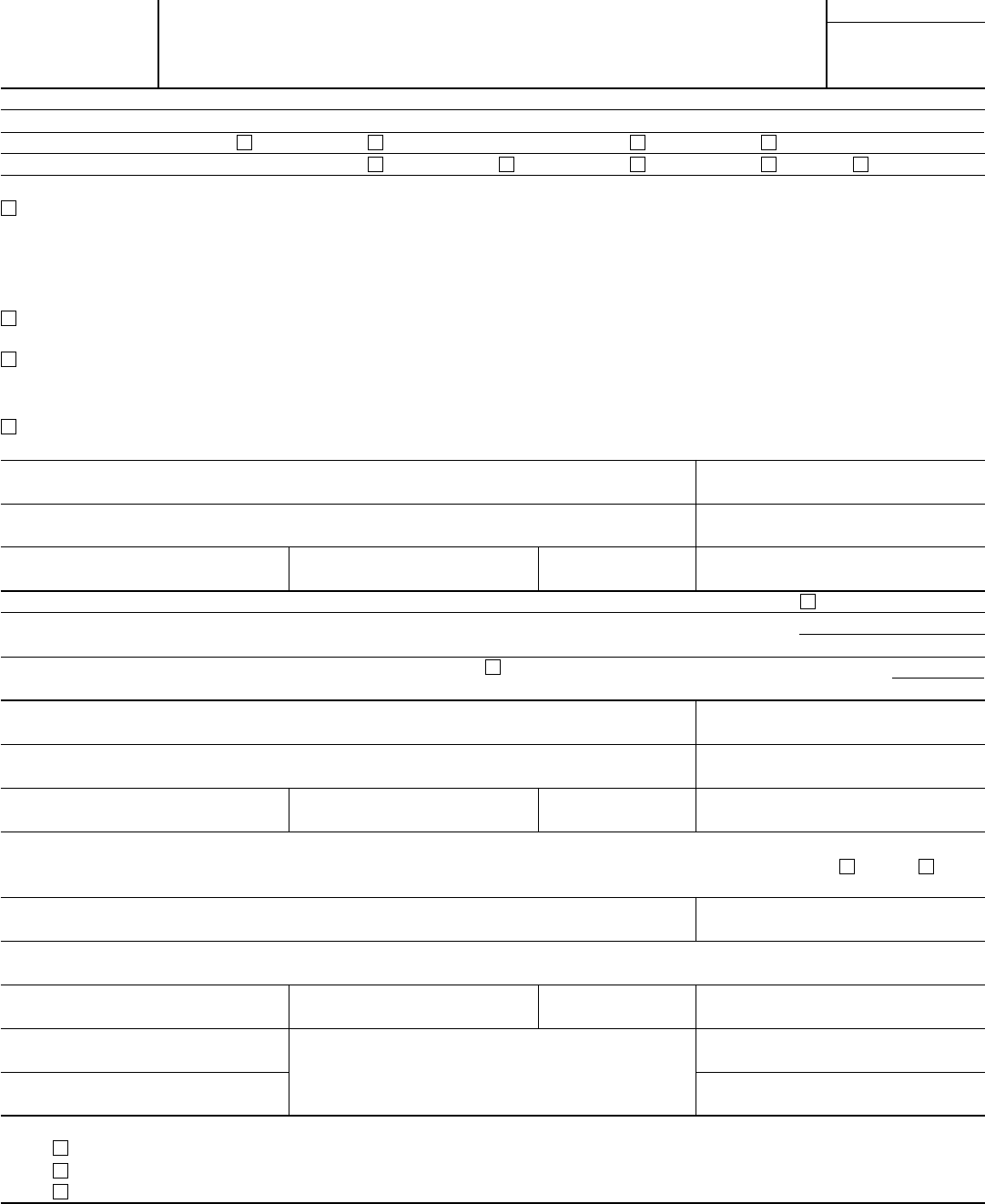

Form 3520 Description Of Property Received

Form 3520 Description Of Property Received - You will file the 3520. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Web yes, you will report the property also in form 3520 part iv. Web requested below and part iii of the form. Web (b) description of property received. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. (d) description of property transferred. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Adjusted basis of property transferred (e) gain recognized at time of transfer (f) excess, if any, of. (c) fmv of property received.

Web related to you during the current tax year, or (2) from which you or a u.s. When a person is a u.s. Web form 3520 & instructions: (e) fmv of property transferred. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web requested below and part iii of the form. Transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust, (b) you held an outstanding obligation of a. Person transferred money into foreign trust. Person who, during the current tax year, received certain gifts or bequests from a foreign person. It does not have to be a “foreign gift.”.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. The accountant will know how to help. Person related to you received the uncompensated use of trust property. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Web (a) you are a u.s. Web related to you during the current tax year, or (2) from which you or a u.s. (d) description of property transferred. Web description of property transferred (c) fmv of property transferred (d) u.s. When a person is a u.s. Web yes, you will report the property also in form 3520 part iv.

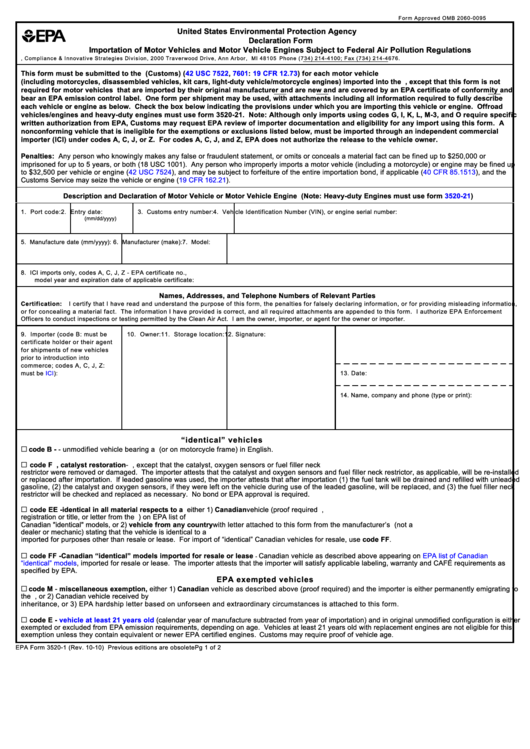

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web requested below and part iii of the form. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. The first component of the form 3520 is fairly. Web (b) description of property received. Web yes, you will report the property also in form 3520 part iv.

US Taxes and Offshore Trusts Understanding Form 3520

Web yes, you will report the property also in form 3520 part iv. Web requested below and part iii of the form. (d) description of property transferred. (e) fmv of property transferred. Enter a brief description of the property and fair market value of the property.

Form 3520 Blank Sample to Fill out Online in PDF

Web hi, i'd like to know how i should fill out the 'description of property received in form 3520, line 54 (b) accountant's assistant: When a person is a u.s. Taxpayer transactions with a foreign trust. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons..

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Web form 3520 is a tax form that us expats.

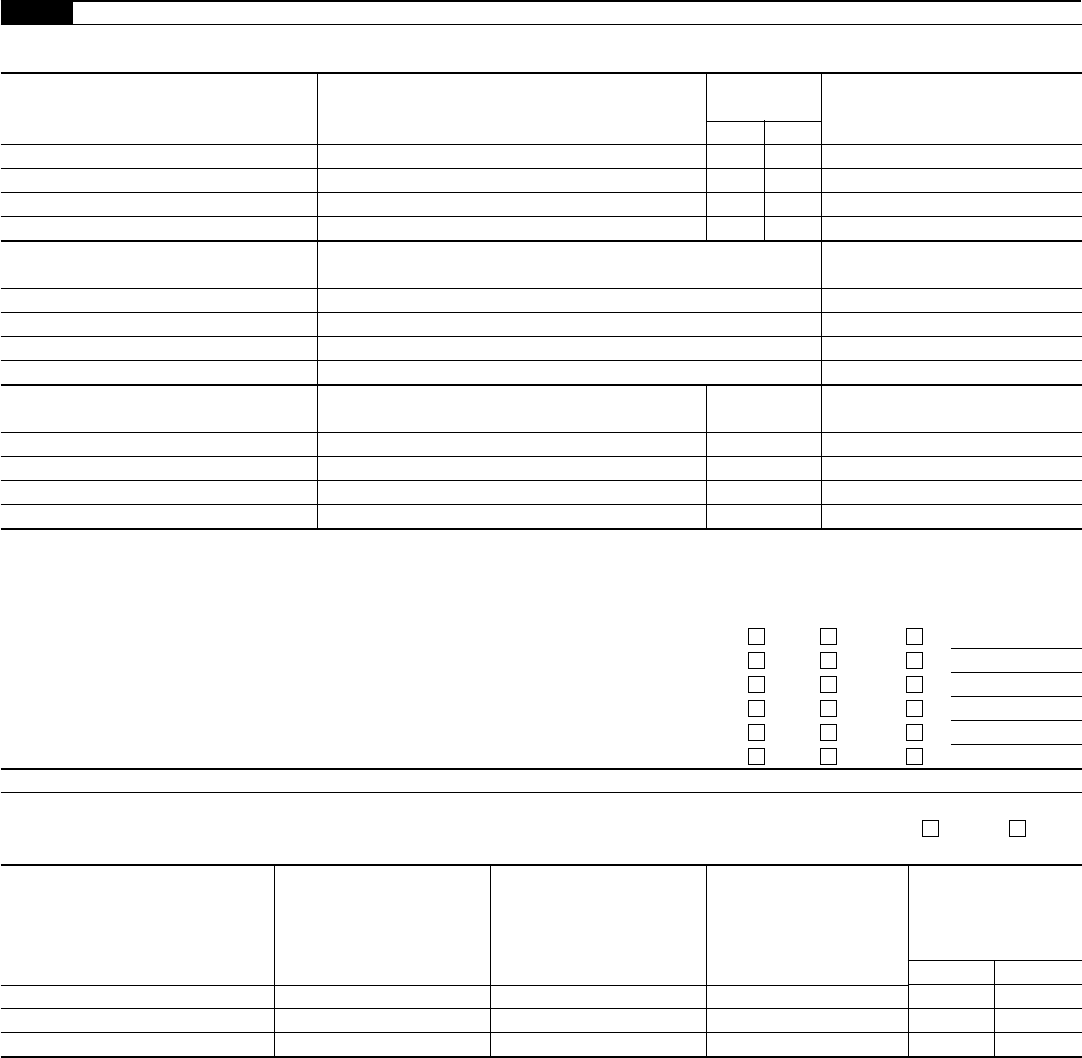

Form 3520A Annual Information Return of Foreign Trust with a U.S

Get ready for tax season deadlines by completing any required tax forms today. Web (b) description of property received. Person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2). Web the fourth and final component of the form 3520.

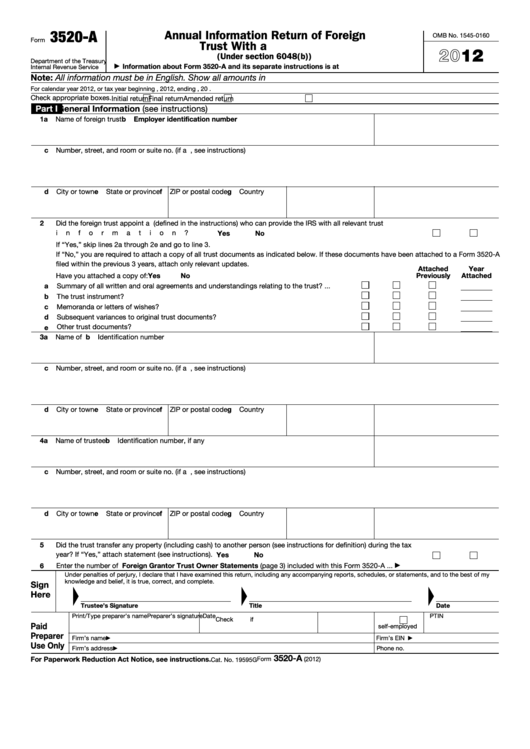

Top Epa Form 35201 Templates free to download in PDF format

Get ready for tax season deadlines by completing any required tax forms today. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. When a person is a u.s. Web requested below and part iii of the form. Web (b) description of property received.

US Taxes and Offshore Trusts Understanding Form 3520

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Enter a brief description of the property and fair market value of the property. Web yes, you will report the property also in form 3520 part iv. Taxpayer transactions with a foreign.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Person and transfers money into a foreign trust, they may also be required to file form 3520. Taxpayer transactions with a foreign trust. Web related to you during the current tax year, or (2) from which you or a u.s. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2). Person who, during the current tax year,.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Enter a brief description of the property and fair market value of the property. There are three main types of transactions with a foreign trust you need to report on: Web (b) description of property received. Person related to you received the uncompensated use of trust property. Web the fourth and final component of the form 3520 is utilized to.

Taxpayer Transactions With A Foreign Trust.

Send form 3520 to the. Person related to you received the uncompensated use of trust property. Get ready for tax season deadlines by completing any required tax forms today. Web form 3520 for u.s.

(E) Fmv Of Property Transferred.

Web (a) you are a u.s. Web (b) description of property received. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Enter a brief description of the property and fair market value of the property.

Ad Download Or Email Irs 3520 & More Fillable Forms, Register And Subscribe Now!

Person who, during the current tax year, received certain gifts or bequests from a foreign person. Web related to you during the current tax year, or (2) from which you or a u.s. The first component of the form 3520 is fairly. 19594vform 3520 (2019) 2 schedule a—obligations of a related trust (see instructions) 11 a during the current tax year, did you transfer property (including cash).

(D) Description Of Property Transferred.

Person and transfers money into a foreign trust, they may also be required to file form 3520. Web yes, you will report the property also in form 3520 part iv. Web form 3520 & instructions: Transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust, (b) you held an outstanding obligation of a.