Form 2553 For Llc

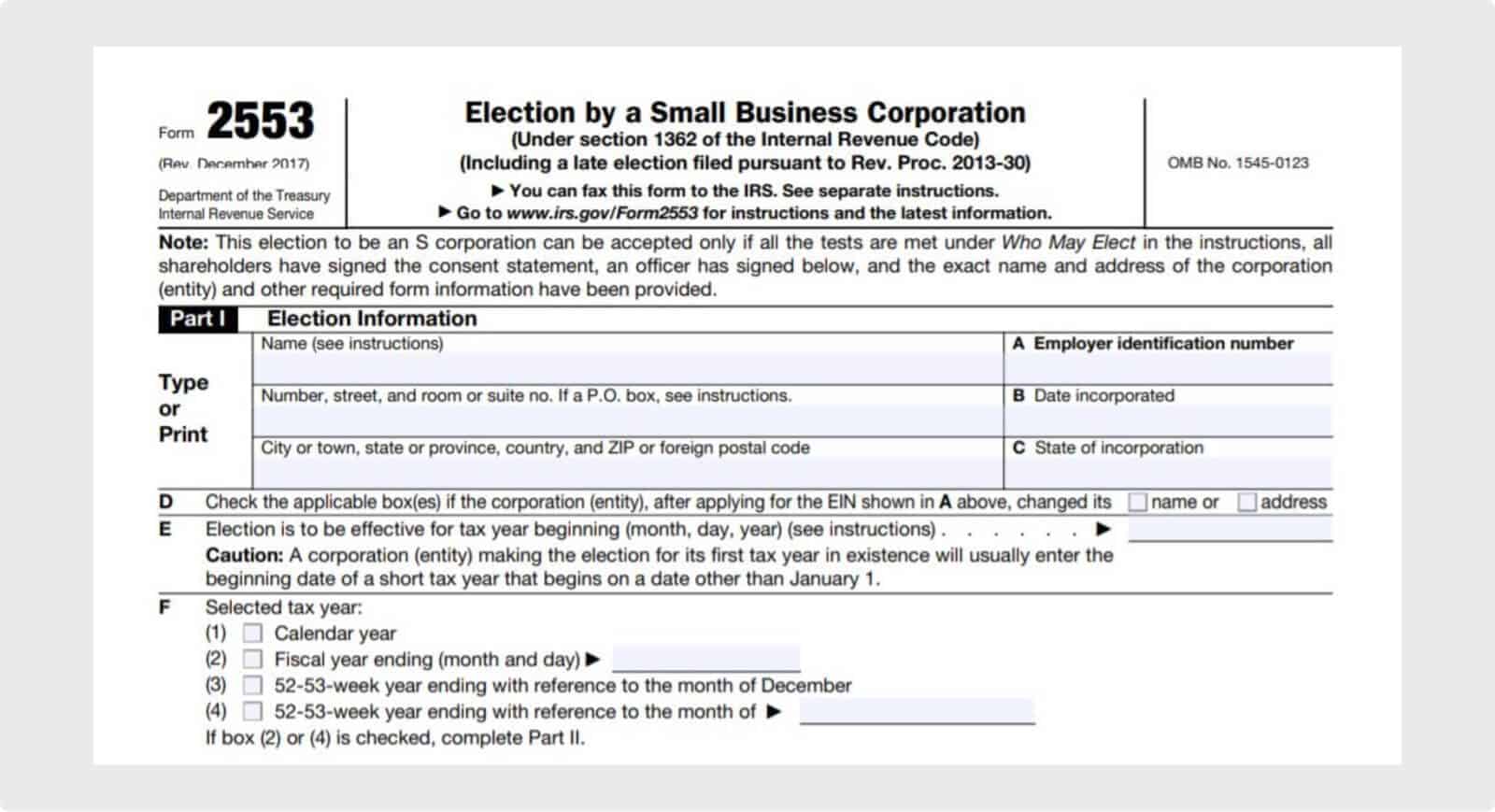

Form 2553 For Llc - How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). Web form 2553 notifies the irs that you want to elect s corp status. We earn a commission from partner links on forbes advisor. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Web 2553 form (under section 1362 of the internal revenue code) (rev. Aug 21, 2022, 10:57pm editorial note: A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes.

Our form 2553 instructions guide below covers: Aug 21, 2022, 10:57pm editorial note: Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Web rob watts editor updated: Where to file form 2553. We earn a commission from partner links on forbes advisor. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. December 2017) (including a late election filed pursuant to rev. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to.

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Web 2553 form (under section 1362 of the internal revenue code) (rev. Web rob watts editor updated: Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. Web form 2553 notifies the irs that you want to elect s corp status. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. The owner must be eligible to be an s. How to complete form 2553.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. We earn a commission from partner links on forbes advisor. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on.

2553 Vorwahl

We earn a commission from partner links on forbes advisor. Where to file form 2553. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. These entities are not required to file form 8832, entity classification election. Web rob watts editor updated:

LLC Taxed as an S Corp Form 2553 LLC University Fill Out and Sign

Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Where to file form 2553. We earn a commission from partner links on forbes advisor. Web form 2553 is used by limited.

Review Paystub News here Everything Paystubs All the time

Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Aug 21, 2022, 10:57pm editorial note: We earn a commission from partner links on forbes advisor. How form 2553 works for many.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Our form 2553 instructions guide below covers: Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. Commissions do not affect our editors' opinions or evaluations. How form 2553 works for many business owners, electing for.

What is IRS Form 2553? Bench Accounting

Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. How.

Ssurvivor Form 2553 Sample

Web rob watts editor updated: A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Aug 21, 2022, 10:57pm editorial note: Web 2553 form (under section.

LLC vs. SCorp (How to Choose) SimplifyLLC

Web rob watts editor updated: How to complete form 2553. Web 2553 form (under section 1362 of the internal revenue code) (rev. Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. Web if a single member limited liability company (llc) owns stock in the.

Form 2553 An Overview of Who, When, and Why

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. December 2017) (including a late election filed pursuant to rev. Web rob watts editor updated: These entities are not required to file form 8832, entity classification election. Web if a.

Web If A Single Member Limited Liability Company (Llc) Owns Stock In The Corporation, And The Llc Is Treated As A Disregarded Entity For Federal Income Tax Purposes, Enter The Owner's Name And Address.

We earn a commission from partner links on forbes advisor. Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. December 2017) (including a late election filed pursuant to rev. Our form 2553 instructions guide below covers:

Web Form 2553 Is Used By Limited Liability Companies (Llcs) And Corporations To Elect The S Corporation (S Corp) Tax Classification With The Us Internal Revenue Service (Irs).

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web 2553 form (under section 1362 of the internal revenue code) (rev. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. How to complete form 2553.

Election By A Small Business Corporation Is Used By Small Businesses That Elect To Be Taxed As An S Corporation, Rather Than The Default C Corporation Business Structure Assigned By.

Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Web rob watts editor updated: These entities are not required to file form 8832, entity classification election. Commissions do not affect our editors' opinions or evaluations.

The Owner Must Be Eligible To Be An S.

Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. Web form 2553 notifies the irs that you want to elect s corp status. Aug 21, 2022, 10:57pm editorial note: How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)