Form 2553 Fill In

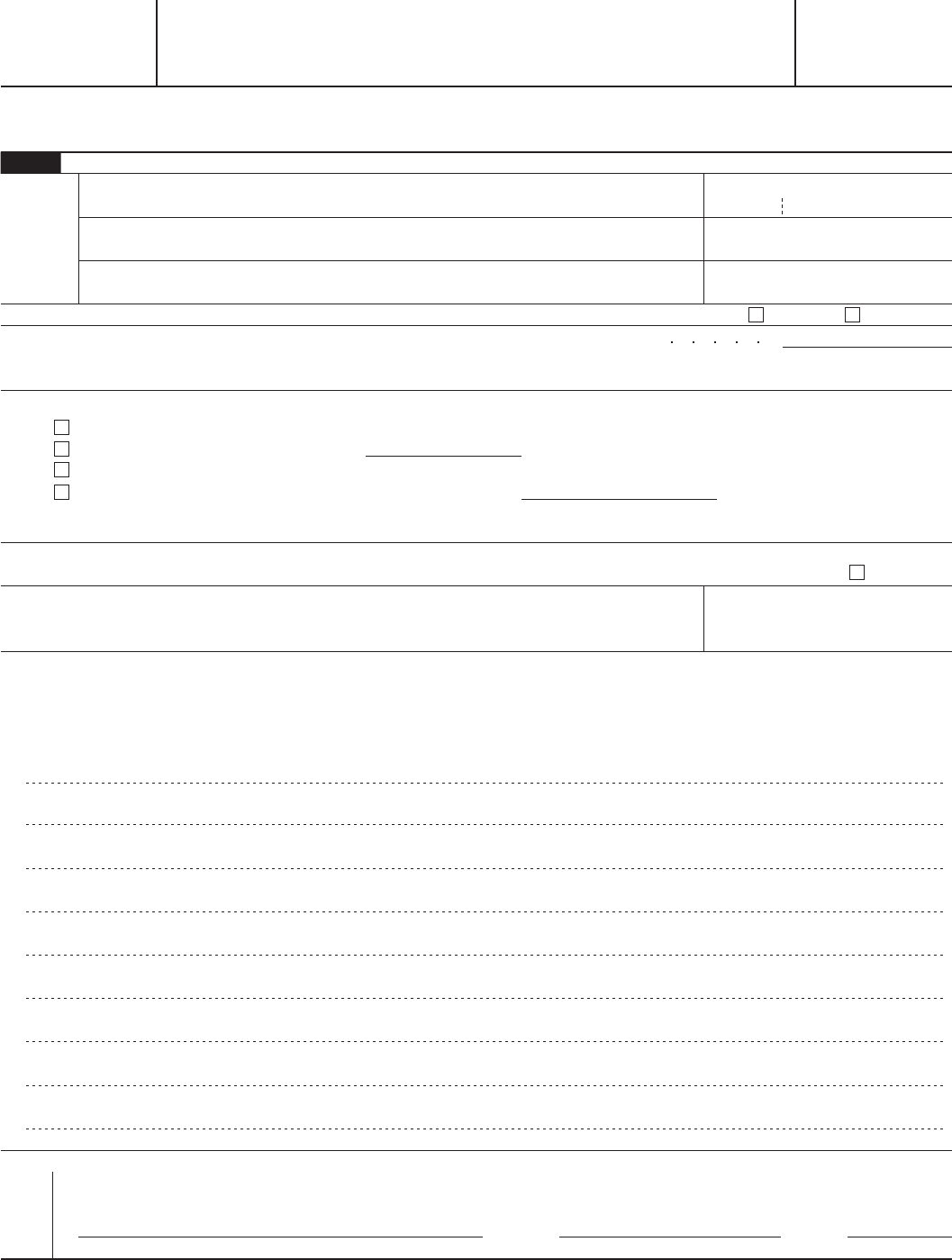

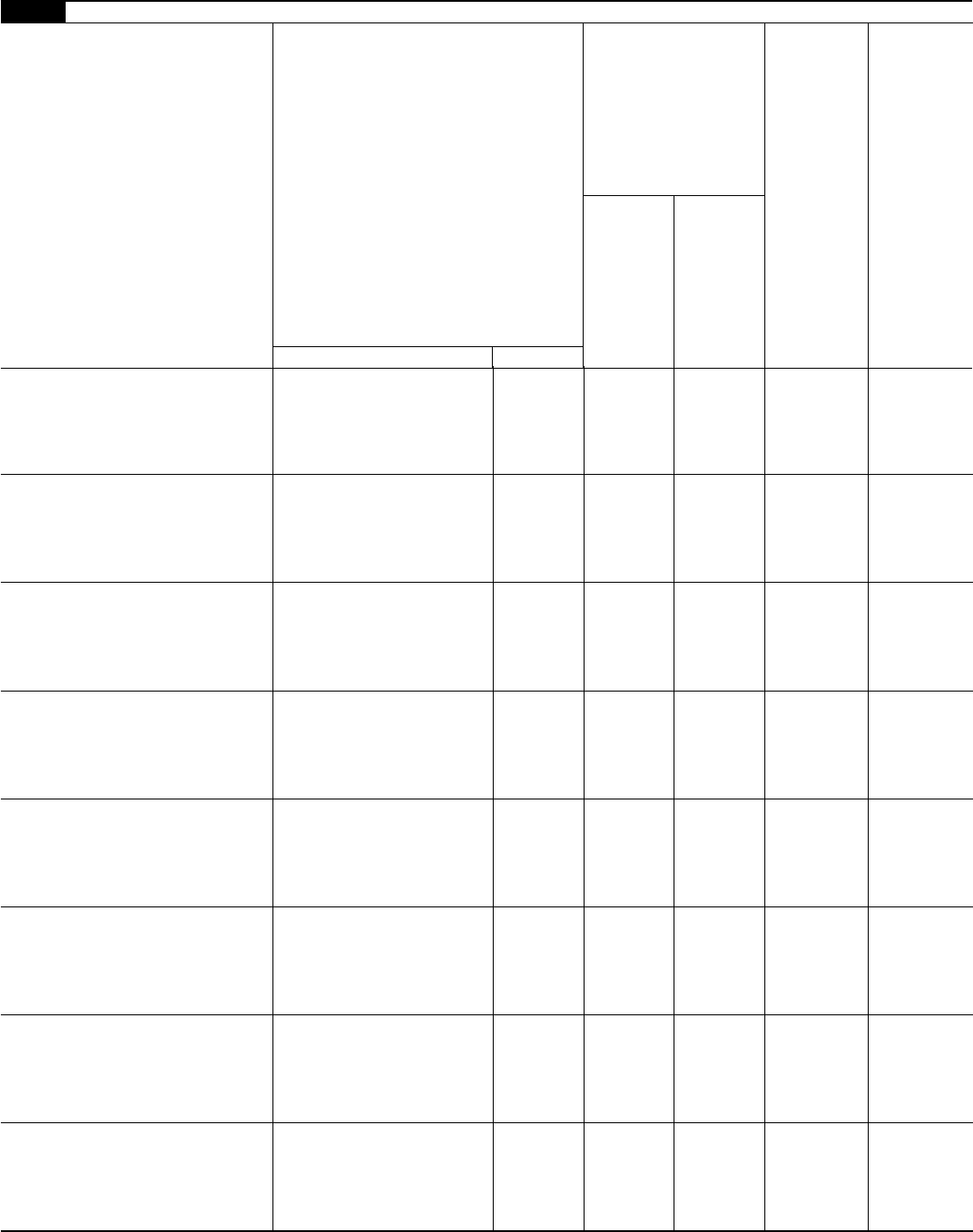

Form 2553 Fill In - Complete, edit or print tax forms instantly. Web where to get form 2553 an interactive form 2553 is available on the irs website. The irs web site provides a list that details the appropriate address or fax. Web where to file irs form 2553? Ad download or email irs 2553 & more fillable forms, register and subscribe now! Businesses can file form 2553 either by fax or by mail. Top 13mm (1⁄2), center sides.prints: Election by a small business corporation (under section 1362 of the internal revenue. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. We know the irs from the inside out.

If your tax year starts on january 1, you have until march 15 to. You can complete it online and download a finished copy to print out. (see, irc section 1362(a)) toggle navigation. A corporation or other entity. Complete irs tax forms online or print government tax documents. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web where to file irs form 2553? Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. If the corporation's principal business, office, or agency is located in.

Web where to get form 2553 an interactive form 2553 is available on the irs website. Top 13mm (1⁄2), center sides.prints: Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. The irs web site provides a list that details the appropriate address or fax. Web the best way for businesses to be taxed varies widely. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web instructions for form 2553 department of the treasury internal revenue service (rev. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web form 2553 is an irs form. Businesses can file form 2553 either by fax or by mail.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web where to file irs form 2553? Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. If the corporation's principal business, office, or.

Form 2553 (Rev December 2007) Edit, Fill, Sign Online Handypdf

Web instructions for form 2553 department of the treasury internal revenue service (rev. Web the best way for businesses to be taxed varies widely. Web where to get form 2553 an interactive form 2553 is available on the irs website. Election by a small business corporation is used by small businesses that elect to be taxed as an s.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web find mailing addresses by state and date for filing form 2553. Businesses can file form 2553 either by fax or by mail. (see, irc section 1362(a)).

IRS Form 2553 No Error Anymore If Following the Instructions

Web where to get form 2553 an interactive form 2553 is available on the irs website. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than.

Ssurvivor Form 2553 Irs Fax Number

A corporation or other entity. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. December 2020) (for use with the december 2017 revision of form 2553, election by a. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Form 2553 Instructions How and Where To File

Web the best way for businesses to be taxed varies widely. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. You can complete it online and download a finished copy to print out. Election by.

Form 2553 Edit, Fill, Sign Online Handypdf

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web form 2553 must be filed before the 16th day of the third month of your corporation’s tax year. We know the irs from the inside out. If the corporation's principal business, office, or agency.

Form 2553 Edit, Fill, Sign Online Handypdf

Election by a small business corporation (under section 1362 of the internal revenue. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Ad access irs tax forms. (see, irc section 1362(a)) toggle navigation. Irs form 2553 can.

Ssurvivor Form 2553 Irs Phone Number

You can complete it online and download a finished copy to print out. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web where to file irs form 2553? Election by a small business corporation (under section 1362 of the internal revenue. Web instructions for form 2553 department of the treasury internal revenue service (rev.

Irs form 2553 fill in 2002 Fill out & sign online DocHub

Web where to get form 2553 an interactive form 2553 is available on the irs website. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Web where to file irs form 2553? Ad download.

(See, Irc Section 1362(A)) Toggle Navigation.

Web form 2553 must be filed before the 16th day of the third month of your corporation’s tax year. Web instructions for form 2553 department of the treasury internal revenue service (rev. December 2017) department of the treasury internal revenue service. Currently, an online filing option does not exist for this form.

December 2020) (For Use With The December 2017 Revision Of Form 2553, Election By A.

Complete, edit or print tax forms instantly. Web where to get form 2553 an interactive form 2553 is available on the irs website. Web how to file the irs form 2553. Top 13mm (1⁄2), center sides.prints:

The Irs Web Site Provides A List That Details The Appropriate Address Or Fax.

Businesses can file form 2553 either by fax or by mail. Complete irs tax forms online or print government tax documents. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15.

Under Election Information, Fill In The Corporation's Name And Address, Along With Your Ein Number And Date And State Of Incorporation.

Ad access irs tax forms. Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Irs form 2553 can be filed with the irs by either mailing or faxing the form.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)