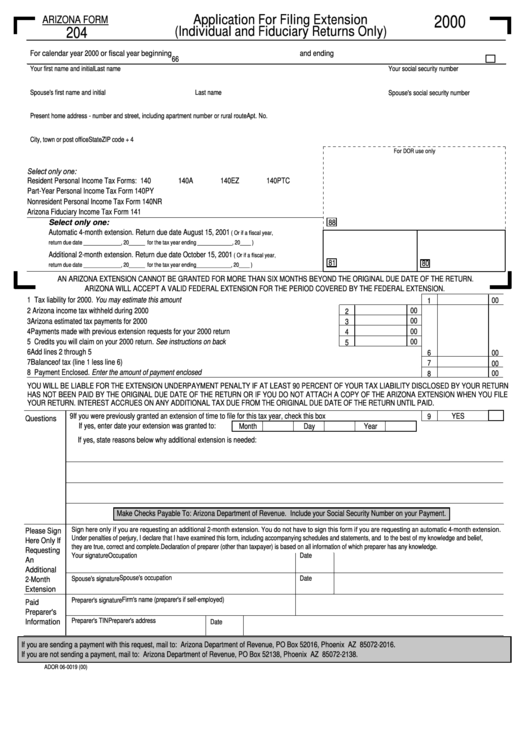

Form 204 Arizona

Form 204 Arizona - Web application for filing extension form. Web individuals to file form 204 to request an extension for form 140 only if the federal tax extension was rejected. Web follow the simple instructions below: Fiscal tax year ending return due date. Web search irs and state income tax forms to efile or complete, download online and back taxes. Web 26 rows individual income tax forms individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Web arizona form 204 application for filing extension for individual returns only for calendar year 2021 check one box: This form is for income earned in tax year 2022, with tax returns due in april.

If you are not making. You do not have to include a copy of the extension with your return when you file, but make sure that you check box 82f on page 1 of the return. Web make an individual or small business income payment. Web search irs and state income tax forms to efile or complete, download online and back taxes. Web individuals to file form 204 to request an extension for form 140 only if the federal tax extension was rejected. An arizona extension will give you until october 15, 2021 to. Web form 204 for details. Web 26 rows individual income tax forms individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement. The completed extension form must be filed by april 18, 2023. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr.

Explore more file form 4868 and extend your 1040 deadline. Web 26 rows individual income tax forms individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. This form is for income earned in tax year 2022, with tax returns due in april. Web make an individual or small business income payment. You do not have to include a copy of the extension with your return when you file, but make sure that you check box 82f on page 1 of the return. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. Purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc,. Web follow the simple instructions below:

Form J 204 Fill Online, Printable, Fillable, Blank PDFfiller

The completed extension form must be filed by april 18, 2023. Web make an individual or small business income payment. Purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc,. Web individuals to file form 204 to request an extension for form 140 only if the.

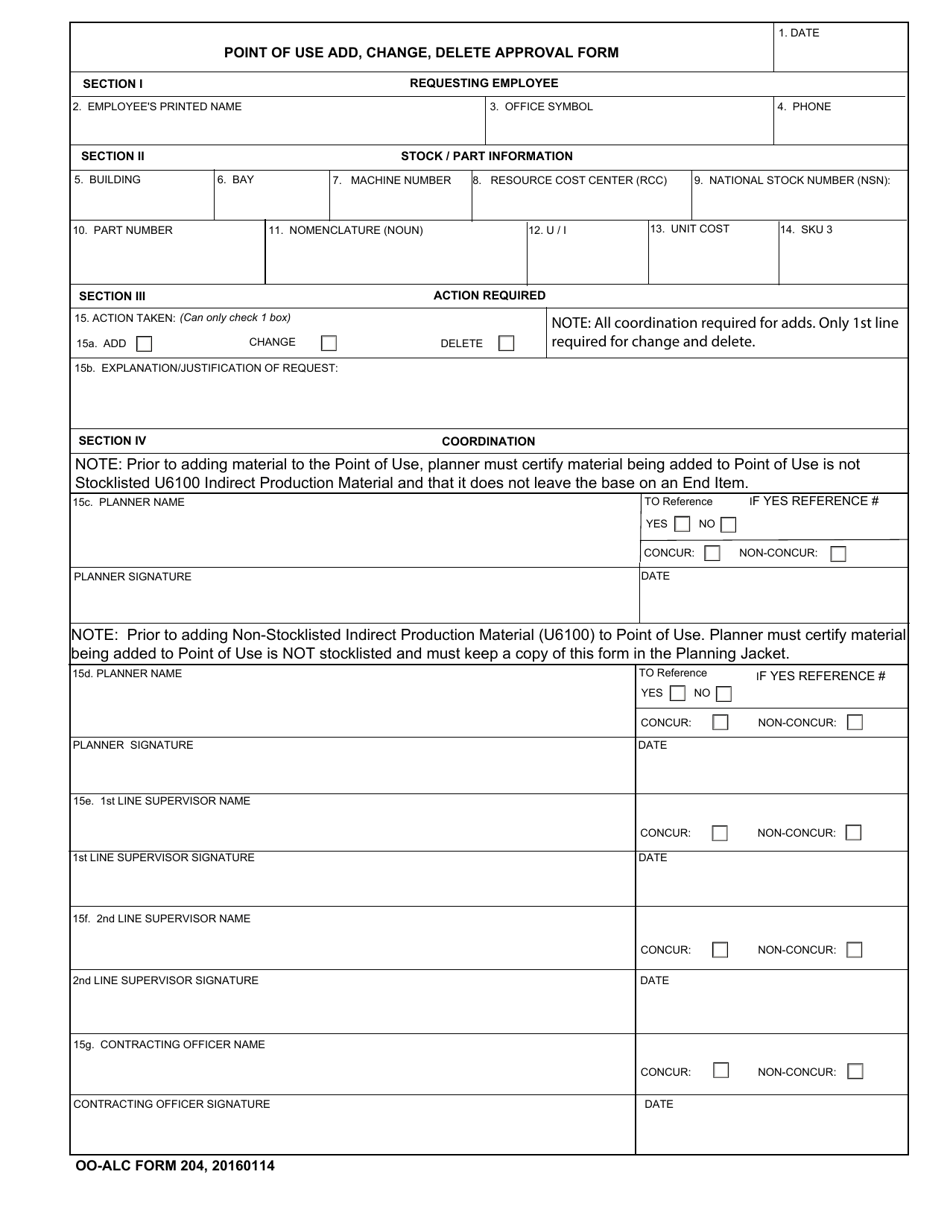

OOALC Form 204 Download Fillable PDF or Fill Online Point of Use Add

Web application for filing extension form. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Fiscal tax year ending return due date. If.

Form 204 Application For Filing Extension (Individual And Fiduciary

Individual payment type options include: Purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc,. Web search irs and state income tax forms to efile or complete, download online and back taxes. Web application for filing extension form. Web make an individual or small business income.

Download Arizona Form A4 (2013) for Free FormTemplate

Web individuals to file form 204 to request an extension for form 140 only if the federal tax extension was rejected. An arizona extension will give you until october 15, 2021 to. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us..

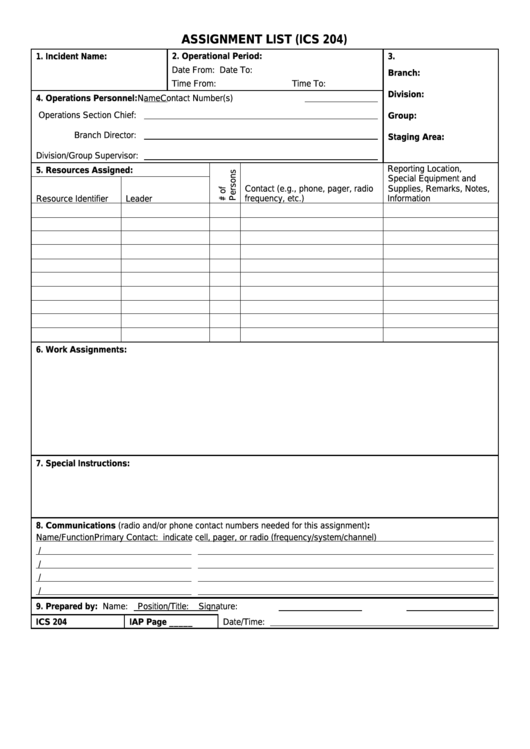

Fillable Ics Form 204 Assignment List printable pdf download

Fiscal tax year ending return due date. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. You do not have to include a copy of the extension with your return when you file, but make sure that you check box 82f on page 1 of the return. Web to file an.

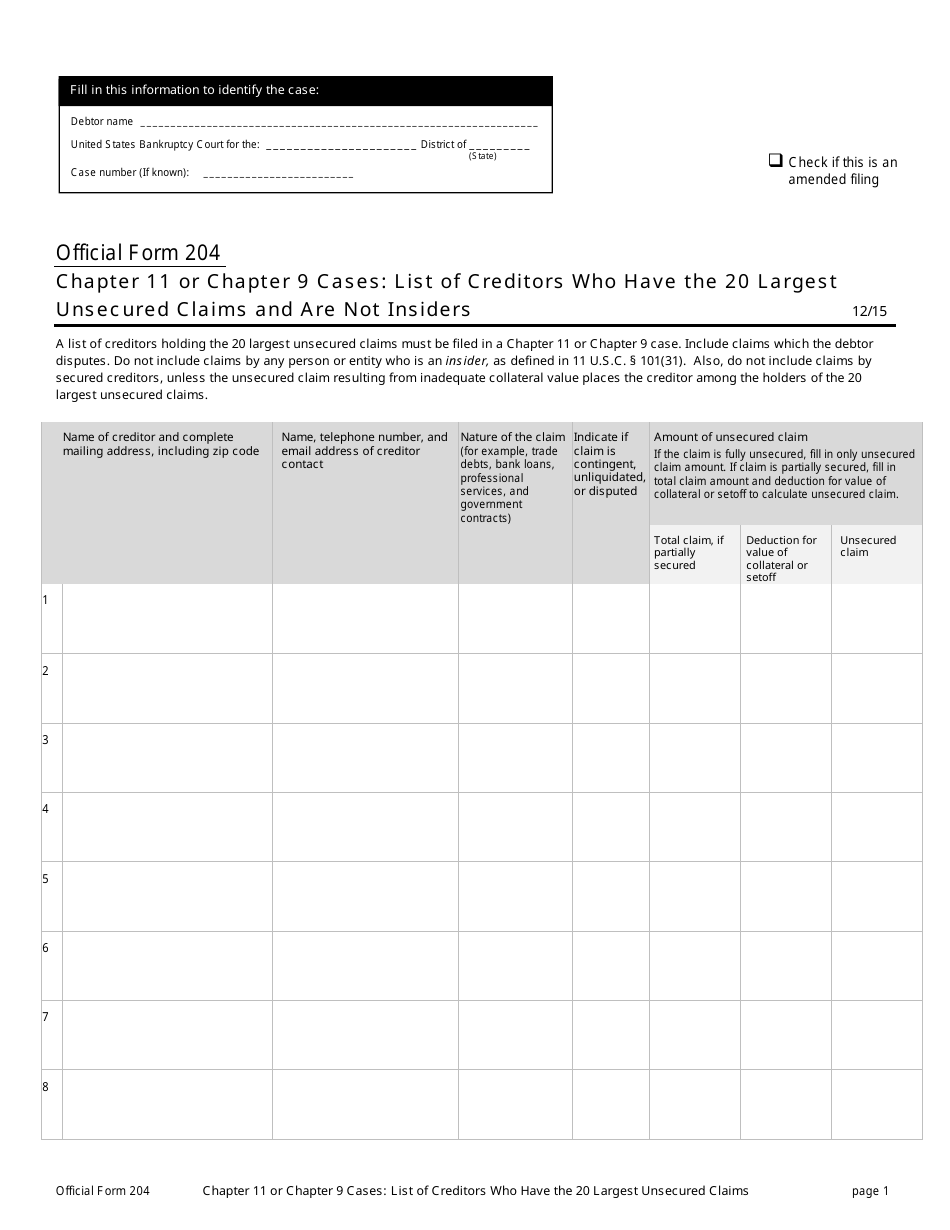

Official Form 204 Download Printable PDF or Fill Online Chapter 11 or

Web make an individual or small business income payment. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. The completed extension form must be filed by april 18, 2023. Explore more file form 4868 and extend your 1040 deadline. Web search.

2012 AL Form 204/205 Fill Online, Printable, Fillable, Blank pdfFiller

Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Individual payment type options.

12052019 SBD Arizona204 US Department of Education Flickr

Web form 204 for details. Web make an individual or small business income payment. Individual payment type options include: If you are not making. This form is for income earned in tax year 2022, with tax returns due in april.

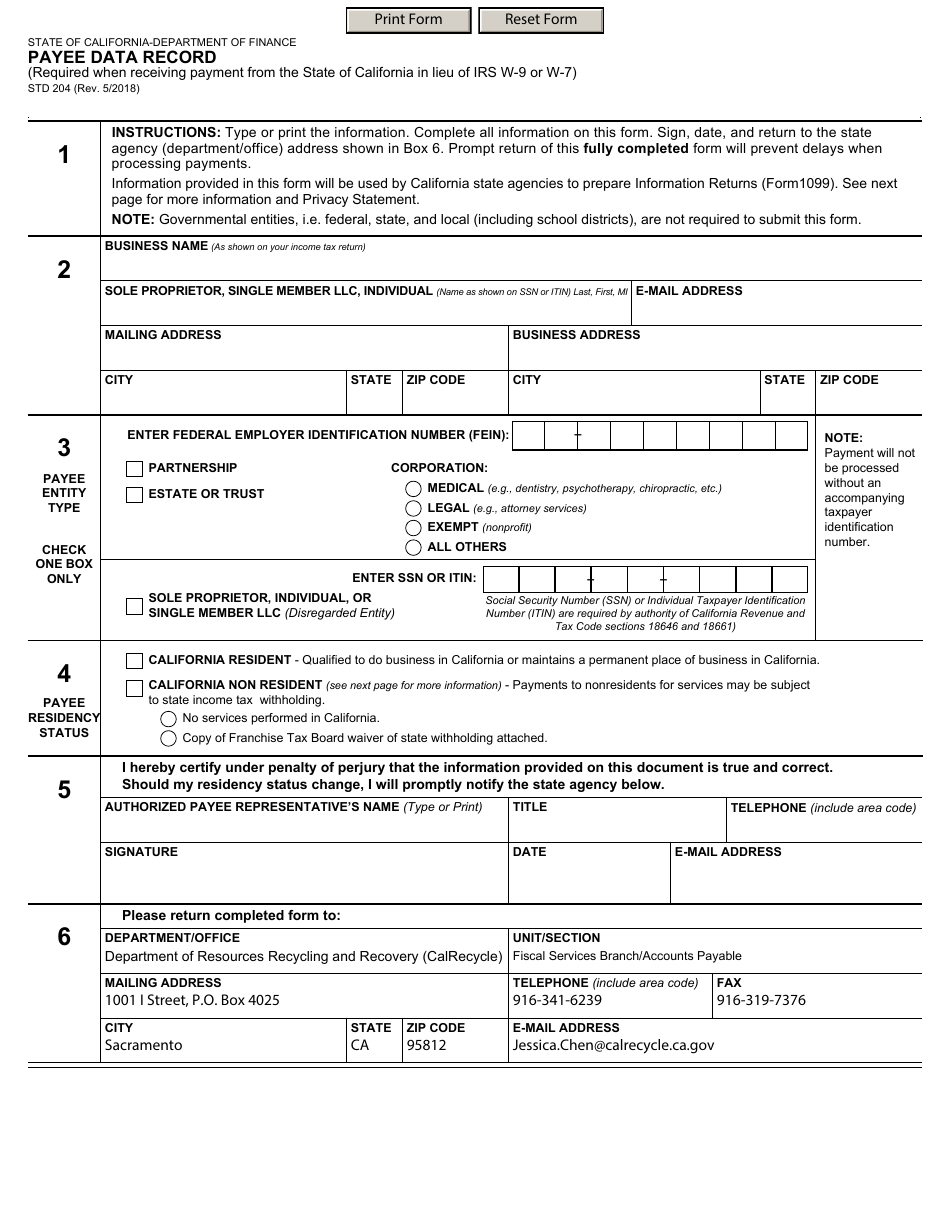

Form STD204 Download Fillable PDF or Fill Online Payee Data Record

Explore more file form 4868 and extend your 1040 deadline. Web follow the simple instructions below: Individual payment type options include: Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. Purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona.

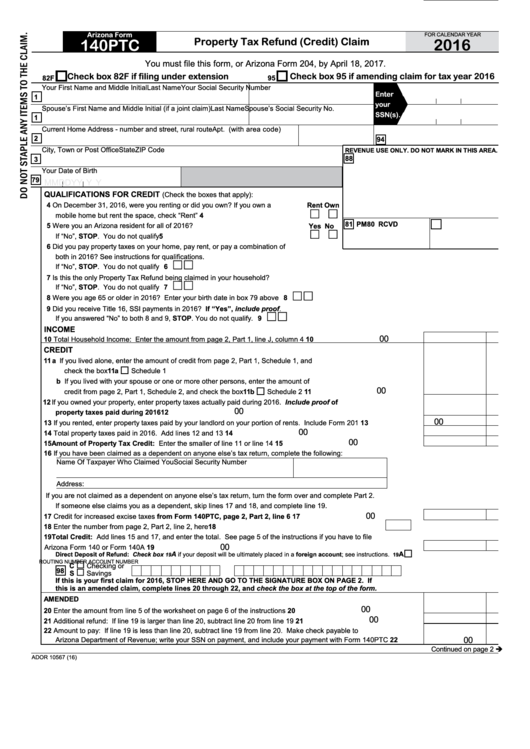

Arizona Form 140ptc Property Tax Refund (credit) Claim 2016

This form is for income earned in tax year 2022, with tax returns due in april. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Purpose of form 204 use arizona form 204 to apply for an extension of time to.

Web Arizona Form 204 Application For Filing Extension For Individual Returns Only For Calendar Year 2021 Check One Box:

Web search irs and state income tax forms to efile or complete, download online and back taxes. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr, 140py, 140ptc or 140et. Web follow the simple instructions below: The completed extension form must be filed by april 18, 2023.

If You Are Filing Under A Federal Extension But Are Making An Arizona Extension Payment By Credit Card Or Electronic Payment, Do Not Mail Form 204 To Us.

If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc,. Web 26 rows individual income tax forms individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement. An arizona extension will give you until october 15, 2021 to.

You Do Not Have To Include A Copy Of The Extension With Your Return When You File, But Make Sure That You Check Box 82F On Page 1 Of The Return.

Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. Web form 204 for details. Explore more file form 4868 and extend your 1040 deadline. Web individuals to file form 204 to request an extension for form 140 only if the federal tax extension was rejected.

Individual Payment Type Options Include:

Web application for filing extension form. Web make an individual or small business income payment. If you are not making. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr.