Form 140 Az

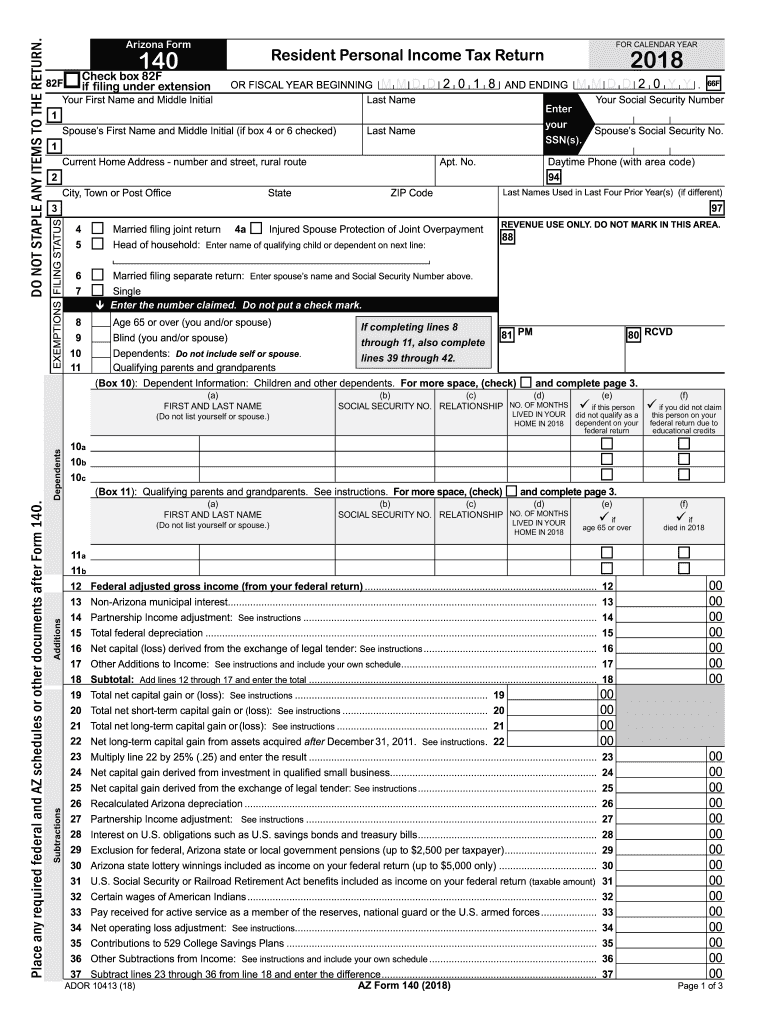

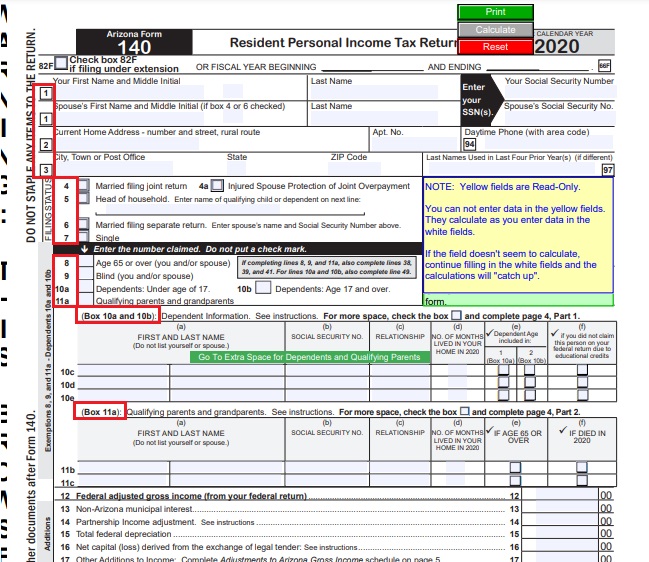

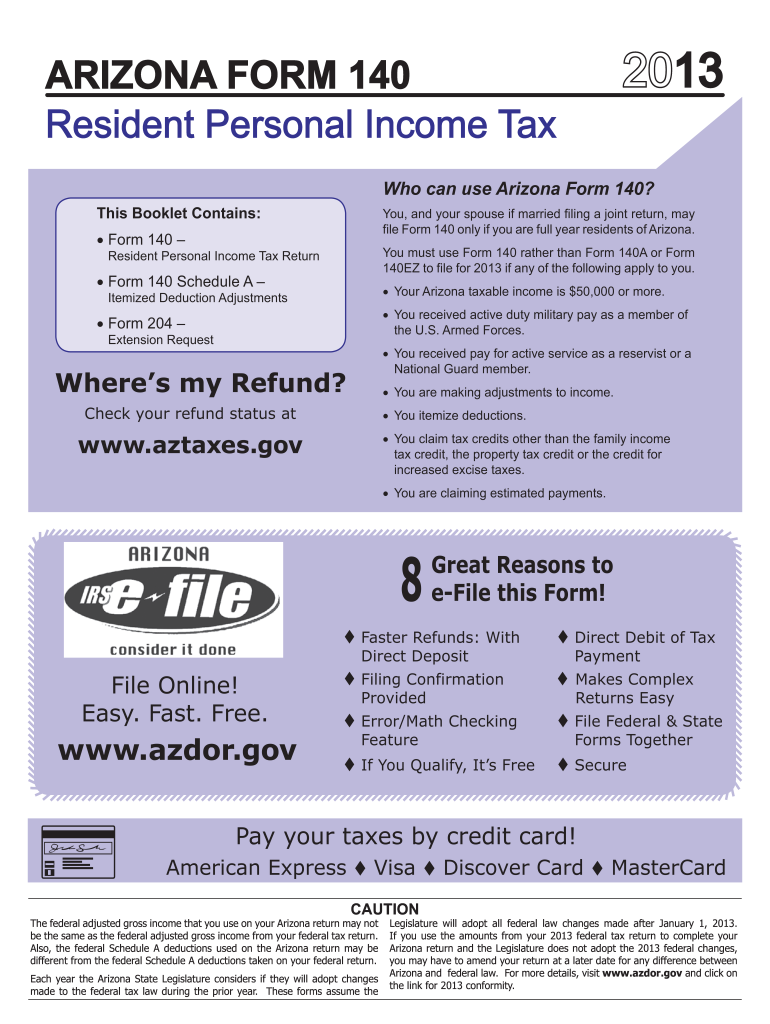

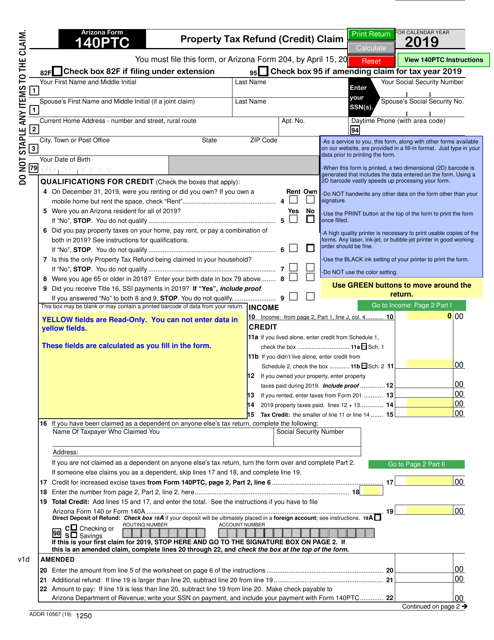

Form 140 Az - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web personal income tax return filed by resident taxpayers. Web the most common arizona income tax form is the arizona form 140. Save or instantly send your ready documents. Your arizona taxable income is $50,000 or more, regardless of filing status. Easily fill out pdf blank, edit, and sign them. Web an individual is filing an who individual income tax form (140 or 140a) and claims a property tax credit on that return is required to complete form 140ptc and include it with their tax. Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you.

Web printable 140 tax return form for arizona residents. You can print other arizona tax forms here. Get ready for this year's tax season quickly and safely with pdffiller! Do not mail this form. Id numbers for paid preparers. You must use form 140 if any of the following apply: Easily fill out pdf blank, edit, and sign them. Your arizona taxable income is $50,000 or more, regardless of filing status; Save or instantly send your ready documents. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

You can print other arizona tax forms here. To avoid interest and penalties you must pay the full amount of your tax by april 18, 2022. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you. Form 140ez (easy form), and form 140a (short form). This form is used by residents who file an individual income tax return. Web the most common arizona income tax form is the arizona form 140. This form is for income earned in tax year 2022, with tax returns due in april 2023. Your arizona taxable income is $50,000 or more, regardless of filing status. Web personal income tax return filed by resident taxpayers.

Printable Az 140 Tax Form Printable Form 2022

Your arizona taxable income is $50,000 or more, regardless of filing status; Please disregard the information provided in the worksheet's note section (note #2 on form 140; Easily fill out pdf blank, edit, and sign them. Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 This form.

Instructions and Download of Arizona Form 140 Unemployment Gov

Web arizona form 2022 nonresident personal income tax return 140nr for information or help, call one of the numbers listed: Download & print with other fillable us tax forms in pdf. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Here are links to common arizona.

AZ DoR 140 Instructions 20202021 Fill out Tax Template Online US

To avoid interest and penalties you must pay the full amount of your tax by april 18, 2022. Form 140ez (easy form), and form 140a (short form). Web arizona form 2022 nonresident personal income tax return 140nr for information or help, call one of the numbers listed: Your arizona taxable income is $50,000 or more, regardless of filing status you.

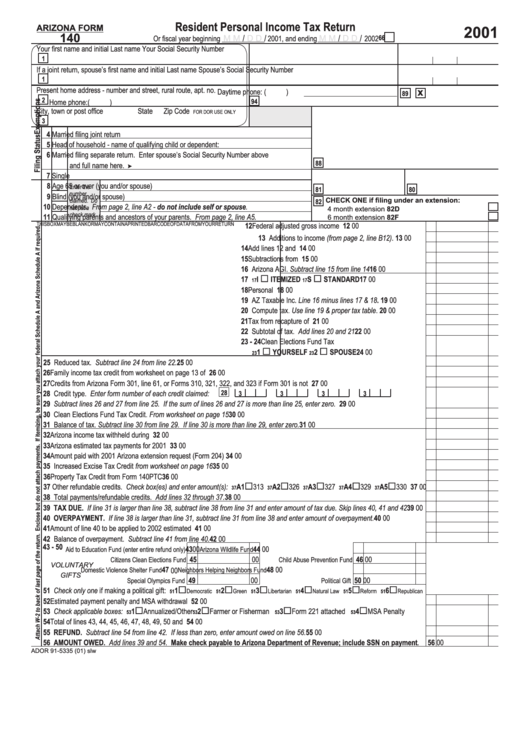

Arizona Form 140 Resident Personal Tax Return 2001 printable

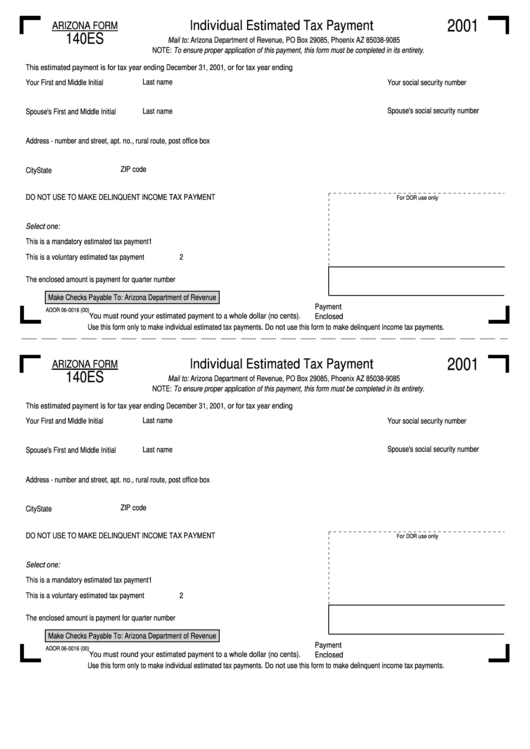

Web the most common arizona income tax form is the arizona form 140. Web we last updated the individual estimated tax payment booklet in february 2023, so this is the latest version of form 140es, fully updated for tax year 2022. Your arizona taxable income is $50,000 or more, regardless of filing status. •our arizona taxable income is y $50,000.

Form 140 Es Individual Estimated Tax Payment 2001 printable pdf

To avoid interest and penalties you must pay the full amount of your tax by april 18, 2022. You can print other arizona tax forms here. Web the most common arizona income tax form is the arizona form 140. Web file your arizona and federal tax returns online with turbotax in minutes. Your arizona taxable income is $50,000 or more,.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

•our arizona taxable income is y $50,000 or more Get ready for this year's tax season quickly and safely with pdffiller! Create a blank & editable az form 140, fill it out and send it instantly to the irs. Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income Web who must.

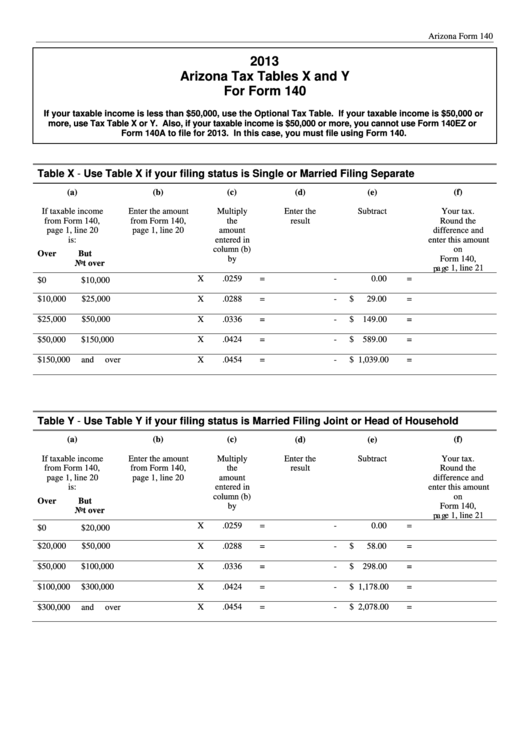

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

Id numbers for paid preparers. Get ready for this year's tax season quickly and safely with pdffiller! Web who must use form 140? Here are links to common arizona tax forms for individual filers, along with instructions: Do not staple any items to the return.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Web place any required federal and az schedules or other documents after form 140. Dependents additions subtractions 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you..

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Note #3 on forms 140nr, 140py and 140x). Web personal income tax return filed by resident taxpayers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the.

Az 140 Form Fill Online, Printable, Fillable, Blank pdfFiller

If you pay someone else to prepare your return, that person must also include an id number where. You must use form 140 if any of the following apply: Web place any required federal and az schedules or other documents after form 140. Download & print with other fillable us tax forms in pdf. Your arizona taxable income is $50,000.

Please Disregard The Information Provided In The Worksheet's Note Section (Note #2 On Form 140;

Download & print with other fillable us tax forms in pdf. This form is used by residents who file an individual income tax return. You can print other arizona tax forms here. Id numbers for paid preparers.

Web We Last Updated The Individual Estimated Tax Payment Booklet In February 2023, So This Is The Latest Version Of Form 140Es, Fully Updated For Tax Year 2022.

Do not mail this form. Easily fill out pdf blank, edit, and sign them. You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

Web Place Any Required Federal And Az Schedules Or Other Documents After Form 140.

Web easily complete a printable irs az form 140 2013 online. Your arizona taxable income is $50,000 or more, regardless of filing status; Form 140ez (easy form), and form 140a (short form). Your arizona taxable income is $50,000 or more, regardless of filing status.

To Avoid Interest And Penalties You Must Pay The Full Amount Of Your Tax By April 18, 2022.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web click on “make a payment” and select “140v” as the payment type. Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income Web file your arizona and federal tax returns online with turbotax in minutes.