Form 1310 Pdf

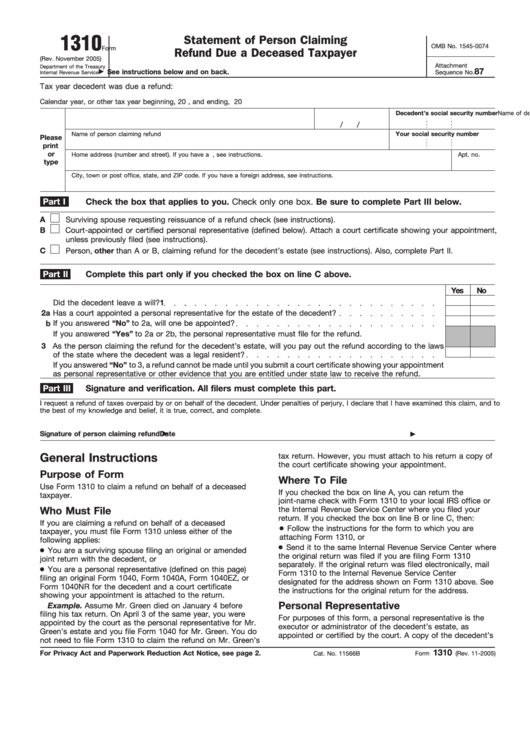

Form 1310 Pdf - Use form 1310 to claim a refund on behalf of a deceased taxpayer. Download the form and open it on pdfelement to start the process of form filling. I am a creditor of the decedent or a person who has paid or incurred the decedent's funeral expense, and 30 Street address of decedent city/town state zip name of claimant relationship to decedent. It appears you don't have a pdf plugin for this browser. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. On april 3 of the same year, you were appointed — statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer.

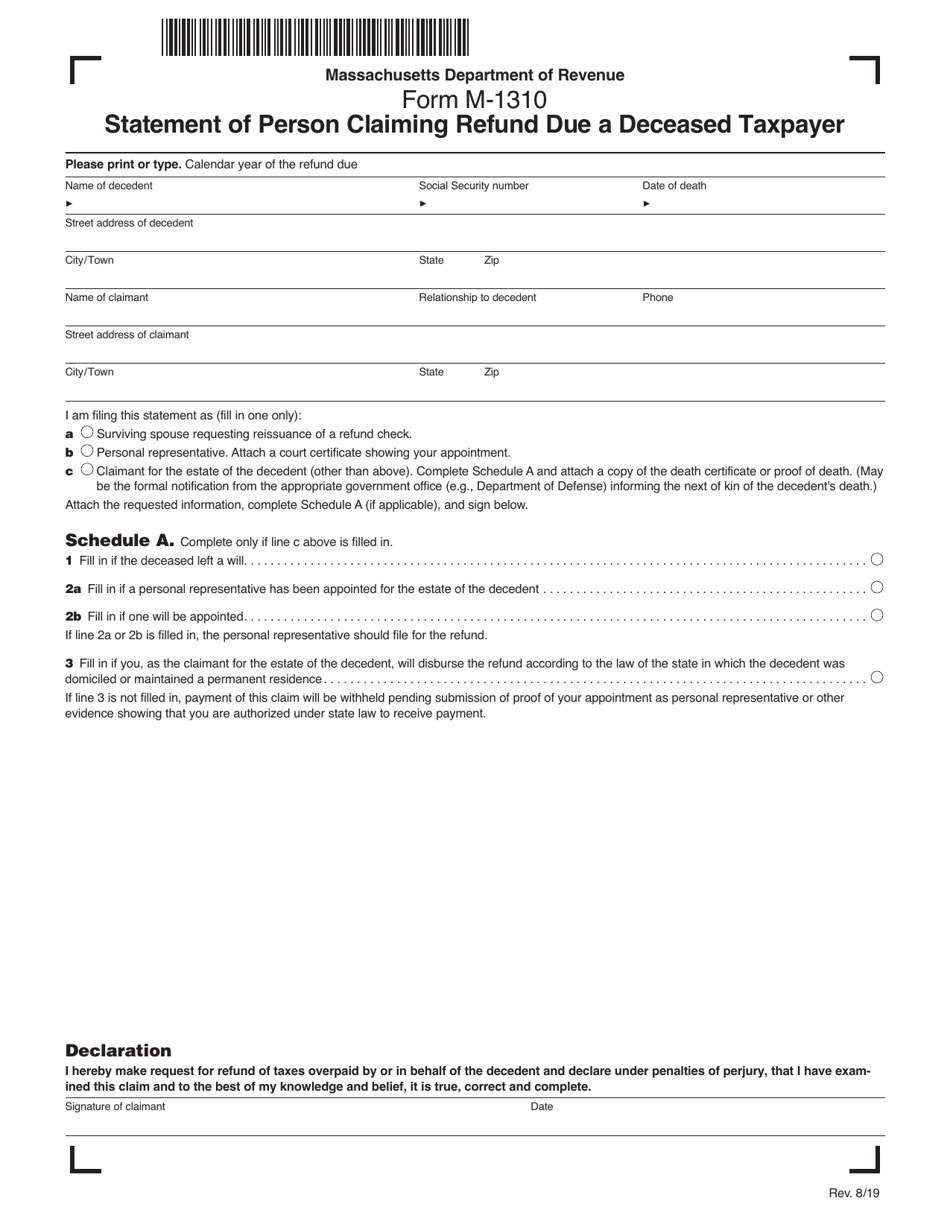

If you are claiming a refund on behalf of a deceased taxpayer, you must. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer. Street address of decedent city/town state zip name of claimant relationship to decedent. Calendar year of the refund due. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Download the form and open it on pdfelement to start the process of form filling. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Web massachusetts department of revenue.

— statement of person claiming refund due a deceased taxpayer. Download the form and open it on pdfelement to start the process of form filling. If you are claiming a refund on behalf of a deceased taxpayer, you must. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note: Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Download your fillable irs form 1310 in pdf. On april 3 of the same year, you were appointed Green died on january 4 before filing his tax return. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Download your fillable irs form 1310 in pdf. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Calendar year of the refund due. Web form 1310 is an irs form used to claim a federal tax.

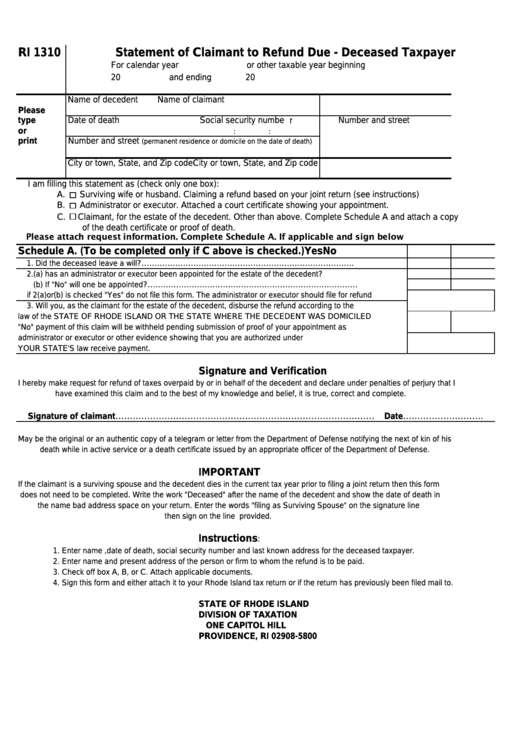

Form Ri 1310 Statement Of Claimant To Refund DueDeceased Taxpayer

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. It appears you don't have a pdf plugin for this browser. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Download the form and open it on pdfelement to start the.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

For section b a table of heirs form must be completed and made part of this affidavit. Download the form and open it on pdfelement to start the process of form filling. On april 3 of the same year, you were appointed The statement is prepared and served as an attachment to the original tax report and filed with the.

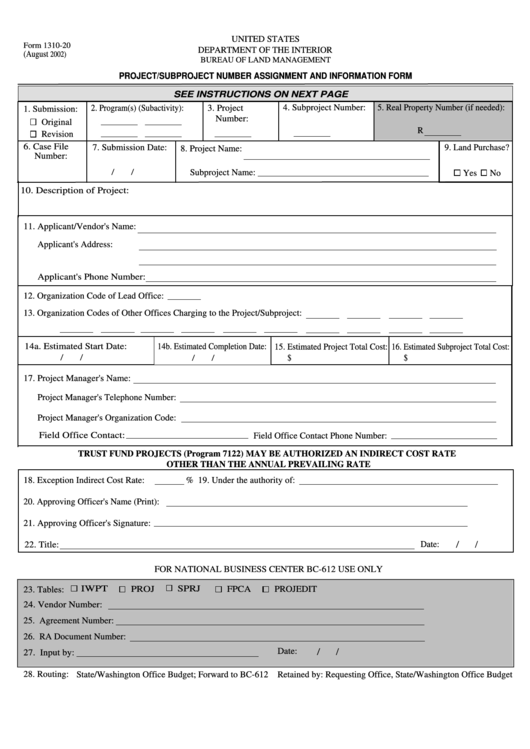

Fillable Form 131020 Project/subproject Number Assignment And

You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. Statement of person claiming refund due a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note: Statement of person claiming refund due a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent.

Form M1310 Download Printable PDF or Fill Online Statement of Person

Web massachusetts department of revenue. You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. Statement of person claiming refund due a deceased taxpayer. Name of decedent social security number date of death. It appears you don't have a pdf plugin for this browser.

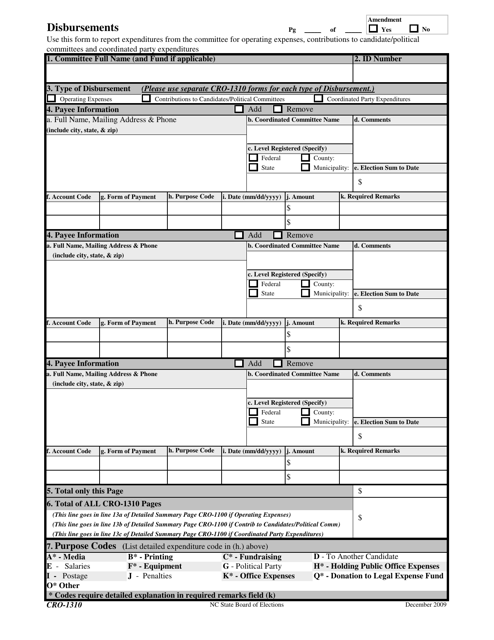

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

Web massachusetts department of revenue. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. The irs form 1310 is titled as statement of person claiming refund due.

2021 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web massachusetts department of revenue. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. It appears you don't have a pdf plugin for this browser. Statement of person claiming refund due a deceased taxpayer.

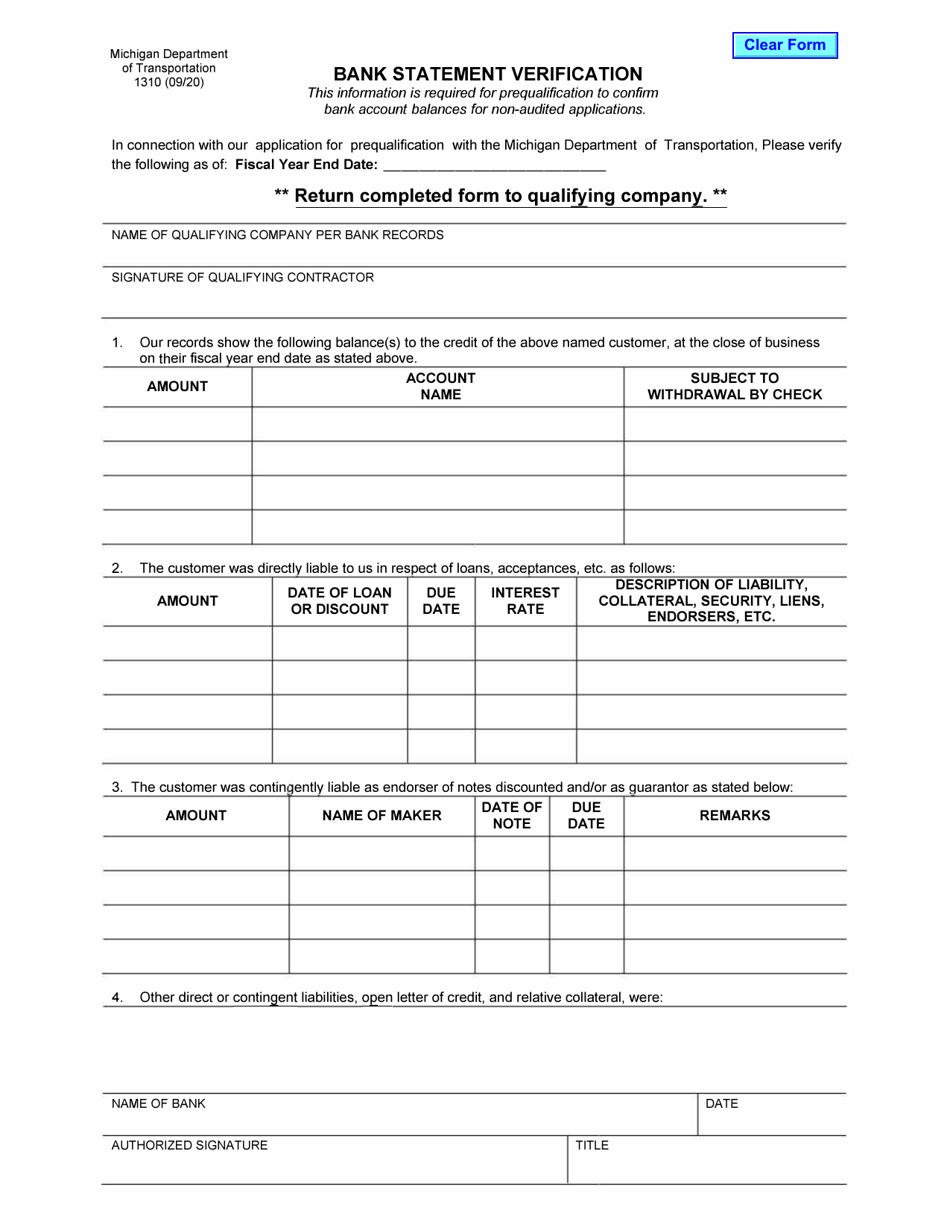

Form 1310 Download Fillable PDF or Fill Online Bank Statement

On april 3 of the same year, you were appointed Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax.

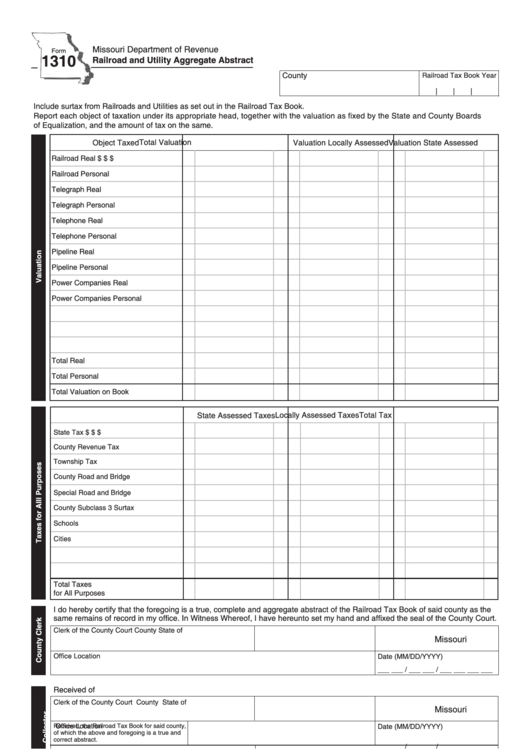

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Download your fillable irs form 1310 in pdf. It appears you don't have a pdf plugin for this browser. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web developments related.

The Statement Is Prepared And Served As An Attachment To The Original Tax Report And Filed With The Irs, Following The Basic Tax Report Recommendations.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. It appears you don't have a pdf plugin for this browser. The irs form 1310 is titled as statement of person claiming refund due a deceased taxpayer.

Download The Form And Open It On Pdfelement To Start The Process Of Form Filling.

You can get the irs form 1310 from the official website of the department of the treasury, internal revenue service. On april 3 of the same year, you were appointed Green died on january 4 before filing his tax return. Street address of decedent city/town state zip name of claimant relationship to decedent.

Calendar Year Of The Refund Due.

Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Download your fillable irs form 1310 in pdf. Name of decedent social security number date of death. Web 1310 of the surrogate's court procedure act, by all debtors of the decedent known to me after diligent inquiry, do note:

Web Information About Form 1310, Statement Of Person Claiming Refund Due A Deceased Taxpayer, Including Recent Updates, Related Forms, And Instructions On How To File.

Web massachusetts department of revenue. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must.