Form 1120 Pol

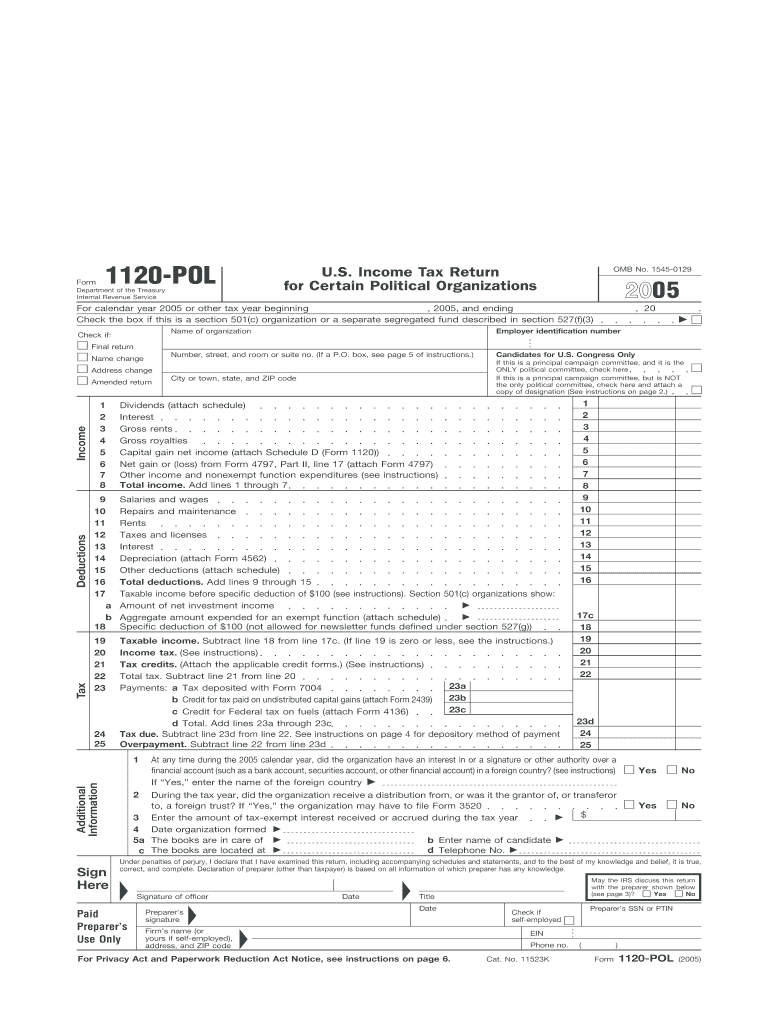

Form 1120 Pol - Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Faqs about the annual form filing requirements; Congress, the tax is calculated using the graduated rates specified in §11 (b). Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. It applies to organizations that pay the federal income tax, with particular attention to. Income tax return for certain political organizations pdf.

Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Congress, the tax is calculated using the graduated rates specified in §11 (b). It applies to organizations that pay the federal income tax, with particular attention to. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web if the organization is the principal campaign committee of a candidate for u.s. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Faqs about the annual form filing requirements; Income tax return for certain political organizations pdf.

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Income tax return for certain political organizations pdf. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. Faqs about the annual form filing requirements; Web if the organization is the principal campaign committee of a candidate for u.s. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. However, if you continue to make installment payments of tax based on a prior year section 965(a).

Form 1120POL U.S. Tax Return for Certain Political

Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web if the organization is the principal campaign committee of a candidate for u.s. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax return for certain political organizations pdf. For the.

Irs Form 1120 Pol Fill Out and Sign Printable PDF Template signNow

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Congress, the tax is calculated using the graduated rates specified in §11 (b). Income tax return for certain political organizations pdf. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for.

Editable IRS Form 1120POL 2018 2019 Create A Digital Sample in PDF

However, if you continue to make installment payments of tax based on a prior year section 965(a). Web if the organization is the principal campaign committee of a candidate for u.s. Income tax return for certain political organizations pdf. Congress, the tax is calculated using the graduated rates specified in §11 (b). Political organizations and certain exempt organizations file this.

File Form 1120POL Online Efile Political Organization Return

However, if you continue to make installment payments of tax based on a prior year section 965(a). Faqs about the annual form filing requirements; Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. It applies to organizations that pay the federal income tax, with particular attention to. Congress, the tax is calculated using the graduated rates specified in.

1120POL Instructions 2022 2023 IRS Forms Zrivo

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Congress, the tax is calculated using the graduated rates specified in §11 (b). Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. For the organizations operating under the calendar year,.

Form 1120POL U.S. Tax Return for Certain Political

However, if you continue to make installment payments of tax based on a prior year section 965(a). Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Faqs about the annual form filing requirements;.

Form 1120POL U.S. Tax Return for Certain Political

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. However, if you continue to make installment payments of tax based on a prior year section 965(a). It applies to organizations that pay the federal income tax, with particular attention to. For the organizations operating under the calendar year, the deadline will be.

An overview of Form 1120POL

Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax return for certain political organizations pdf. Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Web if the organization is the principal campaign committee of a candidate for u.s. However, if you continue to make installment payments of tax.

Form 1120POL U.S. Tax Return for Certain Political

Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. It applies to organizations that pay the federal income tax, with particular attention to. For the organizations operating under the calendar year, the deadline.

Form 1120POL U.S. Tax Return for Certain Political

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Faqs about the annual form filing requirements; However, if you continue to make.

Income Tax Return For Certain Political Organizations Pdf.

Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. However, if you continue to make installment payments of tax based on a prior year section 965(a). Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group.

Congress, The Tax Is Calculated Using The Graduated Rates Specified In §11 (B).

Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. It applies to organizations that pay the federal income tax, with particular attention to. Web if the organization is the principal campaign committee of a candidate for u.s.

Faqs About The Annual Form Filing Requirements;

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years.