Form 1120 2019

Form 1120 2019 - The draft instructions note that for tax. 01 fill and edit template. Web it is generally subject to the same april 15 deadline. •kbox has been added to step 1 for 52/53 week filers. Corporation income tax return, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service. If a corporation will owe taxes, it must estimate. Income tax return for certain political organizations go to www.irs.gov/form1120pol for the latest. Use this form to report the. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the.

01 fill and edit template. Web the corporation must file a corporate tax return, irs form 1120, and pay taxes at a corporate income tax rate on any profits. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Web irs tax update: •kbox has been added to step 1 for 52/53 week filers. Corporation income tax return, including recent updates, related forms and instructions on how to file. If a corporation will owe taxes, it must estimate. Web 522293 international trade financing. See a chec specific instructions for more information. The draft instructions note that for tax.

01 fill and edit template. Department of the treasury internal revenue service. Form cdn, 2019 nebraska community. Use this form to report the. Corporation income tax return, including recent updates, related forms and instructions on how to file. See a chec specific instructions for more information. •kbox has been added to step 1 for 52/53 week filers. 03 export or print immediately. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Web the corporation must file a corporate tax return, irs form 1120, and pay taxes at a corporate income tax rate on any profits.

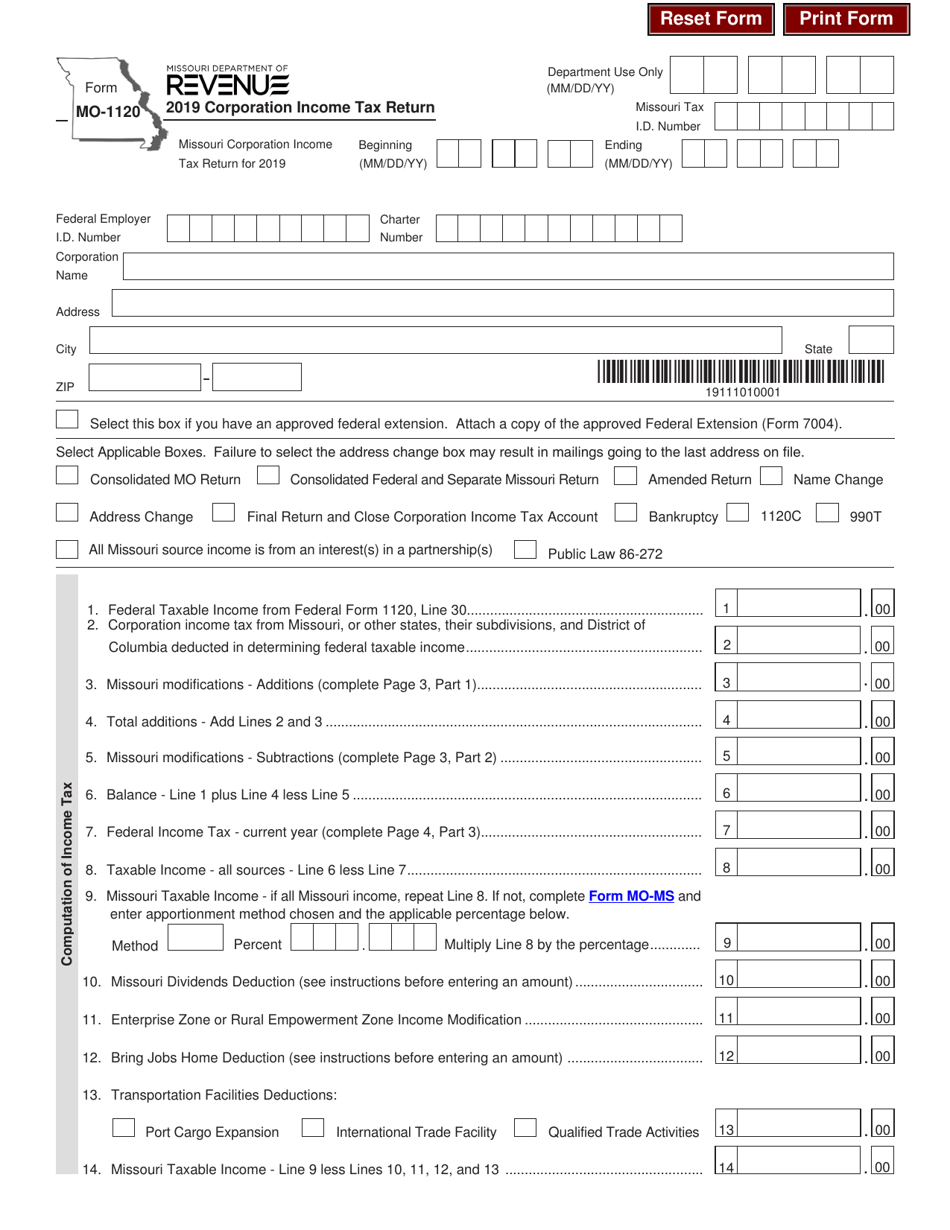

Form MO1120 Download Fillable PDF or Fill Online Corporation

Corporation income tax return, including recent updates, related forms and instructions on how to file. 01 fill and edit template. 03 export or print immediately. If a corporation will owe taxes, it must estimate. The draft instructions note that for tax.

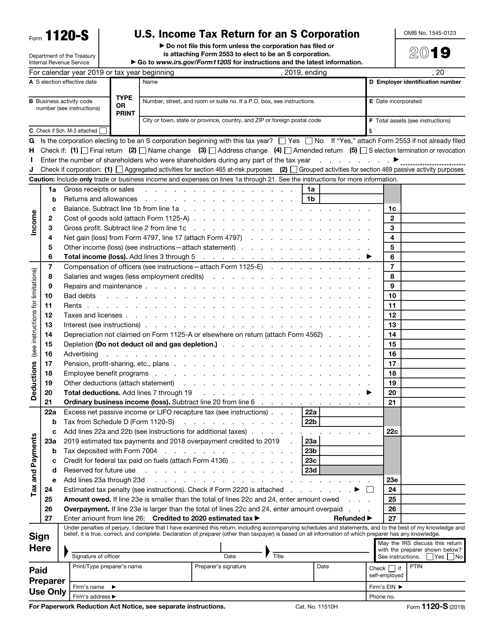

IRS Form 1120S 2019 Fill Out, Sign Online and Download Fillable

Form cdn, 2019 nebraska community. Department of the treasury internal revenue service. 03 export or print immediately. Copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder®. Corporation income tax return, including recent updates, related forms and instructions on how to file.

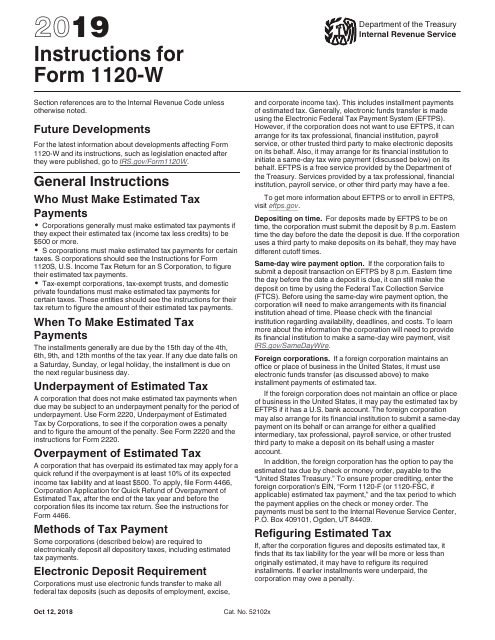

Download Instructions for IRS Form 1120W Estimated Tax for

Corporation income tax return, including recent updates, related forms and instructions on how to file. 03 export or print immediately. Use this form to report the. Copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder®. If a corporation will owe taxes, it must estimate.

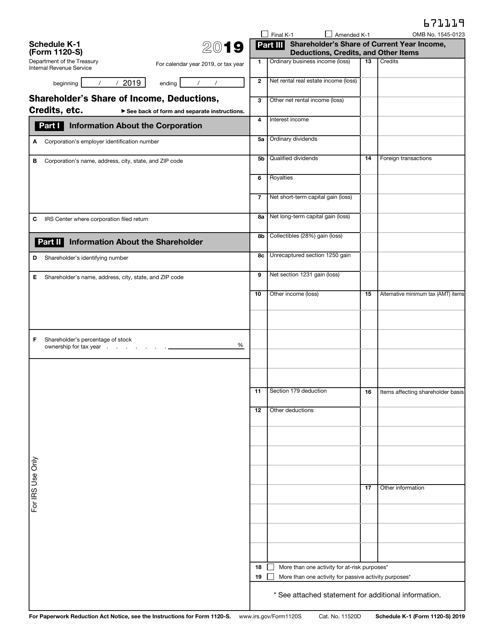

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

•kbox has been added to step 1 for 52/53 week filers. For calendar year 2022 or tax year beginning, 2022, ending. Form cdn, 2019 nebraska community. Copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder®. Department of the treasury internal revenue service.

How to File Tax Form 1120 for Your Small Business

For calendar year 2022 or tax year beginning, 2022, ending. The draft instructions note that for tax. 01 fill and edit template. Income tax return for certain political organizations go to www.irs.gov/form1120pol for the latest. If a corporation will owe taxes, it must estimate.

Fill Free fillable IRS 2019 form 1120F schedule M3 PDF form

Web 522293 international trade financing. •kbox has been added to step 1 for 52/53 week filers. The draft instructions note that for tax. Department of the treasury internal revenue service. 01 fill and edit template.

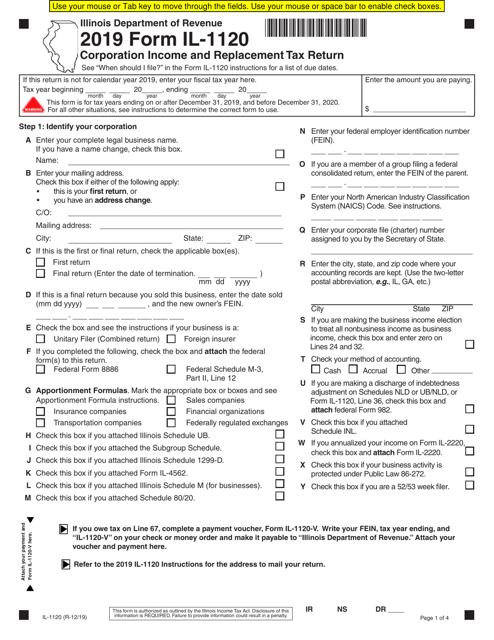

Form IL1120 Download Fillable PDF or Fill Online Corporation

•kbox has been added to step 1 for 52/53 week filers. Web the corporation must file a corporate tax return, irs form 1120, and pay taxes at a corporate income tax rate on any profits. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between.

1120 Fsc 2022. Blank Sample to Fill out Online in PDF

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. See a chec specific instructions for more information. If a corporation will owe taxes, it must estimate. Tax filing deadlines for 2019 tax year. Copyrit 2020 omson reuters quickfinder® handbooks | form.

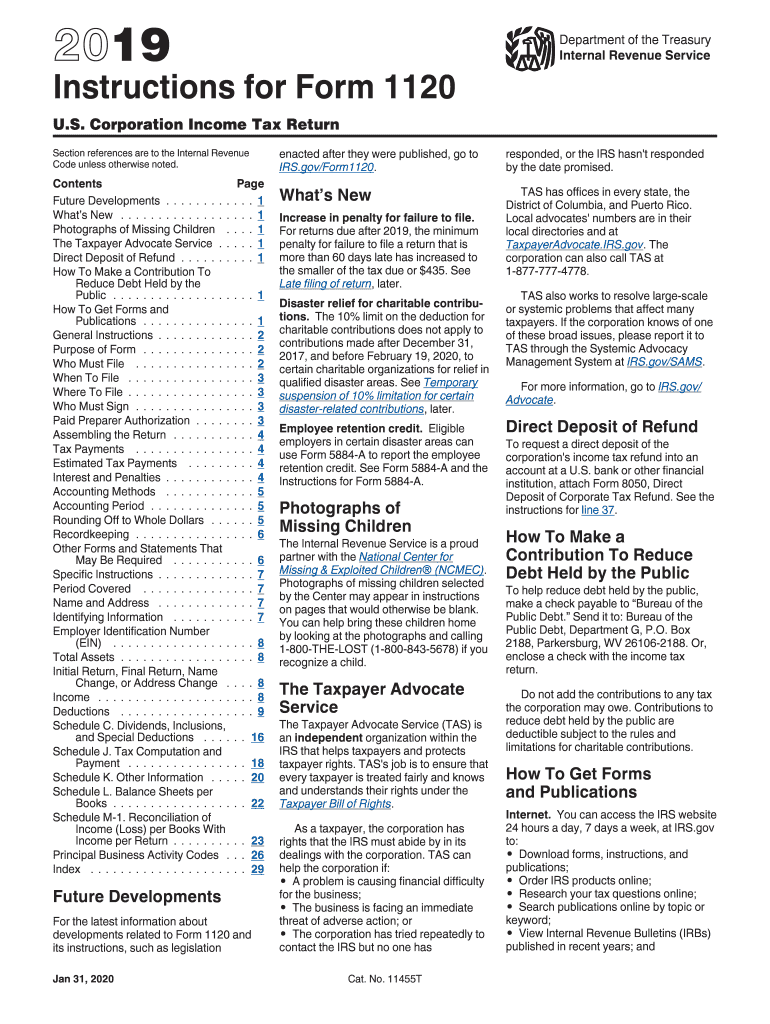

IRS Instructions 1120 2019 Fill and Sign Printable Template Online

For calendar year 2022 or tax year beginning, 2022, ending. Department of the treasury internal revenue service. Web it is generally subject to the same april 15 deadline. Income tax return for certain political organizations go to www.irs.gov/form1120pol for the latest. Corporation income tax return, including recent updates, related forms and instructions on how to file.

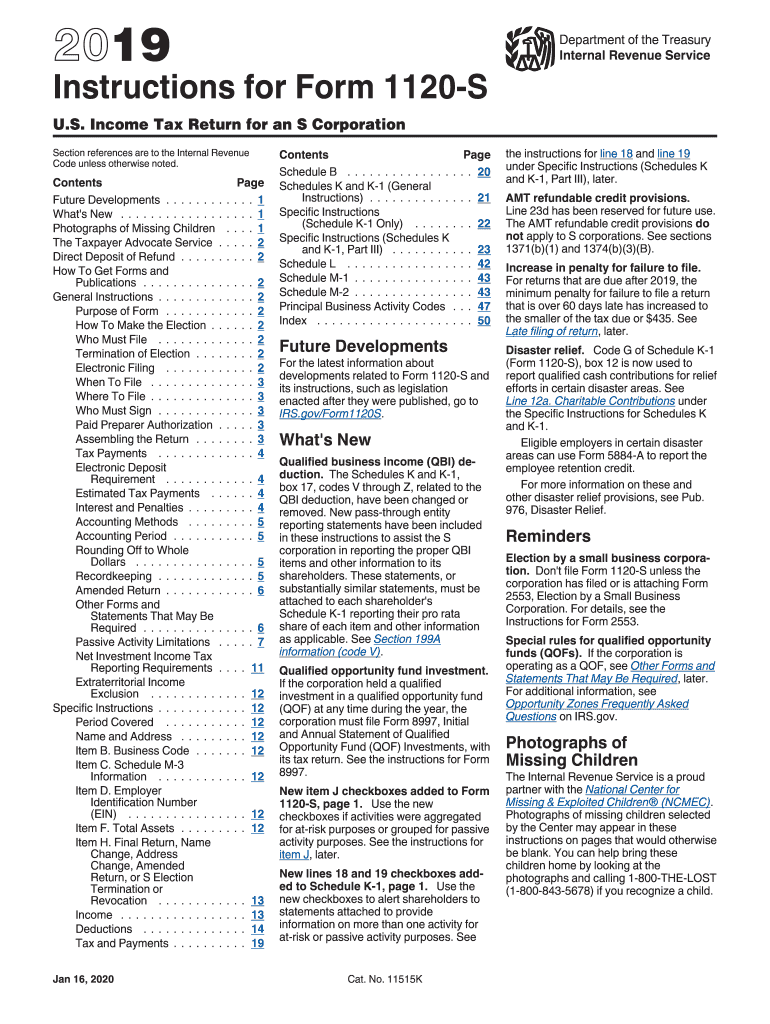

IRS Instructions 1120S 2019 Fill out Tax Template Online US Legal Forms

Web irs tax update: Copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder®. For calendar year 2022 or tax year beginning, 2022, ending. Web it is generally subject to the same april 15 deadline. If a corporation will owe taxes, it must estimate.

Web Irs Tax Update:

•kbox has been added to step 1 for 52/53 week filers. Department of the treasury internal revenue service. Web it is generally subject to the same april 15 deadline. 01 fill and edit template.

Form Cdn, 2019 Nebraska Community.

Web information about form 1120, u.s. Copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder®. Income tax return for certain political organizations go to www.irs.gov/form1120pol for the latest. 03 export or print immediately.

See A Chec Specific Instructions For More Information.

Web 522293 international trade financing. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. If a corporation will owe taxes, it must estimate. Mar 31, 2020 | accounting & audit updates, featured news and events, tax due dates, tax news.

Tax Filing Deadlines For 2019 Tax Year.

Web the corporation must file a corporate tax return, irs form 1120, and pay taxes at a corporate income tax rate on any profits. Use this form to report the. Corporation income tax return, including recent updates, related forms and instructions on how to file. For calendar year 2022 or tax year beginning, 2022, ending.