Form 1116 Instructions 2021

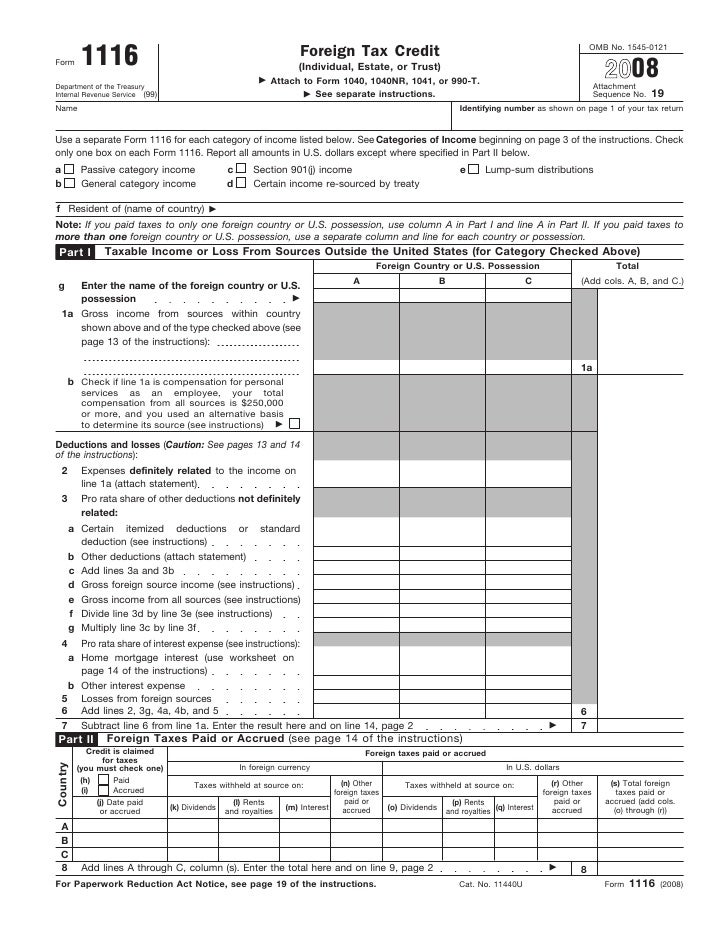

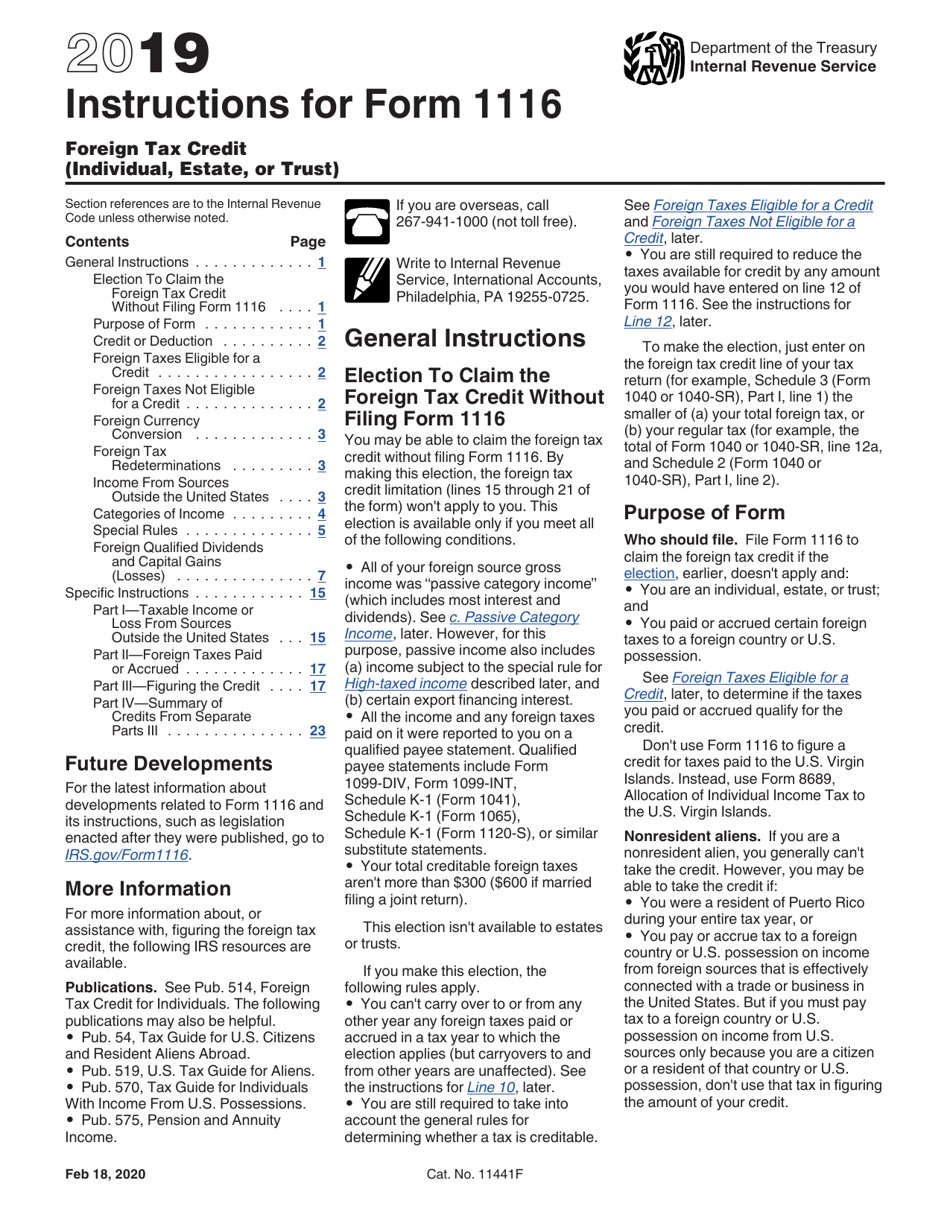

Form 1116 Instructions 2021 - Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: The tax is imposed on you, you have paid or accrued the tax,. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. You may be able to. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Election to claim the foreign tax credit without filing form 1116. Web common questions about form 1116, foreign tax credit in lacerte get answers to frequently asked questions about entering an individual form 1116, foreign. Beginning in 2021, certain information. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Foreign taxes qualify for the credit if:

Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. Taxpayers are therefore reporting running. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Election to claim the foreign tax credit without filing form 1116. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Complete, edit or print tax forms instantly. Try it for free now! Upload, modify or create forms. The tax is imposed on you, you have paid or accrued the tax,.

Complete, edit or print tax forms instantly. Web form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. The tax is imposed on you, you have paid or accrued the tax,. As shown on page 1 of your tax return. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web for instructions and the latest information. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with.

Form 1116Foreign Tax Credit

Web form 1116 instructions step one: You are an individual, estate, or trust; As shown on page 1 of your tax return. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. Election to claim the foreign tax credit.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

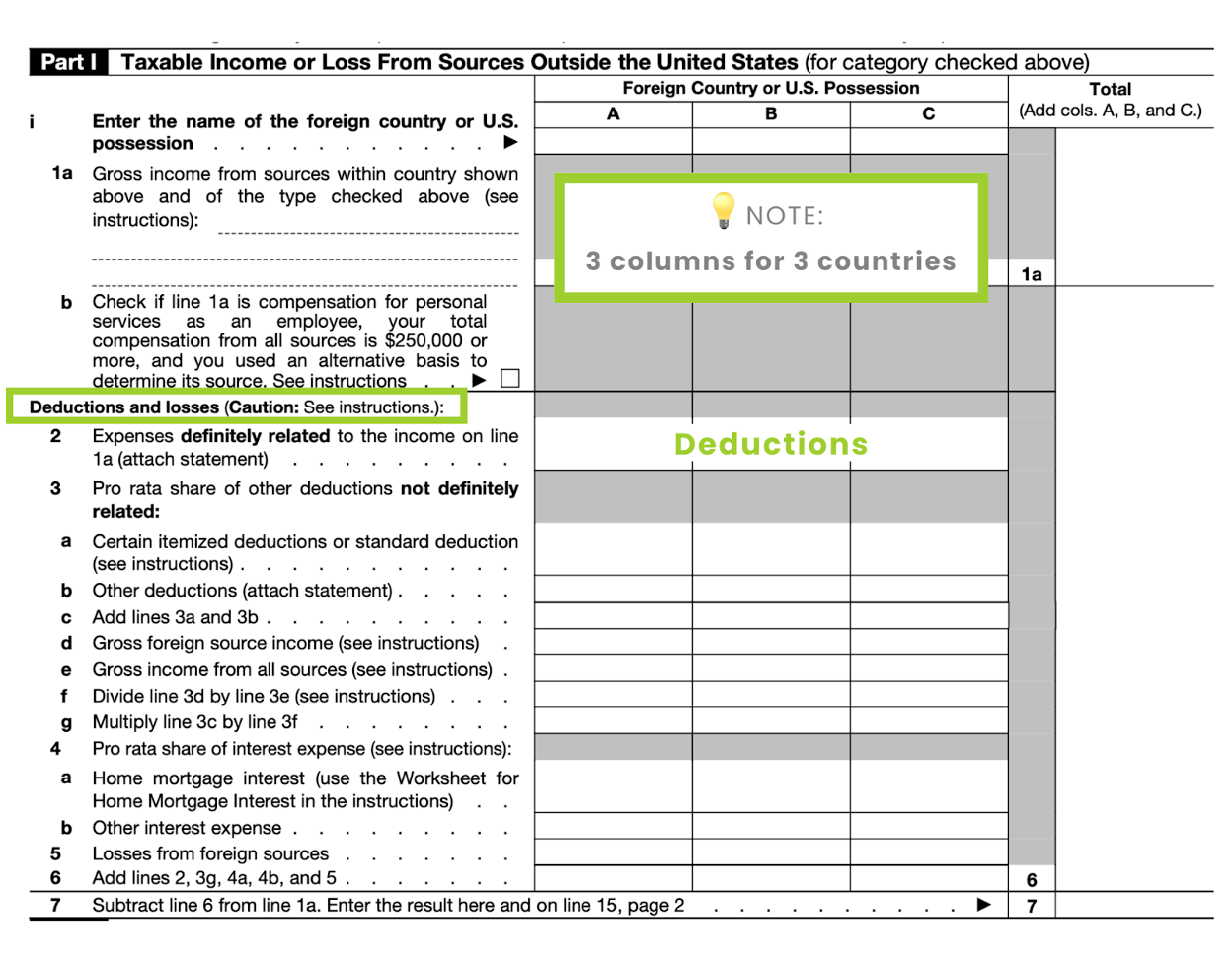

Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Taxpayers are therefore reporting running. Web so continuing on part i of the.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Try it for free now! Complete, edit or print tax forms instantly. And you paid or accrued certain foreign. Taxpayers are therefore reporting running. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

Use form 2555 to claim. You are an individual, estate, or trust; Web so continuing on part i of the form 1116, this section is where foreign gross income that was reported just above is reduced by deductions and losses, working toward that line. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your.

Foreign Tax Credit Form 1116 Instructions

Web for tax year 2022, please see the 2022 instructions. Web generally, you must be a u.s. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: You are an individual, estate, or trust;

コンセク1116 コンセク 変換ロッドネジ

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web common questions about form 1116, foreign tax credit in lacerte get answers to frequently asked questions about entering an individual form 1116, foreign. Citizen or resident alien to take the credit. Find out if you qualify for.

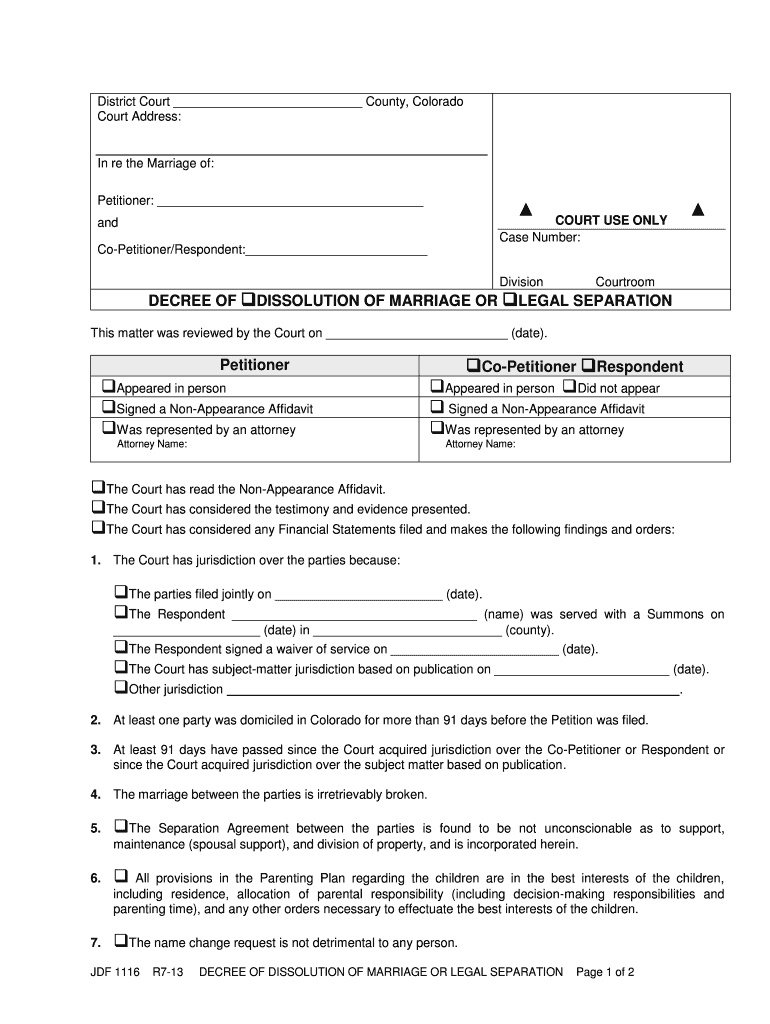

20132021 Form CO JDF 1116 Fill Online, Printable, Fillable, Blank

Web for instructions and the latest information. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a. You are an individual, estate, or trust; Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022,.

Foreign Tax Credit Form 1116 Instructions

Web form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Complete, edit or print tax forms instantly. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web form 1116 instructions step one: Use form 2555 to.

Publication 514, Foreign Tax Credit for Individuals; Simple Example

Complete, edit or print tax forms instantly. Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web starting with.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Web for tax year 2022, please see the 2022 instructions. Beginning in 2021, certain information. Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: Election to claim the foreign tax.

As Shown On Page 1 Of Your Tax Return.

This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with. Web so continuing on part i of the form 1116, this section is where foreign gross income that was reported just above is reduced by deductions and losses, working toward that line. And you paid or accrued certain foreign. Taxpayers are therefore reporting running.

Web For Instructions And The Latest Information.

Foreign taxes qualify for the credit if: Election to claim the foreign tax credit without filing form 1116. Complete, edit or print tax forms instantly. Try it for free now!

Complete, Edit Or Print Tax Forms Instantly.

Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to. Beginning in 2021, certain information. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web on form 1116, there are seven categories of source income, and a separate form needs to be completed for each category and for each country within the category.

Web Use Form 1116 To Claim The Foreign Tax Credit (Ftc) And Subtract The Taxes They Paid To Another Country From Whatever They Owe The Irs.

Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web form 1116 instructions step one: Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: Get ready for tax season deadlines by completing any required tax forms today.