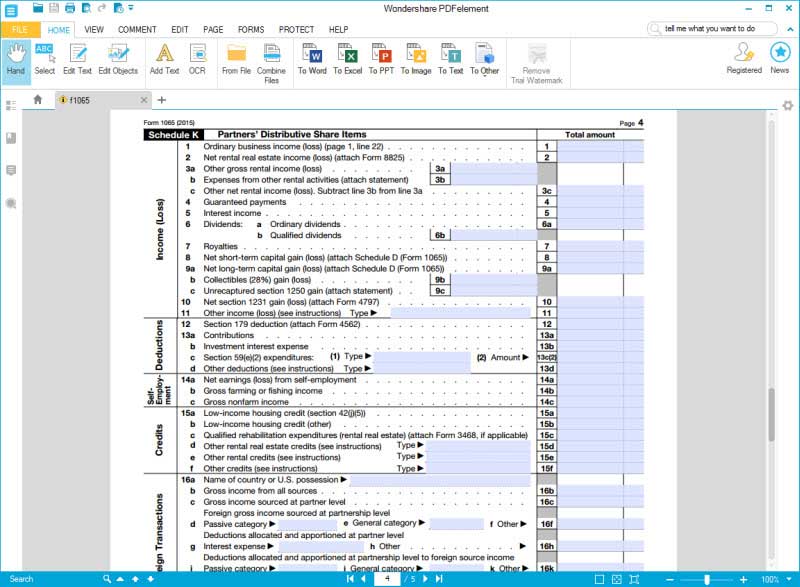

Form 1065 K-3

Form 1065 K-3 - Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 2 schedule b other information 1. Return of partnership income, were first required to be filed for the 2021 tax year. The forms consist of specific. This article will help you:. Partner’s share of income, deductions, credits, etc.—. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Partnership tax return (form 1065); 1065 (2022) form 1065 (2022) page. Web k2 and k3 filing requirements & exceptions.

1) must file a u.s. April 14, 2022 · 5 minute read. Web k2 and k3 filing requirements & exceptions. As you can see from @aliciap1's post, this form will not be available. The forms consist of specific. 2 schedule b other information 1. Web thomson reuters tax & accounting. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Department of the treasury internal revenue service omb no. And 2) it has 2 irs 2017 partnership return data.

The 2019 irs data book has. Paycheck protection program (ppp) loans. Web k2 and k3 filing requirements & exceptions. The forms consist of specific. Partner’s share of income, deductions, credits, etc.—. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Partnership tax return (form 1065); 1065 (2022) form 1065 (2022) page. 1) must file a u.s.

Llc Tax Form 1065 Universal Network

Web thomson reuters tax & accounting. The forms consist of specific. Partnership tax return (form 1065); The 2019 irs data book has. Partner’s share of income, deductions, credits, etc.—.

Form 1065X Amended Return or Administrative Adjustment Request (2012

Return of partnership income, were first required to be filed for the 2021 tax year. The 2019 irs data book has. Web thomson reuters tax & accounting. What type of entity is filing this return? 1065 (2022) form 1065 (2022) page.

Irs Form 1065 K 1 Instructions Universal Network

1065 (2022) form 1065 (2022) page. Web k2 and k3 filing requirements & exceptions. April 14, 2022 · 5 minute read. Department of the treasury internal revenue service omb no. 1) must file a u.s.

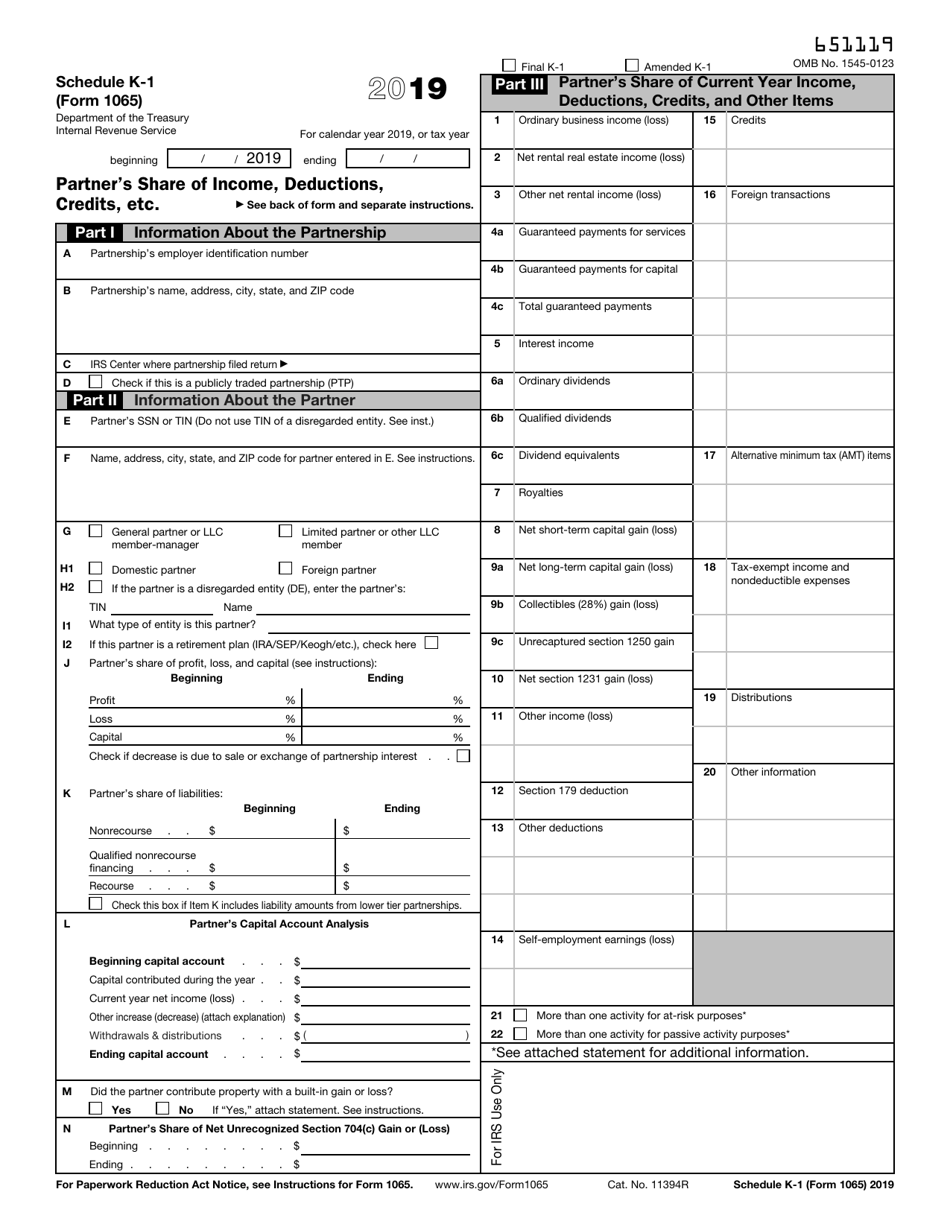

5 Changes to Note on New Draft of 2019 Form 1065 K1 October 11, 2019

Web k2 and k3 filing requirements & exceptions. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. And 2) it has 2 irs 2017 partnership return data. 1) must file a u.s. Partner’s share of income, deductions, credits, etc.—.

Publication 541 Partnerships; Form 1065 Example

1) must file a u.s. This article will help you:. Partnership tax return (form 1065); It’s generally used to report a partner’s or shareholder’s portion of the items reported on. The forms consist of specific.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

What type of entity is filing this return? Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, were first required to be filed for the 2021 tax year. Partner’s share of income, deductions, credits, etc.—. This article will help you:.

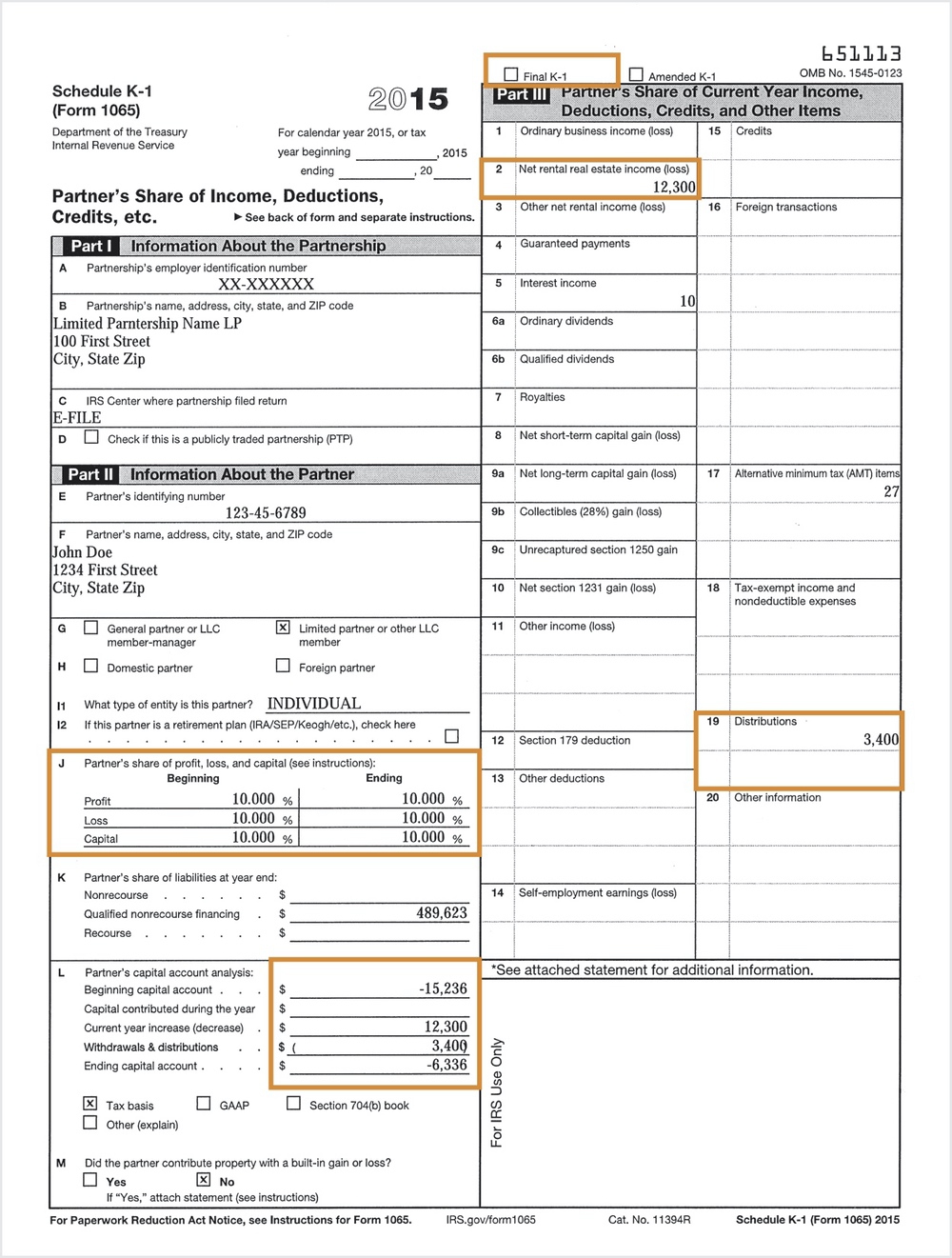

IRS Form 1065 How to fill it With the Best Form Filler

The forms consist of specific. Web thomson reuters tax & accounting. The 2019 irs data book has. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 1065 (2022) form 1065 (2022) page.

IRS Form 1065 Schedule K1 Download Fillable PDF or Fill Online Partner

April 14, 2022 · 5 minute read. Paycheck protection program (ppp) loans. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This article will help you:. It’s generally used to report a partner’s or shareholder’s portion of the items reported on.

Schedule K1 / 1065 Tax Form Guide LP Equity

Return of partnership income, were first required to be filed for the 2021 tax year. 2 schedule b other information 1. This article will help you:. Paycheck protection program (ppp) loans. As you can see from @aliciap1's post, this form will not be available.

As You Can See From @Aliciap1'S Post, This Form Will Not Be Available.

Return of partnership income, were first required to be filed for the 2021 tax year. Partner’s share of income, deductions, credits, etc.—. The 2019 irs data book has. April 14, 2022 · 5 minute read.

The Forms Consist Of Specific.

Partnership tax return (form 1065); 1) must file a u.s. Web k2 and k3 filing requirements & exceptions. Paycheck protection program (ppp) loans.

Web Thomson Reuters Tax & Accounting.

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This article will help you:. Department of the treasury internal revenue service omb no. 2 schedule b other information 1.

1065 (2022) Form 1065 (2022) Page.

It’s generally used to report a partner’s or shareholder’s portion of the items reported on. What type of entity is filing this return? And 2) it has 2 irs 2017 partnership return data.