Form 1065 2021

Form 1065 2021 - Or getting income from u.s. For calendar year 2021, or tax year beginning / / 2021. Web partnerships needing to modify a previously filed form 1065, u.s. Web where to file your taxes for form 1065. Web information about form 1065, u.s. Web go to www.irs.gov/form1065 for instructions and the latest information. You can file form 1065 using turbotax business. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. City or town, state or province, country, and zip or foreign postal code a

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. New code u under line 20c is used to report the total If the partnership's principal business, office, or agency is located in: For the 2022 tax year, you can file 2022, 2021, and 2020 tax year returns. This irs will accept the current year and two previous years of returns for regular, superseded, or amended electronic returns. Web when to file form 1065. Web where to file your taxes for form 1065. Part i information about the partnership. Web go to www.irs.gov/form1065 for instructions and the latest information.

Return of partnership income, must be mindful of the changes brought about by the bipartisan budget act (bba) of 2015, 1 which created a new centralized partnership audit regime. City or town, state or province, country, and zip or foreign postal code a Department of the treasury internal revenue service. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. Web information about form 1065, u.s. Form 1065 must be filed by the 15th day of the third month following the date the tax year ended. Web partnerships needing to modify a previously filed form 1065, u.s. Web when to file form 1065. And the total assets at the end of the tax year are: See back of form and separate instructions.

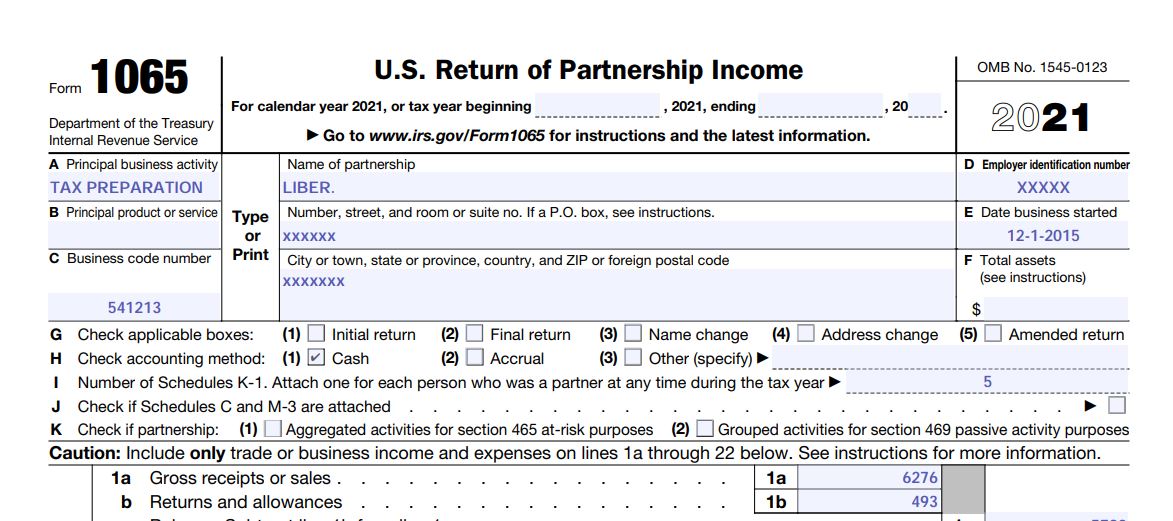

1How to complete 2021 IRS Form 1065 and Schedule K1 For your LLC

Web partnerships needing to modify a previously filed form 1065, u.s. If the partnership's principal business, office, or agency is located in: Return of partnership income, must be mindful of the changes brought about by the bipartisan budget act (bba) of 2015, 1 which created a new centralized partnership audit regime. For the 2022 tax year, you can file 2022,.

form 1065, U.S. Return of Partnership Meru Accounting

Web where to file your taxes for form 1065. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. City or town, state or province, country, and zip or foreign postal code a Web go to www.irs.gov/form1065 for instructions and the latest information. See back of form and separate.

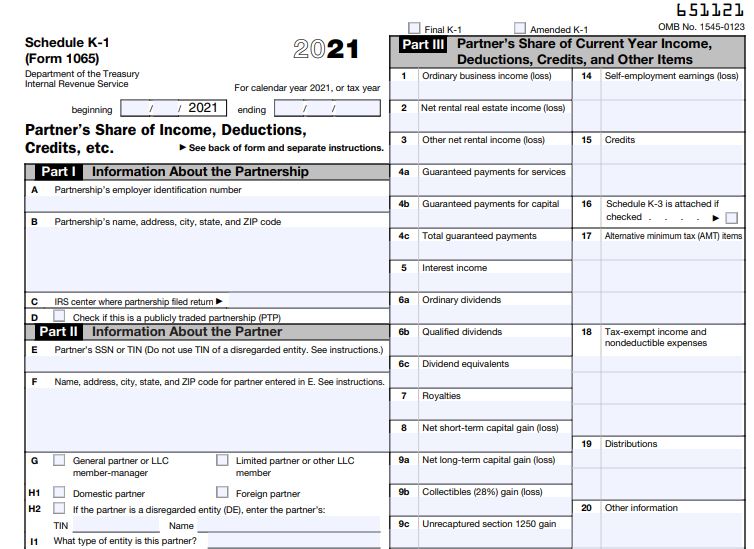

2How to complete 2021 IRS Form 1065 and Schedule K1 For your LLC

New code u under line 20c is used to report the total Department of the treasury internal revenue service. Form 1065 must be filed by the 15th day of the third month following the date the tax year ended. You can file form 1065 using turbotax business. Use the following internal revenue service center address:

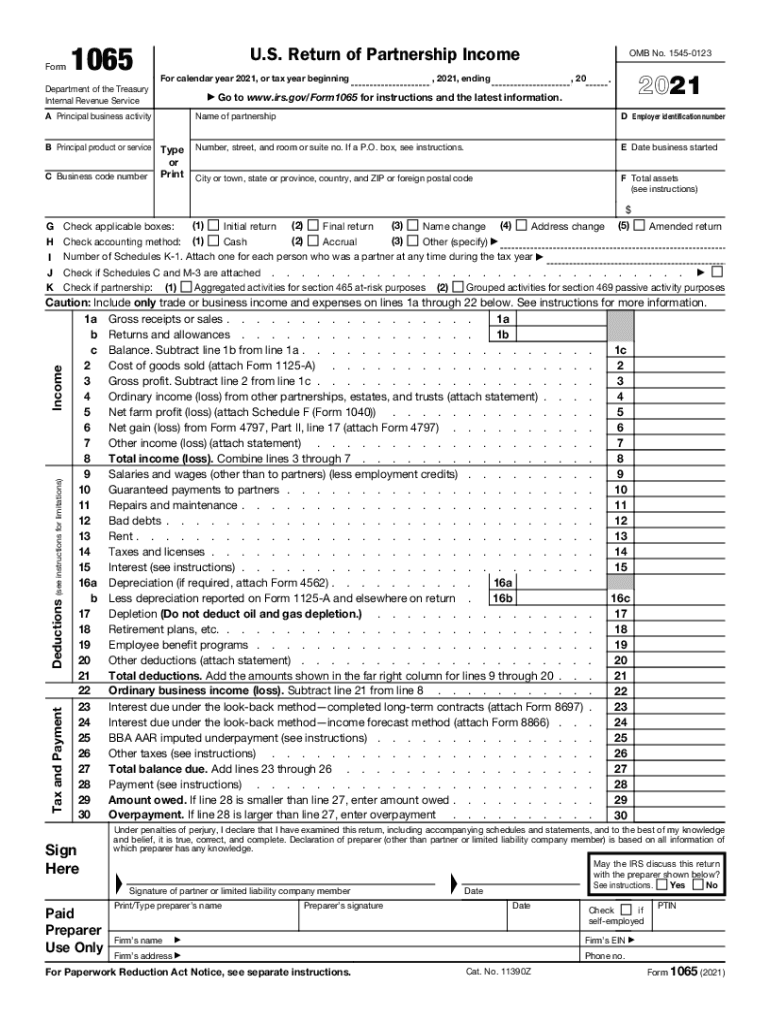

Form 1065 Fill Out and Sign Printable PDF Template signNow

If the partnership's principal business, office, or agency is located in: Use the following internal revenue service center address: For the 2022 tax year, you can file 2022, 2021, and 2020 tax year returns. Web where to file your taxes for form 1065. Return of partnership income, must be mindful of the changes brought about by the bipartisan budget act.

IRS Form 1065 or Form 1120S FirstTime Late Filing Penalty Abatement

This means that if you’re filing irs form 1065 for the 2021 calendar. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. You can file form 1065 using turbotax business. Or getting income from u.s. If the partnership's principal business, office, or agency is located in:

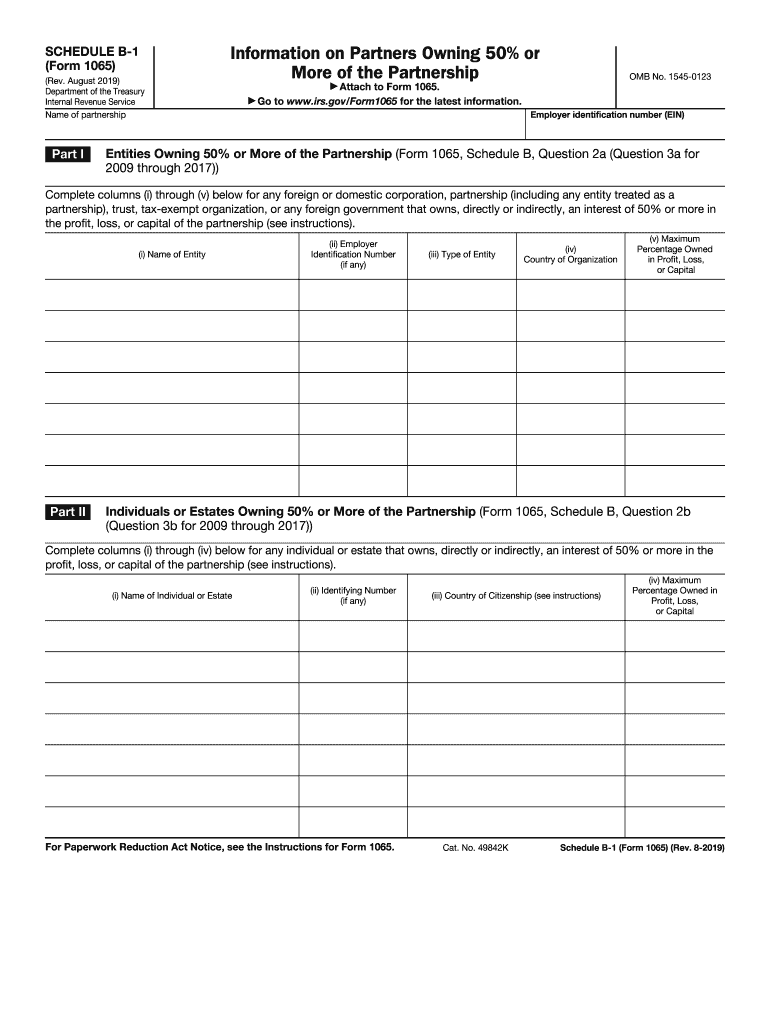

Form 7 Analysis Of Net Five Secrets About Form 7 Analysis Of Net

Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Department of the treasury internal revenue service. This means that if you’re filing irs form 1065 for the 2021 calendar. Form 1065 must be filed by the 15th day of the third month following the date the tax year.

Schedule K10 Form 10 Five Awesome Things You Can Learn From Schedule K

Web information about form 1065, u.s. Web when to file form 1065. Web due dates for form 1065 are: You can file form 1065 using turbotax business. Or getting income from u.s.

Download Form 1065 for Free Page 5 FormTemplate

Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. This means that if you’re filing irs form 1065 for the 2021 calendar. If the partnership's principal business, office, or agency is located in: This irs will accept the current year and two previous years of returns for regular,.

2017 Federal Tax Forms Fill Out and Sign Printable PDF Template signNow

See back of form and separate instructions. Part i information about the partnership. Web go to www.irs.gov/form1065 for instructions and the latest information. If the partnership's principal business, office, or agency is located in: Web due dates for form 1065 are:

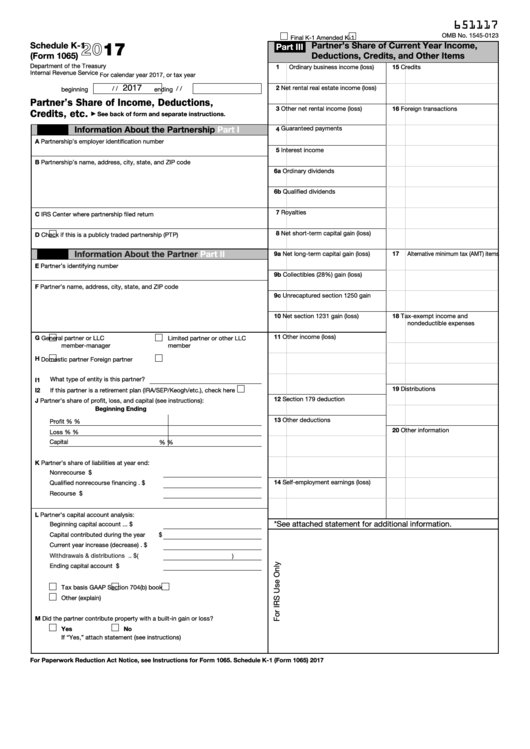

Fillable Schedule K1 (Form 1065) Partner'S Share Of

For calendar year 2021, or tax year beginning / / 2021. City or town, state or province, country, and zip or foreign postal code a Web information about form 1065, u.s. Ending / / partner’s share of income, deductions, credits, etc. This means that if you’re filing irs form 1065 for the 2021 calendar.

Web Where To File Your Taxes For Form 1065.

Return of partnership income, must be mindful of the changes brought about by the bipartisan budget act (bba) of 2015, 1 which created a new centralized partnership audit regime. Return of partnership income, including recent updates, related forms and instructions on how to file. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. If the partnership's principal business, office, or agency is located in:

Form 1065 Is Used To Report The Income Of Every Domestic Partnership And Every Foreign Partnership Doing Business In The U.s.

You can file form 1065 using turbotax business. See back of form and separate instructions. For the 2022 tax year, you can file 2022, 2021, and 2020 tax year returns. Web when to file form 1065.

New Code U Under Line 20C Is Used To Report The Total

Form 1065 must be filed by the 15th day of the third month following the date the tax year ended. Ending / / partner’s share of income, deductions, credits, etc. City or town, state or province, country, and zip or foreign postal code a March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns.

This Means That If You’re Filing Irs Form 1065 For The 2021 Calendar.

Part i information about the partnership. Use the following internal revenue service center address: Web go to www.irs.gov/form1065 for instructions and the latest information. Or getting income from u.s.