Form 104Cr Instructions

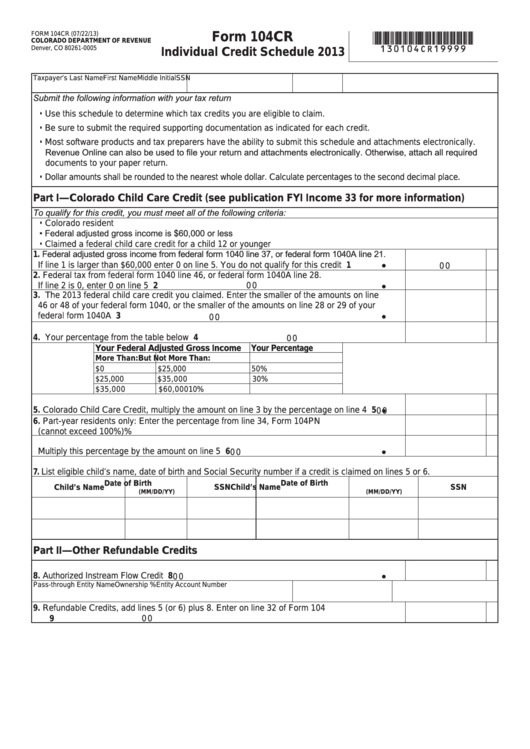

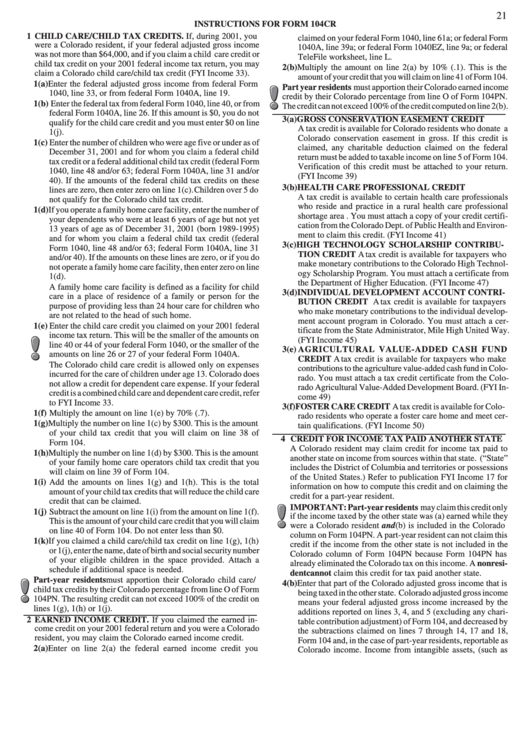

Form 104Cr Instructions - Web listed on the form: Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Web instructions for form 104cr introduction when taking a tax credit, always send documentation. Web 4 rows complete form 104cr to claim various refundable credits. Apply a check mark to point the choice wherever required. Read the instructions carefully and answer each of the questions, being sure to check the appropriate boxes or fill in the blanks as indicated. • be sure to submit the required supporting. If you or someone in your family was. Double check all the fillable fields to ensure complete accuracy. This form is for income earned in tax year 2022, with tax returns due in.

Web 4 rows complete form 104cr to claim various refundable credits. Web enter your official contact and identification details. • be sure to submit the required supporting. Continue following the instructions within the installation wizard 2. This form is for income earned in tax year 2022, with tax returns due in. • capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages to character or. Web up to $40 cash back 3. Web form 104cr individual credit schedule 2019 taxpayer’s last namefirst namemiddle initial ssn or itin use this schedule to calculate your income tax credits. Read the instructions carefully and answer each of the questions, being sure to check the appropriate boxes or fill in the blanks as indicated. Web type cr and press ok to bring up the form 104cr.

• capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages to character or. Double check all the fillable fields to ensure complete accuracy. This form is for income earned in tax year 2022, with tax returns due in. Web up to $40 cash back 2. If you or someone in your family was. Web listed on the form: Web we would like to show you a description here but the site won’t allow us. Web use this schedule to calculate your income tax credits. Continue following the instructions within the installation wizard 2. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail.

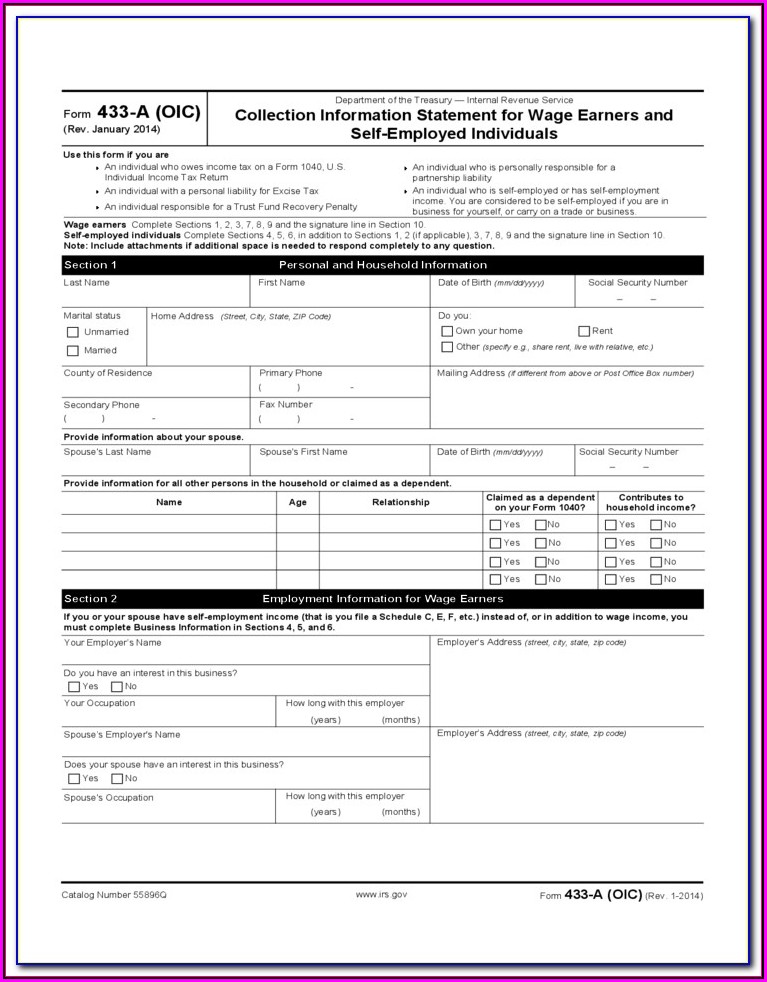

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

Apply a check mark to point the choice wherever required. Web we would like to show you a description here but the site won’t allow us. Tax return for seniors, including recent updates, related forms and instructions on how to file. Web listed on the form: Web instructions for form 104cr introduction when taking a tax credit, always send documentation.

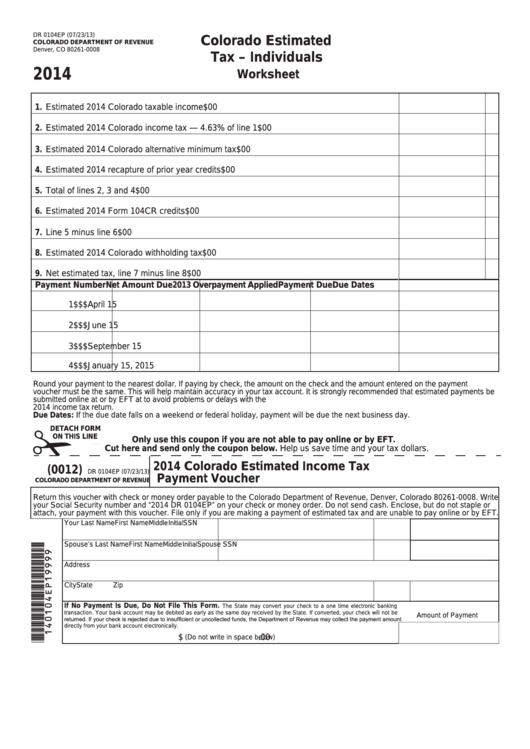

Fillable Form Dr 0104ep Colorado Estimated Tax Individuals

Web 4 rows complete form 104cr to claim various refundable credits. Web use this schedule to calculate your income tax credits. Web we last updated colorado form 104cr in january 2023 from the colorado department of revenue. Web up to $40 cash back 3. Double check all the fillable fields to ensure complete accuracy.

Fillable Form 104cr Individual Credit Schedule 2013 printable pdf

Web instructions for form 104cr introduction when taking a tax credit, always send documentation. Apply a check mark to point the choice wherever required. Continue following the instructions within the installation wizard 2. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. • be sure to.

Instructions For Form 104cr printable pdf download

Apply a check mark to point the choice wherever required. • be sure to submit the required supporting. Web use this schedule to calculate your income tax credits. Web we would like to show you a description here but the site won’t allow us. Select add new on your dashboard and upload a file from your device or import it.

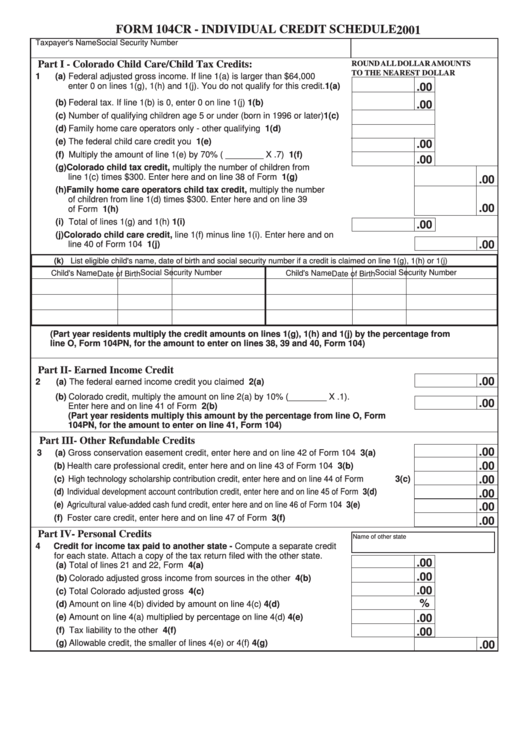

Form 104cr Individual Credit Schedule 2001 printable pdf download

Web instructions for form 104cr introduction when taking a tax credit, always send documentation. Double check all the fillable fields to ensure complete accuracy. • capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages to character or. Read the instructions carefully and answer each of the questions,.

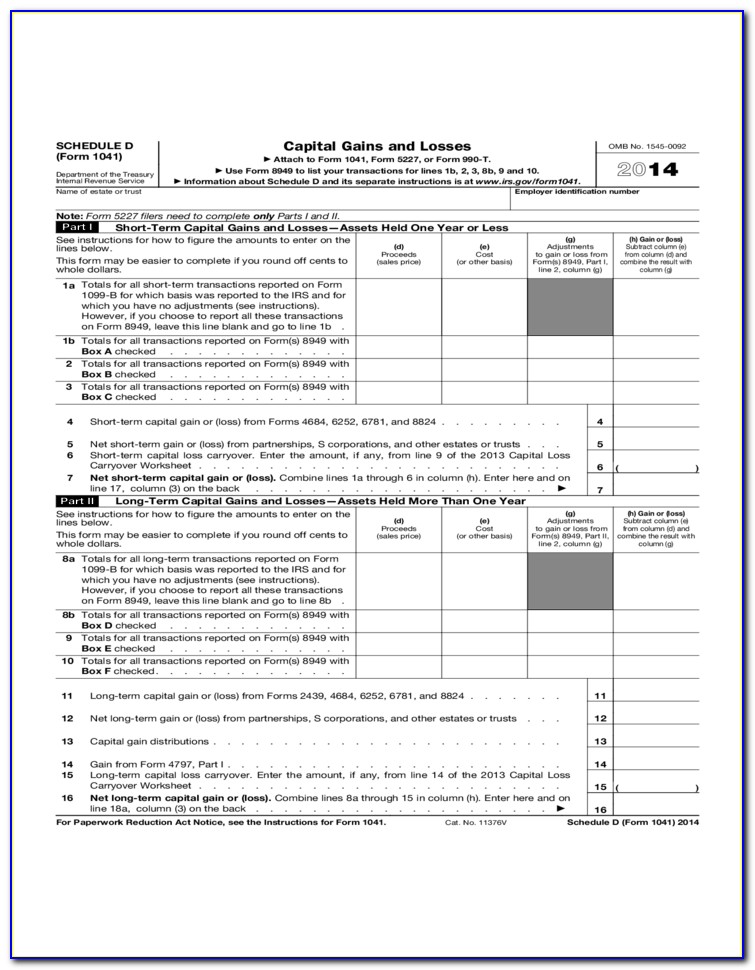

2019 2020 IRS Instructions 1041 Fill Out Digital PDF Sample

Web 4 rows complete form 104cr to claim various refundable credits. For revenue online, click the edit. • capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages to character or. Web we last updated colorado form 104cr in january 2023 from the colorado department of revenue. Web.

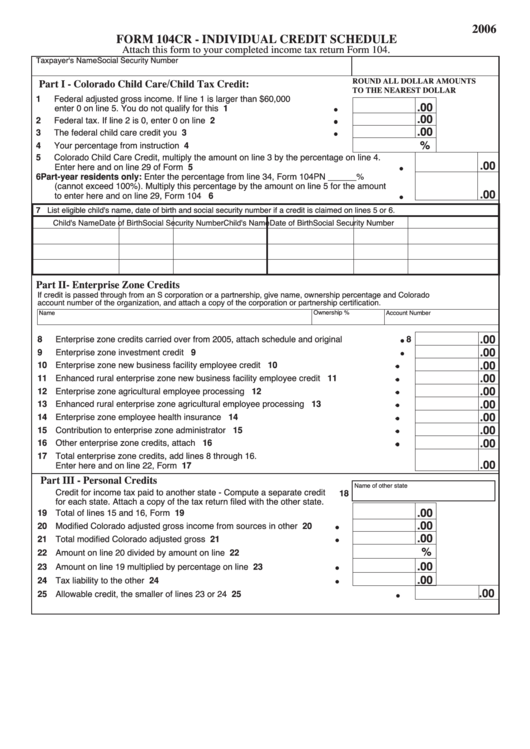

Form 104cr Individual Credit Schedule 2006 printable pdf download

Web enter your official contact and identification details. Web up to $40 cash back 2. Web up to $40 cash back 3. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Web we would like to show you a description here but the site won’t allow.

Best Tax Software For Form 1041 Form Resume Examples mL52wRnOXo

This form is for income earned in tax year 2022, with tax returns due in. Web type cr and press ok to bring up the form 104cr. Double check all the fillable fields to ensure complete accuracy. • capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages.

form 1042s instructions 2021 Fill Online, Printable, Fillable Blank

Web use this schedule to calculate your income tax credits. Tax return for seniors, including recent updates, related forms and instructions on how to file. If you or someone in your family was. For revenue online, click the edit. Web type cr and press ok to bring up the form 104cr.

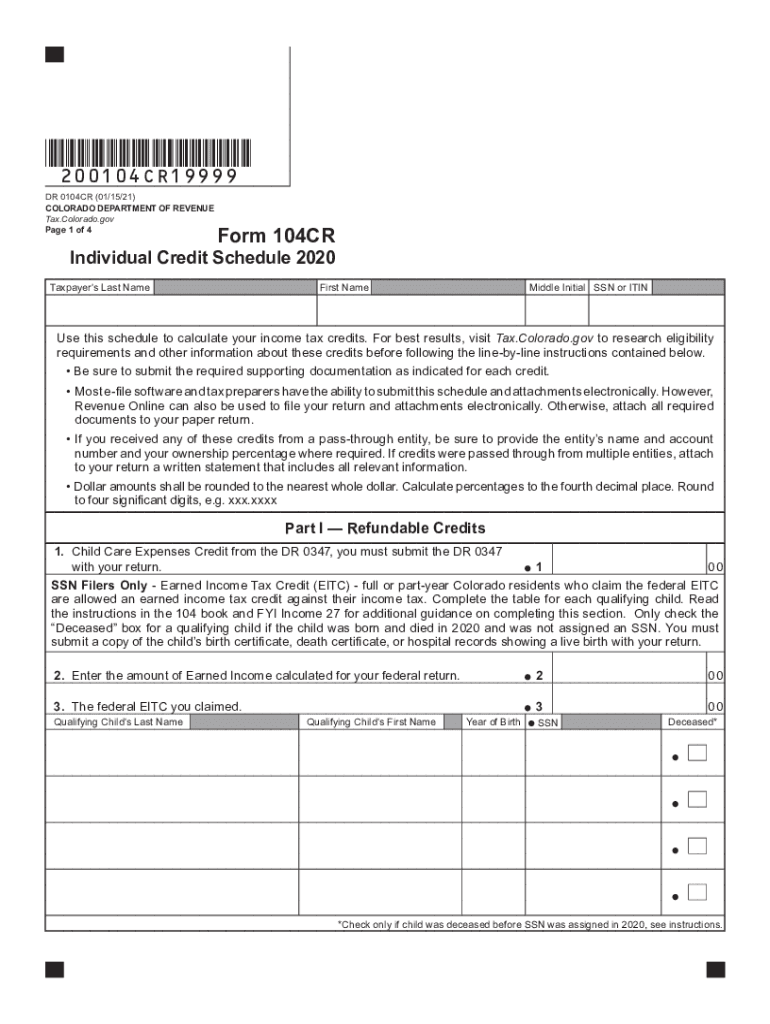

Dr 0104Cr Fill Out and Sign Printable PDF Template signNow

Web up to $40 cash back 3. Web we would like to show you a description here but the site won’t allow us. Web we last updated colorado form 104cr in january 2023 from the colorado department of revenue. • be sure to submit the required supporting. Web up to $40 cash back 2.

Complete Form 8962 To Claim The Credit And To Reconcile Your Advance Credit Payments.

For revenue online, click the edit. Web we would like to show you a description here but the site won’t allow us. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. If you or someone in your family was.

Web Listed On The Form:

This form is for income earned in tax year 2022, with tax returns due in. Web 4 rows complete form 104cr to claim various refundable credits. Don’t assume that — because a credit has been taken before. Web enter your official contact and identification details.

Continue Following The Instructions Within The Installation Wizard 2.

Web up to $40 cash back 2. • be sure to submit the required supporting. Web form 104cr individual credit schedule 2019 taxpayer’s last namefirst namemiddle initial ssn or itin use this schedule to calculate your income tax credits. • capital gains on the sale of your residence regardless if the gains are exempt from federal income tax • compensation for damages to character or.

Web Type Cr And Press Ok To Bring Up The Form 104Cr.

Read the instructions carefully and answer each of the questions, being sure to check the appropriate boxes or fill in the blanks as indicated. Web use this schedule to calculate your income tax credits. Apply a check mark to point the choice wherever required. Tax return for seniors, including recent updates, related forms and instructions on how to file.