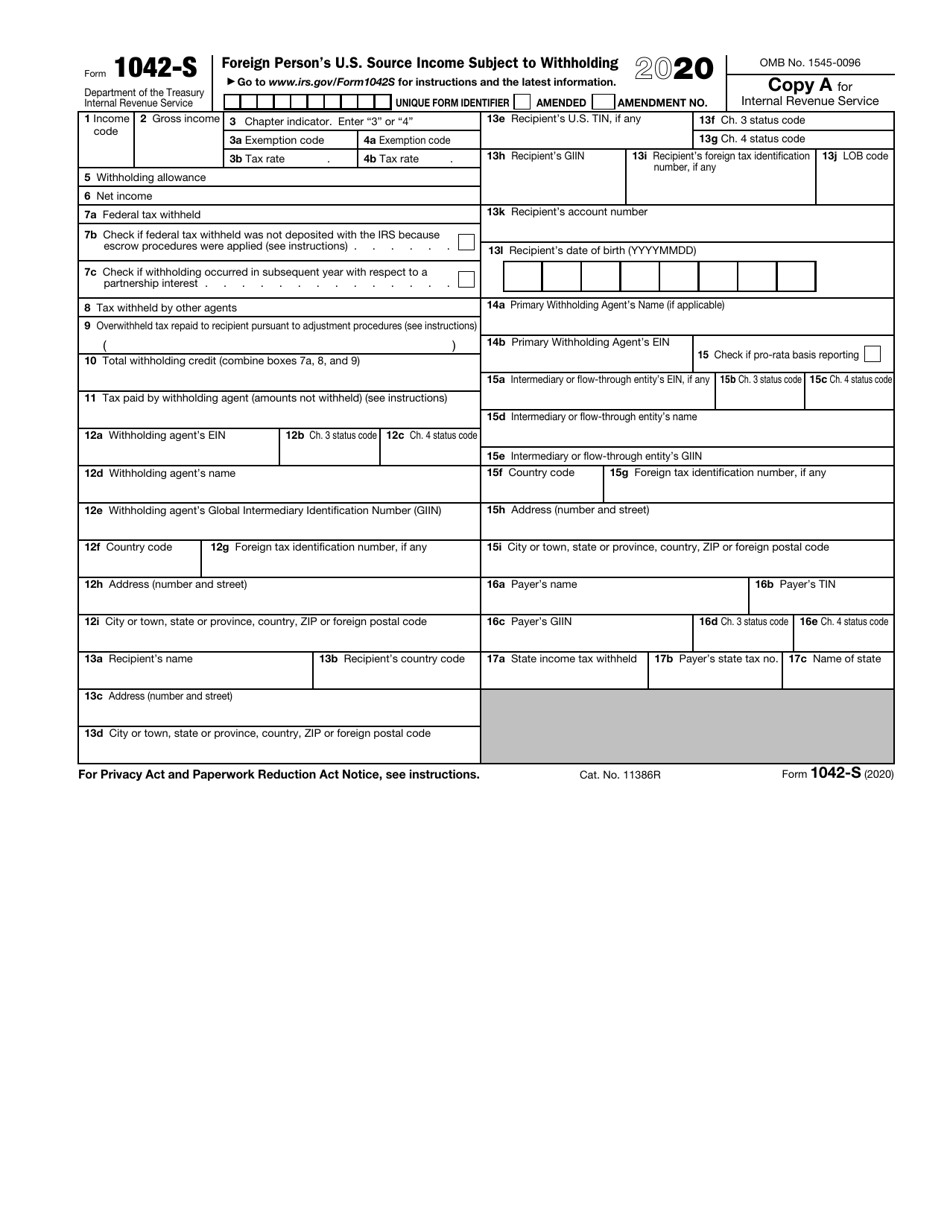

Form 1042 S Turbotax

Form 1042 S Turbotax - Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web form 1042, also annual withholding tax return for u.s. How do i file an irs extension (form 4868) in turbotax online? Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Currently, turbotax does not support this form. At the right upper corner, in the search box, type in “1098t” and enter. Last updated wednesday, january 4, 2023. Ad register and subscribe now to work on instr. Source income subject to withholding (pdf). Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a.

Source income subject to withholding. Source income of foreign persons section references are to the internal revenue code. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Complete, edit or print tax forms instantly. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding (pdf). Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, to report amounts paid to. Withholding agents and amounts paid by. How do i file an irs extension (form 4868) in turbotax online?

Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding (pdf). Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Currently, turbotax does not support this form. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. At the right upper corner, in the search box, type in “1098t” and enter. Ad register and subscribe now to work on instr. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Last updated wednesday, january 4, 2023.

Instructions for IRS Form 1042S How to Report Your Annual

Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a. Taxation under a tax treaty. At the right upper corner, in the search box, type in “1098t” and enter. Ad register and subscribe now to work on instr. Web here are the steps:

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income of foreign persons section references are to the internal revenue code. Web here are the steps: Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Ad access irs tax forms. Web view and download up to seven years of past returns in turbotax online.

Form 1042S comes under increased IRS scrutiny Refinitiv Perspectives

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Last updated wednesday, january 4, 2023. Web form 1042, also annual withholding tax return for u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income of foreign persons, is used to report.

turbotax 1042s treaty Fill Online, Printable, Fillable Blank form

How do i file an irs extension (form 4868) in turbotax online? This webinar is scheduled for approximately 120 minutes. Web view and download up to seven years of past returns in turbotax online. Ad access irs tax forms. Ad register and subscribe now to work on instr.

Form 1042 s instructions United States guide User Examples

Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Withholding agents and amounts paid by. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web form 1042, also annual withholding tax return for u.s. Source income of foreign persons section references are to the.

Formulario 1042S skuylahhu 2

How do i file an irs extension (form 4868) in turbotax online? Web use form 1042 to report the following: Last updated wednesday, january 4, 2023. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Source income of foreign persons section references are to the internal revenue code.

Form 1042S USEReady

File an extension in turbotax online. Source income of foreign persons section references are to the internal revenue code. Source income subject to withholding. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. How do i file an irs extension (form 4868) in turbotax online?

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Web here are the steps: Last updated wednesday, january 4, 2023. At the right upper corner, in the search box, type in “1098t” and enter. How do i file an irs extension (form 4868) in turbotax online?

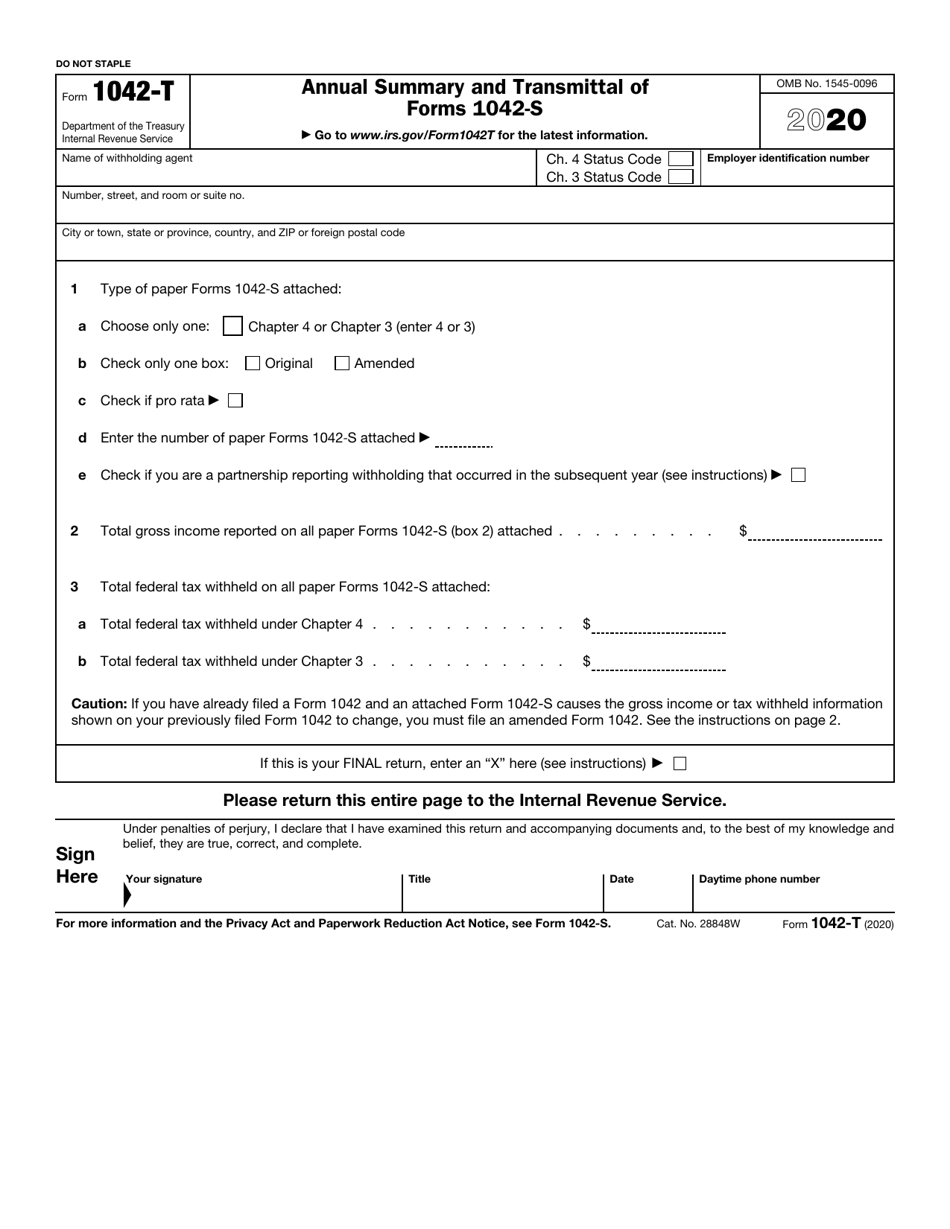

IRS Form 1042T Download Fillable PDF or Fill Online Annual Summary and

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Currently, turbotax does not support this form. File an extension in turbotax online. This webinar is scheduled for approximately 120 minutes. Source income subject to withholding.

Form 1042 Alchetron, The Free Social Encyclopedia

Taxation under a tax treaty. Ad access irs tax forms. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Currently, turbotax does not support this form.

Ad Register And Subscribe Now To Work On Instr.

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Source income of foreign persons section references are to the internal revenue code. Web view and download up to seven years of past returns in turbotax online. This webinar is scheduled for approximately 120 minutes.

At The Right Upper Corner, In The Search Box, Type In “1098T” And Enter.

Complete irs tax forms online or print government tax documents. Web use form 1042 to report the following: Taxation under a tax treaty. How do i file an irs extension (form 4868) in turbotax online?

Source Income Subject To Withholding, Is Used To Report Amounts Paid To Foreign Persons (Including Those Presumed To Be Foreign) By A.

Web here are the steps: Source income subject to withholding (pdf). Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. File an extension in turbotax online. Web form 1042, also annual withholding tax return for u.s. Web instructions instructions for form 1042 (2022) annual withholding tax return for u.s.