Form 1041-Es 2022

Form 1041-Es 2022 - Web information about form 1041, u.s. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 schedule i (form 1041) form 4952. Web department of revenue services state ofform ct‑1041es connecticut 2022 estimated connecticut income taxpayment coupon for trusts and estates 2022 (rev. Complete, edit or print tax forms instantly. Form 1041 estate tax deduction with ird computation statement. Web application for extension of time to file income tax return. Web estate or trust estimated income tax payment. Enhance your skills & earn cpe. Ad access irs tax forms.

Ad form 1041 schedule j—trusts & throwback rules. Web information about form 1041, u.s. Enhance your skills & earn cpe. Schedules i, ii, and iii; Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web application for extension of time to file income tax return. Web gross income of $10,000 or more for the taxable year (resident estate or trust) or both distributable net income derived from or connected with sources in this state and gross. Form is used by a fiduciary to make voluntary estimated tax payments for an estate or trust. Form 1041 is used by a. Form 1041 estate tax deduction with ird computation statement.

Expert guidance on financial & estate planning. Form 1041 schedule i (form 1041) form 4952. Web application for extension of time to file income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web department of revenue services state ofform ct‑1041es connecticut 2022 estimated connecticut income taxpayment coupon for trusts and estates 2022 (rev. Complete, edit or print tax forms instantly. Schedules i, ii, and iii; Enhance your skills & earn cpe. Form is used by a fiduciary to make voluntary estimated tax payments for an estate or trust. Ad access irs tax forms.

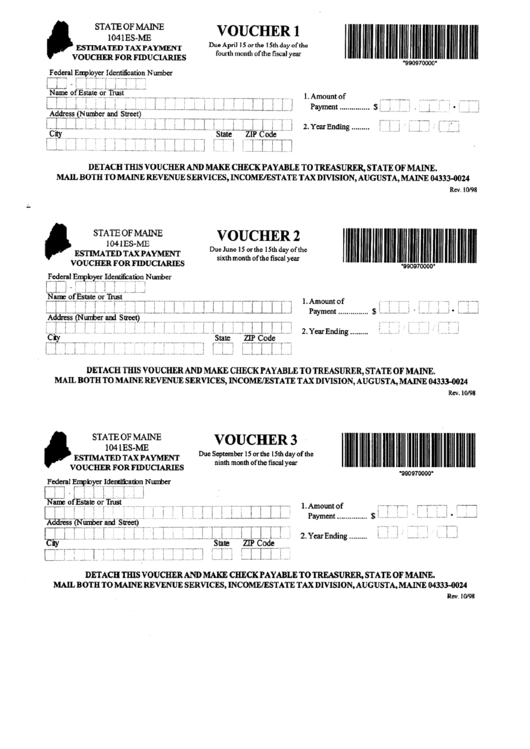

Form 1041esMe Estimated Tax Payment Voucher For Individuals

Form is used by a fiduciary to make voluntary estimated tax payments for an estate or trust. Web application for extension of time to file income tax return. Ad form 1041 schedule j—trusts & throwback rules. Ad access irs tax forms. Form 1041 schedule i (form 1041) form 4952.

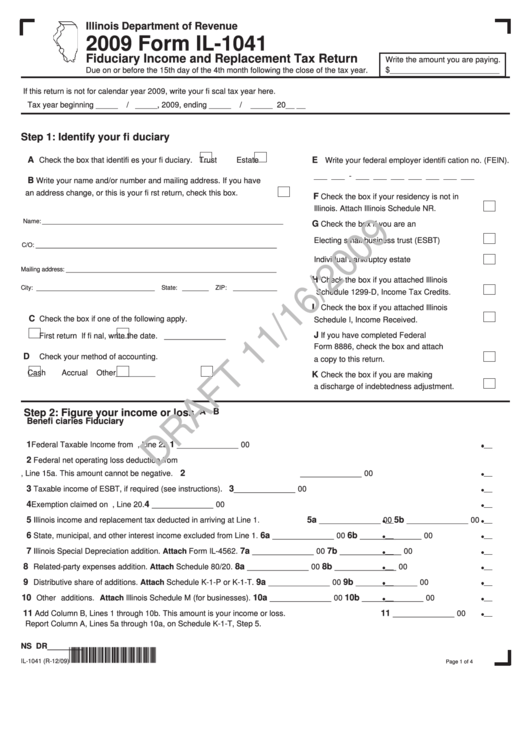

Form Il1041 Fiduciary And Replacement Tax Return printable

Estimated income tax payment voucher for 2023. Web application for extension of time to file income tax return. Web gross income of $10,000 or more for the taxable year (resident estate or trust) or both distributable net income derived from or connected with sources in this state and gross. Income tax return for estates and trusts, including recent updates, related.

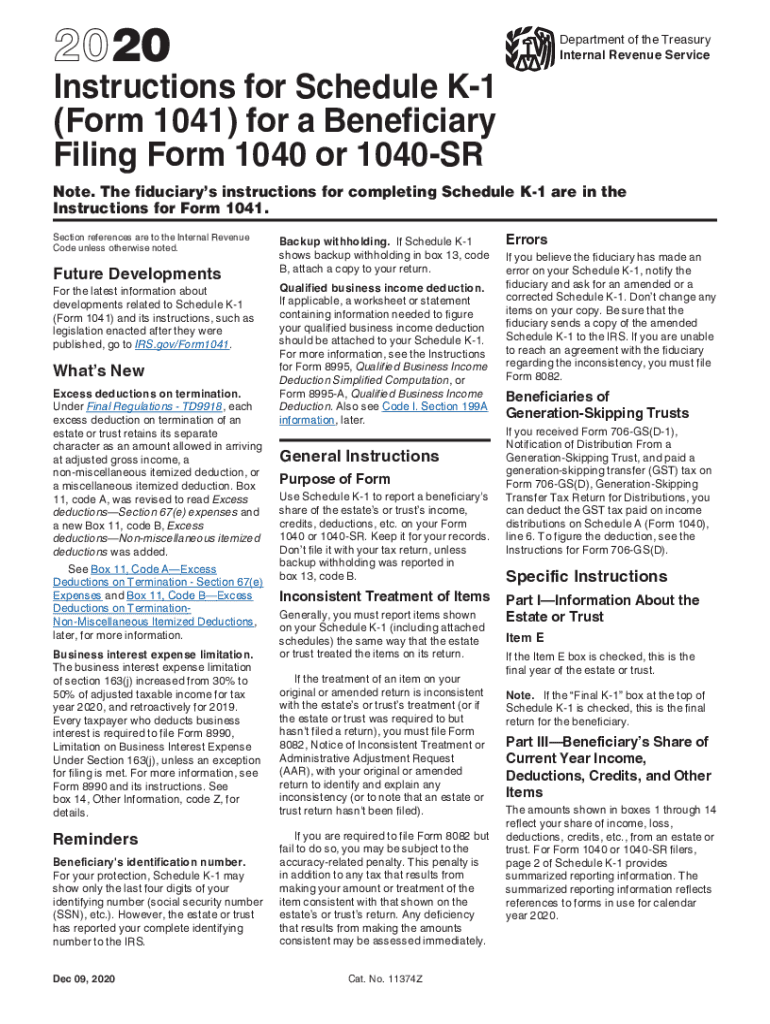

Instructions For Schedule K 1 Form 1041 For A Beneficiary Filing Form

Get ready for tax season deadlines by completing any required tax forms today. Schedules i, ii, and iii; Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web gross income of $10,000 or more for the taxable year (resident estate or trust) or both distributable net income derived from or connected.

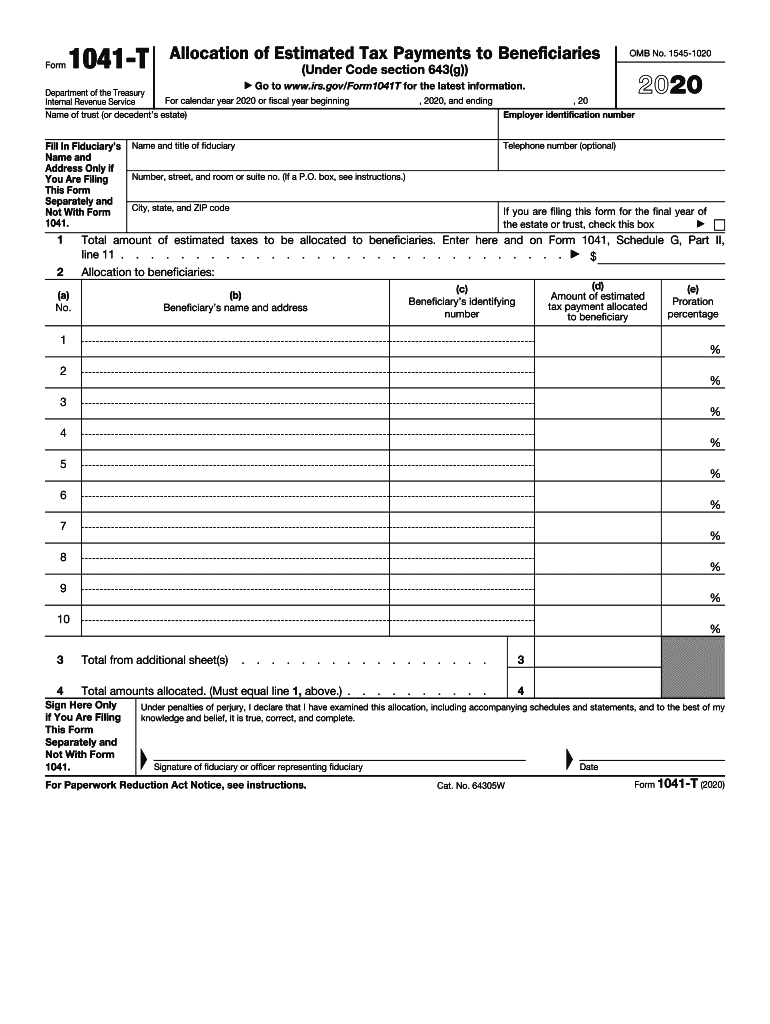

1041 Form 1041 T Allocation of Estimated Tax Payments to Fill Out and

Estimated income tax payment voucher for 2023. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Estimated payments should only be. Ad form 1041 schedule j—trusts & throwback rules.

Form 2018 Estimated Fill Out and Sign Printable PDF Template signNow

Estimated payments should only be. Complete, edit or print tax forms instantly. Form 1041 estate tax deduction with ird computation statement. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Ad form 1041 schedule j—trusts & throwback rules.

Form 1041 k1 Fill online, Printable, Fillable Blank

Form is used by a fiduciary to make voluntary estimated tax payments for an estate or trust. Expert guidance on financial & estate planning. Application for automatic extension of time (12/2022) 7004n. Estimated income tax payment voucher for 2023. Estimated payments should only be.

U.S. Tax Return for Estates and Trusts, Form 1041

Ad access irs tax forms. Expert guidance on financial & estate planning. Form is used by a fiduciary to make voluntary estimated tax payments for an estate or trust. Application for automatic extension of time (12/2022) 7004n. Web application for extension of time to file income tax return.

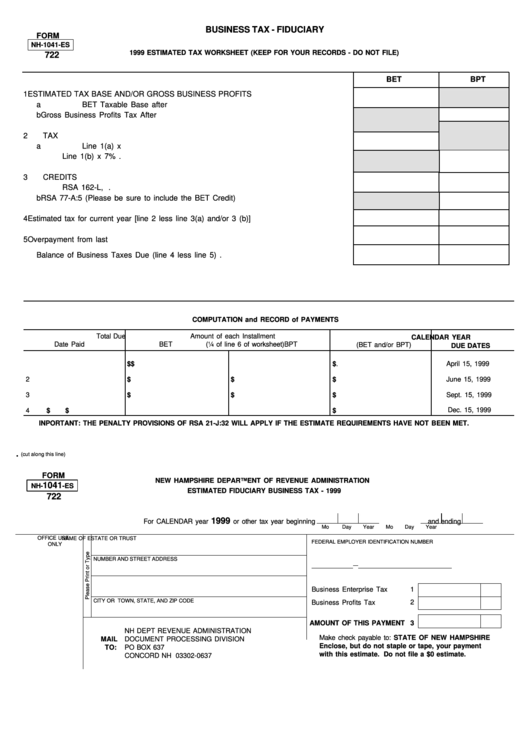

Fillable Form Nh1041Es Estimated Fiduciary Business Tax 1999

Enhance your skills & earn cpe. Web gross income of $10,000 or more for the taxable year (resident estate or trust) or both distributable net income derived from or connected with sources in this state and gross. Form 1041 estate tax deduction with ird computation statement. Form 1041 is used by a. Ad access irs tax forms.

2019 2020 IRS Instructions 1041 Fill Out Digital PDF Sample

Ad access irs tax forms. Estimated income tax payment voucher for 2023. Form 1041 estate tax deduction with ird computation statement. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

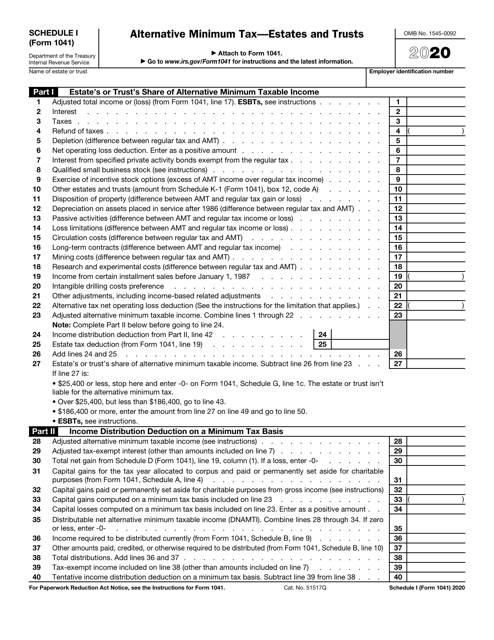

IRS Form 1041 Schedule I Download Fillable PDF or Fill Online

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Ad access irs tax forms. Expert guidance on financial & estate planning. Web information about form 1041, u.s. Get ready for tax season deadlines by completing any required tax forms today.

Web Information About Form 1041, U.s.

Web estate or trust estimated income tax payment. Web gross income of $10,000 or more for the taxable year (resident estate or trust) or both distributable net income derived from or connected with sources in this state and gross. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Complete, Edit Or Print Tax Forms Instantly.

Web department of revenue services state ofform ct‑1041es connecticut 2022 estimated connecticut income taxpayment coupon for trusts and estates 2022 (rev. Form 1041 estate tax deduction with ird computation statement. Application for automatic extension of time (12/2022) 7004n. Enhance your skills & earn cpe.

Form Is Used By A Fiduciary To Make Voluntary Estimated Tax Payments For An Estate Or Trust.

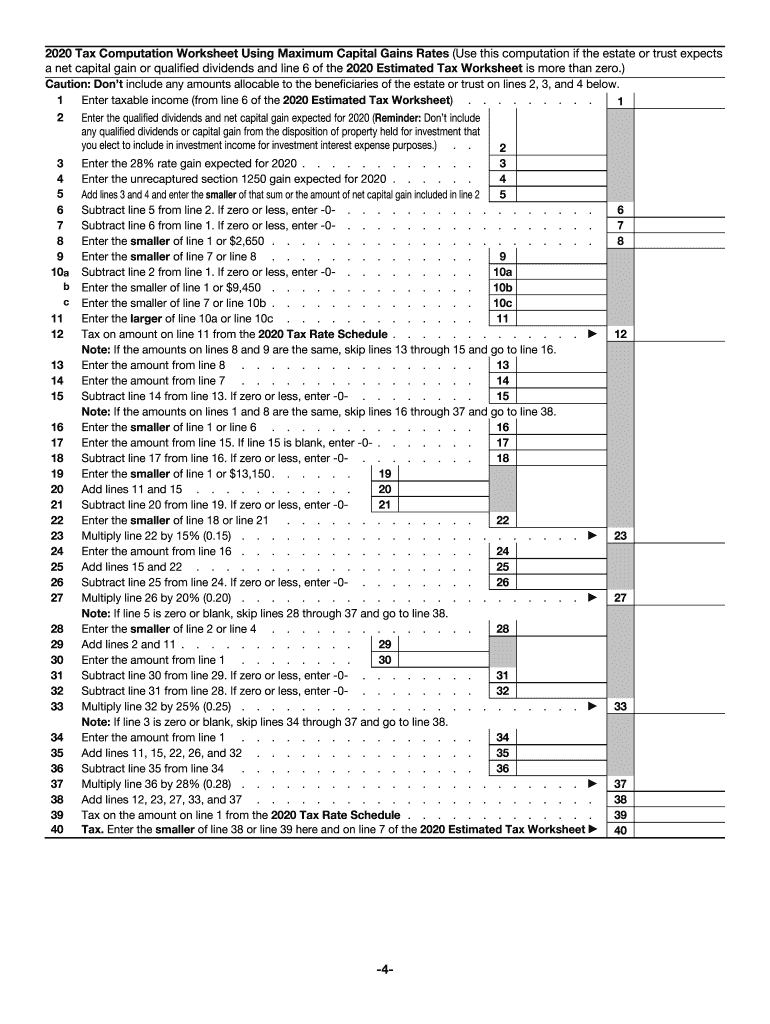

Form 1041 schedule i (form 1041) form 4952. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web application for extension of time to file income tax return. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings.

Estimated Payments Should Only Be.

Ad form 1041 schedule j—trusts & throwback rules. Expert guidance on financial & estate planning. Schedules i, ii, and iii; Estimated income tax payment voucher for 2023.