Form 1040Nr Online

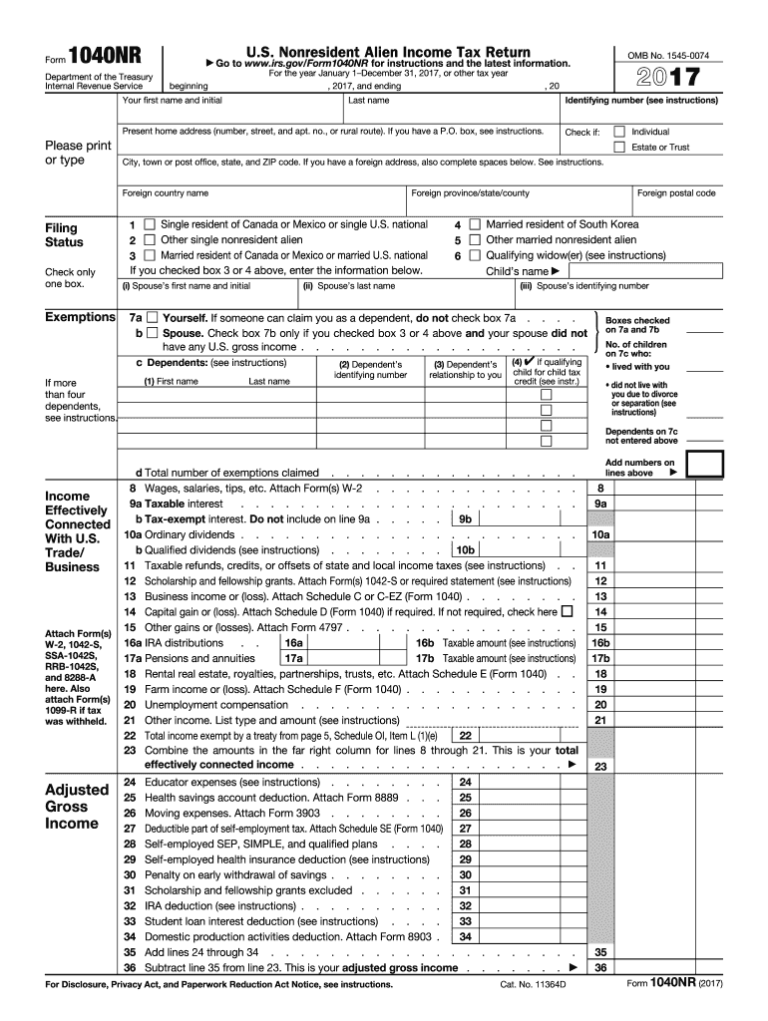

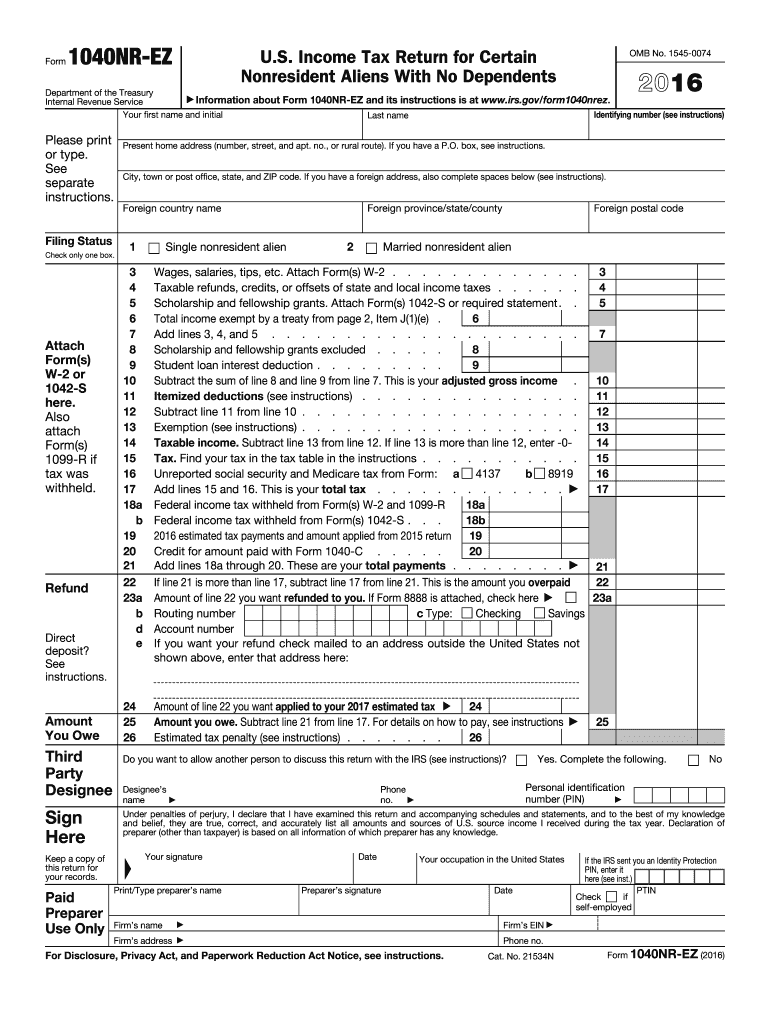

Form 1040Nr Online - Complete, edit or print tax forms instantly. Efileit on efile.com between january and october after a given tax year. Nonresident alien income tax return can be filed electronically using ultratax cs. Complete, edit or print tax forms instantly. Citizens and resident aliens use. Web you must file form 1040, u.s. Web this article will help you generate form 1040nr as well as how to suppress it.before you start:the 1040nr can only be generated in an individual (1040) return.f you need to. Nonresident alien income tax return (irs)form is 5 pageslong and contains: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file.

Ad download or email 1040nr form & more fillable forms, register and subscribe now! Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Irs compliance 100% guaranteed you will have a clean us tax record. $99 per state partnership, trust, or estate income partnership, trust, or estate income. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Complete, edit or print tax forms instantly. Ad download or email 1040nr form & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Resident during the year and who is a resident of the u.s. Resident return), you must report, and are subject to taxation on your worldwide income.

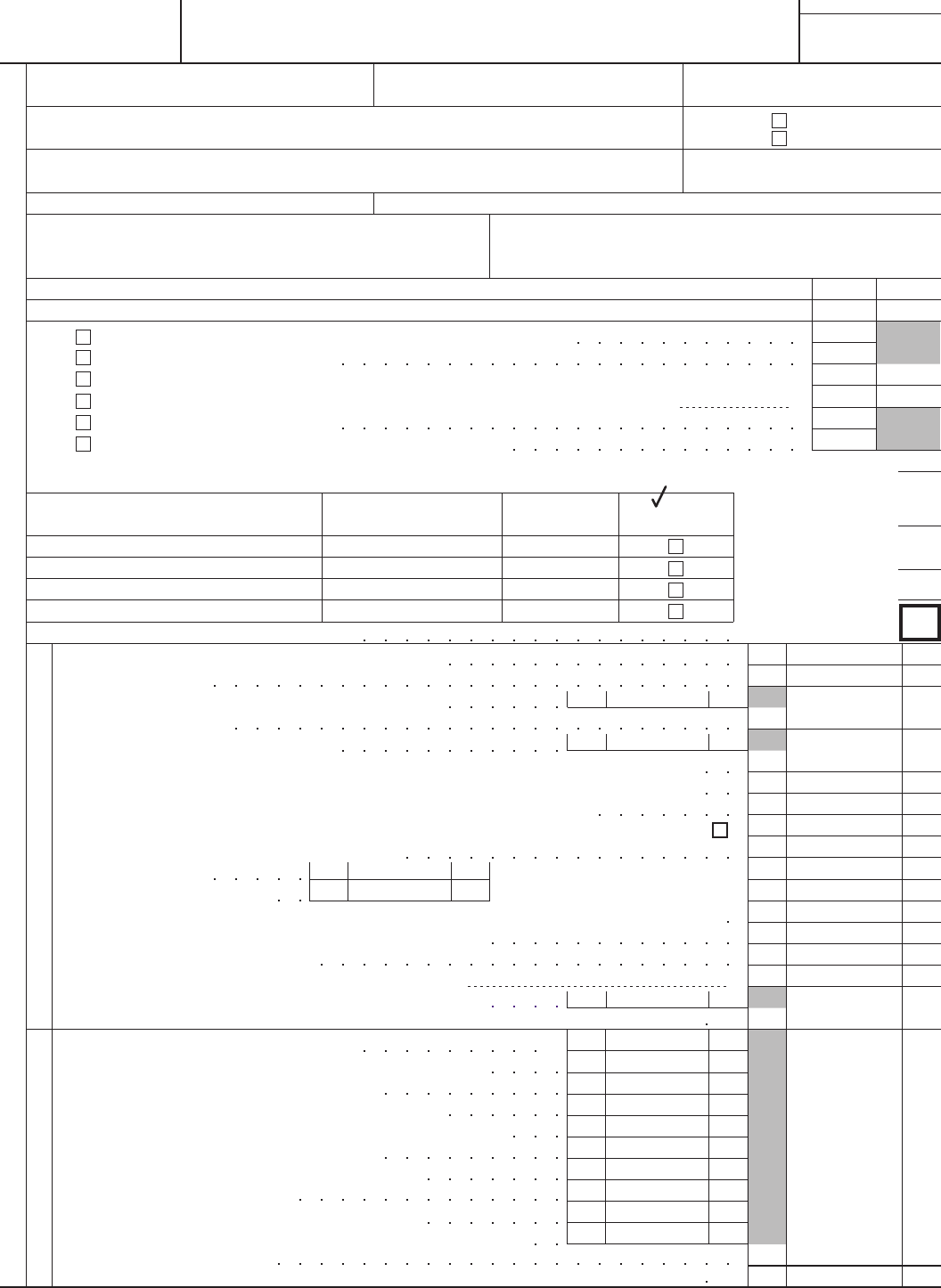

Complete, edit or print tax forms instantly. Resident during the year and who is a resident of the u.s. Nonresident alien income tax return can be filed electronically using ultratax cs. Nonresident alien income tax return (irs)form is 5 pageslong and contains: Only the schedules that ae right for you! 1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked. Web if you file form 1040 (u.s. $99 per state partnership, trust, or estate income partnership, trust, or estate income. Department of the treasury internal revenue service beginning. Citizens and resident aliens use.

2017 Tax Tables 1040nr Awesome Home

April 18, 2023 is the timely deadline. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Get ready for tax season deadlines by completing.

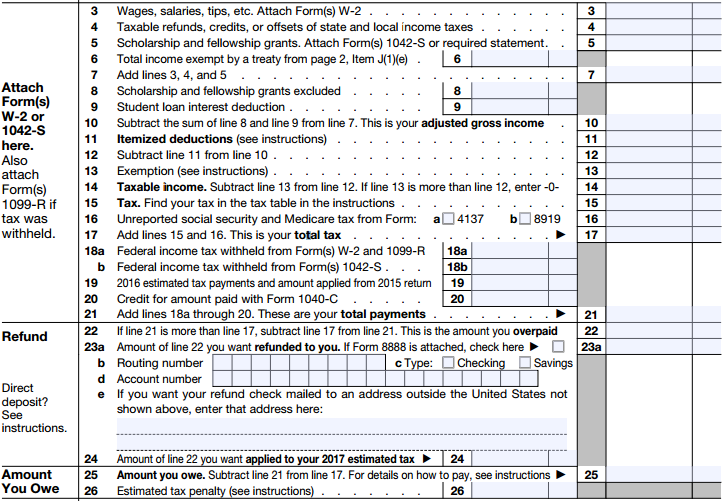

1040nr Fill Out And Sign Printable PDF Template SignNow 2021 Tax

Only the schedules that ae right for you! Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Nonresident alien income tax return (irs)form is 5 pageslong and contains: Department of the treasury internal revenue service beginning. Nonresident alien income tax return can be filed electronically using ultratax cs.

1040Nr Ez Fill Out and Sign Printable PDF Template signNow

Ad download or email 1040nr form & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web you must file form 1040, u.s. Citizens and resident aliens use. Get ready for tax season deadlines by completing any required tax forms today.

2007 Form 1040Nr Edit, Fill, Sign Online Handypdf

Ad download or email 1040nr form & more fillable forms, register and subscribe now! Resident return), you must report, and are subject to taxation on your worldwide income. Citizens and resident aliens use. Irs compliance 100% guaranteed you will have a clean us tax record. Web the 1040 form is the official tax return that taxpayers have to file with.

1040nrez Tax Table

1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Nonresident alien income tax return (irs)form is 5 pageslong and contains: Get ready for tax season deadlines by.

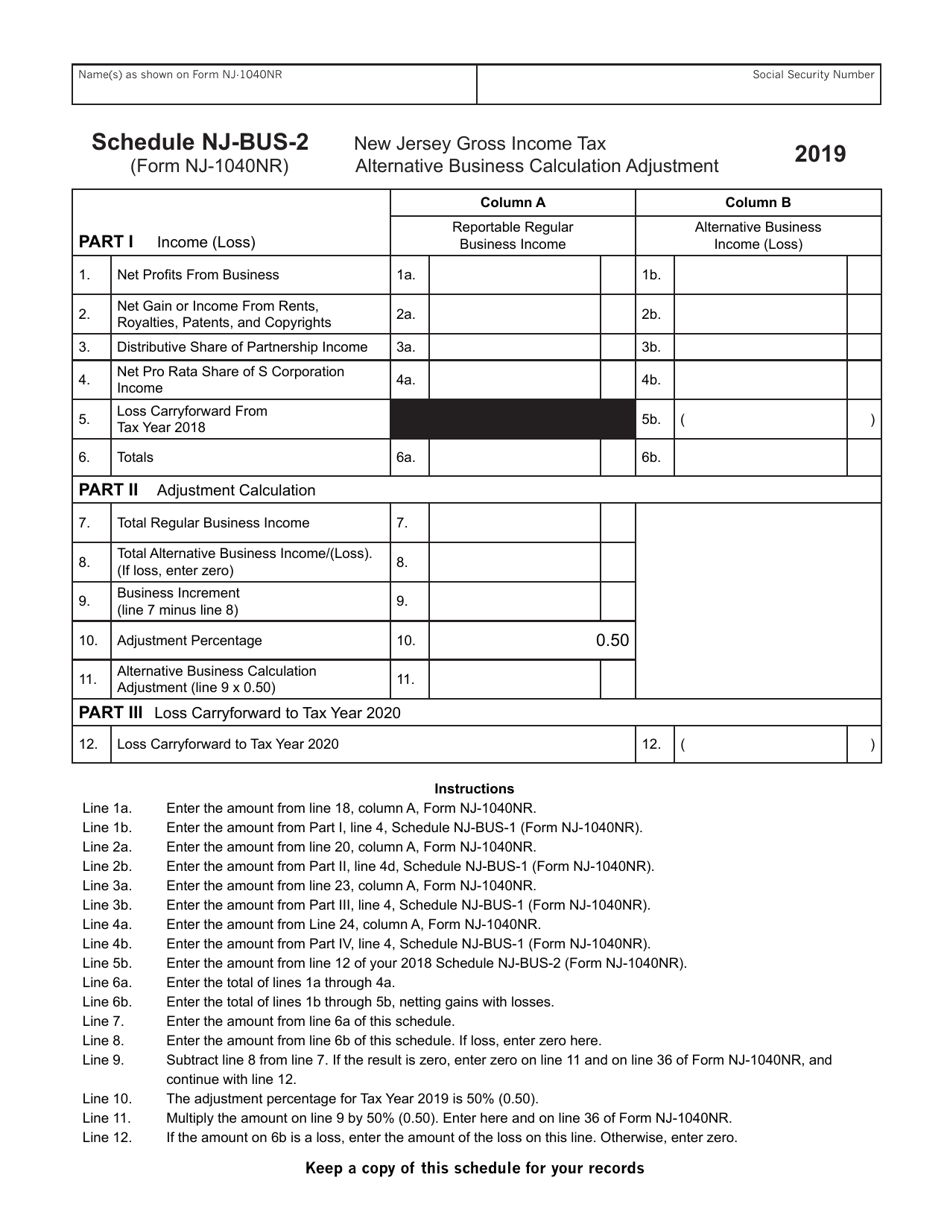

Form NJ1040NR Schedule NJBUS2 Download Fillable PDF or Fill Online

Nonresident alien income tax return can be filed electronically using ultratax cs. Resident return), you must report, and are subject to taxation on your worldwide income. 1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked. Web if you file form 1040 (u.s. Extensions for form 1040nr can also be filed electronically.

2017 Tax Tables 1040nr Awesome Home

Extensions for form 1040nr can also be filed electronically. Nonresident alien income tax return (irs)form is 5 pageslong and contains: Resident return), you must report, and are subject to taxation on your worldwide income. Ad download or email 1040nr form & more fillable forms, register and subscribe now! $99 per state partnership, trust, or estate income partnership, trust, or estate.

2015 Form NE DoR 1040N Fill Online, Printable, Fillable, Blank pdfFiller

Nonresident alien income tax return (irs)form is 5 pageslong and contains: Irs compliance 100% guaranteed you will have a clean us tax record. Complete, edit or print tax forms instantly. Web this article will help you generate form 1040nr as well as how to suppress it.before you start:the 1040nr can only be generated in an individual (1040) return.f you need.

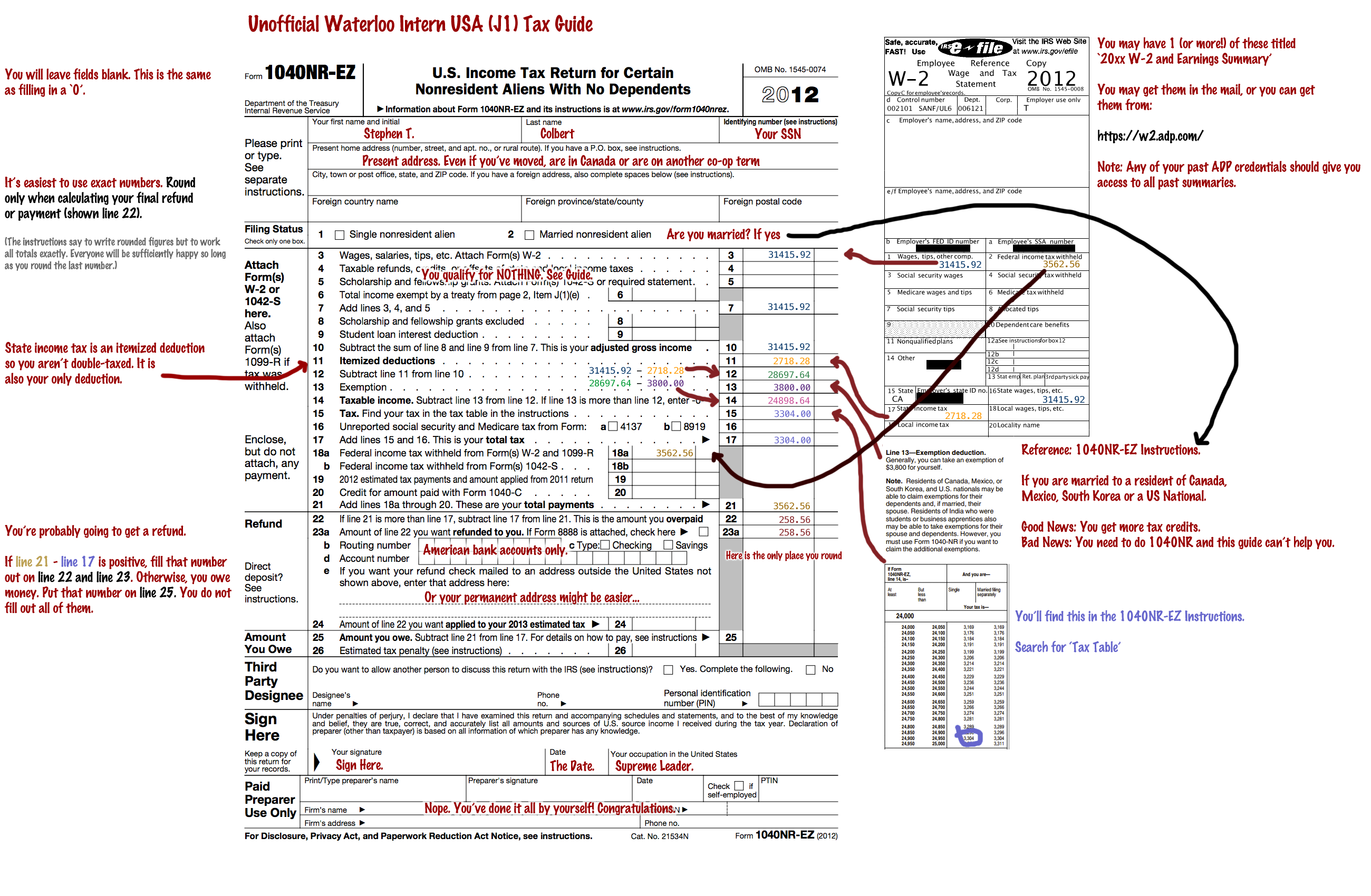

Unofficial UWaterloo Intern USA Tax Guide

Ad download or email 1040nr form & more fillable forms, register and subscribe now! Web you must file form 1040, u.s. $99 per state partnership, trust, or estate income partnership, trust, or estate income. Efileit on efile.com between january and october after a given tax year. Citizens and resident aliens use.

Everything You Need to Know About Form 1040NR SDG Accountant

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Nonresident alien income tax return can be filed electronically using ultratax cs. Complete, edit or print tax forms instantly. Resident during the year and who is a resident of the u.s. Complete,.

Ad Download Or Email 1040Nr Form & More Fillable Forms, Register And Subscribe Now!

Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Nonresident alien income tax return can be filed electronically using ultratax cs. Only the schedules that ae right for you! Get ready for tax season deadlines by completing any required tax forms today.

Efileit On Efile.com Between January And October After A Given Tax Year.

Complete, edit or print tax forms instantly. Web if you file form 1040 (u.s. Nonresident alien income tax return (irs)form is 5 pageslong and contains: $99 per state partnership, trust, or estate income partnership, trust, or estate income.

April 18, 2023 Is The Timely Deadline.

Extensions for form 1040nr can also be filed electronically. Ad download or email 1040nr form & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Web The 1040 Form Is The Official Tax Return That Taxpayers Have To File With The Irs Each Year To Report Taxable Income And Calculate Their Taxes Due.

Resident return), you must report, and are subject to taxation on your worldwide income. Citizens and resident aliens use. Web you must file form 1040, u.s. 1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked.