Foreign Gift Form

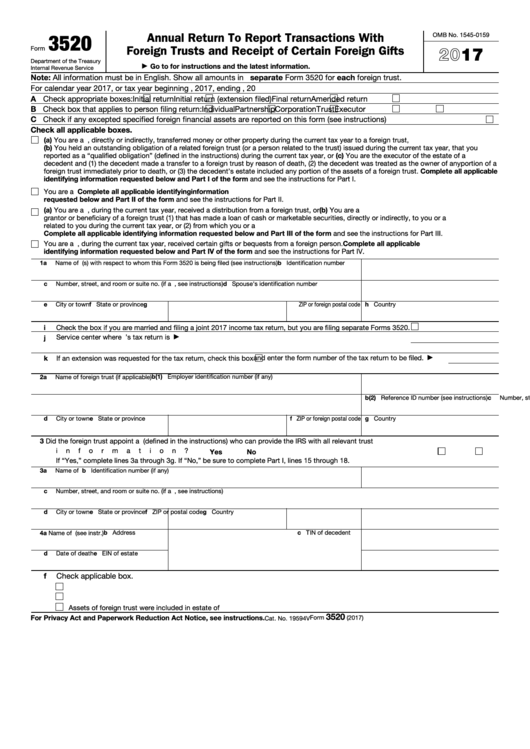

Foreign Gift Form - Persons who must file this form: These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl headed for u.s. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report transactions involving foreign trusts, entities, or gifts from foreign persons. Foreign gift tax & the irs: About our international tax law firm is there a foreign gift tax in the us? Name and position of the individual who presented the gift, award,. Web operations blue lotus and four horsemen: Web it doesn’t matter if the gift is to a u.s. Decedents) file form 3520 with the irs to report: Web general instructions purpose of form u.s.

Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. What are the general requirements to report foreign gifts? It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s. Here are a few tax form 709 examples: That word “certain” is key here — there are different reporting triggers depending on the nature of the foreign asset. These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl headed for u.s. 7342), which establishes policies and procedures pertaining to the acceptance, use, and disposition of gifts or decorations from foreign governments. Form 3520 is due the fourth month following the end of the person's tax year, typically april 15. The interactive data displayed below reflects foreign gifts and contracts that institutions of higher education reported to the department through the updated reporting portal, which became available for data entry on june 22, 2020.

Persons may not be aware of their requirement to file a form 3520 because they have no income or have no tax return filing requirements. Web form 3520 & instructions: The form 3520 is used to report the value of a gift received from a foreign person. Web form 3520 is an informational return in which u.s. When it comes to gifts from foreign persons, it is important to distinguish between the tax and reporting rules. Name and position of the individual who presented the gift, award,. The rules are different when the u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web it doesn’t matter if the gift is to a u.s.

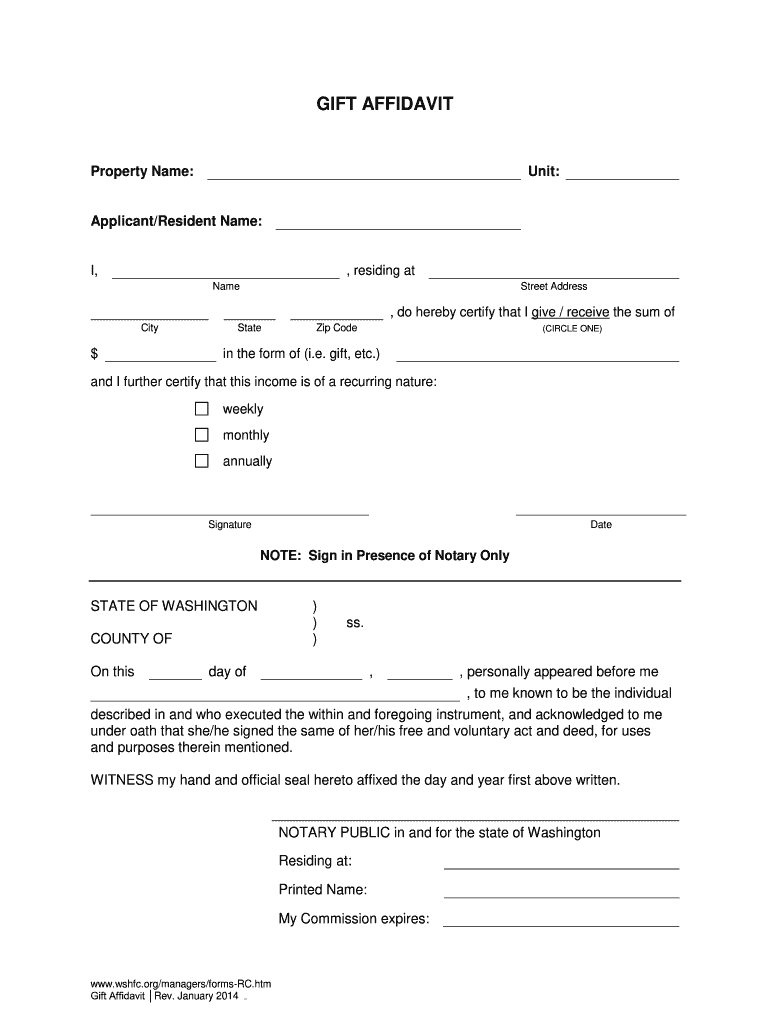

Gift Affidavit Fill Out and Sign Printable PDF Template signNow

Donor government or international organization (use a separate form for each government. Person gives a gift that exceeds the annual exclusion amount, they typically must file a form 709, unless an exception or exclusion applies. Web it doesn’t matter if the gift is to a u.s. Here are a few tax form 709 examples: Web form 3520 & instructions:

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web general instructions purpose of form u.s. Citizen, is moving from illinois to london for a new job. Web irs form 3520, “annual report to report transactions with foreign trusts and receipts of foreign gifts,” is one of the most common reports required when a u.s. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and receipts of.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web general instructions purpose of form u.s. What are the general requirements to report foreign gifts? Foreign gift tax & the irs: Web 3.ame and position of person completing form (if different from recipient): Form 3520 is due the fourth month following the end of the person's tax year, typically april 15.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Circumstances under which gifts or travel were accepted (e.g., that refusal of tangible gift would cause donor embarrassment or travel was consistent with interests of the u.s.): The rules are different when the u.s. Persons who receive gifts or bequests from foreign persons beware—these gifts or bequests may need to be reported to the internal revenue service (“irs”). The consequences.

Reporting requirements for US tax persons who receive a foreign gift

Web foreign gifts and irs reporting. The rules are different when the u.s. Donor government or international organization (use a separate form for each government. It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s. Web irs form 3520, “annual report to report transactions with foreign trusts and receipts of foreign gifts,” is one.

Foreign Gift & Trust Penalties Tax Attorney Douglas Greenberg

Person gives a gift that exceeds the annual exclusion amount, they typically must file a form 709, unless an exception or exclusion applies. When it comes to gifts from foreign persons, it is important to distinguish between the tax and reporting rules. Web foreign gifts and irs reporting. Web form 3520 is used to report the existence of a gift,.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

The form 3520 is used to report the value of a gift received from a foreign person. Web form 3520 & instructions: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. What are the general requirements to report foreign gifts? Now that you know what form 3520 is, you.

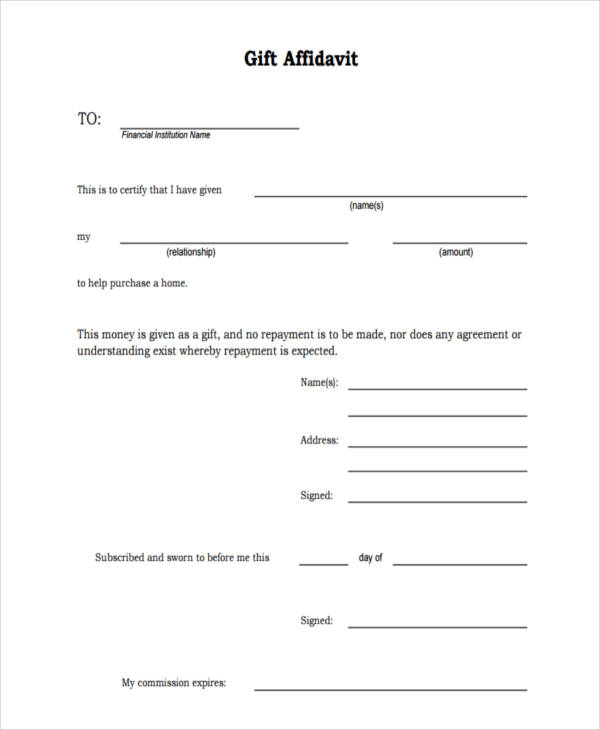

FREE 6+ Gift Affidavit Forms in MS Word PDF

Name and position of the individual who presented the gift, award,. Now that you know what form 3520 is, you must determine your eligibility when filing this form. The interactive data displayed below reflects foreign gifts and contracts that institutions of higher education reported to the department through the updated reporting portal, which became available for data entry on june.

Changes to Foreign Gift Reporting for Higher Education

If the value of those gifts to any one person exceeds $15,000, you need to file a gift tax return. Persons may not be aware of their requirement to file a form 3520 because they have no income or have no tax return filing requirements. Persons (and executors of estates of u.s. Web form 3520 is an informational return in.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

For gifting purposes, there are three key categories of u.s. Web it doesn’t matter if the gift is to a u.s. These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl headed for u.s. The form 3520 complexity is on a sliding scale. Who should file for form 3520?

7342 (Fgda) An Employee May Not Accept A Gift Exceeding $480 (Effective January 1, 2023) In Value From A Foreign Government Or An International Organization.

Persons who receive gifts or bequests from foreign persons beware—these gifts or bequests may need to be reported to the internal revenue service (“irs”). Web form 3520 & instructions: Circumstances under which gifts or travel were accepted (e.g., that refusal of tangible gift would cause donor embarrassment or travel was consistent with interests of the u.s.): Web form 3520 is an informational return in which u.s.

Persons (And Executors Of Estates Of U.s.

For purposes of the fgda, all international organizations are foreign government entities, including those of which the u.s. Web these regulations implement the provisions of the foreign gifts and decorations act (5 u.s.c. Citizen, is moving from illinois to london for a new job. Now that you know what form 3520 is, you must determine your eligibility when filing this form.

Web General Instructions Purpose Of Form U.s.

These customs and border protection, or cbp, initiatives resulted in the seizure of nearly 10,000 pounds of fentanyl headed for u.s. About our international tax law firm is there a foreign gift tax in the us? Name and position of the individual who presented the gift, award,. Web it doesn’t matter if the gift is to a u.s.

That Word “Certain” Is Key Here — There Are Different Reporting Triggers Depending On The Nature Of The Foreign Asset.

The form 3520 is used to report the value of a gift received from a foreign person. Web irs form 3520, “annual report to report transactions with foreign trusts and receipts of foreign gifts,” is one of the most common reports required when a u.s. What are the general requirements to report foreign gifts? Web foreign gifts and irs reporting.