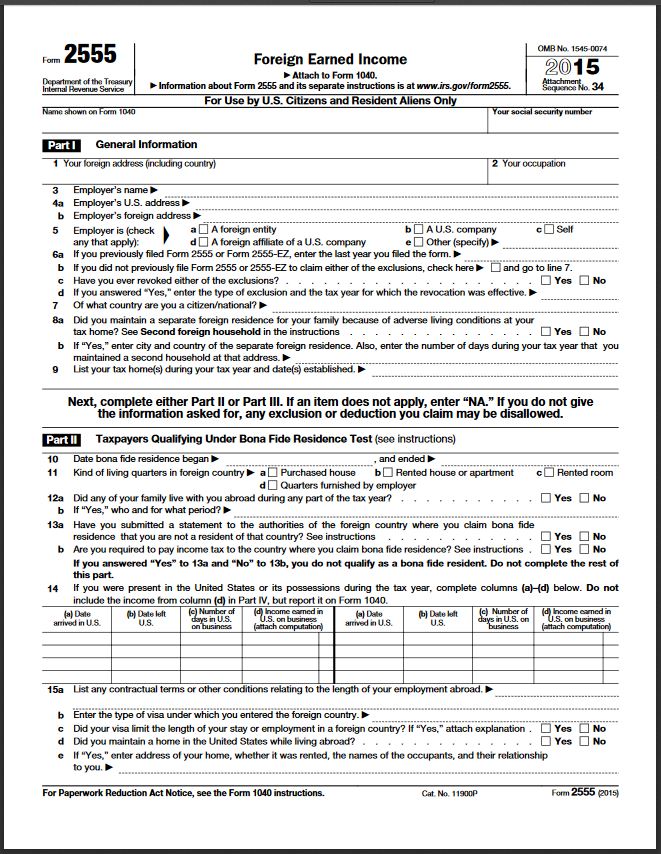

Foreign Earned Income Form 2555

Foreign Earned Income Form 2555 - Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web what is the foreign earned income exclusion (form 2555)? After sign into your account, select take me to my return. Web while you still have to declare all worldwide income to the internal revenue service on your federal income tax return, filing irs form 2555 may help you exclude. Ad download or email irs 2555 & more fillable forms, register and subscribe now! If you qualify, you can use the form 2555 to figure your foreign earned income exclusion and your housing. Create legally binding electronic signatures on any device. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web listen as our experienced panel explores filing form 2555, foreign income exclusion, including eligibility and applying for recently released relief for individuals. What this means for most expats is that they can use the.

You may also qualify to exclude. Web foreign earned income exclusion (form 2555) u.s. If eligible, you can also use form 2555 to request the foreign housing. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Web foreign earned income reported on form 2555 016. Beginning 10/1/2002, reintroduce rc 017 for. Web what is the foreign earned income exclusion (form 2555)? Resident alien living and working in a foreign. If you qualify, you can use the form 2555 to figure your foreign earned income exclusion and your housing. Web irs form 2555 is used to claim the foreign earned income exclusion (feie).

Resident alien living and working in a foreign. Web irs form 2555 is used to claim the foreign earned income exclusion (feie). You may also qualify to exclude. What this means for most expats is that they can use the. Web listen as our experienced panel explores filing form 2555, foreign income exclusion, including eligibility and applying for recently released relief for individuals. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. If you qualify, you can use the form 2555 to figure your foreign earned income exclusion and your housing. Web while you still have to declare all worldwide income to the internal revenue service on your federal income tax return, filing irs form 2555 may help you exclude. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country.

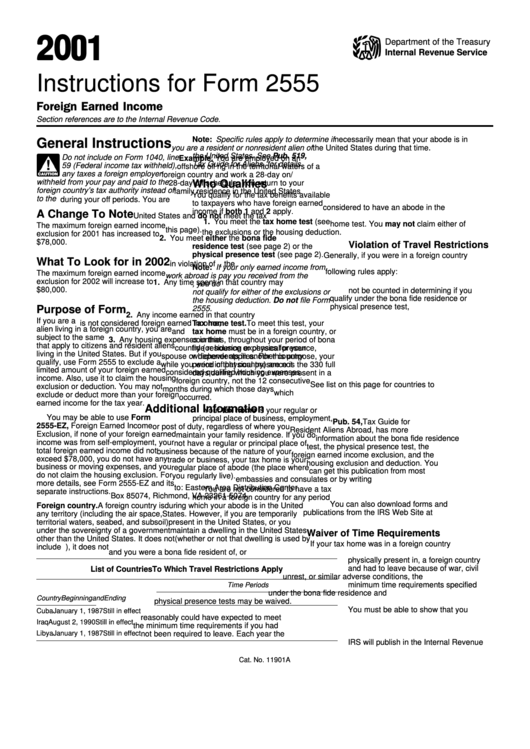

Instructions For Form 2555 Foreign Earned 2001 printable pdf

Nothing prints on the cp 21/22. You may also qualify to exclude. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion. Resident alien living and working in a foreign. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s.

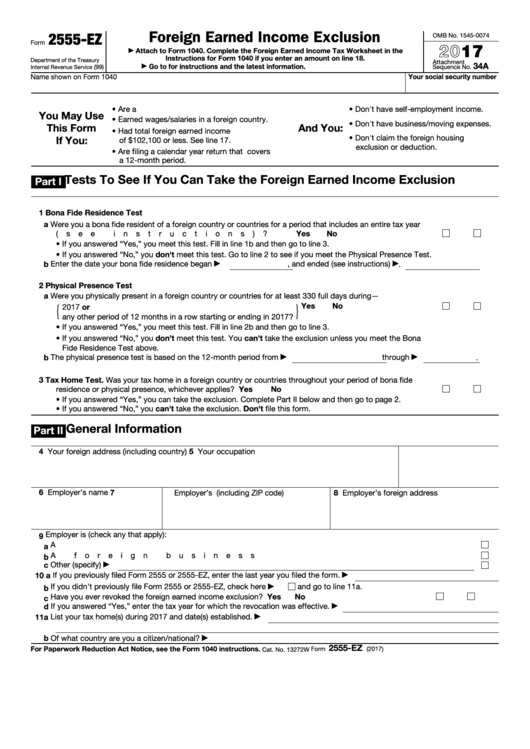

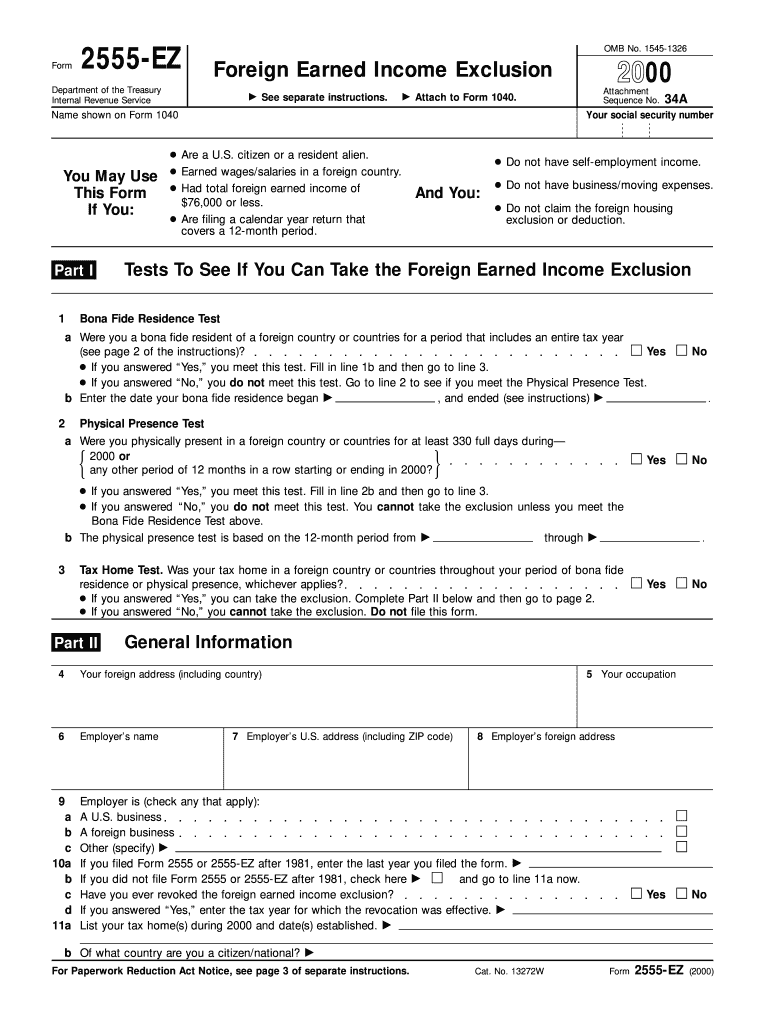

Fillable Form 2555Ez Foreign Earned Exclusion 2017 printable

Web irs form 2555 is used to claim the foreign earned income exclusion (feie). One of the more common misconceptions. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Ad download or email irs 2555 & more fillable forms, register and subscribe now! Web to enter foreign earned income /.

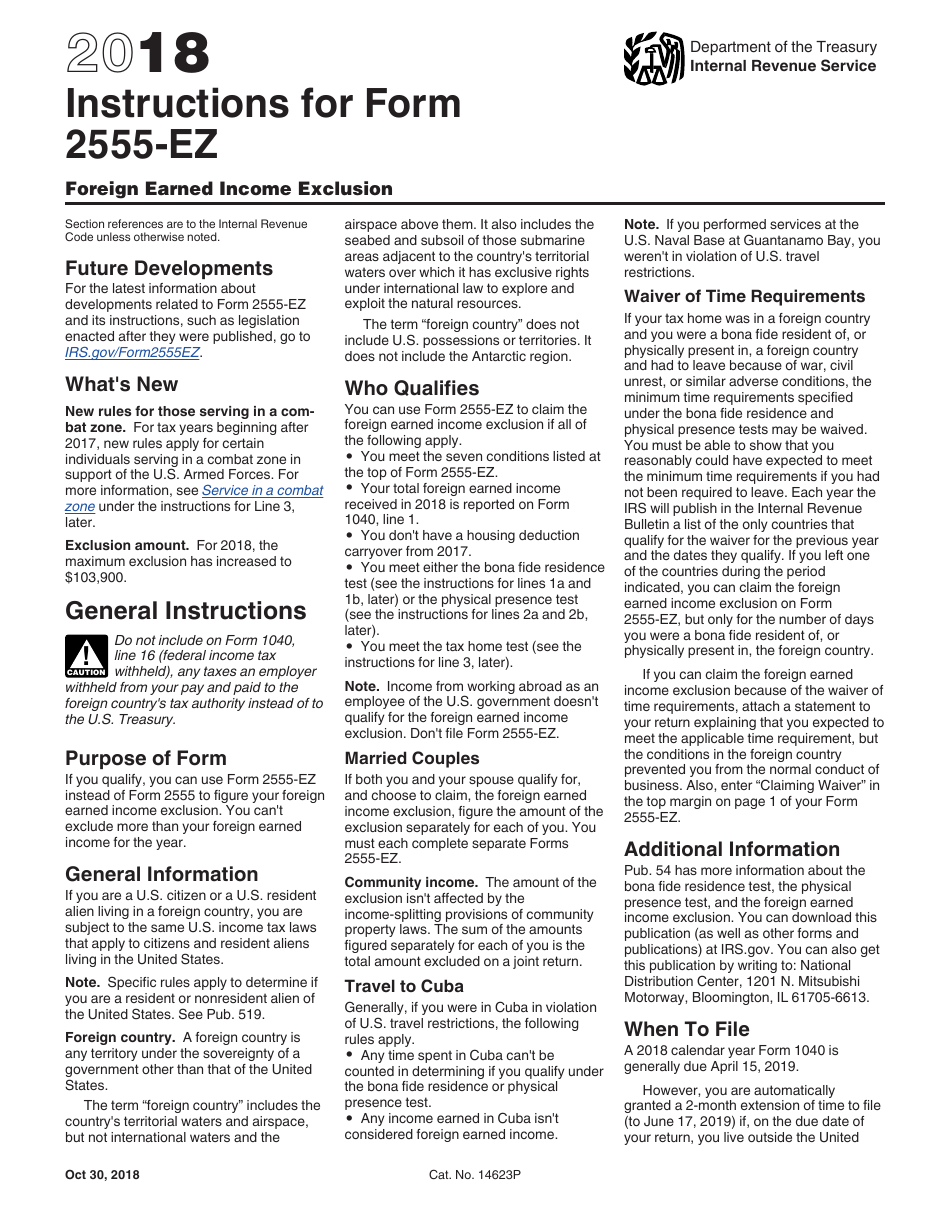

Download Instructions for IRS Form 2555EZ Foreign Earned

Web the foreign earned income exclusion, or feie, is one of the tax breaks available for us expats to eliminate or reduce any us tax liability on income earned. You may also qualify to exclude. Resident alien living and working in a foreign. Resident alien living and working in a foreign. Beginning 10/1/2002, reintroduce rc 017 for.

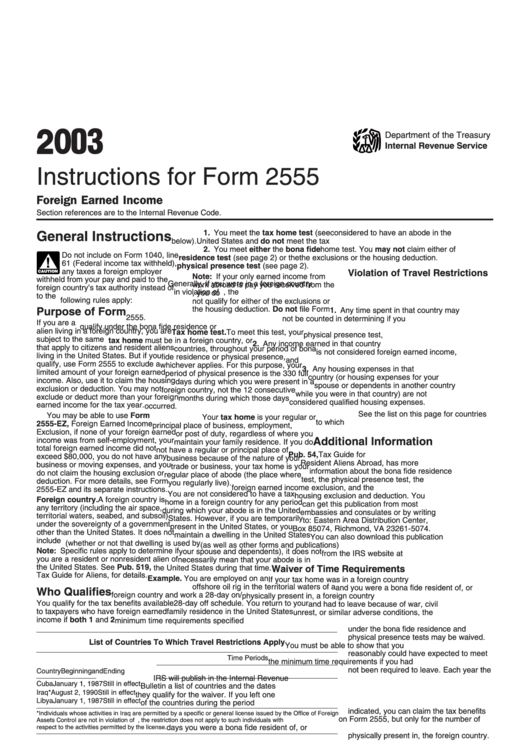

Instructions For Form 2555 Foreign Earned Internal Revenue

What this means for most expats is that they can use the. Create legally binding electronic signatures on any device. Resident alien living and working in a foreign. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion. To prepare a 2555 for both the taxpayer and spouse, after completing the initial 2555 screen.

Foreign Earned Exclusion Form 2555 Verni Tax Law

What this means for most expats is that they can use the. Web the foreign earned income exclusion, or feie, is one of the tax breaks available for us expats to eliminate or reduce any us tax liability on income earned. Web what is the foreign earned income exclusion (form 2555)? This form allows an exclusion of up to $100,800.

The Foreign Earned Exclusion is Only Available If a U.S.

Resident alien living and working in a foreign. Beginning 10/1/2002, reintroduce rc 017 for. Web what is the foreign earned income exclusion (form 2555)? This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. What this means for most expats is that they can use the.

Form 2555 EZ Foreign Earned Exclusion Irs Fill Out and Sign

If eligible, you can also use form 2555 to request the foreign housing. One of the more common misconceptions. To prepare a 2555 for both the taxpayer and spouse, after completing the initial 2555 screen. Create legally binding electronic signatures on any device. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion.

Form 2555 Foreign Earned

Web the foreign earned income exclusion, or feie, is one of the tax breaks available for us expats to eliminate or reduce any us tax liability on income earned. Web while you still have to declare all worldwide income to the internal revenue service on your federal income tax return, filing irs form 2555 may help you exclude. Web if.

Form 2555 Foreign Earned (2014) Free Download

Web use the tabs at the top of screen 2555 to navigate to the various parts of the form. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web irs form 2555 is used to claim the foreign earned income exclusion (feie). This form allows an exclusion of up to $107,600 of.

Foreign Earned Credit MissionaryHelp

This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. After sign into your account, select take me to my return. Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web to enter foreign earned income / exclusion in turbotax deluxe online program, here.

Resident Alien Living And Working In A Foreign.

Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages. To prepare a 2555 for both the taxpayer and spouse, after completing the initial 2555 screen. Web foreign earned income reported on form 2555 016. This form allows an exclusion of up to $100,800 of your foreign earned income if you are a u.s.

Web While You Still Have To Declare All Worldwide Income To The Internal Revenue Service On Your Federal Income Tax Return, Filing Irs Form 2555 May Help You Exclude.

One of the more common misconceptions. Web foreign earned income exclusion (form 2555) u.s. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Nothing prints on the cp 21/22.

Create Legally Binding Electronic Signatures On Any Device.

Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. If eligible, you can also use form 2555 to request the foreign housing. Web use the tabs at the top of screen 2555 to navigate to the various parts of the form. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion.

Beginning 10/1/2002, Reintroduce Rc 017 For.

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. You may also qualify to exclude. This form allows an exclusion of up to $107,600 of your foreign earned income if you are a u.s. After sign into your account, select take me to my return.