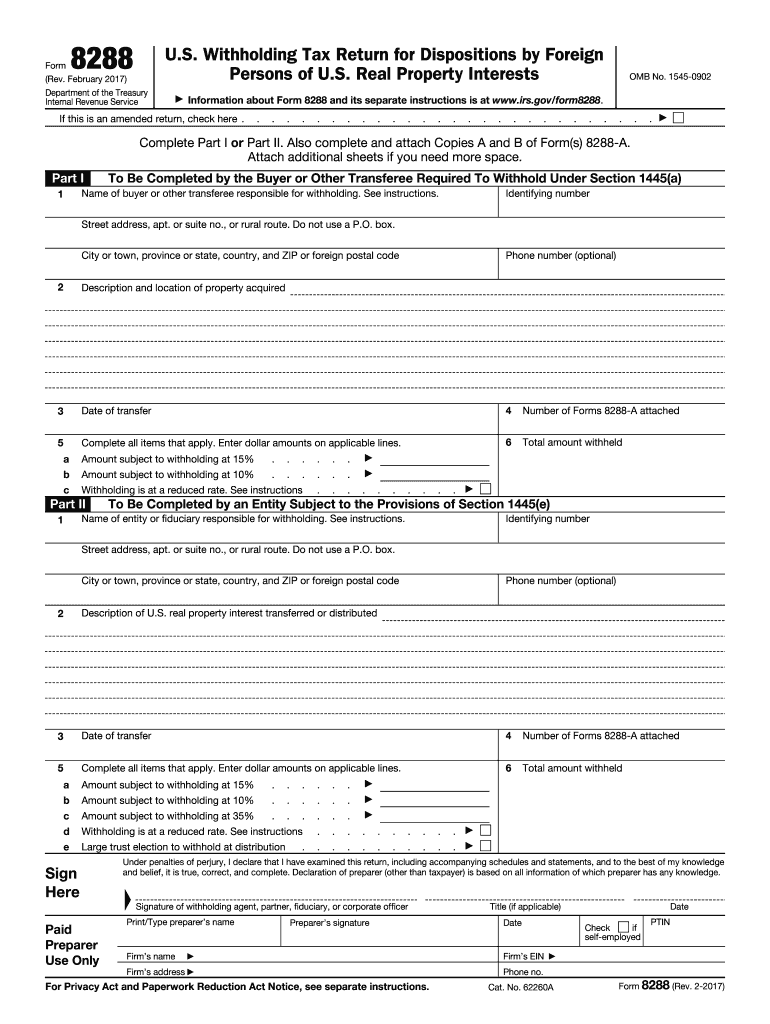

Firpta Form 8288

Firpta Form 8288 - Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Tax that may be owed by the foreign person. Web information about form 8288, u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Real property interests) to pay over all amounts withheld. Withholding tax return for dispositions by foreign persons of u.s. Real property interests | internal revenue service The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interests, where they will enter the amount subject to 10% or 15% withholding. Withholding tax return for dispositions by foreign persons of u.s.

Notify the irs before the disposition or Withholding tax return for dispositions by foreign persons of u.s. If this is a corrected return, check here. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Tax that may be owed by the foreign person. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for dispositions by foreign persons of u.s. Web to apply for the firpta exemption: Web information about form 8288, u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding.

Notify the irs before the disposition or Real property interests) to pay over all amounts withheld. Web information about form 8288, u.s. Real property interests | internal revenue service Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Tax that may be owed by the foreign person. Use form 8288 to report and transmit the amount withheld.” who files form 8288? The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. If this is a corrected return, check here. This withholding serves to collect u.s.

What is FIRPTA and How to Avoid It

The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. If this is a corrected return, check here. Withholding tax return for dispositions by foreign persons of u.s. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Real.

Form 8288, U.S. Withholding Tax Return for Dispositions by IRS

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. If this is a corrected return, check here. Web information about form 8288, u.s. Real property interests, including recent updates, related forms and instructions on how to file. Web foreign persons use this form to.

State Of Nc Firpta Affidavit Form Fill and Sign Printable Template

Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Web to apply for the firpta exemption: Use form 8288 to report and transmit.

Form 8288B FIRPTA and reduced withholding

Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Use form 8288 to report and transmit the amount withheld.” who files form 8288? Real property interests) to pay over all amounts withheld. The 15% will be held in escrow while the.

What is FIRPTA and how do I avoid it? Sarasota/Manatee Area Real

Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s. Real property interests, where they will enter the amount subject to 10% or 15% withholding. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and.

Firpta Exemption Certificate Master of Documents

Tax that may be owed by the foreign person. Withholding tax return for dispositions by foreign persons of u.s. Real property interests) to pay over all amounts withheld. Withholding tax return for dispositions by foreign persons of u.s. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal.

Form 8288B FIRPTA and reduced withholding

Real property interests) to pay over all amounts withheld. Web in most cases, the buyer must complete form 8288, u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. This withholding serves to collect u.s. Real property interests, including recent updates, related forms and instructions on how to file.

Form 8288B and FIRPTA FIRPTA FIRPTA!

Real property interests, including recent updates, related forms and instructions on how to file. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Use form 8288 to report and transmit the amount withheld.” who files form 8288? Tax that may be owed by the foreign person. Withholding.

Firpta Form 8288 Fill online, Printable, Fillable Blank

Web to apply for the firpta exemption: Use form 8288 to report and transmit the amount withheld.” who files form 8288? Real property interests, where they will enter the amount subject to 10% or 15% withholding. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. If this is a corrected.

Form 8288B Application for Withholding Certificate for Dispositions

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. If this is a corrected return, check here. Real property interests | internal revenue service Real property interests, where they will enter the amount subject to 10% or 15% withholding. Web in most cases, the.

Withholding Tax Return For Dispositions By Foreign Persons Of U.s.

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Real property interests) to pay over all amounts withheld. Web information about form 8288, u.s. Web in most cases, the buyer must complete form 8288, u.s.

Web The Withholding Obligation Also Applies To Foreign And Domestic Corporations, Qualified Investment Entities, And The Fiduciary Of Certain Trusts And Estates.

Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s.

If This Is A Corrected Return, Check Here.

Web to apply for the firpta exemption: Real property interests, where they will enter the amount subject to 10% or 15% withholding. Withholding tax return for dispositions by foreign persons of u.s. Notify the irs before the disposition or

Tax That May Be Owed By The Foreign Person.

The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. This withholding serves to collect u.s. Real property interests | internal revenue service Use form 8288 to report and transmit the amount withheld.” who files form 8288?