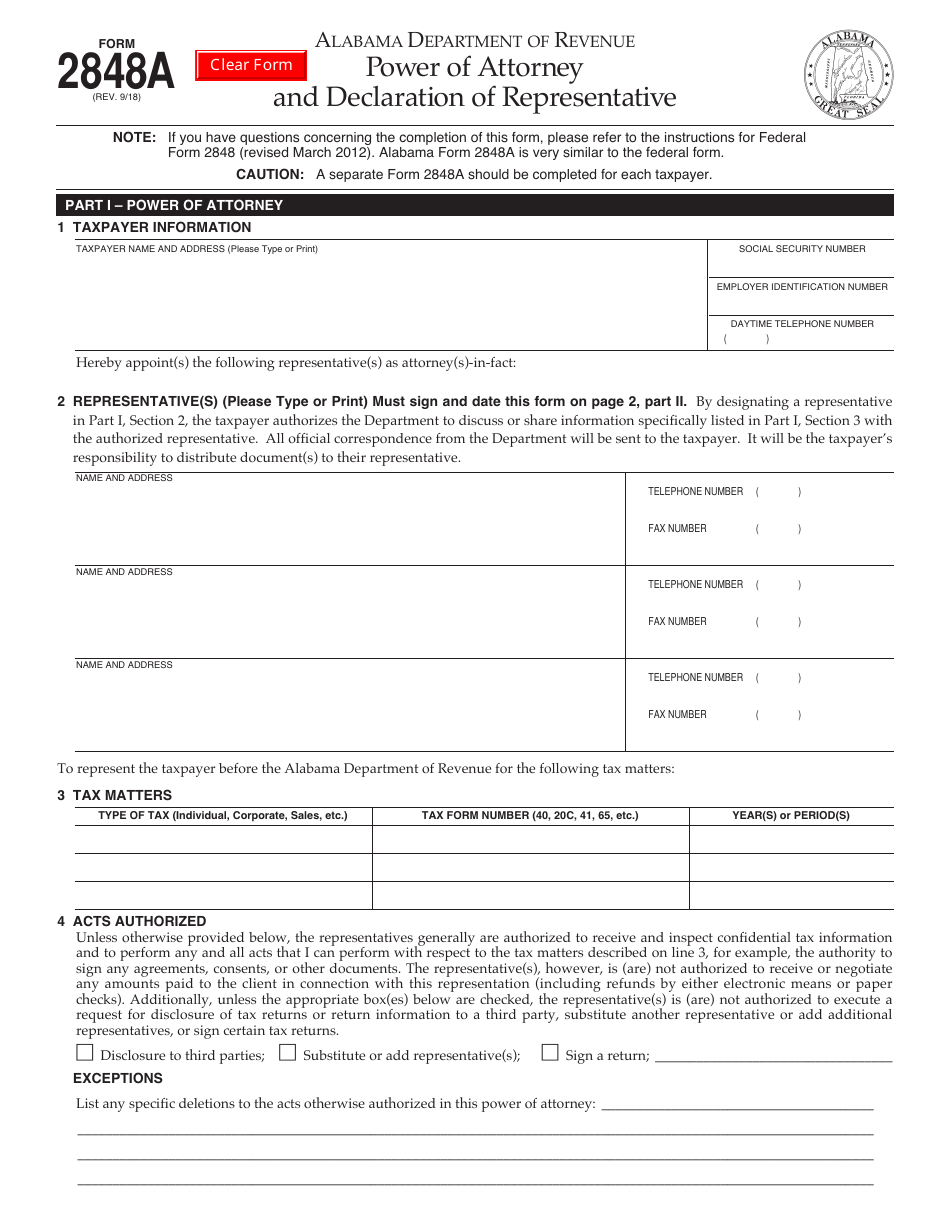

Fillable Form 2848

Fillable Form 2848 - Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more. Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. We are passionate about helping our readers understand the complexities of this form. Part i power of attorney caution: January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. Department of the treasury internal revenue service type or print. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Web irs power of attorney form 2848 | revised jan.

A separate form 2848 must be completed for each taxpayer. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Department of the treasury internal revenue service type or print. Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. A separate form 2848 should be completed for each taxpayer. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Part i power of attorney caution:

This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web 2848 power of attorney form (rev. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. We are passionate about helping our readers understand the complexities of this form. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Part i power of attorney caution: Web 2848 power of attorney omb no. Part i power of attorney caution: Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. A separate form 2848 must be completed for each taxpayer.

Form 2848‐ME‐L Download Fillable PDF or Fill Online Limited Power of

Department of the treasury internal revenue service type or print. A separate form 2848 must be completed for each taxpayer. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. Web 2848 power of attorney form (rev. Irs power of attorney form 2848 is a document used when.

Form 2848 Edit, Fill, Sign Online Handypdf

Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the.

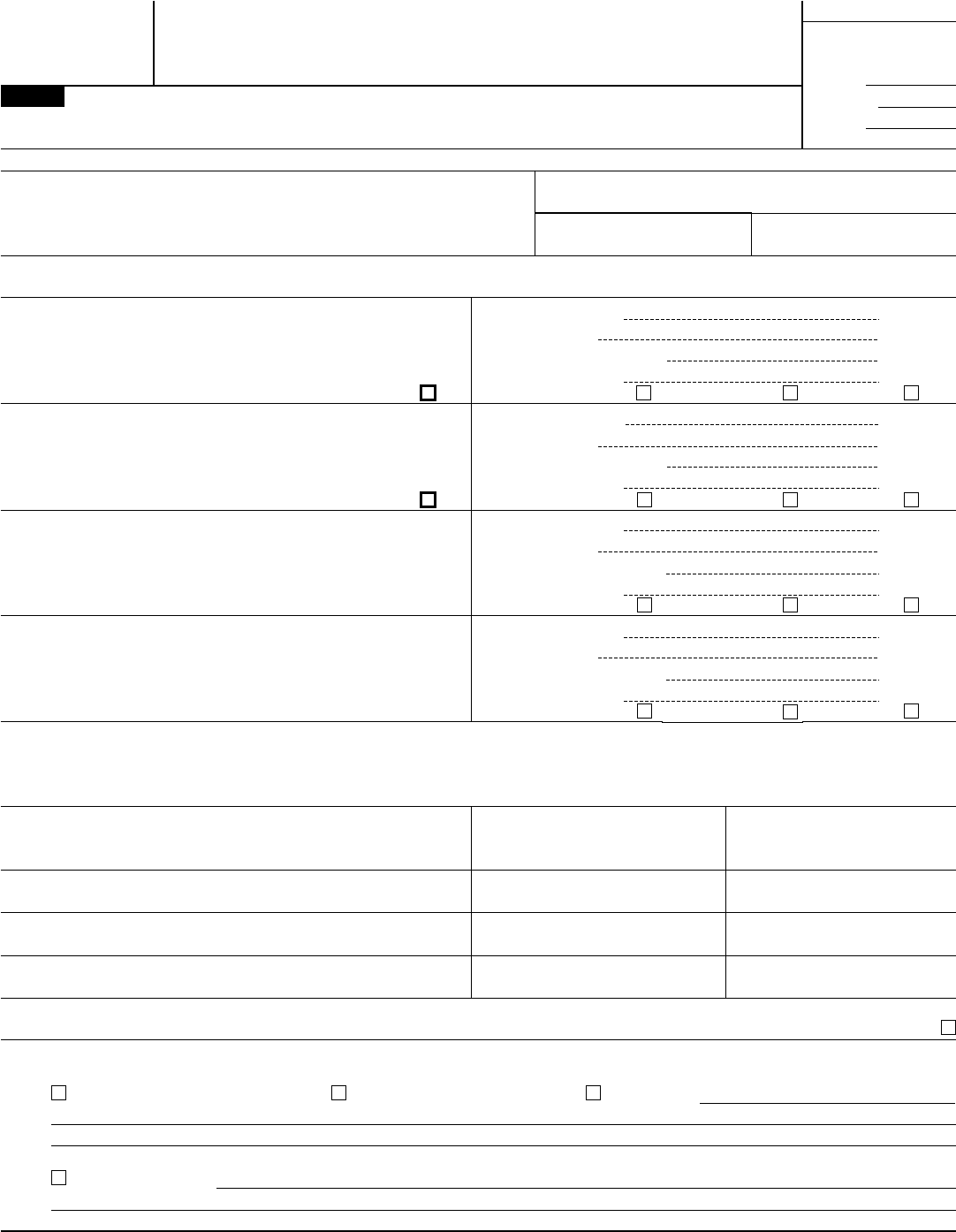

Form IL2848A Download Fillable PDF or Fill Online Power of Attorney

A separate form 2848 should be completed for each taxpayer. We are passionate about helping our readers understand the complexities of this form. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Because a partnership representative is required to be designated for each.

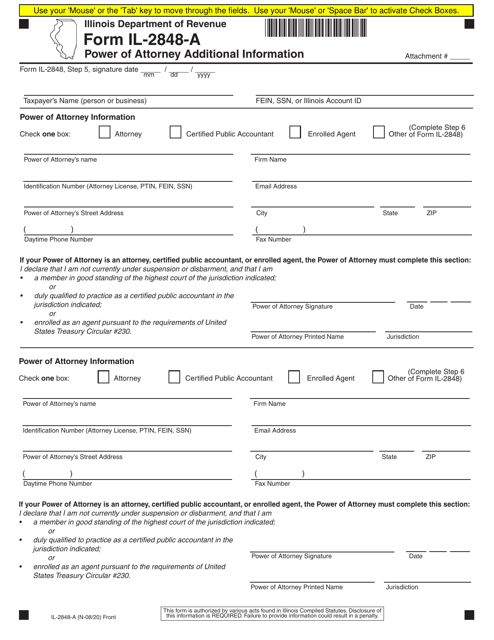

Download Instructions for IRS Form 2848 Power of Attorney and

January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. Web 2848 power of attorney form (rev. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income.

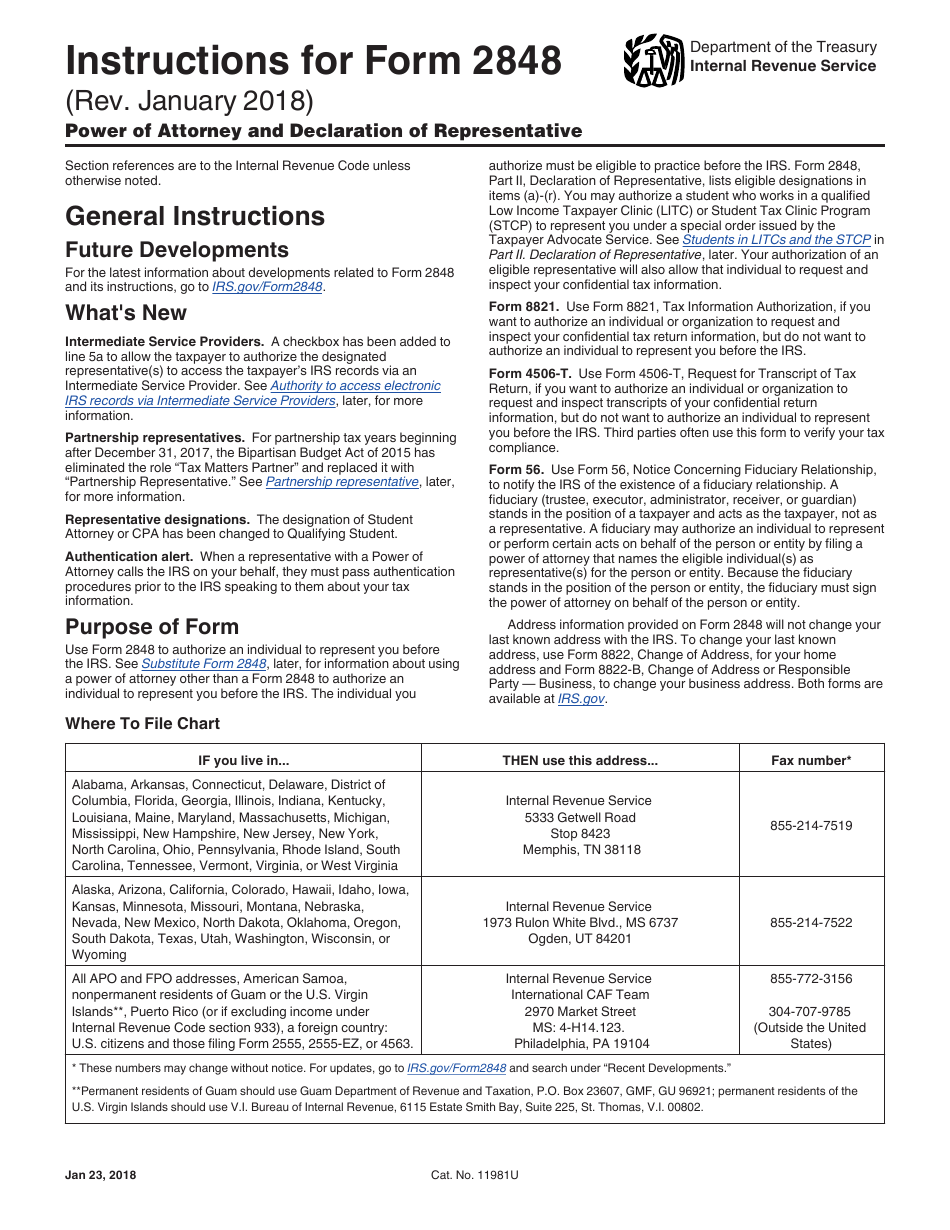

Form 2848A Download Fillable PDF or Fill Online Power of Attorney and

Part i power of attorney caution: A separate form 2848 should be completed for each taxpayer. Web 2848 power of attorney omb no. Because a partnership representative is required to be designated for each tax year, it is recommended that a separate form 2848 be completed for each tax year a particular pr would like to appoint a power of.

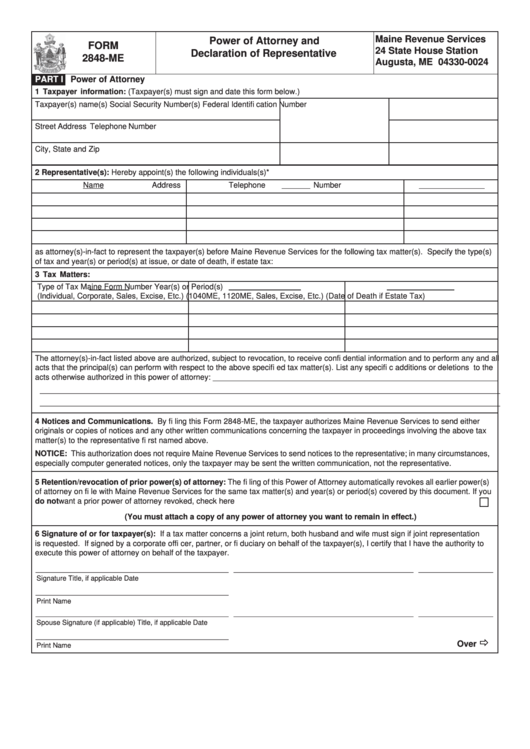

Fillable Form 2848Me Power Of Attorney And Declaration Of

Part i power of attorney caution: Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. A separate form 2848 should be completed for each taxpayer. This form grants a designated individual the authority to represent you.

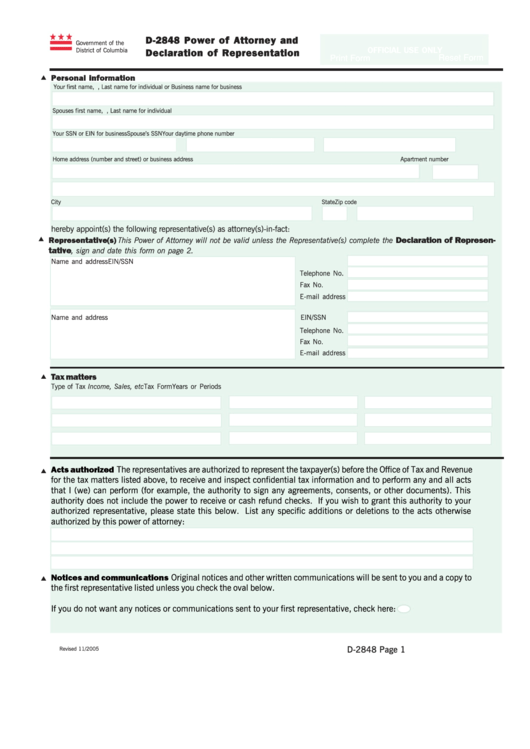

Fillable Form D2848 Power Of Attorney And Declaration Of

Part i power of attorney caution: A separate form 2848 should be completed for each taxpayer. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. A separate form 2848 must be completed for each taxpayer. Web.

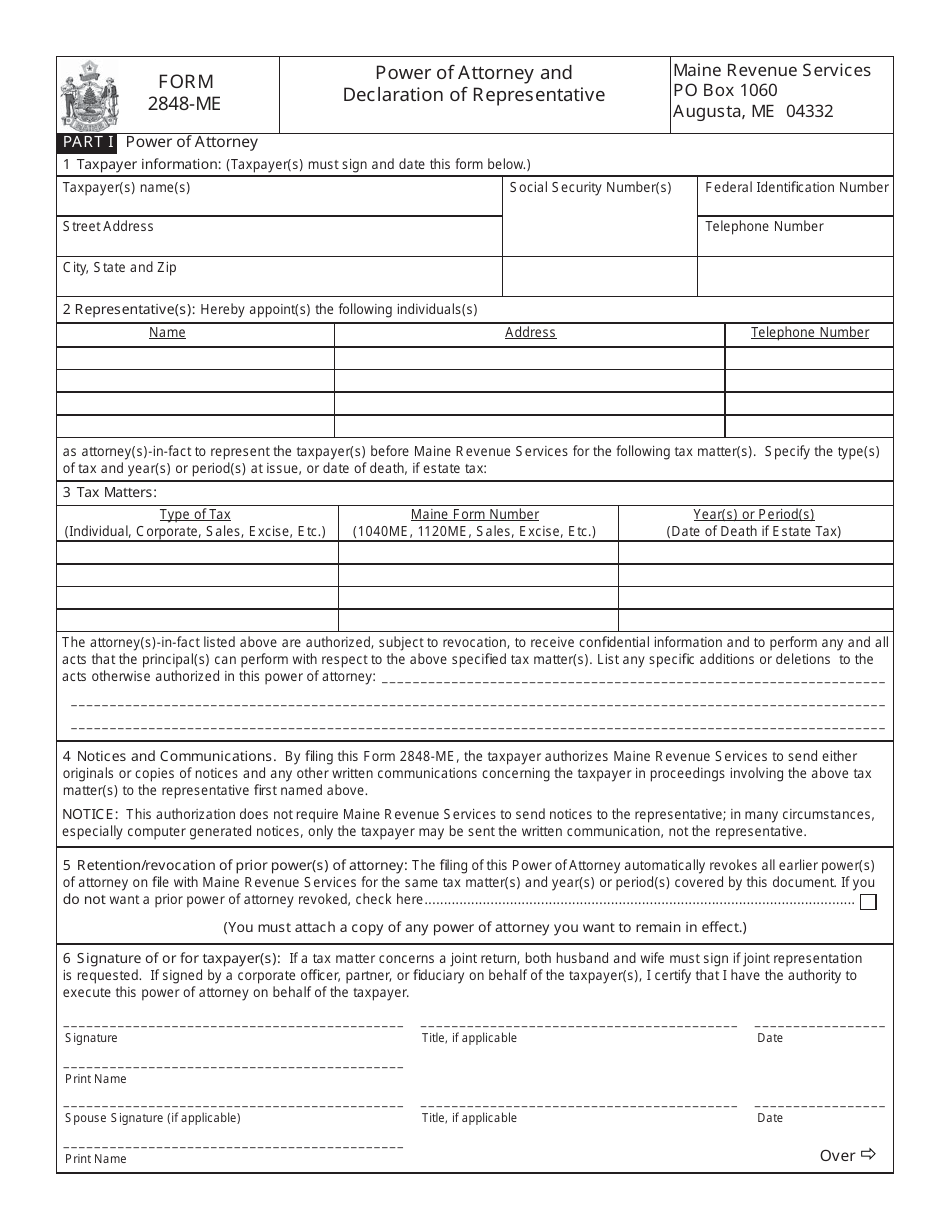

Form 2848ME Download Printable PDF or Fill Online Power of Attorney

Because a partnership representative is required to be designated for each tax year, it is recommended that a separate form 2848 be completed for each tax year a particular pr would like to appoint a power of attorney. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information..

20182020 Form IRS 2848 Fill Online, Printable, Fillable, Blank PDFfiller

Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the.

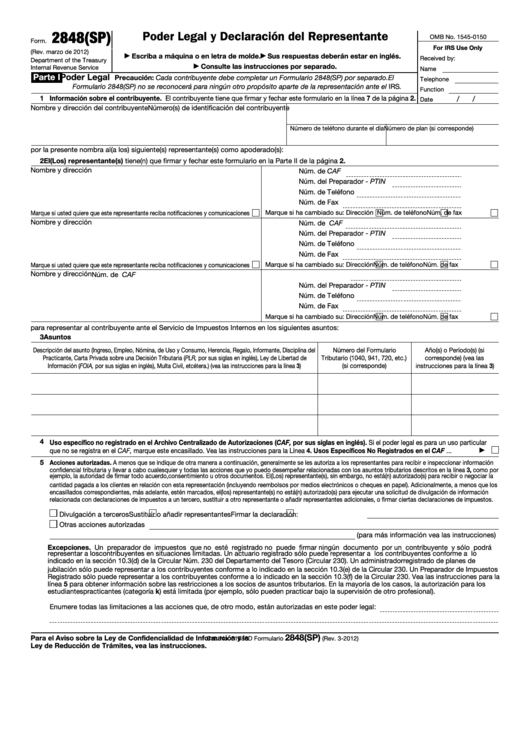

Fillable Form 2848(Sp) Poder Legal Y Declaracion Del Representante

Part i power of attorney caution: Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. A separate form 2848 must be completed for each taxpayer. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions.

We Are Two Financial Specialists That Have Come Together To Create A Website Dedicated To Providing Valuable Guidance And Tips For People Who Use The 2848 Form.

Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Because a partnership representative is required to be designated for each tax year, it is recommended that a separate form 2848 be completed for each tax year a particular pr would like to appoint a power of attorney.

Irs Power Of Attorney Form 2848 Is A Document Used When Designating Someone Else (Accountant) To File Federal Taxes On Behalf Of An Entity Or Individual.

Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web 2848 power of attorney omb no. Part i power of attorney caution:

A Separate Form 2848 Should Be Completed For Each Taxpayer.

Web 2848 power of attorney form (rev. Part i power of attorney caution: A separate form 2848 must be completed for each taxpayer. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information.

Web Irs Power Of Attorney Form 2848 | Revised Jan.

Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Department of the treasury internal revenue service type or print. We are passionate about helping our readers understand the complexities of this form. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination.