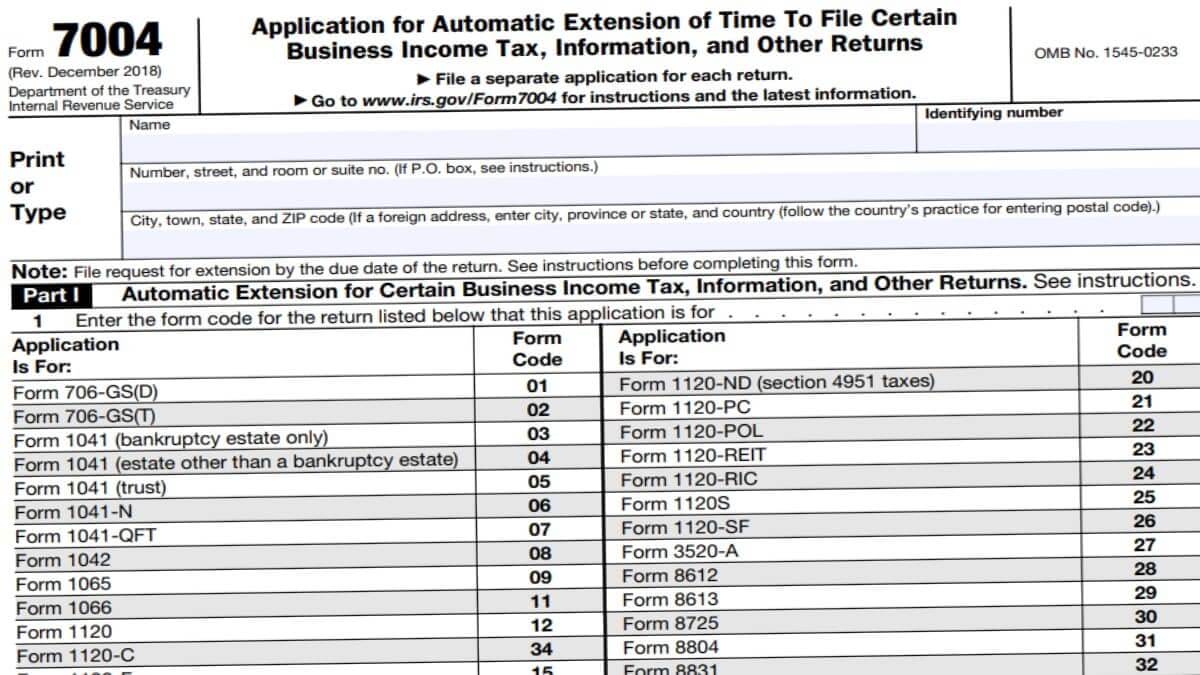

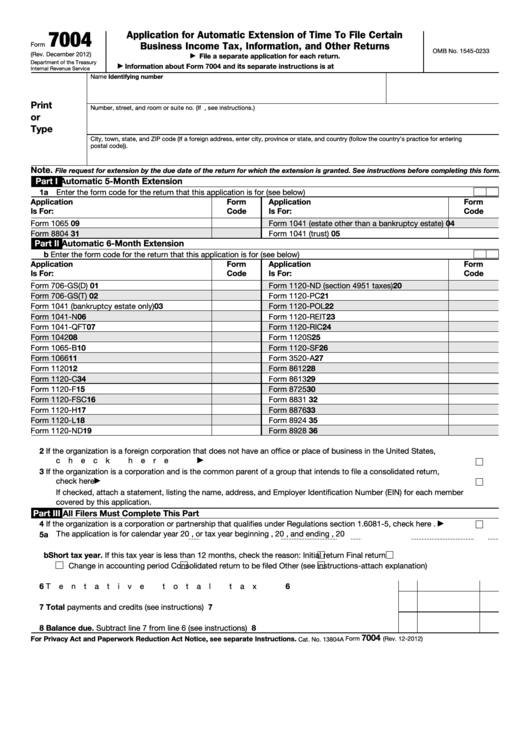

Fill In Form 7004

Fill In Form 7004 - Irs form 7004 is the form required by the internal revenue service in case your. Complete, edit or print tax forms instantly. Web where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to. Form 7004 has three parts ― depending. Corporation tax returns are due on. Complete, edit or print tax forms instantly. Form 7004 is used to request an automatic. The first part has all the needed forms for which it can be. Web the following instructions were revised: Web you must file form 7004 by the due date of your business tax return.

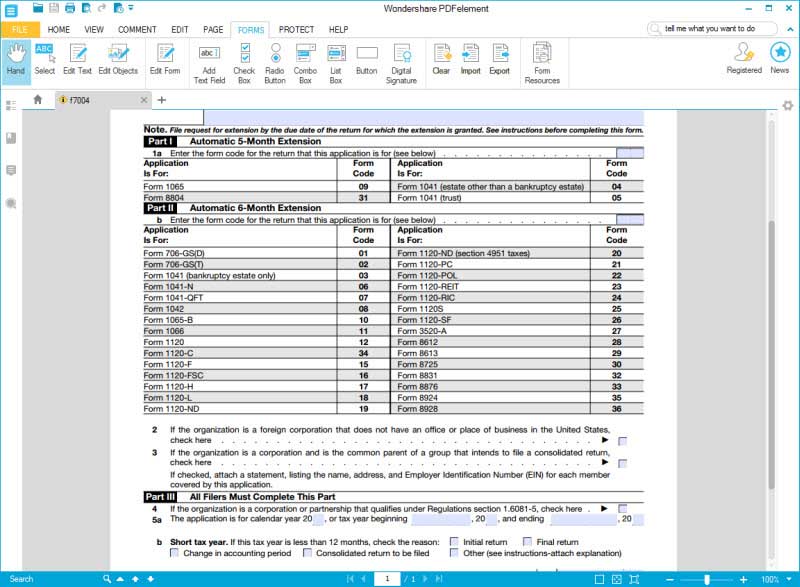

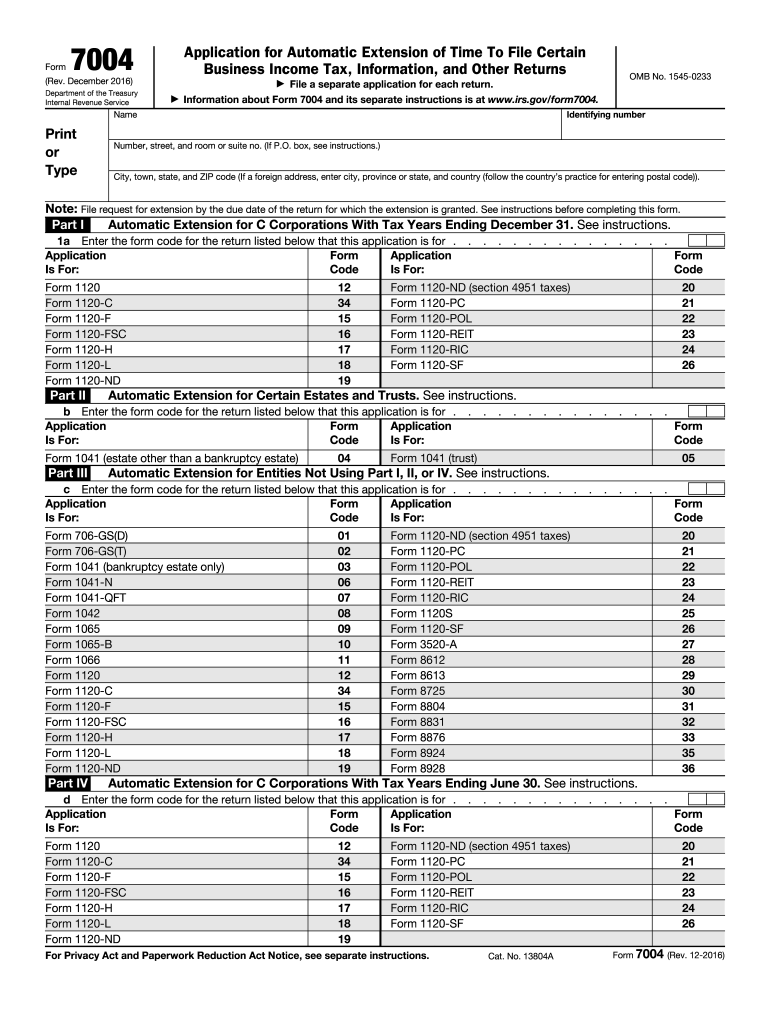

Form 7004 has three parts ― depending. The form's structure was changed, and it now consists of two distinct parts. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. File your taxes like a pro. Ad filing your tax extension just became easier! Choose form 7004 and select the form. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 7004? Web 13 rows purpose of form. Complete irs tax forms online or print government tax documents.

Web 13 rows purpose of form. Web how to fill out form 7004 form 7004 is a relatively short form by irs standards. Irs form 7004 is the form required by the internal revenue service in case your. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. You do not have to wait to be approved. Form 7004 is used to request an automatic. Ad access irs tax forms. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 7004? Complete irs tax forms online or print government tax documents. If you just need the basics, here’s.

Business Tax Extension 7004 Form 2021

Web here what you need to start: Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 7004? How and when to file form 7004 and make tax payments; Web follow these steps to complete your business tax extension form 7004 using expressextension: It only requires that you enter the name,.

Instructions for How to Fill in IRS Form 7004

Complete irs tax forms online or print government tax documents. Before you start filling out the printable. File your taxes like a pro. Web here what you need to start: Form 7004 has three parts ― depending.

2020 IRS Form 7004 A Complete Guide! IRSForm7004

The first part has all the needed forms for which it can be. Form 7004 is used to request an automatic. Use form 7004 to request an automatic extension of time to file certain. Web form 7004 can be filed electronically for most returns. Complete irs tax forms online or print government tax documents.

Where to file Form 7004 Federal Tax TaxUni

Web you must file form 7004 by the due date of your business tax return. Complete irs tax forms online or print government tax documents. Web where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to. You do not have to wait.

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Web form 7004 can be filed electronically for most returns. Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs. Web follow these steps to complete your business tax extension form 7004 using expressextension: Ad get ready for tax season deadlines by completing any required tax forms today..

Form 7004 Fill Out and Sign Printable PDF Template signNow

Page 1 of 3 omb no. Who’s eligible for a form 7004 extension; Web how to fill out form 7004 form 7004 is a relatively short form by irs standards. Complete, edit or print tax forms instantly. It only requires that you enter the name, address, and tax id number for your.

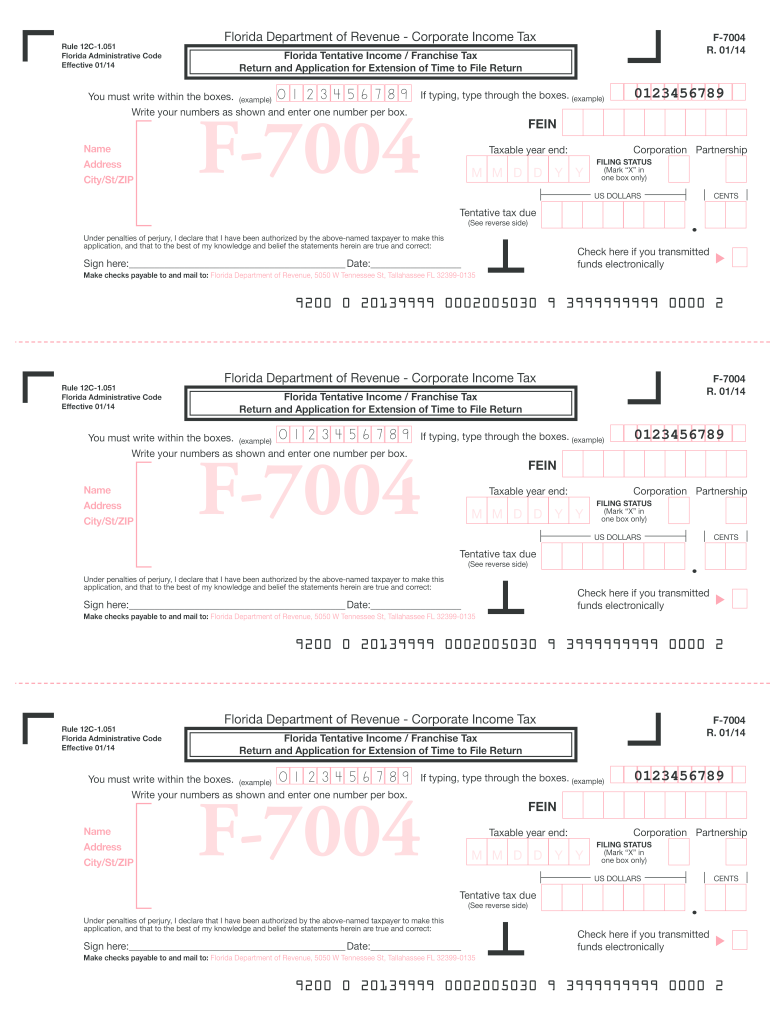

2014 Form FL DoR F7004 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web you must file form 7004 by the due date of your business tax return. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 7004? The form's structure was changed, and it now consists of two distinct parts. Complete, edit or print tax.

Fillable Form 7004 Application For Automatic Extension Of Time To

Web here what you need to start: Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs. Web follow these steps to complete your business tax extension form 7004 using expressextension: Who’s eligible for a form 7004 extension; Use form 7004 to request an automatic extension of time.

Form Mo7004 Application For Extension Of Time To File Edit, Fill

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for. Ad access irs tax forms. The first part has.

How to Fill Out Tax Extension Form 7004 IRS Tax Lawyer

Page 1 of 3 omb no. Complete, edit or print tax forms instantly. Form 7004 has three parts ― depending. The form's structure was changed, and it now consists of two distinct parts. Web where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of.

Web What Form 7004 Is;

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web form 7004 can be filed electronically for most returns. How and when to file form 7004 and make tax payments; Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for.

Before You Start Filling Out The Printable.

The first part has all the needed forms for which it can be. Complete irs tax forms online or print government tax documents. Page 1 of 3 omb no. Irs form 7004 is the form required by the internal revenue service in case your.

Web 01 Fill And Edit Template 02 Sign It Online 03 Export Or Print Immediately What Is Irs Form 7004?

Choose form 7004 and select the form. Form 7004 has three parts ― depending. The form's structure was changed, and it now consists of two distinct parts. Web the following instructions were revised:

Web 13 Rows Purpose Of Form.

Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs. Complete, edit or print tax forms instantly. Form 7004 is used to request an automatic. Who’s eligible for a form 7004 extension;