Filing Form 1096 Electronically

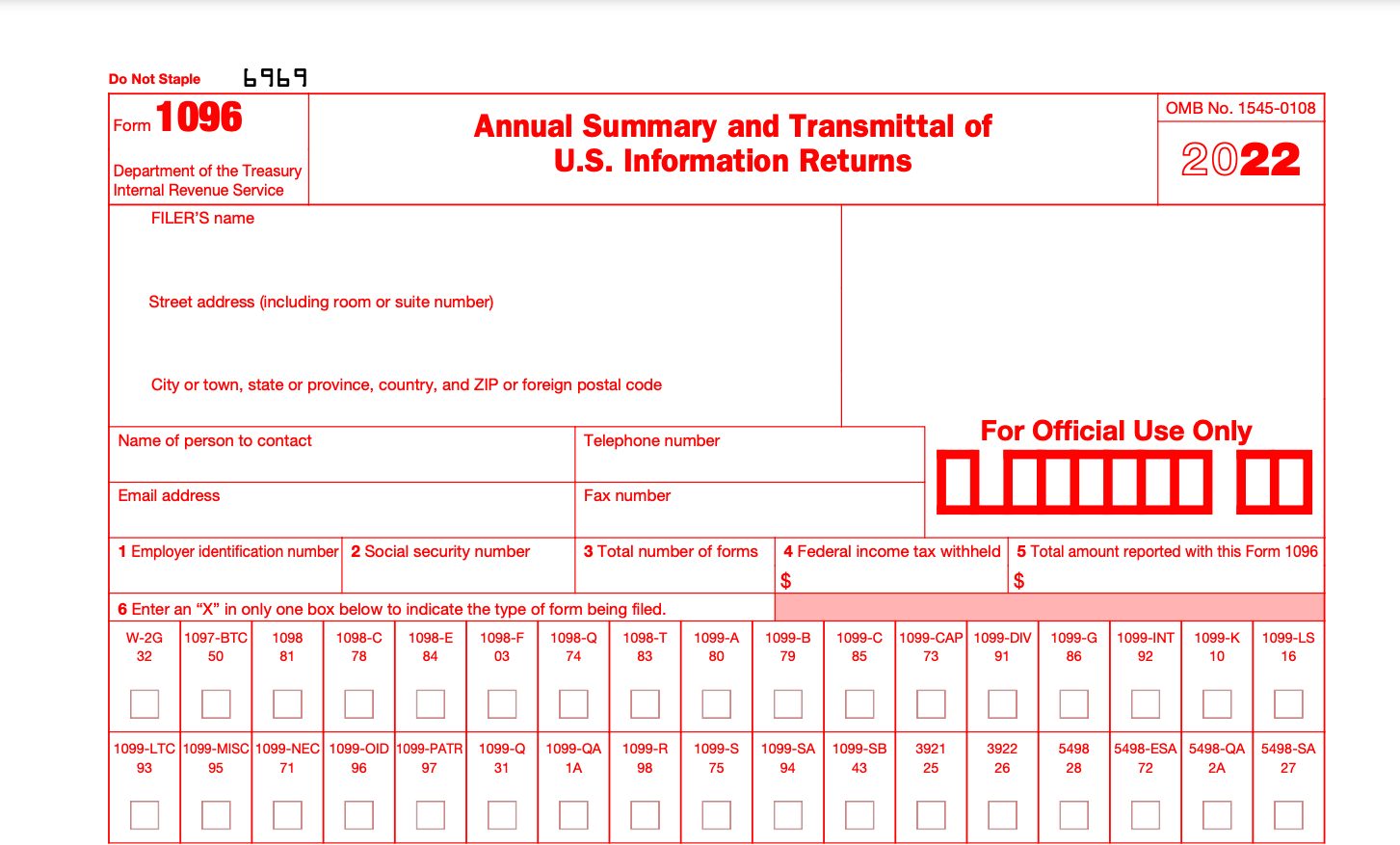

Filing Form 1096 Electronically - Upload, modify or create forms. Web when filing 1099 forms electronically, there’s no need to submit form 1096 to the irs. Web what is form 1096? Obtain a blank 1099 form (which is printed. Information returns are records other than tax returns that the irs requires to document certain financial transactions. Do not use form 1096 to transmit electronically. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. That said, you don't need to file. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Follow these steps to prepare and file a form 1099:

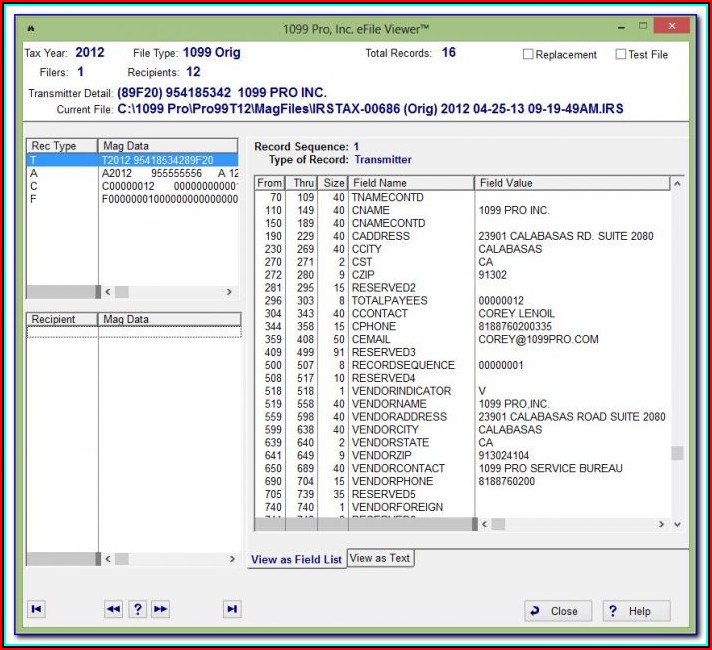

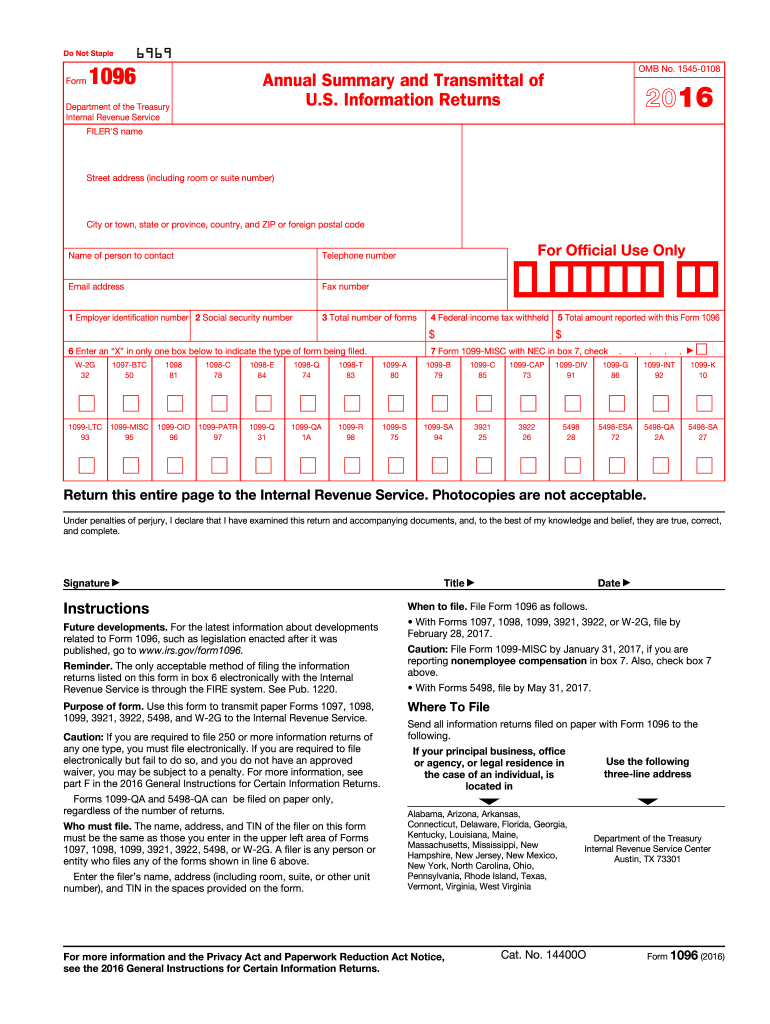

Upload, modify or create forms. Web when filing 1099 forms electronically, there’s no need to submit form 1096 to the irs. Web when you electronically file your 1099s and 1096, you'll receive an email that contains the link to download the employer copy of the forms. Enter your name, address, and identification numbers in the designated spaces. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Information returns are records other than tax returns that the irs requires to document certain financial transactions. Complete, edit or print tax forms instantly. Send all information returns filed on paper to the following. Do not use form 1096 to transmit electronically. Web form 1096 is the summary form that you must also file when filing on paper with the irs.

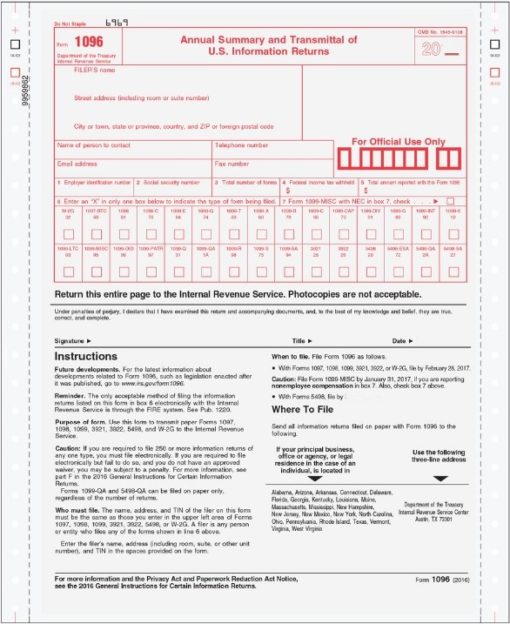

Send all information returns filed on paper to the following. More information can be found at: Edit, sign and save irs 1096 form. Provide the total number of information returns being filed. Follow these steps to prepare and file a form 1099: Obtain a blank 1099 form (which is printed. Official site | smart tools. Irs form 1096 is the annual summary and transmittal of u.s. Try it for free now! Information returns are records other than tax returns that the irs requires to document certain financial transactions.

Filing Form 1099 And 1096 Form Resume Examples MeVReE6YDo

Send all information returns filed on paper to the following. Web what is an information return? The following forms may be. More information can be found at: Provide the total number of information returns being filed.

Printable Form 1096 1096 Tax Form Due Date Universal Network What

More information can be found at: Official site | smart tools. Web form 1096 is the summary form that you must also file when filing on paper with the irs. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Complete, edit or print tax forms instantly.

1096 (2019) PDFRun

Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Upload, modify or create forms. Send all information returns filed on paper to the following. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Do not use form 1096 to transmit electronically.

Form 1096 A Simple Guide Bench Accounting

Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Enter your name, address, and identification numbers in the designated spaces. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Do not use form 1096 to transmit electronically. Follow these steps to prepare.

Printable Form 1096 / 1096 Tax Form Due Date Universal Network

Web what is an information return? More information can be found at: Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Upload, modify or create forms. Provide the total number of information returns being filed.

1099 Filing with 1099 Forms, Envelopes, Software, Efile

Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. However, form 1096 is not needed when filing electronically. The following forms may be. More information can be found at: Send all information returns filed on paper to the following.

What You Need to Know About 1096 Forms Blue Summit Supplies

Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Complete, edit or print.

1096 Form Fill Out and Sign Printable PDF Template signNow

Web what is form 1096? Irs form 1096 is the annual summary and transmittal of u.s. Official site | smart tools. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Edit, sign and save irs 1096 form.

Form 1096, Transmittal of Forms 1098, 1099, 5498 and W2G to the IRS

The following forms may be. Do not use form 1096 to transmit electronically. Follow these steps to prepare and file a form 1099: Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Web when you electronically file your 1099s and 1096, you'll receive an email that contains the link to download the employer copy.

Filing Form 1096 and Form W3 with TaxBandits Blog TaxBandits

Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Provide the total number of information returns being filed. Follow these steps to prepare and file a form 1099: See electronic filing requirement, on the reverse. Irs form 1096 is the annual summary and transmittal of u.s.

Follow These Steps To Prepare And File A Form 1099:

Provide the total number of information returns being filed. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. More information can be found at: Web form 1096 is used to transmit paper forms 1099 to the internal revenue service.

Web What Is Form 1096?

That said, you don't need to file. Complete, edit or print tax forms instantly. Obtain a blank 1099 form (which is printed. Web form 1096 is the summary form that you must also file when filing on paper with the irs.

Do Not Use Form 1096 To Transmit Electronically.

See electronic filing requirement, on the reverse. Send all information returns filed on paper to the following. Irs form 1096 is the annual summary and transmittal of u.s. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format.

More Information Can Be Found At:

Edit, sign and save irs 1096 form. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. Information returns are records other than tax returns that the irs requires to document certain financial transactions. Upload, modify or create forms.