Federal Form 4797

Federal Form 4797 - Web how do i fill out tax form 4797 after sale of a rental property? This may include your home that was converted into a rental property or any real property used for trade or business. Gains and losses on the sale of depreciable assets held. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web use form 4797 to report the following. Web a if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web federal form 4797 federal sales of business property form 4797 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Complete and file form 4797: Gains and losses on the sale of nondepreciable assets.

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web partnerships, limited liability companies (llcs) classified as partnerships, s corporations, and their partners, members, and shareholders, must follow the procedures for reporting. Real property used in your trade or business; Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web form 4797, sales of business property, page 1, is used to report: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. •the sale or exchange of: Web a if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of.

This may include your home that was converted into a rental property or any real property used for trade or business. Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web use form 4797 to report the following. Complete, edit or print tax forms instantly. Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of. Web a if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web how do i fill out tax form 4797 after sale of a rental property? Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,.

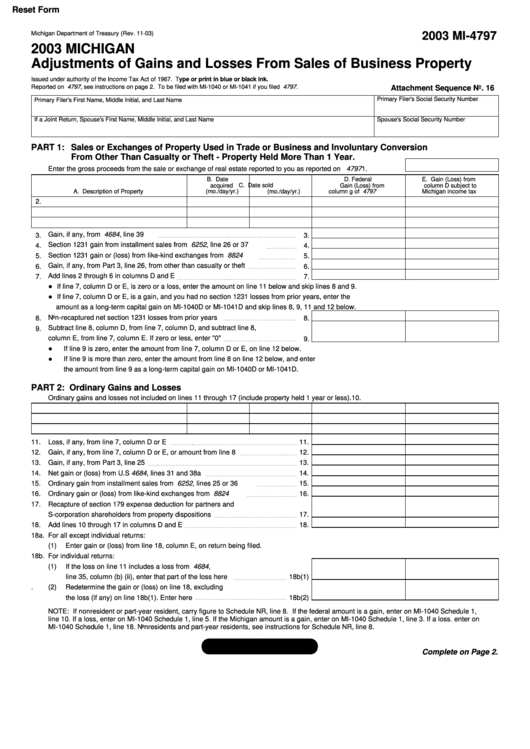

Form Mi4797 Michigan Adjustments Of Gains And Losses From Sales Of

Web form 4797, sales of business property, page 1, is used to report: Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797, in order to. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on.

Fill Form 2020 20S *2000012S* 6 S Corporation InformationTax (State

Web generally, form 4797 is used to report the sale of a business. Web federal form 4797 federal sales of business property form 4797 pdf form content report error it appears you don't have a pdf plugin for this browser. Gains and losses on the sale of nondepreciable assets. Gains and losses on the sale of depreciable assets held. Web.

How to Report the Sale of a U.S. Rental Property Madan CA

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Complete and file form 4797: Depreciable and amortizable tangible property used in your. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web you must report the full amount of depreciation, allowed.

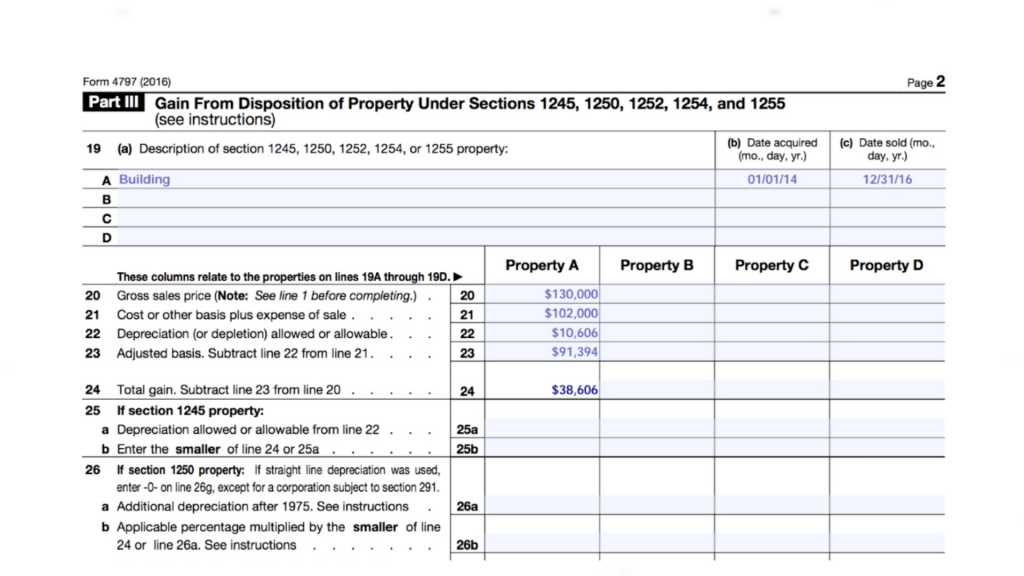

Use your tax software to complete the following

Web form 4797, sales of business property, page 1, is used to report: Attach form 4684 to your tax. Real property used in your trade or business; Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of. This may include.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Attach form 4684 to your tax. Web use form 4797 to report the following. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Web find federal form 4797 instructions at esmart tax today.

IRS 4797 2019 Fill and Sign Printable Template Online US Legal Forms

Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of. Web up to $40 cash back form 4797 department of the treasury internal revenue service (99) (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)). Web federal form.

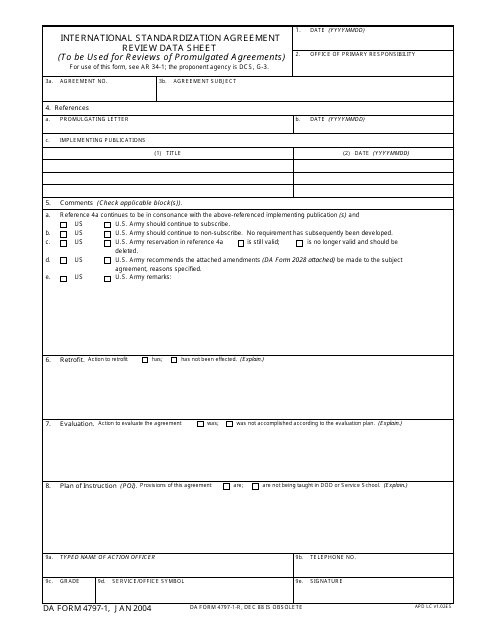

DD Form 47971 Download Fillable PDF or Fill Online International

Ad get ready for tax season deadlines by completing any required tax forms today. This might include any property used to generate rental income or even a. Complete and file form 4797: Web a if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web form 4797.

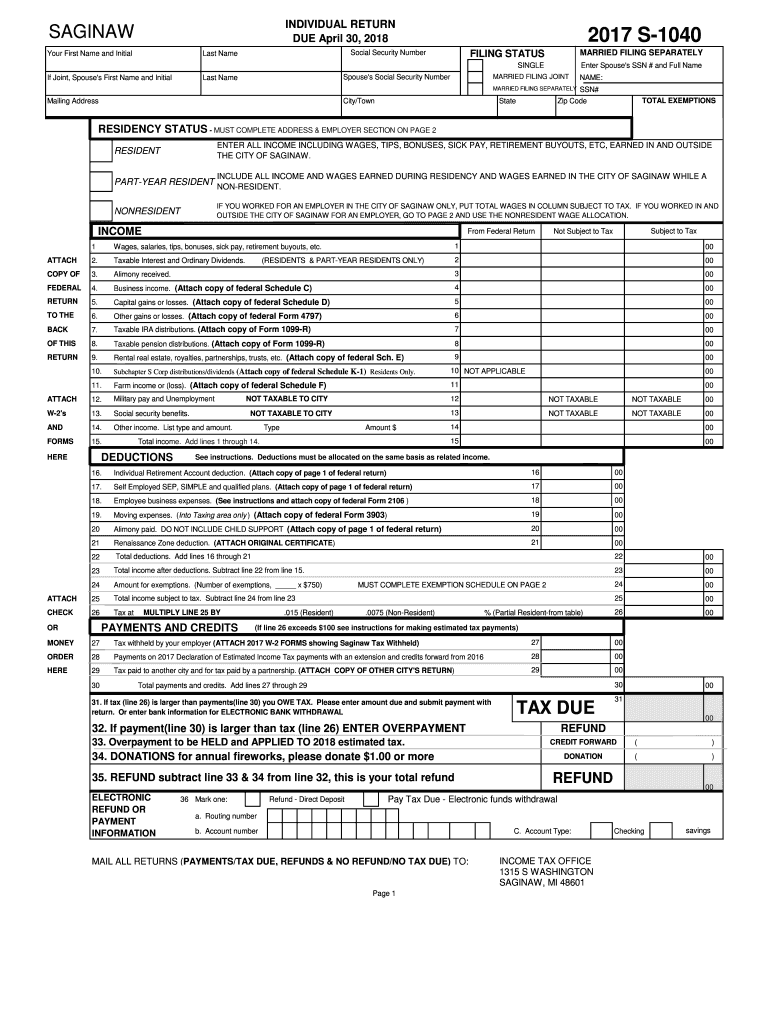

Enter Spouse's SSN and Full Name Fill Out and Sign Printable PDF

Web find federal form 4797 instructions at esmart tax today. Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of. This might include any property used to generate rental income or even a. Hello all, i am trying to figure.

IRS 2106 20202022 Fill out Tax Template Online US Legal Forms

Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web generally, form 4797 is used to report the sale of a.

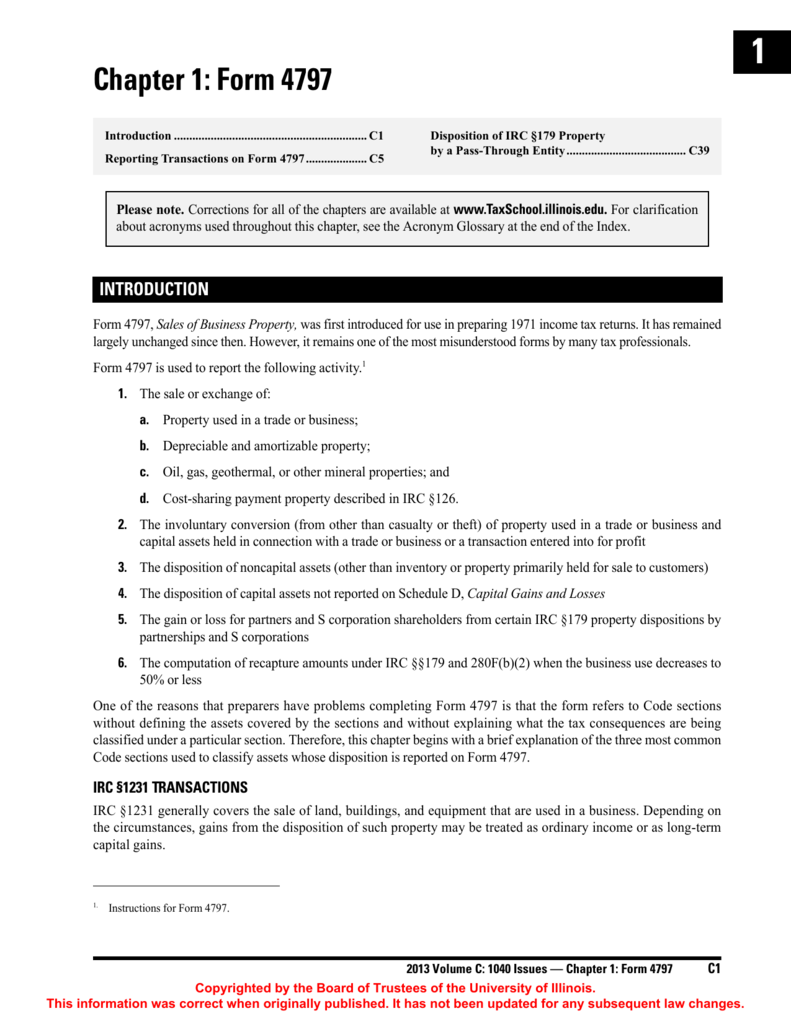

Chapter 1 Form 4797 University of Illinois Tax School

Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web up to $40 cash back form 4797 department of the treasury internal revenue service (99) (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)). This may include your home that was converted into.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web a if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web how do i fill out tax form 4797 after sale of a rental property? Web generally, form 4797 is used to report the sale of a business. This might include any property used to generate rental income or even a.

Web You Must Report The Full Amount Of Depreciation, Allowed Or Allowable, Up To The Date Of Disposal When Reporting The Asset’s Disposal On The Federal Form 4797, In Order To.

•the sale or exchange of: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Real property used in your trade or business; Gains and losses on the sale of nondepreciable assets.

Web Federal Form 4797 Federal Sales Of Business Property Form 4797 Pdf Form Content Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

Web up to $40 cash back form 4797 department of the treasury internal revenue service (99) (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)). Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of. Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions.

Attach Form 4684 To Your Tax.

Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web partnerships, limited liability companies (llcs) classified as partnerships, s corporations, and their partners, members, and shareholders, must follow the procedures for reporting. Web find federal form 4797 instructions at esmart tax today. Web use form 4797 to report the following.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://proconnect.intuit.com/community/image/serverpage/image-id/1455i57DF454B42459DE0?v=v2)