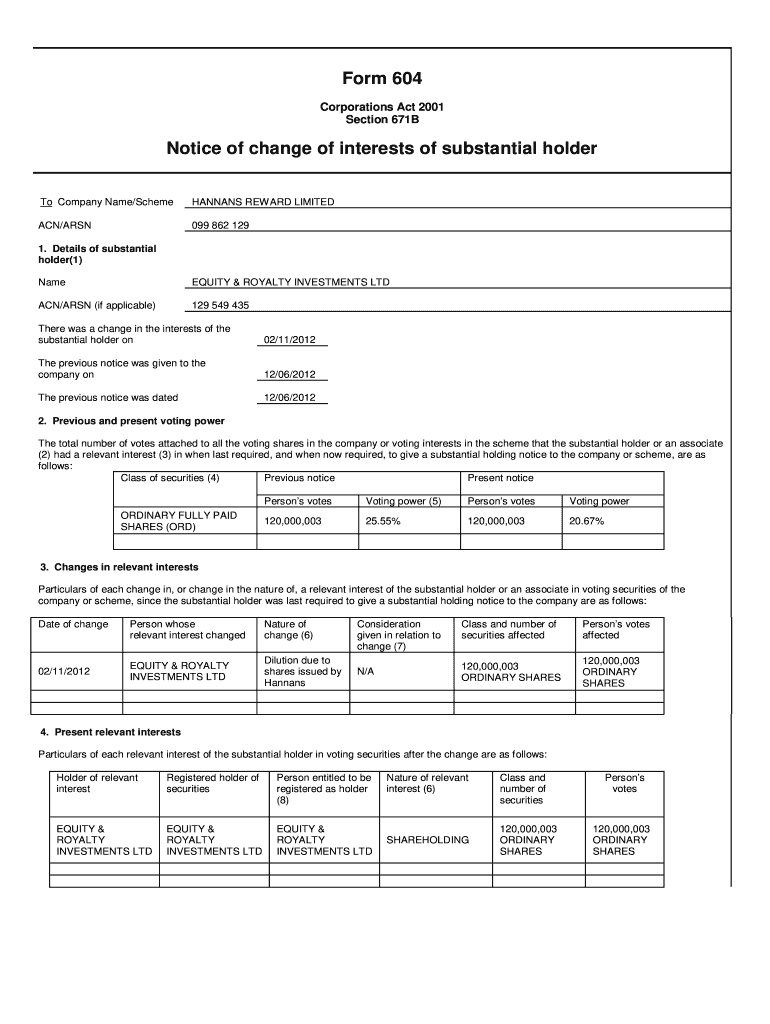

Fair Credit Reporting Act Form 604

Fair Credit Reporting Act Form 604 - In addition, all consumers are entitled to one free disclosure every 12 months. Opt for the file format for your fair credit act form 604 for 2022 and download it to your device. 1681 b), section 604, (b)(2)(a) and (b), permissible purposes of consumer reports, we may not obtain the. Writing this type of letter can help you ensure that any negative items on. Web fair credit reporting act rules. Permissible purposes of consumer reports. This is in response to your letter asking for clarification of sections 604 and 606 of the fair credit. Web view the pdf for 16 cfr part 604; Web the act (title vi of the consumer credit protection act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies. Sections 604 and 606 of the fair credit reporting act.

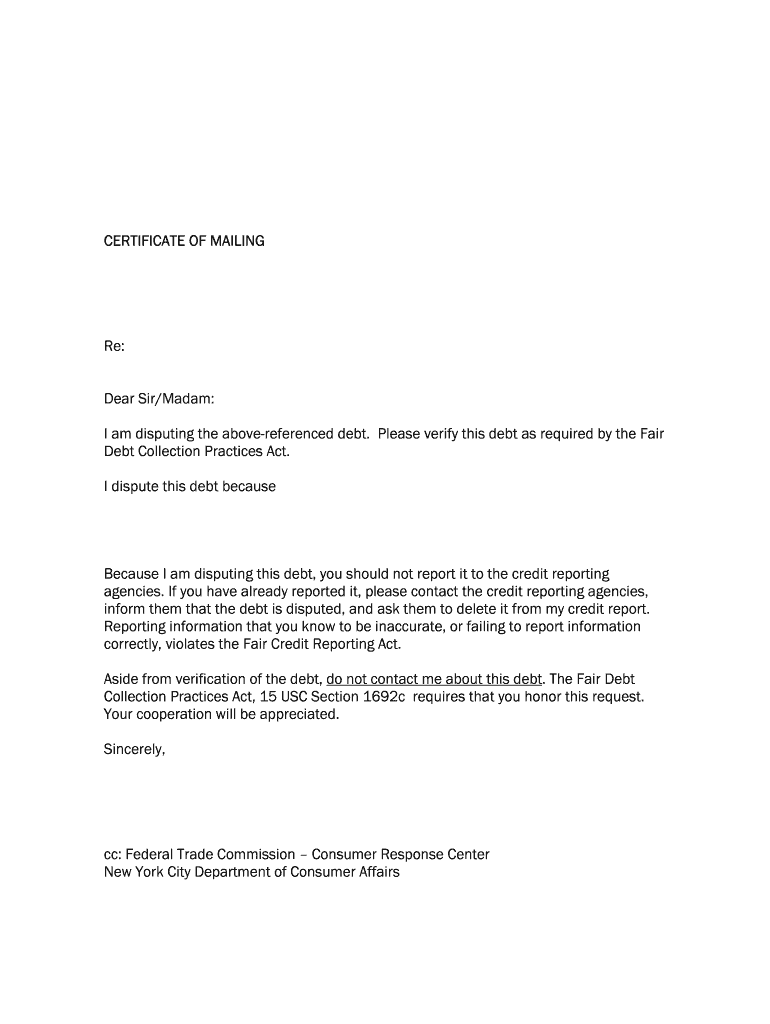

Ad credit report dispute & more fillable forms, register and subscribe now! Opt for the file format for your fair credit act form 604 for 2022 and download it to your device. Dispute items on your credit report like a professional, using disputebee. Web part 604—fair credit reporting act rules authority: Web description violation fair debt. 1681 b), section 604, (b)(2)(a) and (b), permissible purposes of consumer reports, we may not obtain the. Web make payment for your subscription with a card or via paypal to continue. Competition and consumer protection guidance documents In addition, all consumers are entitled to one free disclosure every 12 months. 3, 111, 112, 114, 151, 153, 211, 212, 213, 214, 216, 311, 315;

Web a 604 dispute letter is a great way to get inaccurate information off your credit report. Ad our software is perfect for both new and existing credit repair business owners. Permissible purposes of consumer reports [15 u.s.c. Web you are on public assistance; Free electronic credit monitoring for active duty military. Web fair credit reporting act rules. Go paperless, fill & sign documents electronically. Ad credit report dispute & more fillable forms, register and subscribe now! Competition and consumer protection guidance documents Permissible purposes of consumer reports.

Form 604 edit versrion Fill out & sign online DocHub

Are you complying with the requirement that you. Print out your form to fill it out by hand or upload the sample if you prefer to work. In addition, all consumers are entitled to one free disclosure every 12 months. Web pick the file format for your fair credit reporting act form 604 and download it to your device. Web.

Fair Credit Reporting Act Policy Template

Web description violation fair debt. Dispute items on your credit report like a professional, using disputebee. 1681 b), section 604, (b)(2)(a) and (b), permissible purposes of consumer reports, we may not obtain the. Web section 604(f) of the fcra prohibits any person from obtaining a consumer report from a consumer reporting agency (cra) unless the person has certified to the.

Fair Credit Reporting Act Policy

Writing this type of letter can help you ensure that any negative items on. Web pick the file format for your fair credit reporting act form 604 and download it to your device. Ad credit report dispute & more fillable forms, register and subscribe now! This is in response to your letter asking for clarification of sections 604 and 606.

20152023 Form IRS 13340 Fill Online, Printable, Fillable, Blank

This form is for use by debtors in unfair collection practice situations, a notice of violation of fair debt act regarding creditor misrepresented. Permissible purposes of consumer reports. 3, 111, 112, 114, 151, 153, 211, 212, 213, 214, 216, 311, 315; Rules of construction [15 u.s.c. You are unemployed but expect to apply for employment within 60 days.

Ae form 604 1b Fill out & sign online DocHub

Subject to subsection (c), any consumer reporting agency may furnish a consumer report under the following. Web view the pdf for 16 cfr part 604; Web a 604 dispute letter is a great way to get inaccurate information off your credit report. Permissible purposes of consumer reports [15 u.s.c. Print out your form to fill it out by hand or.

FAIR CREDIT REPORTING ACT POLICY MANUAL Think Compliance

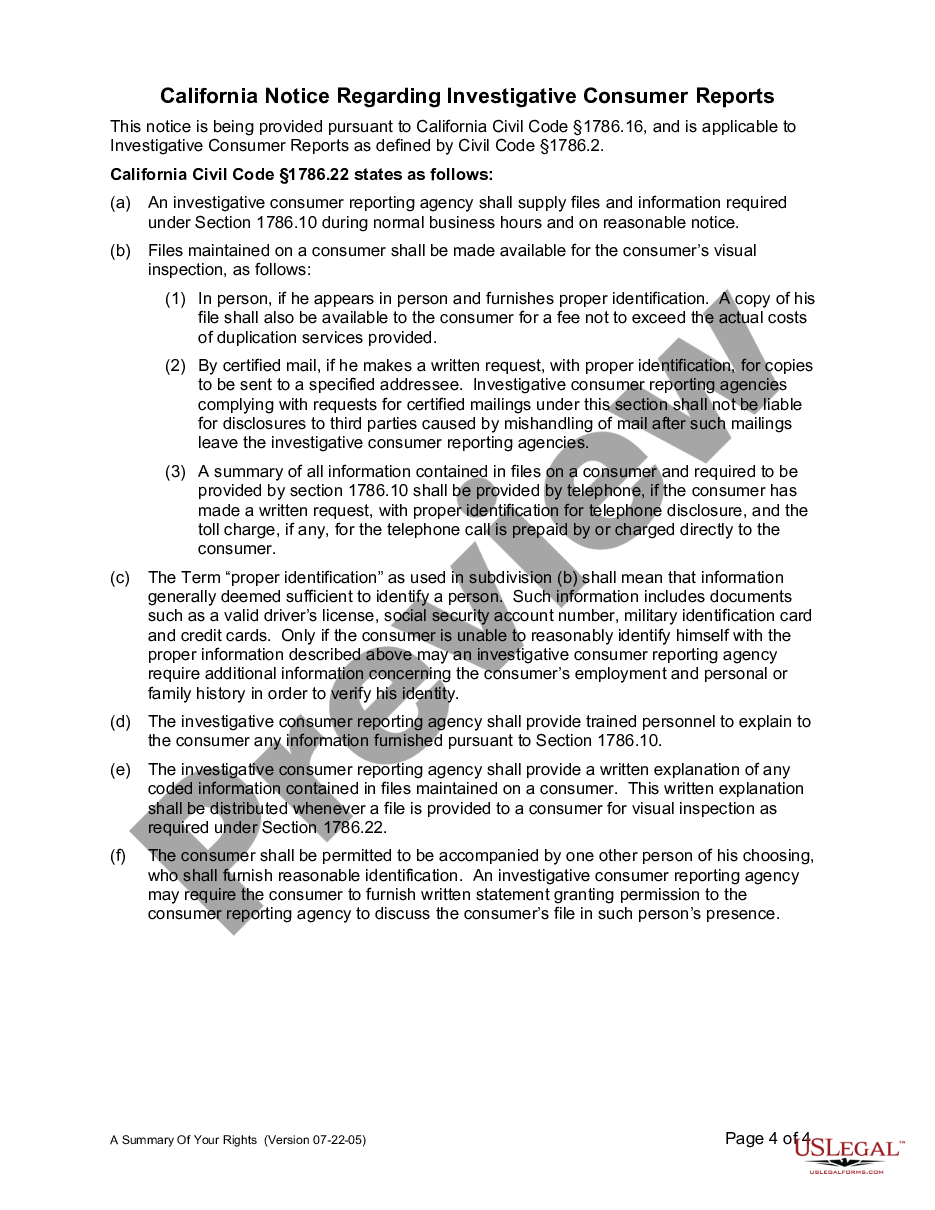

Web 604 permissible purposes of consumer reports 605 requirements relating to information contained in consumer reports 606 disclosure of investigative consumer reports 607. Permissible purposes of consumer reports [15 u.s.c. Are you complying with the requirement that you. Free electronic credit monitoring for active duty military. Web view the pdf for 16 cfr part 604;

A Guide to the Fair Credit Reporting Act (FCRA) CreditFresh

Web pick the file format for your fair credit reporting act form 604 and download it to your device. Web 604 permissible purposes of consumer reports 605 requirements relating to information contained in consumer reports 606 disclosure of investigative consumer reports 607. Web you are on public assistance; Go paperless, fill & sign documents electronically. As a result, it may.

Fair Credit Reporting Act Form 604 Letter US Legal Forms

Dispute items on your credit report like a professional, using disputebee. Sections 604 and 606 of the fair credit reporting act. Web part 604—fair credit reporting act rules authority: 1681 b), section 604, (b)(2)(a) and (b), permissible purposes of consumer reports, we may not obtain the. Competition and consumer protection guidance documents

Five Secrets About Equifax Dispute That Has Never Been Revealed For The

Web this form is meant to give credit reporting agencies (cras) and law enforcement an opportunity to disclose information concerning an individual's history with the individual's. Sections 604 and 606 of the fair credit reporting act. This is in response to your letter asking for clarification of sections 604 and 606 of the fair credit. Web pick the file format.

Fair Credit Act 604 Form Pdf Fill Online, Printable, Fillable, Blank

Opt for the file format for your fair credit act form 604 for 2022 and download it to your device. Web you are on public assistance; This is in response to your letter asking for clarification of sections 604 and 606 of the fair credit. Web fair credit reporting act rules. You are unemployed but expect to apply for employment.

Web Pick The File Format For Your Fair Credit Reporting Act Form 604 And Download It To Your Device.

As a result, it may not include the most recent changes applied to the. Opt for the file format for your fair credit act form 604 for 2022 and download it to your device. Sections 604 and 606 of the fair credit reporting act. Ad our software is perfect for both new and existing credit repair business owners.

Web Cfr Prev | Next § 604.1 Severability.

Web view the pdf for 16 cfr part 604; Dispute items on your credit report like a professional, using disputebee. Web enforcement show/hide enforcement menu items. Web 604 permissible purposes of consumer reports 605 requirements relating to information contained in consumer reports 606 disclosure of investigative consumer reports 607.

Permissible Purposes Of Consumer Reports [15 U.s.c.

3, 111, 112, 114, 151, 153, 211, 212, 213, 214, 216, 311, 315; Permissible purposes of consumer reports [15 u.s.c. Web description violation fair debt. In addition, all consumers are entitled to one free disclosure every 12 months.

Rules Of Construction [15 U.s.c.

Web a 604 dispute letter is a great way to get inaccurate information off your credit report. This is in response to your letter asking for clarification of sections 604 and 606 of the fair credit. Web this form is meant to give credit reporting agencies (cras) and law enforcement an opportunity to disclose information concerning an individual's history with the individual's. Are you complying with the requirement that you.