Empower Retirement Distribution Form

Empower Retirement Distribution Form - Based upon the distribution options listed on the implementation worksheet at plan setup, fascore will create a custom distribution form to be available on psc and the. Additionally, certain 457 plans may. Web use this form for a direct rollover: Web securities, when presented, are offered and/or distributed by empower financial services, inc., member finra/sipc. Contact your tax professional for more information. Web distribution, which is usually at retirement (when many. Web overvi ew plans may require former employee accounts with vested balances below a plan defined threshold to be distributed from the plan. Web • you use the distributions to buy, build, or rebuild a first home. Web spousal consent form note: Governmental 457(b) and 457(b) obra.

Contact your tax professional for more information. Governmental 457(b) and 457(b) obra. Based upon the distribution options listed on the implementation worksheet at plan setup, fascore will create a custom distribution form to be available on psc and the. Plans may set their mandatory. Web • you use the distributions to buy, build, or rebuild a first home. For more details, review the important information associated with the. Web one of the most common investment vehicles that americans use to save for retirement is a 401(k). Web use this form for a direct rollover: • a cash payment • a direct rollover to an eligible. Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal.

Plans may set their mandatory. Web spousal consent form note: Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal. Web one of the most common investment vehicles that americans use to save for retirement is a 401(k). Your information print in block letters in black or. • a cash payment • a direct rollover to an eligible. Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Governmental 457(b) and 457(b) obra. Web use this form for a direct rollover: Use this form if you want to request from your plan account:

Empower Retirement to Acquire FullService Retirement Business of

• a cash payment • a direct rollover to an eligible. Web overvi ew plans may require former employee accounts with vested balances below a plan defined threshold to be distributed from the plan. Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory.

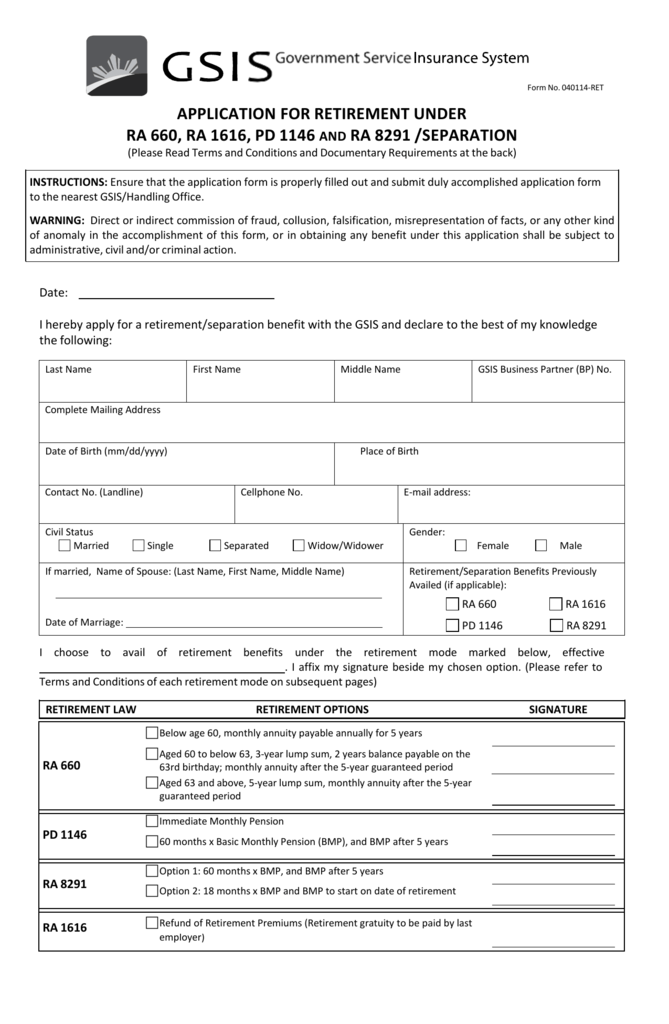

Application for Retirement

Spouse may either take this form to a notary public or sign the form with the plan administrator as a witness: Plans may set their mandatory. Web • you use the distributions to buy, build, or rebuild a first home. Use this form if you want to request from your plan account: Web participants initiate rmd requests online, by speaking.

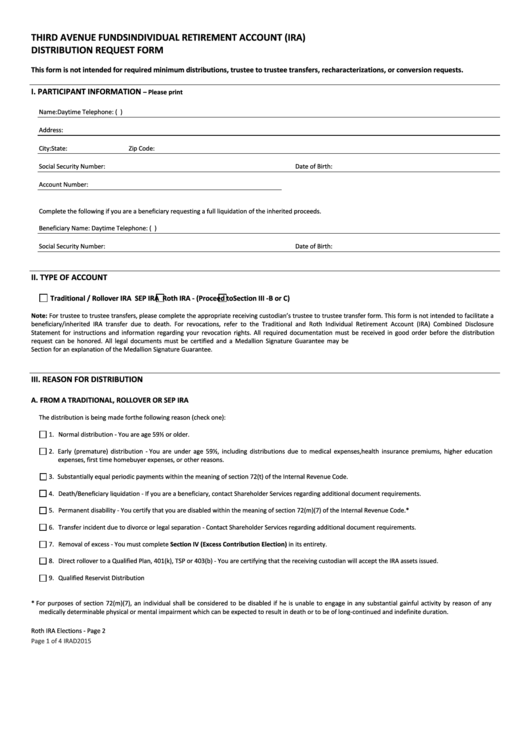

Individual Retirement Account (Ira) Distribution Request Form printable

Web participants initiate rmd requests online, by speaking with a service center representative, or by submitting a distribution request form to empower. • a cash payment • a direct rollover to an eligible. Spouse may either take this form to a notary public or sign the form with the plan administrator as a witness: Web • you use the distributions.

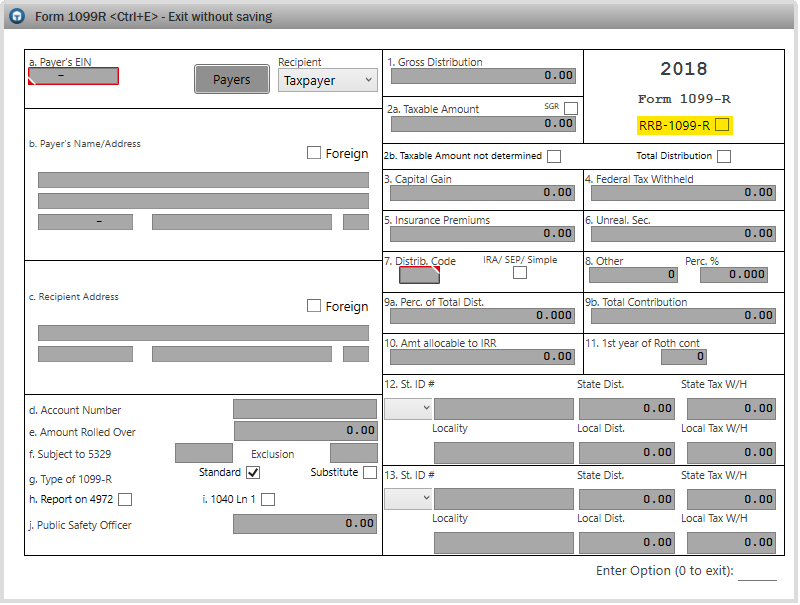

Form RRB1099R Railroad Retirement Benefits Support

• the distribution is due to an irs levy of the qualified plan. For more details, review the important information associated with the. Your information print in block letters in black or. Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal. Web.

Empower 401k Withdrawal Form Universal Network

Contact your tax professional for more information. Web overvi ew plans may require former employee accounts with vested balances below a plan defined threshold to be distributed from the plan. Additionally, certain 457 plans may. Use this form if you want to request from your plan account: Web use this form for a direct rollover:

Empower Retirement 403(b) threefund portfolio assistance personalfinance

• the distribution is a qualified reservist distribution. Web spousal consent form note: Governmental 457(b) and 457(b) obra. Web participants initiate rmd requests online, by speaking with a service center representative, or by submitting a distribution request form to empower. Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not.

Distribution From 401K Fill Out and Sign Printable PDF Template signNow

Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal. Additionally, certain 457 plans may. A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account. Plans.

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

Based upon the distribution options listed on the implementation worksheet at plan setup, fascore will create a custom distribution form to be available on psc and the. • the distribution is due to an irs levy of the qualified plan. Web overvi ew plans may require former employee accounts with vested balances below a plan defined threshold to be distributed.

Retirement requirement Distributions YouTube

Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal. Web spousal consent form note: Web one of the most common investment vehicles that americans use to save for retirement is a 401(k). Web overvi ew plans may require former employee accounts with.

Working at Empower Retirement Glassdoor

Plans may set their mandatory. • a cash payment • a direct rollover to an eligible. • the distribution is a qualified reservist distribution. Web spousal consent form note: Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal.

• The Distribution Is Due To An Irs Levy Of The Qualified Plan.

Based upon the distribution options listed on the implementation worksheet at plan setup, fascore will create a custom distribution form to be available on psc and the. Additionally, certain 457 plans may. Use this form if you want to request from your plan account: Efsi is an affiliate of empower retirement, llc;

Plans May Set Their Mandatory.

Your information print in block letters in black or. Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Governmental 457(b) and 457(b) obra. • a cash payment • a direct rollover to an eligible.

Web One Of The Most Common Investment Vehicles That Americans Use To Save For Retirement Is A 401(K).

Hereby certify that i am the. Web • you use the distributions to buy, build, or rebuild a first home. Web participants initiate rmd requests online, by speaking with a service center representative, or by submitting a distribution request form to empower. Spouse may either take this form to a notary public or sign the form with the plan administrator as a witness:

Web Overvi Ew Plans May Require Former Employee Accounts With Vested Balances Below A Plan Defined Threshold To Be Distributed From The Plan.

Web divorce1 excess contribution for prior year excess contribution for current year disability3 hardship am aware the distribution will not be subject to the 20% mandatory federal. For more details, review the important information associated with the. Web securities, when presented, are offered and/or distributed by empower financial services, inc., member finra/sipc. Contact your tax professional for more information.