Efile Form 7004

Efile Form 7004 - For details on electronic filing, visit irs.gov/efile7004. We'll provide the mailing address and any payment instructions Enter tax payment details step 5: Enter tax year information and tax form details ; You will receive an email confirmation from tax2efile with a status update from the irs With your return open, select search and enter extend; Make sure to submit your 7004 example for 2022 by the deadline to avoid penalties. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return.

Check and submit to irs ; Create your account and select form 7004 extension; Enter your business information & applicable business entity type; Enter tax payment details step 5: Select business entity & form step 3: Web use the chart to determine where to file form 7004 based on the tax form you complete. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Enter tax year information and tax form details ; Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Follow the instructions to prepare and print your 7004 form.

The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. Select business entity & form step 3: Web use the chart to determine where to file form 7004 based on the tax form you complete. Web form 7004 can be filed electronically for most returns. Make sure to submit your 7004 example for 2022 by the deadline to avoid penalties. You will receive an email confirmation from tax2efile with a status update from the irs For details on electronic filing, visit irs.gov/efile7004. Follow the instructions to prepare and print your 7004 form. Create your account and select form 7004 extension; Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns

E File Form 7004 Turbotax Universal Network

The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. Enter tax year information and tax form details ; We'll provide the mailing address and any payment instructions Check and submit to irs ; Make sure to submit.

Efile Form 7004 & get extension up to 6 months. in 2021 Business tax

Web form 7004 can be filed electronically for most returns. Enter tax payment details step 5: Enter tax year information and tax form details ; Web follow these steps to print a 7004 in turbotax business: With your return open, select search and enter extend;

efile form 7004 Blog TaxBandits

With your return open, select search and enter extend; Web use the chart to determine where to file form 7004 based on the tax form you complete. You will receive an email confirmation from tax2efile with a status update from the irs Enter tax payment details step 5: Select the tax year step 4:

efile form 7004 ThinkTrade Inc Blog

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns We'll provide the mailing address and any payment instructions Enter your business information & applicable business entity type; Check and submit to irs ; Create your account and.

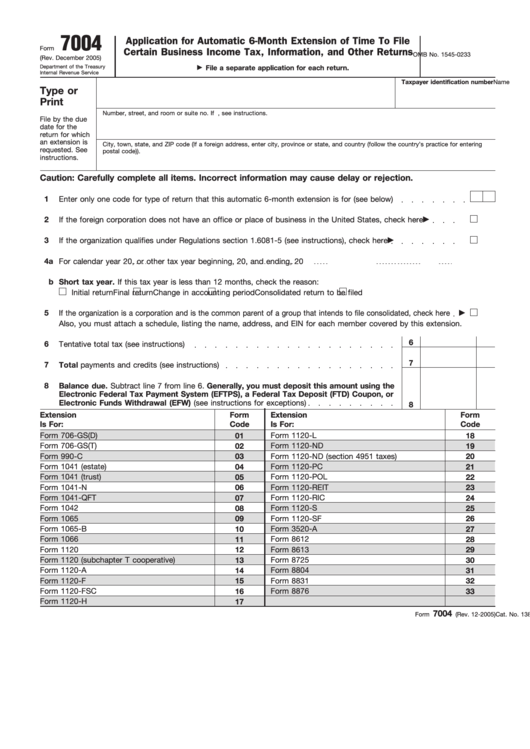

Irs Form 7004 amulette

Select extension of time to file (form 7004) and continue; Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web follow these steps to print a 7004 in turbotax business: You will receive an email confirmation from tax2efile with a status update from the irs Enter your business information.

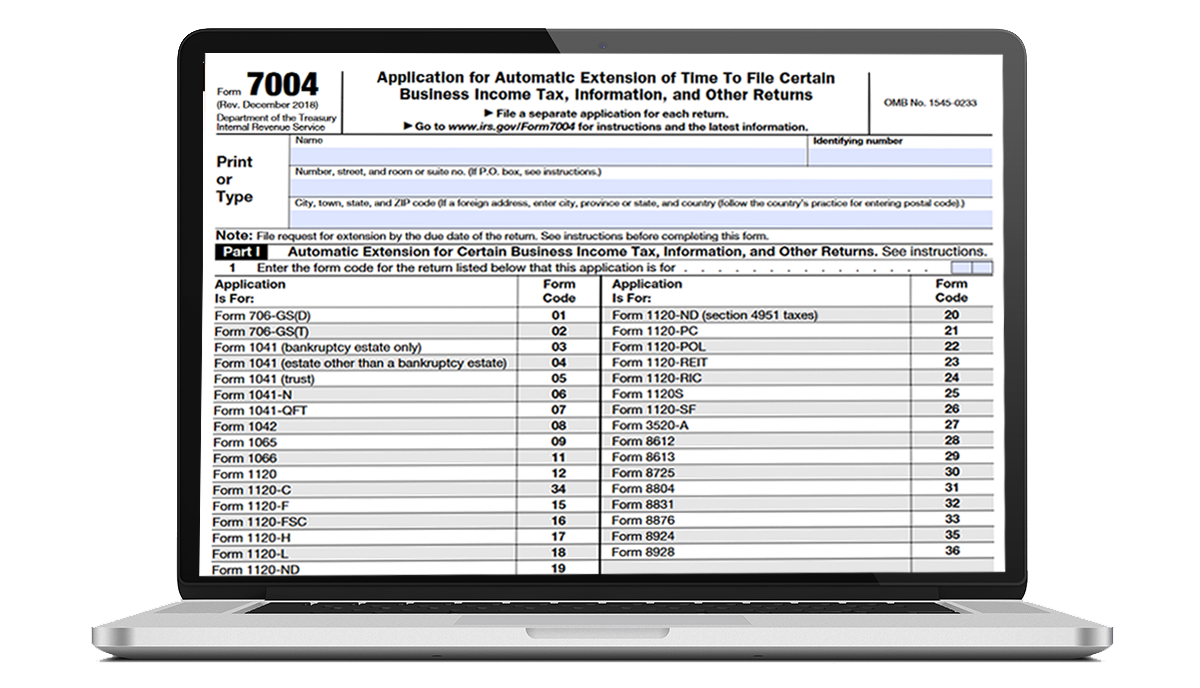

Efile Tax Form 7004 Universal Network

The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. Enter tax payment details step 5: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. For details.

E File Form 7004 Online Universal Network

We'll provide the mailing address and any payment instructions You will receive an email confirmation from tax2efile with a status update from the irs Make sure to submit your 7004 example for 2022 by the deadline to avoid penalties. Web form 7004 can be filed electronically for most returns. Select business entity & form step 3:

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

Create your account and select form 7004 extension; The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due.

Fillable Form 7004 Application For Automatic 6Month Extension Of

Web use the chart to determine where to file form 7004 based on the tax form you complete. Select the tax year step 4: Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns You will receive an.

EFile 7004 Online 2022 File Business Tax extension Form

Select the tax year step 4: Create your account and select form 7004 extension; Follow the instructions to prepare and print your 7004 form. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Select extension of time to file (form 7004) and continue;

We'll Provide The Mailing Address And Any Payment Instructions

Web form 7004 can be filed electronically for most returns. Enter your business information & applicable business entity type; Create your account and select form 7004 extension; Select the tax year step 4:

Enter Tax Year Information And Tax Form Details ;

Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic business extension (form 7004 mef) returns. With your return open, select search and enter extend; You will receive an email confirmation from tax2efile with a status update from the irs

Select Extension Of Time To File (Form 7004) And Continue;

Make sure to submit your 7004 example for 2022 by the deadline to avoid penalties. For details on electronic filing, visit irs.gov/efile7004. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Select business entity & form step 3:

Check And Submit To Irs ;

Web use the chart to determine where to file form 7004 based on the tax form you complete. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Enter business details step 2: Follow the instructions to prepare and print your 7004 form.