Does My Business Need To File Form 720

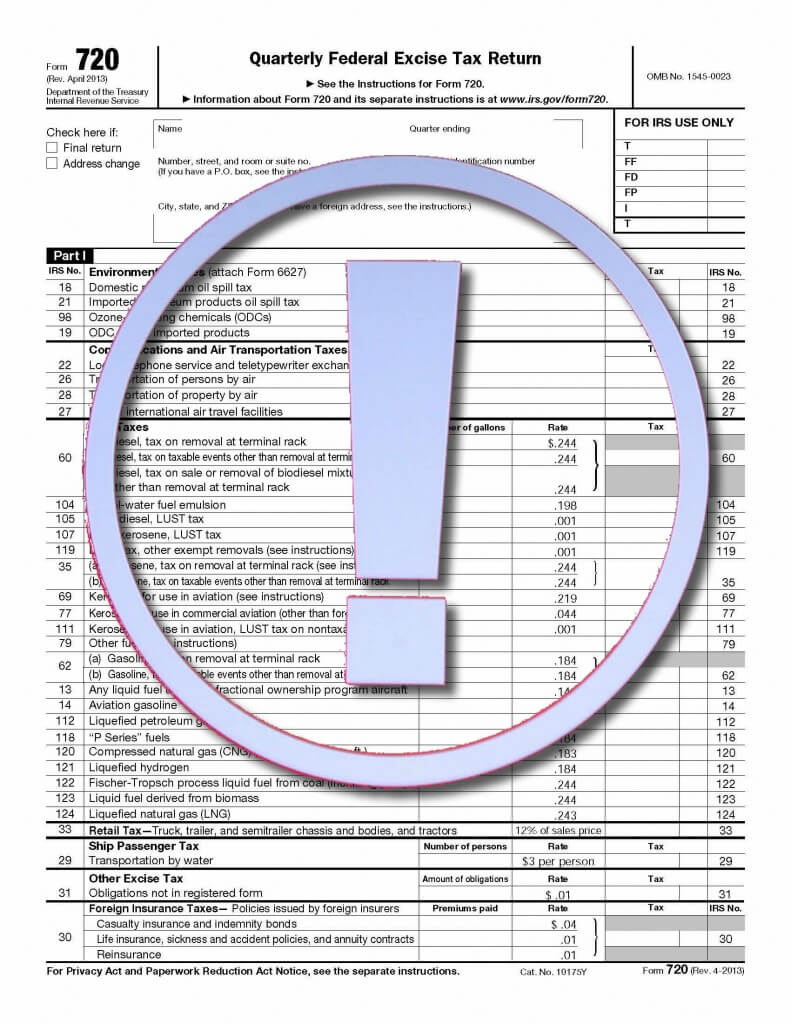

Does My Business Need To File Form 720 - Form 720 is used by taxpayers to report. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Web businesses providing goods and services that are subject to excise tax must file a form 720 quarterly to report the tax to the irs. Web a business that only purchases the excise goods does not need to file a form 720. This is a different form than what is used to file business income tax returns. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Web efile irs form 720, form 2290 & form 8849 through an irs authorized official efile provider, most experienced and 1st in the list. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs.

Web forms 1120, 1120a and 1120s. Web does my business need to submit irs form 720? Form 720, quarterly federal excise tax; Complete part ii, line 133 (c) or (d). Web instructions for form 720 (rev. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Web don't file duplicate excise tax forms paper excise forms are taking longer to process. Web efile irs form 720, form 2290 & form 8849 through an irs authorized official efile provider, most experienced and 1st in the list. Web a business that only purchases the excise goods does not need to file a form 720. Web whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file.

Here’s what you need to know. However, certain companies — such as those in farming, manufacturing,. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Web those that can be filed electronically, according to the irs, are: Web businesses providing goods and services that are subject to excise tax must file a form 720 quarterly to report the tax to the irs. Form 720 is used by taxpayers to report. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. This is a different form than what is used to file business income tax returns. Web forms 1120, 1120a and 1120s. Due april 15th (for 2015 taxes, the filing deadline is april 18, 2016):

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Web businesses that owe excise taxes might need to file form 720. Form 2290, heavy highway vehicle use tax; Web don't file duplicate excise tax forms paper excise forms are taking longer to process. Form 720, quarterly federal excise tax; Web whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Web.

Model 720 in Spain Guide) How to Do Your Asset Declaration

Web those that can be filed electronically, according to the irs, are: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Web businesses that owe excise taxes might need to file form 720. Web.

Form 720 Quarterly Federal Excise Tax Return

Here’s what you need to know. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Web whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file. Web.

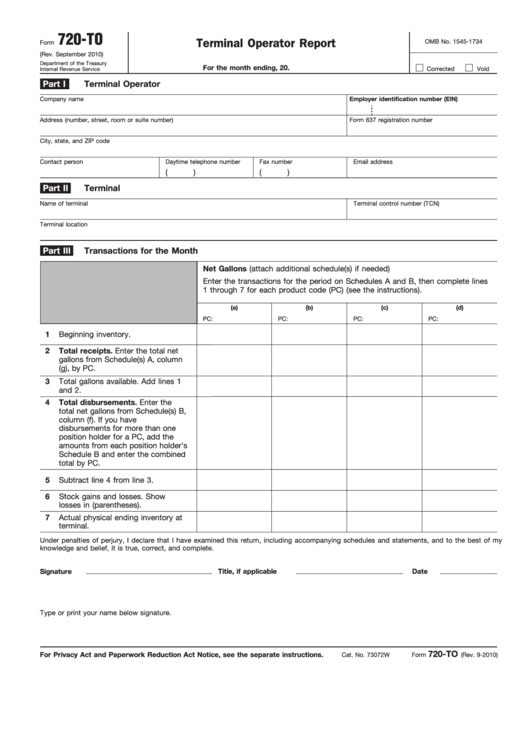

Fillable Form 720To Terminal Operator Report printable pdf download

Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. However, certain companies — such as those in farming, manufacturing,. Web don't file duplicate excise tax forms paper excise forms are taking longer to process. Here’s what you need to know. Web businesses providing goods and services that are.

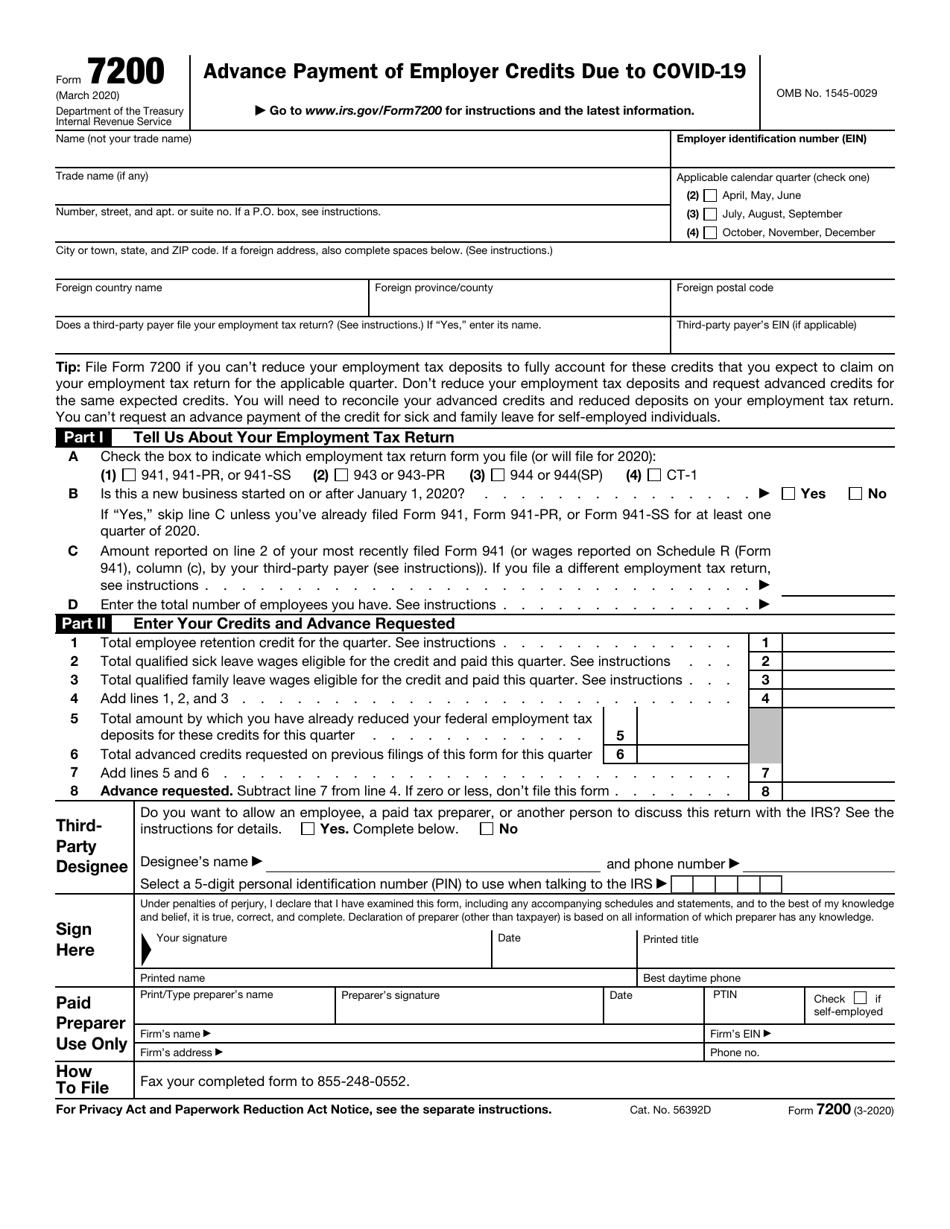

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Form 720 is used by taxpayers to report. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web businesses that owe excise taxes might need to file form 720. Form 720, quarterly federal excise tax; Is electronic filing of form 720 required?

Why Does My Business Need A Website? Evans Alliance Evans Alliance

Web businesses providing goods and services that are subject to excise tax must file a form 720 quarterly to report the tax to the irs. Form 720, quarterly federal excise tax; Complete part ii, line 133 (c) or (d). If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day.

FORM 720 DEADLINE MARCH 2014 FATCA DEADLINE JUNE 2014 THE FINAL N…

Form 2290, heavy highway vehicle use tax; Form 720 is used by taxpayers to report. Here’s what you need to know. Web only check the final return if the company is 1) going out of business or 2) will not be required to file a form 720 in future quarters. Web businesses that are subject to excise tax generally must.

PCORI Fee Reporting in Excise Tax Form 720 IRS

Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Form 720 is used by.

Does my business need file storage? Key things to consider before you

Web a business that only purchases the excise goods does not need to file a form 720. Irs still accepts paper forms 720. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Web businesses that owe excise taxes might need to file form 720..

Form 2290, Heavy Highway Vehicle Use Tax;

This is a different form than what is used to file business income tax returns. Web instructions for form 720 (rev. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web only check the final return if the company is 1) going out of business or 2) will not be required to file a form 720 in future quarters.

Web Businesses That Owe Excise Taxes Might Need To File Form 720.

Irs still accepts paper forms 720. Is electronic filing of form 720 required? Web businesses providing goods and services that are subject to excise tax must file a form 720 quarterly to report the tax to the irs. To report loss or profit of the.

Here’s What You Need To Know.

Form 720 is used by taxpayers to report. Web forms 1120, 1120a and 1120s. Complete part ii, line 133 (c) or (d). Web don't file duplicate excise tax forms paper excise forms are taking longer to process.

Form 720, Quarterly Federal Excise Tax;

Due april 15th (for 2015 taxes, the filing deadline is april 18, 2016): Web a business that only purchases the excise goods does not need to file a form 720. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Web you don't import gas guzzling automobiles in the course of your trade or business.