Do I Qualify For Form 7202

Do I Qualify For Form 7202 - What is 7202 and do i qualify. Web frequently asked questions about form 7202 tax relief. Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Unfortunately, they don't tell you this. Web how to generate form 7202 in lacerte. Web 4.1k views 1 year ago. The credits for sick leave and family. The credits for sick leave and family leave for certain self. Who may file form 7202. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec.

Web how to generate form 7202 in lacerte. Usually, this includes obtaining an acknowledgment letter from the charity. Do federal or state government employers qualify for tax credits? Web irs form 7202 is a tax form used to calculate your sick and family leave credits. Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. The form is also referred to as credits for sick leave and family leave for. Web print only is not helpful. This is a giant fail on the part of turbotax. Web frequently asked questions about form 7202 tax relief. No, federal, state, or their instrumentalities,.

Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. No, federal, state, or their instrumentalities,. Web frequently asked questions about form 7202 tax relief. Web how to generate form 7202 in proconnect. Unfortunately, they don't tell you this. This is a giant fail on the part of turbotax. I use turbo tax so that i don't have to mail in my return. The form is also referred to as credits for sick leave and family leave for. Web certain restrictions apply. The credits for sick leave and family leave for certain self.

IRS comes with a New Form 7202 to Claim Tax Credits for Sick and Family

Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. This article will assist you with generating form 7202 in intuit proconnect. Web how to generate form 7202 in lacerte. Usually, this includes obtaining an.

Form 7202 SelfEmployed Audit Risk Form 7202 Tax Return Evidence the

Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Who may file form 7202. No, federal, state, or their instrumentalities,. Web irs form 7202 is a tax form used to calculate your sick and family leave credits. The form is also referred to as credits for sick leave and family leave for.

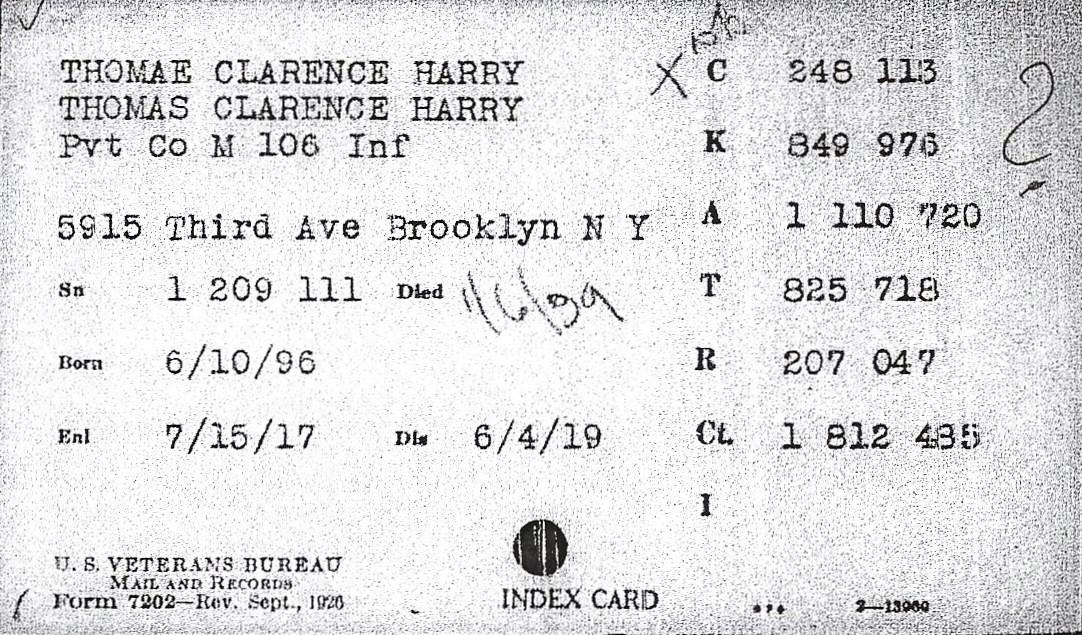

united states How to decode / read US Veterans Bureau Form 7202

What is 7202 and do i qualify. Solved • by intuit • 170 • updated december 21, 2022. Web irs form 7202 is a tax form used to calculate your sick and family leave credits. Usually, this includes obtaining an acknowledgment letter from the charity. The credits for sick leave and family.

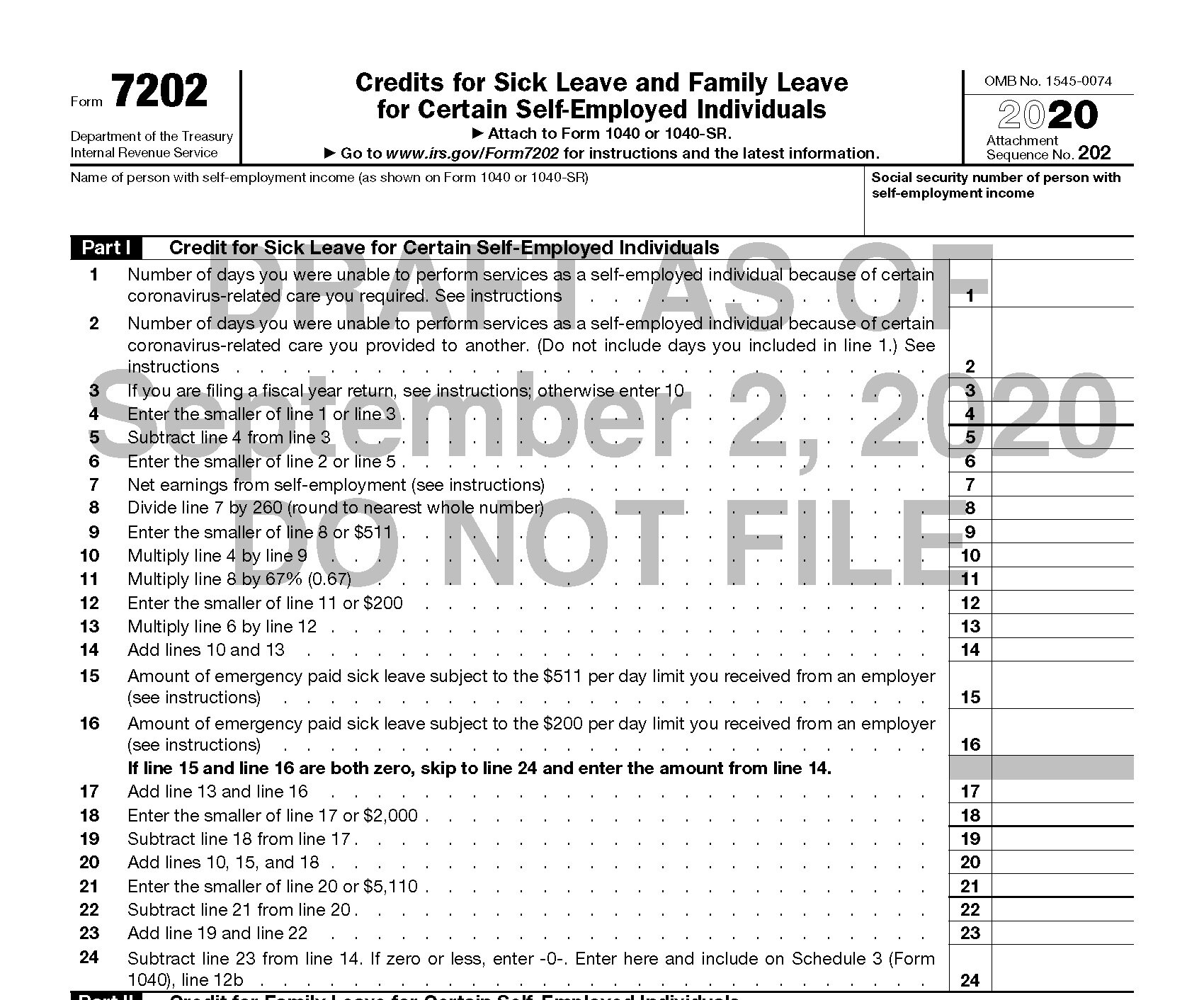

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

No, federal, state, or their instrumentalities,. Irs instructions can be found. Web print only is not helpful. The credits for sick leave and family leave for certain self. This is a giant fail on the part of turbotax.

Desktop 2020 Form 7202 Credits for Sick Leave and Family Leave for

I use turbo tax so that i don't have to mail in my return. Web certain restrictions apply. The credits for sick leave and family. Web how to generate form 7202 in proconnect. Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web how to generate form 7202 in proconnect. The credits for sick leave and family. Irs instructions can be found. Unfortunately, they don't tell you this. I use turbo tax so that i don't have to mail in my return.

Do I Qualify for Disability? What You Need to Know Before You Apply

Web how to generate form 7202 in lacerte. The credits for sick leave and family leave for certain self. Web 4.1k views 1 year ago. I use turbo tax so that i don't have to mail in my return. Solved • by intuit • 170 • updated december 21, 2022.

What is FORM 7202 and Do I qualify?? here is the best answer YouTube

Solved • by intuit • 170 • updated december 21, 2022. Web frequently asked questions about form 7202 tax relief. Eligible to receive qualified sick leave wages under the emergency paid sick leave act if you had been an employee of an employer (other than yourself), and/or b. Usually, this includes obtaining an acknowledgment letter from the charity. Web how.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Web irs form 7202 is a tax form used to calculate your sick and family leave credits. This article will assist you with generating form 7202 in intuit proconnect. Usually, this includes obtaining an acknowledgment letter from the charity. Do federal or state government employers qualify for tax credits? Web special recordkeeping rules apply to any taxpayer claiming a charitable.

Web 4.1K Views 1 Year Ago.

Irs instructions can be found. This article will assist you with generating form 7202 in intuit proconnect. No, federal, state, or their instrumentalities,. Web frequently asked questions about form 7202 tax relief.

Web Irs Form 7202 Is A Tax Form Used To Calculate Your Sick And Family Leave Credits.

Web certain restrictions apply. Web form 7202 will allow tax credits on taxpayers’ 2020 filing if they had to take leave between april 1 and dec. What is 7202 and do i qualify. Do federal or state government employers qualify for tax credits?

The Form Is Also Referred To As Credits For Sick Leave And Family Leave For.

Web special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. The credits for sick leave and family. This is a giant fail on the part of turbotax. Solved • by intuit • 170 • updated december 21, 2022.

Usually, This Includes Obtaining An Acknowledgment Letter From The Charity.

Web print only is not helpful. Web how to generate form 7202 in proconnect. Unfortunately, they don't tell you this. I use turbo tax so that i don't have to mail in my return.