De 9C Form Pdf

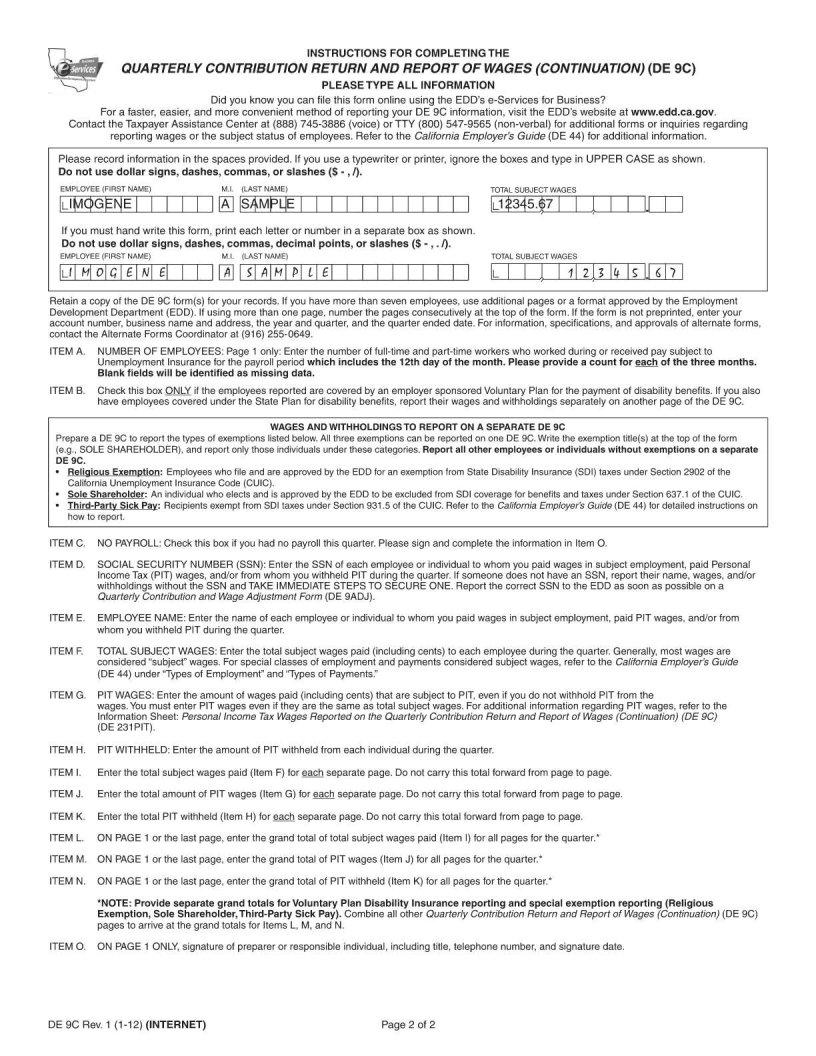

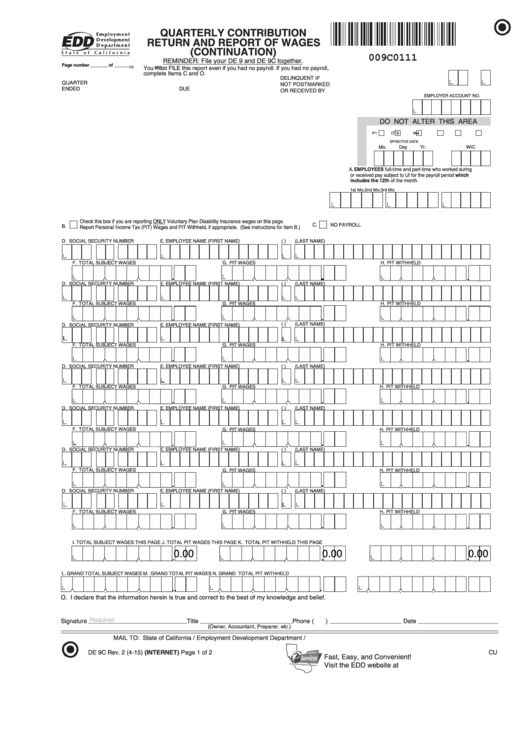

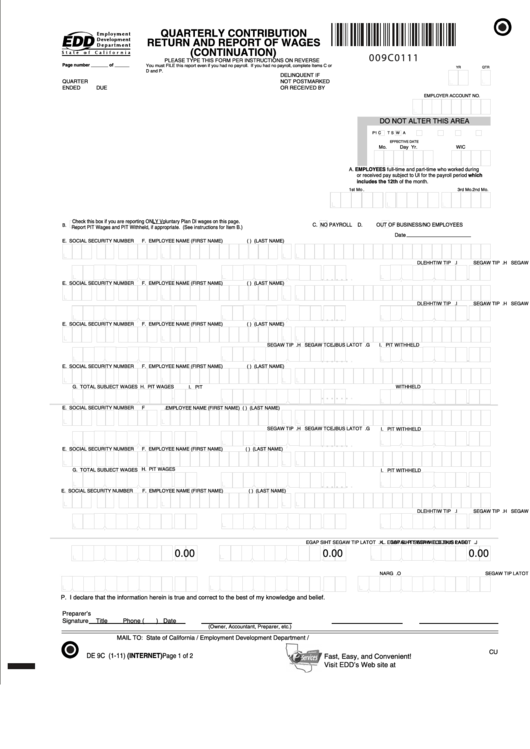

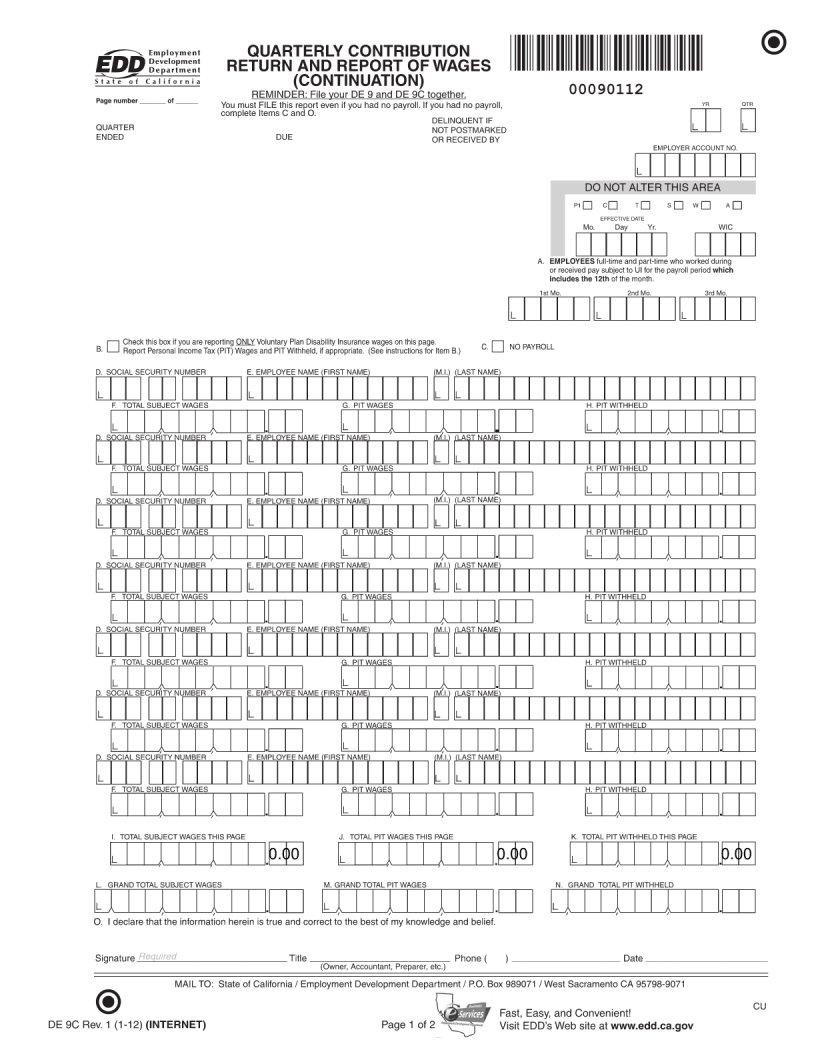

De 9C Form Pdf - Total subject wages paid this quarter Use our detailed instructions to fill out and esign your documents online. Web the de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. Wages and withholdings to report on a separate de 9c prepare a de 9c to report the types of exemptions listed below. All three exemptions can be reported on one de 9c. Navigate to where you wish to save the file. Enter the ob/ne date where indicated and complete line k. The form is used to report wage and payroll tax withholding information for california employers. Web mail the de 9 and de 9c together to this address:

In this blog post, we will provide an. The form is used to report wage and payroll tax withholding information for california employers. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Enter the amount of pit withheld from each individual during the quarter. If you closed the business this quarter, you must file the de 9 and de 9c within ten days of closing the. Write the exemption title(s) at the top of the form (e.g., sole shareholder), and report only those individuals under these categories. If you want to acquire this form pdf, our form editor is what you need! You must specify the quarter on the report or deposit. Employers may be confused thinking the de 9 or de 9c is the federal 941 form. Web form de9c is the quarterly wage and withholding report for california employers.

Web quick guide on how to complete form de9c. The form is also used to report any foreign income, including income from investments, pensions, and other sources. Individuals must complete and submit the 9c form by april 30 each year. Report all other employees or. Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd's website at www.edd.ca.gov. Web mail the de 9 and de 9c together to this address: Forget about scanning and printing out forms. Follow our simple actions to have your de9c sample prepared rapidly: Enter any applicable information on the setup window and click ok. Use our detailed instructions to fill out and esign your documents online.

De 9C Form ≡ Fill Out Printable PDF Forms Online

If you closed the business this quarter, you must file the de 9 and de 9c within ten days of closing the. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages.

2011 Form CA EDD DE 9ADJI Fill Online, Printable, Fillable, Blank

Web complete item c and item o on the de 9c. Individuals must complete and submit the 9c form by april 30 each year. The state of california requires ca companies to file both a quarterly contribution return and report of wages (de 9) and the quarterly contribution return and report of wages (continuation) (de 9c) each quarter. Web the.

Form CADE9 & CADE9C

Report all other employees or. Web the de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Enter the total subject wages paid (item f) for each separate page. Web wages and withholdings to report on a separate de 9c. Select print reports > tax reports > special suta.

Form De 9c With Instructions Quarterly Contribution Return And Report

Web separate form de 9c for employees who meet the following criteria: Web wages and withholdings to report on a separate de 9c. Web the de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Make sure you put it somewhere easy to get to for uploading to edd..

Quarterly Contribution Return And Report Of Wages (Continuation) (De

Web this article will explain how to create the electronic file for transmitting a de 9 and de 9c to the california state unemployment agency: Forget about scanning and printing out forms. In a way, it is the california equivalent of the form 941 except the detailed withholding for each employee is reported. The form is also used to report.

De 9C Edit, Fill, Sign Online Handypdf

Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of. Enter any applicable information on the setup window and click ok. Enter the total subject wages paid (item f) for each separate page. Web.

CA Forms DE 9 and DE 9C CFS Tax Software, Inc.

Web personal income tax wages reported on the quarterly contribution return and report of wages (continuation) (de 9c) (de 231pit). By clicking on the button down below, you'll open the page where it's possible to modify, download, and store your document. Web wages and withholdings to report on a separate de 9c. In this blog post, we will provide an..

GSTR 9C Reconciliation Statement & Certificate Format, Filing & Rules

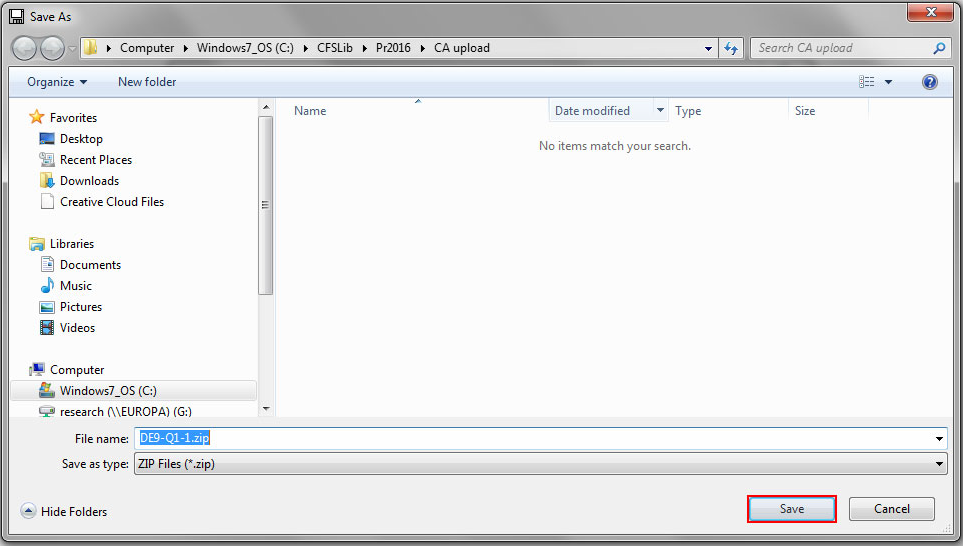

• when you click ok, you get a save dialog box. The intuitive drag&drop interface allows you to include or move areas. The form is also used to report any foreign income, including income from investments, pensions, and other sources. In this blog post, we will provide an. Business to avoid any penalties.

Fillable Form De 9c Quarterly Contribution Return And Report Of Wages

Wages and withholdings to report on a separate de 9c prepare a de 9c to report the types of exemptions listed below. Prepare a de 9c to report the types of exemptions listed below. Enter the amount of pit withheld from each individual during the quarter. Type all required information in the required fillable areas. Web separate form de 9c.

De 9C Form ≡ Fill Out Printable PDF Forms Online

Data may be imported from the. Find the web sample from the catalogue. Web separate form de 9c for employees who meet the following criteria: Prepare a de 9c to report the types of exemptions listed below. Employers will be notifed by mail if their waiver is approved or denied.

• When You Click Ok, You Get A Save Dialog Box.

Enter the total subject wages paid (item f) for each separate page. Employers will be notifed by mail if their waiver is approved or denied. Navigate to where you wish to save the file. Web quick guide on how to complete form de9c.

Type All Required Information In The Required Fillable Areas.

The state of california requires ca companies to file both a quarterly contribution return and report of wages (de 9) and the quarterly contribution return and report of wages (continuation) (de 9c) each quarter. Web personal income tax wages reported on the quarterly contribution return and report of wages (continuation) (de 9c) (de 231pit). In this blog post, we will provide an. Web separate form de 9c for employees who meet the following criteria:

Total Subject Wages Paid This Quarter

The form is used to report wage and payroll tax withholding information for california employers. An approved waiver will be valid for one year. Enter any applicable information on the setup window and click ok. Web mail the de 9 and de 9c together to this address:

State Updates Alabama Arkansas California Sui

Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously reported quarterly contribution return and report of wages (de 9) and/or quarterly contribution return and report of wages (continuation) (de 9c). Web for a faster, easier, and more convenient method of reporting your de 9c information, visit the edd's website at www.edd.ca.gov. Business to avoid any penalties. Enter the amount of pit withheld from each individual during the quarter.